Are you worried about missing a car payment? Concerned about what might happen next?

You’re not alone. Many people wonder how many payments they can miss before their vehicle is at risk of repossession. The fear of losing your car can be overwhelming, especially if you rely on it for daily activities. This article will guide you through the process, giving you a clear understanding of what to expect and how to protect yourself.

By the end, you’ll feel more confident about managing your payments and keeping your car safe. Let’s dive in and uncover the facts you need to know.

Repossession Basics

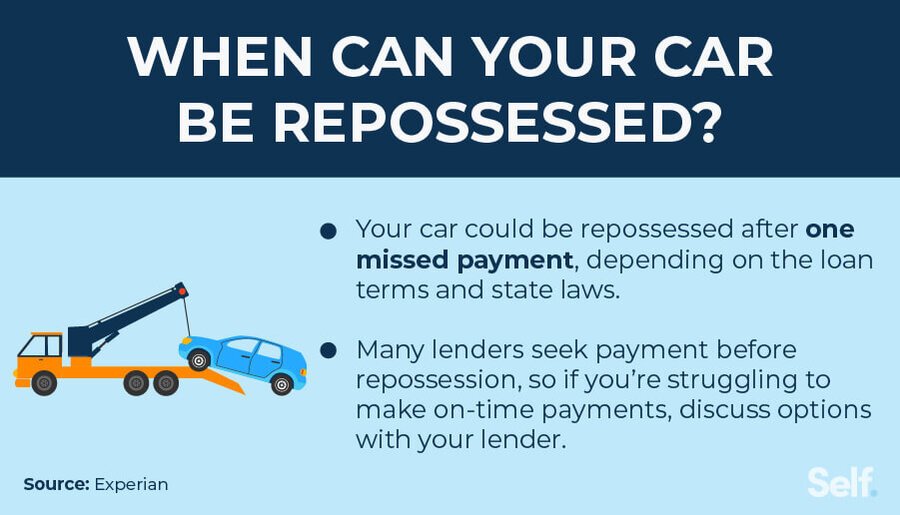

Missing payments can lead to car repossession. Usually, lenders start repossession after two or three missed payments. Each lender may have different policies, so it’s important to check your agreement.

Definition And Process

Repossession means taking back property. This happens after missed payments. Cars, houses, or other items can be repossessed. Lenders have the right to take property back. The process starts after missed payments. Usually, after three missed payments lenders start repossession.

A notice is sent first. This warns the borrower. The borrower can pay to stop repossession. If payments are not made, repossession continues. Repossession can be quick. Sometimes property is taken without warning.

Legal Considerations

Laws protect borrowers during repossession. Lenders must follow rules. They cannot break into homes. Peaceful repossession is required. Borrowers should know their rights. State laws differ. Some states need a court order. Others allow repossession without it.

Legal help is available. Borrowers can seek advice. It is important to understand contracts. Contracts show terms of repossession. Reading contracts helps avoid surprises. Being informed is the best defense.

Factors Influencing Repossession

The loan agreement is very important. It tells how many payments you can miss. Some agreements allow one missed payment. Others give more time. Read the terms carefully. Know your rights and duties.

Each state has different rules. State laws decide repossession rules. Some states are strict. Others are more lenient. Learn the laws in your state. This helps you understand what might happen.

Common Payment Thresholds

Most lenders allow you to miss two to three payments. Missing more can lead to repossession. Each lender might have a different rule. It’s important to know what your lender requires. Some may give more time or options. Always check your loan agreement. Understand the terms well.

Different lenders have different rules. Some are stricter than others. A few might allow only one missed payment. Others might allow up to four. It’s key to communicate with your lender. Ask questions if unsure. This can help avoid losing your car or house. Always stay informed and proactive.

Consequences Of Missing Payments

Missed payments can hurt your credit score. Each missed payment can lower it. A low credit score makes borrowing money hard. Creditors see missed payments as a risk. They may not trust you to pay back loans. Keeping a good score is important for future loans.

