Have you ever wondered what exactly happens when you swipe your card or hit that “buy now” button online? Understanding customer payment is crucial, not just for businesses but for you as a consumer.

Whether you’re buying your morning coffee or the latest gadget, there’s a complex process working behind the scenes to ensure your transaction is smooth and secure. By grasping the basics of customer payment, you’ll gain insights into how your money moves and how you can make smarter purchasing decisions.

Let’s delve into the world of customer payments and uncover what really happens when you make a purchase.

Customer Payment Basics

Customer payment is the money customers give for goods or services. Payments can be made in different ways. Common methods include cash, credit cards, and digital wallets. Each method has its own advantages. Cash is simple. Credit cards offer security. Digital wallets are fast and easy.

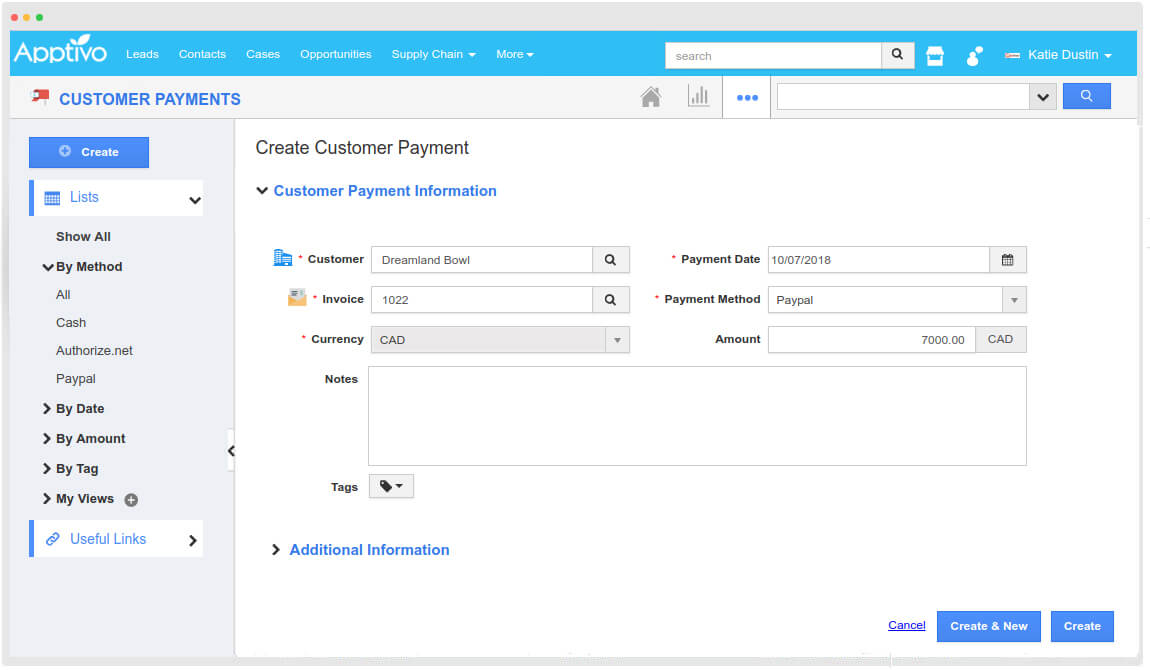

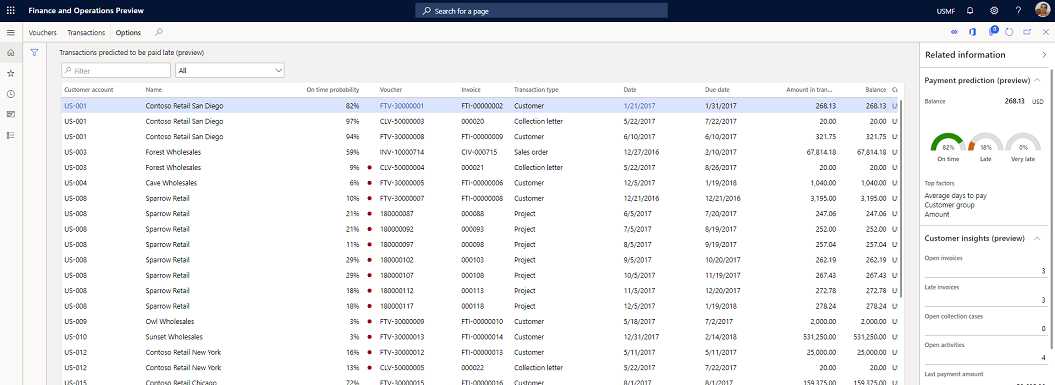

Stores often use payment systems to manage transactions. These systems track sales and payment details. They help in keeping records clean. Some systems are online, while others are offline. Online systems can work anytime. Offline systems need manual handling.

Payments are important for business success. They ensure businesses get paid for their products. Customers expect smooth payment experiences. Businesses aim to provide secure and quick methods. This builds trust and keeps customers happy.

Payment Methods

Credit and debit cards are easy to use. They are popular payment methods worldwide. You swipe or insert the card to pay. Enter your PIN for security. Many people find this method convenient. It is fast and simple. Most stores accept cards. This makes shopping easy for everyone.

Digital wallets hold money on your phone. Pay quickly using apps like PayPal. These wallets keep your info safe. You don’t need cash or cards. Just a phone is needed. Many people use them for online shopping. Digital wallets are becoming more common every day.

