Imagine you’re on the brink of purchasing your dream home. You’ve found the perfect property, and the excitement is palpable.

Yet, there’s one hurdle you need to clear: the down payment. As you navigate through financing options, a question might pop into your mind: Can seller credit be used for the down payment? This is a crucial moment, and the answer could potentially reshape your path to homeownership.

Understanding the intricacies of seller credits and how they can impact your financial strategy is vital. We’ll unravel the truth about seller credits, empowering you with the knowledge you need to make informed decisions. So, stay with us, because what you discover might just bring you a step closer to turning the key in the lock of your new home.

What Is Seller Credit?

Seller credit is money from the seller. It helps buyers with costs. Closing costs are fees when buying a home. Seller credit can pay these fees. This helps buyers save money. Sellers offer credit to make homes sell faster. Buyers like seller credit. It reduces their out-of-pocket expenses. Seller credit cannot be used for a down payment. Down payments are separate from closing costs. Buyers must have their own money for down payments. Seller credit is useful but limited.

How Seller Credit Works

Seller credit is a special offer from the seller. It helps buyers save money. Sellers give money to buyers to cover extra costs. This makes homes cheaper to buy. Seller credit cannot be used for down payments. It only covers closing costs. Closing costs include fees like inspections and title checks.

Buyers get help with seller credit. They pay less upfront. This can make buying a home easier. It is important to know rules about seller credit. Only certain costs can be covered. Buyers should ask questions. Understanding seller credit is important.

Benefits Of Seller Credit

Using seller credit helps in reducing closing costs. This means you pay less at the end. You save money on fees. Less cost means you can buy a house easier.

Seller credit can increase affordability. You have more money for other things. It helps make the house fit in your budget. More savings mean more choices.

Seller credit gives you negotiation leverage. You can ask for better terms. It makes the deal fair. You have more power in talks. Good deals mean happy buyers.

Limitations Of Seller Credit

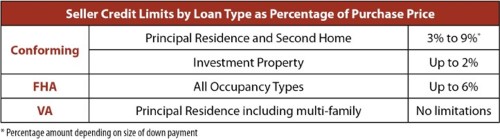

Seller credit is not always easy to use. Lenders often set rules on how much credit can be used. Some lenders do not allow it for a down payment. They might have their own specific guidelines. This can make things tricky for buyers.

Seller credit can change the final price of a home. Sellers may raise the price to cover the credit. This can make homes more expensive. Buyers should be careful. They need to watch out for these price changes. It’s important to know all the costs involved.

Using Seller Credit For Down Payment

Seller credit can help with home buying. But, there are rules. Buyers and sellers must follow legal guidelines. Some loans do not allow seller credits for down payments. FHA loans are one example. USDA loans might have different rules. Always check with a loan officer. They know the rules well. Understanding these rules helps avoid problems.

Sometimes, seller credit is not enough. Buyers need other options. Gifts from family can help. Borrowers can also use savings. Some people try grants or down payment assistance programs. These programs can be very helpful. They are different in each area. Ask a local expert for advice. They can find the best options for you.

Maximizing Savings With Seller Credit

Seller credit can help save money. Negotiating with sellers is key. Buyers might get better deals this way. Sellers can offer credits to attract buyers. These credits reduce the buyer’s costs. This makes buying a home more affordable.

Real estate experts give valuable advice. They understand the market well. Experts can help buyers use seller credit wisely. This helps in finding the best deals. They guide on how to approach sellers. Experts make the buying process smoother. Their advice is often helpful.

Common Misconceptions

Many people think seller credit can be used for a down payment. This is not true. Seller credit usually helps with closing costs. These costs can be taxes and fees. Down payments are different. They need to be paid by the buyer. Seller credit cannot cover them.

Misunderstanding Eligibility

Some believe anyone can use seller credit. This is wrong. Eligibility depends on the loan type. Some loans do not allow it. Always check with your lender. Make sure you know what is allowed. Rules can change. Be informed.

Confusing With Other Credits

Seller credit and other credits are mixed up often. People think they are the same. They are not. Seller credit is from the seller. Other credits can be from the bank or government. They have different uses and rules. Know the difference. It helps avoid mistakes.

Real-life Examples

Seller credit can sometimes help with a down payment. Buyers may negotiate with sellers to cover a portion of closing costs, potentially freeing up funds for a down payment. This approach often depends on the lender’s policies and the specific terms of the sale agreement.

Successful Transactions

Many buyers have used seller credit for down payments. One example is John, who bought a cozy house. The seller gave him a $5,000 credit. This helped John reduce his upfront costs. It made buying the home easier.

Another example is Emma. She wanted a condo in the city. The seller offered a $7,000 credit. This credit covered part of her down payment. Emma was thrilled to get her dream condo.

Lessons Learned

Using seller credit can be helpful. Buyers save money upfront. It also makes homes more affordable. Sellers can close deals faster. But it’s important to read the terms. Not all sellers offer credits. Always check with your lender. Some lenders have rules about credits.

Overall, seller credit can be a useful tool. It benefits both buyers and sellers. Many have found success with it. Always ask questions and understand the process.

Frequently Asked Questions

Can Seller Credit Cover Down Payment Costs?

Seller credit cannot be used for the down payment. It is typically used to cover closing costs. Lenders require buyers to provide their own funds for the down payment to ensure financial commitment.

What Is The Purpose Of Seller Credit?

Seller credit is used to assist buyers with closing costs. It helps reduce the buyer’s out-of-pocket expenses. This can make purchasing a home more affordable.

How Does Seller Credit Benefit Buyers?

Seller credit reduces the buyer’s financial burden at closing. It allows buyers to allocate funds elsewhere. This can be particularly helpful for first-time homebuyers.

Can Seller Credit Lower My Mortgage Rate?

Seller credit does not directly affect mortgage rates. It covers closing costs, not interest rates. Buyers should discuss rate options with their lender.

Conclusion

Seller credit offers flexibility in home buying. It covers closing costs, reducing out-of-pocket expenses. But it can’t be used for down payments. Understanding this distinction is crucial for buyers. Consult with your lender to explore options. Every bit of knowledge helps in decision-making.

Proper planning leads to successful home purchases. Remember, every situation is unique. Tailor your approach accordingly. Stay informed and make smart choices. Knowledge empowers home buyers. Keep learning and asking questions. The right information can guide you to your dream home.

Happy house hunting!