Missed payments come with extra costs. Lenders charge late fees. Fees add up quickly. Sometimes, they charge interest on missed payments. This means you owe more money. Paying on time helps avoid these extra costs. It keeps your finances healthy.

Preventing Repossession

Talking to your lender is very important. This is because it helps in avoiding repossession. Always tell them about your financial problems. Lenders can help you with new payment plans. This keeps your car safe. Never hide money issues from them. Being open can save you from losing your car. Lenders want to help you. They don’t want to take your car away. So, always talk to them first. This is the best way to solve problems early.

Refinancing is a smart choice. It can lower your monthly payments. This makes payments easier for you. Refinancing can change your loan terms. It helps in keeping your car safe. Talk to your bank about this option. They can offer you better rates. Make sure you understand all the terms. This will help you decide better. Refinancing can be a good solution. Especially if you are struggling with payments.

Alternatives To Repossession

Voluntary surrender means giving back the car to the lender. This can be a smart choice if you can’t pay anymore. No more monthly payments. It helps avoid the stress of forced repossession. It might impact your credit score. But, it shows you took responsibility. Avoid extra fees and charges. Discuss with your lender first. They might offer better solutions.

Loan modification changes your loan terms. Lower monthly payments help manage finances. Extend the loan period or reduce interest rates. This can save your car from repossession. Talk to your lender about options. They might agree if you show proof of hardship. It can be a lifeline when struggling. Keep communication open. Document your needs clearly.

Legal Rights And Resources

Consumer protection laws keep people safe from unfair practices. These laws give rights to consumers about their property. They also make rules about missed payments and repossession. Knowing these rules helps you understand your rights. Consumers have the right to get notices before repossession. This notice tells the amount owed and time to pay. People can use these laws to protect their stuff.

Legal assistance helps people understand their rights. Lawyers can give advice on missed payments. They help with legal steps if needed. They explain the repossession process clearly. Lawyers can help find ways to solve payment issues. They also make sure companies follow the law. Legal help can be found in local areas. Many offer help for free or low cost. It is good to talk to a lawyer if you need help.

Case Studies

Maria missed three payments on her car. The bank sent a warning. She had to act fast. She called them. They made a plan. Maria paid a little more each month. She saved her car.

Tom missed five payments. He lost his job. Tom did not call the bank. They took his car away. He learned a big lesson. Always talk to the bank early. They can help.

Frequently Asked Questions

How Many Payments Can You Miss Before Repossession?

Typically, you can miss three payments before repossession begins. Lenders usually start the repossession process after 90 days of non-payment. However, this can vary based on the lender’s policies and your contract.

What Happens After Missing One Car Payment?

Missing one payment typically results in late fees and a negative mark on your credit report. Lenders may contact you to remind you of the missed payment. It’s crucial to communicate with your lender immediately to avoid further penalties.

Can You Stop Repossession After Missed Payments?

Yes, communicating with your lender can help stop repossession. You might negotiate a payment plan or deferment. Being proactive and transparent about your financial situation is essential to finding a solution.

How Does Repossession Affect Your Credit Score?

Repossession significantly impacts your credit score, usually lowering it by 100 points or more. This negative mark can remain on your credit report for up to seven years, affecting future loan approvals and interest rates.

Conclusion

Understanding repossession timelines helps maintain financial health. It’s crucial to know payment terms. Missed payments could lead to serious consequences. Repossession risks increase with each missed payment. Communicate with lenders if problems arise. Discuss options to avoid repossession. Stay informed about your rights and responsibilities.

This knowledge empowers better decisions. Protect your assets by staying proactive. Financial discipline keeps repossession at bay. Always prioritize essential payments. Budget wisely to prevent defaults. Early action can prevent future stress. Keep track of payment dates. Being responsible ensures peace of mind.

Stay vigilant and informed for financial stability.