Bank transfers move money between accounts. They are safe and reliable. You can use online banking. It takes a few days sometimes. But it’s a trusted way. Many people pay bills this way. Businesses also use bank transfers a lot.

Cash is simple to use. No need for technology. Everyone understands cash. It is accepted everywhere. Some people feel secure using cash. You can see what you spend. But carrying a lot of cash can be risky.

Payment Processing

Authorization is when the bank checks if you have enough money. It also checks if your card is valid. This step makes sure you can pay. Without it, payments might fail. The process is fast, often a few seconds.

Authentication keeps your payment safe. It checks if you are the real card owner. Security features like PINs and passwords help. They stop bad people from using your card. Strong security is key for safe payments.

Settlement is when the money moves from your account to the seller’s. Clearing is the final step. It confirms the money transfer. This process ensures sellers get paid. It usually takes a few days. Banks make sure everything is correct.

Payment Gateways

Payment gateways are crucial for online purchases. They help process payments safely. Security is their top priority. They encrypt sensitive data. This keeps customer info safe. They also check for fraud. Payment gateways work with banks. They ensure funds are available. They offer multiple payment options. Credit cards, debit cards, and more. They make transactions fast. Payments are processed in seconds. This improves customer satisfaction. Easy checkout is key for more sales.

Picking the right gateway is important. Fees vary between gateways. Some are cheaper than others. Look for ones with low fees. Security features should be strong. Choose gateways with good security. Check for customer support. Good support helps solve issues fast. Make sure it supports your currency. Compatibility with your website matters. It should integrate easily. Read reviews before deciding. Reviews show real user experiences.

Trends In Customer Payments

People love using contactless payments now. They are fast and easy. Just tap your card or phone. No need for cash or coins. It is safe too. Many stores accept it. You can see it everywhere. It makes buying things simple. You can leave your wallet at home.

Cryptocurrency is like digital money. It is used online. Some people pay with it. It is called a cryptocurrency transaction. Bitcoin and Ethereum are popular ones. Not everyone uses it yet. But it is growing. Many websites take it now. It feels like the future.

Phones can be wallets too. This is called mobile payment solutions. Apps like Apple Pay or Google Pay help. You pay just by using your phone. It is very handy. No need to carry cards. Just your phone. Many people use it daily. It is quick and smart.

Security Concerns

Fraud is a big problem. Payment systems must be very safe. They use smart tools to stop fraud. Detecting strange behavior helps catch bad guys. Alerts warn when something is wrong. These systems protect your money.

Data must be safe. Encryption is like a secret code. It hides information. Only the right person can see it. This keeps your details safe. Hackers cannot read encrypted data. Your payment info is secure.

Rules are important. Payment systems follow many laws. These laws keep your data safe. Compliance means obeying rules. Systems are checked often. They make sure everything is right. Your money is protected by these laws.

Future Of Customer Payments

Smartphones change payment ways. People use apps to pay fast. Biometric payment is new. Fingerprints and face scans make payments safe. Voice recognition helps too. Digital wallets keep money online. Blockchain offers secure paths. Some use cryptocurrency for privacy. Artificial intelligence improves security. It checks for fraud. IoT devices make payments easy. Wearables like watches pay with a tap. Contactless cards are popular. Tap and go is simple.

Many countries see new ways to pay. Mobile payments grow fast. QR codes make it easy. Cross-border payments are quicker. Fintech companies help with this. Digital banks offer online services. Instant payments mean no waiting. Cashless is common now. Some places use virtual currencies. E-commerce uses them too. Online transfers are simple. People trust secure networks. Payment gateways protect money. Peer-to-peer payments are popular. They help friends share money.

Frequently Asked Questions

What Is Customer Payment?

Customer payment refers to the process where customers pay for goods or services. It involves various payment methods like credit cards, cash, or digital wallets. Businesses must ensure secure, efficient, and convenient payment options to enhance customer satisfaction and streamline transactions.

How Does Customer Payment Work?

Customer payment involves the transfer of funds from the customer to the business. This can be done through various channels, including online payment gateways, direct bank transfers, or in-person transactions. The process ensures that the customer fulfills their financial obligation for the purchased product or service.

Why Is Customer Payment Important?

Customer payment is crucial for business revenue and cash flow management. It ensures that businesses receive timely compensation for their products or services. Efficient payment systems also improve customer satisfaction and loyalty, reducing cart abandonment and boosting overall sales performance.

What Are Common Customer Payment Methods?

Common customer payment methods include credit and debit cards, bank transfers, and digital wallets like PayPal. Cash and checks are also traditional methods. Offering diverse payment options caters to customer preferences and can enhance the shopping experience, leading to higher conversion rates.

Conclusion

Understanding customer payment is crucial for business success. It involves transactions between buyers and sellers. Businesses must ensure smooth payment processes. This builds trust and enhances customer satisfaction. Different payment methods suit different needs. Credit cards, digital wallets, and cash are common choices.

Offering options increases flexibility for customers. Security is vital in payment systems. Protecting customer data builds confidence. Efficient payment processes can boost sales and loyalty. Always stay updated with payment technology trends. This keeps your business competitive and customer-friendly. By mastering customer payments, businesses can thrive in a dynamic market.