Are you wondering if ERC payments are taxable? You’re not alone.

Navigating the world of taxes can feel like solving a complex puzzle. The Employee Retention Credit (ERC) has been a financial lifeline for many businesses, but understanding its tax implications is crucial. Your curiosity is valid, and getting the right information could save you from potential headaches or financial surprises down the road.

We’ll break down everything you need to know about the taxability of ERC payments, ensuring you’re well-equipped to make informed decisions. Stay with us, and let’s turn this confusing topic into a clear and manageable one.

Understanding Erc Payments

ERC payments help businesses during tough times. They support employers. ERC stands for Employee Retention Credit. This credit helps keep workers employed. Businesses get money from the government. It helps them pay their employees. These payments are important. They help both employers and employees. They keep jobs safe. Businesses need support to survive.

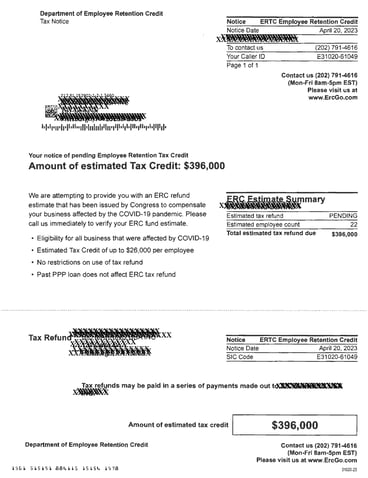

Not every business gets ERC payments. Eligibility is key. Businesses must meet certain rules. They need to show loss in revenue. They must have kept employees working. Size matters too. Small businesses often qualify. Some big ones do too. Rules can change. It’s important to check often. Government sets these rules. They want to help as many as possible.

Taxability Of Erc Payments

ERC payments can be taxable. The IRS sets rules for these payments. They are not always free from taxes. Businesses need to check the IRS guidelines. These rules help understand what is taxable. Sometimes, ERC payments can be income. This means taxes might apply. Reading the IRS guidelines is very important. It helps with correct tax filing.

ERC payments must be reported correctly. Reporting these payments is required by law. Businesses must include ERC in their tax reports. This helps avoid problems with tax authorities. Proper reporting ensures compliance. It is key to follow the rules. Keeping records of ERC payments is necessary. This makes the reporting process smoother.

Implications For Businesses

ERC payments can affect financial statements. These payments are considered income. They must be reported correctly. This is important for transparency and accuracy. Businesses should monitor these payments closely. They must ensure all records are up to date. Mistakes can lead to fines or penalties. Proper documentation is key. Understanding these implications helps in making smart decisions.

Financial statements may appear stronger with ERC payments. But, they need careful evaluation. These payments can change the balance sheet. They can also affect cash flow. Businesses should analyze these impacts. It is important to plan wisely. Knowing this helps in managing finances better.

Small businesses need special attention. ERC payments can be a big help. But, they must be handled properly. Proper accounting is essential. Small businesses should seek expert advice. This ensures compliance with tax rules. Planning and guidance can prevent issues. It also helps in understanding future obligations.

Strategies For Managing Erc Taxes

ERC payments can be taxable. It’s important to know how to use tax credits wisely. Tax credits help reduce the amount you owe. They are like coupons for your taxes. Use them when you file your taxes. Make sure to check which credits apply to you. Some credits are only for businesses. Others are for individuals. Knowing the difference helps save money. Always keep records of your payments. These records help prove your claims. Claim the credits that fit your situation. This reduces what you owe.

Tax professionals can make things easier. They understand the laws better. They help you find the right credits. They also ensure everything is correct. This avoids mistakes that cost money. Professionals keep up with changing rules. They know new laws and updates. Hiring one might seem costly. But it saves money in the long run. Choose someone with good reviews. Ask friends for recommendations. This ensures you get help from experts. They make filing taxes less stressful.

Future Considerations

Exploring tax implications of ERC payments is vital for future financial planning. Understanding if these payments are taxable can impact budgeting and compliance. This knowledge ensures businesses navigate taxation correctly, avoiding potential legal pitfalls.

Potential Changes In Legislation

Laws can change over time. Erc payments might face new tax rules. This could affect how much you keep. It’s important to stay updated. Knowing the changes helps plan better. You can ask an expert for advice. They can explain new laws clearly. This makes things easier to understand.

Long-term Financial Planning

Planning for the future is smart. Erc payments could be part of your plan. Save some money for unexpected taxes. This helps avoid surprises later. Think about your future goals. Saving now can help you reach them. Discuss your plans with a financial advisor. They can offer useful tips. It’s good to know all options. This way, you stay prepared.

Frequently Asked Questions

What Are Erc Payments?

ERC payments refer to the Employee Retention Credit, a refundable tax credit. It’s designed to support businesses that retained employees during the COVID-19 pandemic. The credit helps reduce payroll taxes.

Are Erc Payments Considered Taxable Income?

