Are you dreaming of hitting the road in a brand-new Jeep? If so, you’re probably wondering about the monthly payments and how they fit into your budget.

Understanding the cost is crucial before making this exciting purchase. In this guide, you’ll discover everything you need to know about Jeep monthly payments. We’ll break down the factors that influence these costs and offer tips to help you secure the best deal.

Stick around to ensure you’re fully prepared to make an informed decision about financing your dream Jeep.

Factors Affecting Monthly Payments

Jeep models vary in price. Higher trims often cost more. This affects monthly payments. A basic model might be cheaper. Fancy features increase costs. Choose wisely based on your budget.

Down payments reduce monthly costs. Paying more upfront lowers payments. Trading in your old car helps. Trade-ins can give extra money. This lowers what you pay each month. Both options are helpful.

Interest rates affect payment size. Lower rates mean less money each month. Loan terms also play a role. Short terms increase payments. Longer terms decrease them. It’s important to understand these elements.

Understanding Total Vehicle Cost

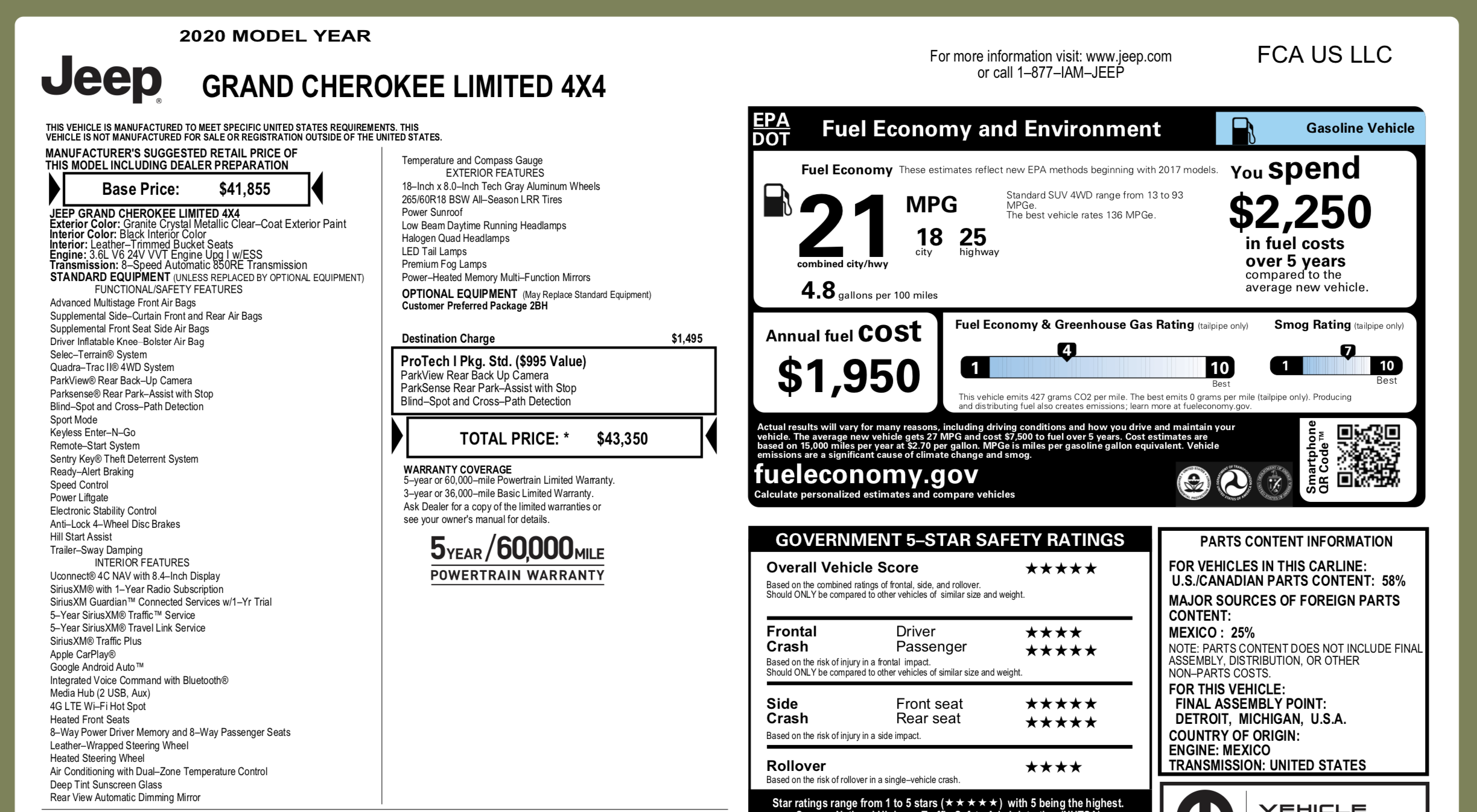

The MSRP is the price set by the maker. It’s the sticker price you see. But you can negotiate this price. This means you can talk to the seller. You might get a lower price. Always try to get the best deal. It saves you money.

Extra features can make a Jeep cost more. Like a sunroof or leather seats. These are upgrades. They make the car nice. But they add to the price. Choose what you really need. It’s easy to spend too much.

You must pay taxes when buying a Jeep. These are extra costs. Fees are also added. Like registration and documentation fees. These are not in the car price. Know these costs before buying. They can be a lot.

Financing Options

Dealerships offer financing plans to help buy a Jeep. They often work with banks to provide loans. Interest rates can vary. Some dealerships have special offers. These may include low interest rates or zero down payment. Check for any hidden fees. Always read the contract carefully. It is important to ask questions. Be sure you understand the terms fully.

Banks and credit unions provide auto loans. These loans may have better rates than dealerships. Loan approval depends on credit score. A good score can mean lower rates. Credit unions often offer more flexible terms. They may require being a member. Compare rates from different places. It helps in making a smart choice.

Leasing is another option for driving a Jeep. It means renting the vehicle for a set time. Monthly payments are usually lower. At the end of the lease, return the Jeep. Sometimes, you can buy it. Leases often have mileage limits. Extra miles can cost more. It’s a good option if you like new cars often.

Calculating Monthly Payments

Online calculators help find the monthly payment for a Jeep. Users enter the price of the Jeep, the down payment, and the interest rate. The calculator shows the monthly cost. This tool is easy and saves time. It helps to budget and plan before buying.

A loan has many parts. The principal amount is the Jeep’s price. The interest rate adds extra cost over time. Loan fees might be included. Each part affects the monthly payment. Knowing each part helps in understanding the total cost.

Loan duration affects monthly payments. Longer loans reduce monthly payments. But they increase total interest paid. Shorter loans have higher monthly payments. They reduce total interest. Choose the right loan duration for your budget.

Tips For Lowering Payments

A better credit score means lower payments. Pay your bills on time. Make sure you check your credit report. Look for mistakes. Fix any errors you find. A higher score can save you money.

Talk to the dealer. Ask for better terms. See if you can get a lower interest rate. This can reduce your monthly payment. Do not be afraid to ask questions. Be polite but firm.

Pick a Jeep that costs less. Smaller models often have lower prices. They also use less gas. Make a list of what you need. Choose a Jeep that fits your budget. This helps keep payments low.

Common Mistakes To Avoid

Estimating a Jeep monthly payment can be tricky. Many people forget to include taxes and fees. Overlooking these costs might lead to budget surprises. Always calculate the total cost, not just the base price.

Ignoring Additional Costs

Monthly payments aren’t the only expense. Insurance adds to the cost. Maintenance fees can surprise you. Fuel costs need attention too. These can make a big difference.

Overextending Finances

Buying a Jeep can be exciting. But, be careful with spending. Stick to your budget. Avoid loans that stretch your limits. Emergency funds need protection. Don’t risk financial trouble.

Not Comparing Offers

Always check different deals. Dealerships have varied prices. Some offer better rates. Interest rates can vary a lot. Comparing helps save money. Shop around for the best deal.

Real-life Payment Examples

Jeep offers many models. Each model has a different monthly payment. A Jeep Wrangler might cost $350 per month. The Cherokee could be $300 monthly. The Grand Cherokee might be $400. Model choice affects your payment.

A bigger down payment can lower your monthly cost. Paying $5,000 upfront may drop payments to $250. A $2,000 down payment might keep them at $300. The more you pay first, the less each month.

Credit scores change your payment plan. A high score means lower interest rates. This could make payments cheaper. A low score might increase rates. You might pay more every month. Better scores save money.

Frequently Asked Questions

What Factors Affect Jeep Monthly Payments?

Jeep monthly payments depend on several factors. Vehicle model, loan term, interest rate, and down payment are key elements. Your credit score can also significantly impact the payment amount. Additionally, any dealer incentives or promotions can alter the final monthly cost.

Always review these aspects when planning your purchase.

How Can I Lower My Jeep Payment?

To lower your Jeep payment, consider increasing the down payment. A higher credit score might secure a better interest rate. Opt for a longer loan term if needed, but be aware this may increase total interest. Shop around for competitive financing options to find the best deal.

Is Leasing Cheaper Than Buying A Jeep?

Leasing a Jeep often results in lower monthly payments compared to buying. However, purchasing builds equity and doesn’t involve mileage limits. Leasing may include additional fees for excess wear and tear. Evaluate your driving habits and financial goals to determine the best option for you.

Does Jeep Offer Financing Incentives?

Yes, Jeep often provides financing incentives to attract buyers. These can include low interest rates, cashback offers, or special lease deals. Incentives vary by model, location, and time of year. Check Jeep’s official website or contact a local dealer for current promotions and eligibility requirements.

Conclusion

Understanding Jeep monthly payments is crucial for budgeting. Factors like credit score, loan term, and down payment affect costs. Compare different financing options. Dealers often provide tailored plans. Always read the fine print. Calculating your budget helps prevent surprises. Consider insurance and maintenance costs, too.

A Jeep can be a great choice for adventure lovers. Make informed decisions to enjoy your ride without financial stress. Always research before committing to a plan. Your financial peace depends on it.