No, ERC payments are not considered taxable income. However, claiming the ERC reduces deductible wage expenses. This adjustment indirectly affects taxable income.

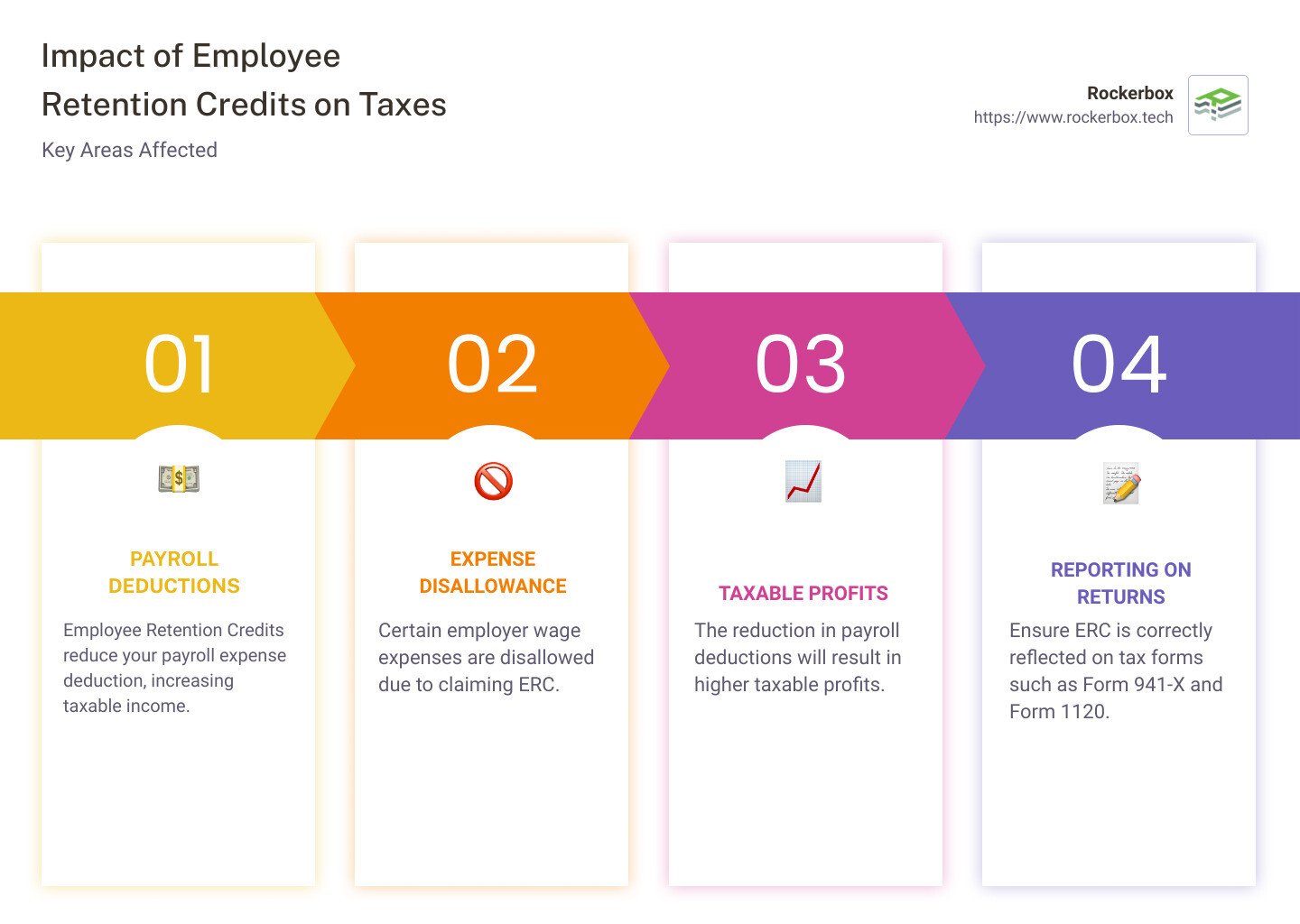

How Do Erc Payments Affect My Taxes?

While ERC payments aren’t taxable, they reduce deductible wage expenses. This can increase taxable income. Consult a tax professional to understand specific impacts on your tax situation.

Can I Claim Erc Payments And Ppp Loans?

Yes, businesses can claim both ERC payments and PPP loans. However, they cannot use the same wages for both benefits. Proper documentation is essential to ensure compliance.

Conclusion

Understanding ERC payments is crucial for your financial planning. Tax rules can be tricky. Always check the latest guidelines. Consulting a tax professional helps. They can provide accurate advice. Remember, tax laws change often. Stay informed and compliant. This ensures peace of mind.

It’s important to handle finances wisely. Avoid mistakes by being proactive. Seek help if uncertain. Your financial health depends on it. Be diligent with your records. Keep them organized and accessible. This will simplify the process. Make informed decisions about your ERC payments.

Stay updated and make the best choices.