Are you a homeowner wondering if your HOA payments could save you money during tax season? You’re not alone.

Many people grapple with understanding the nuances of Homeowners Association (HOA) fees and their potential impact on taxes. It’s a complex topic, and unraveling it could mean the difference between optimizing your financial situation or missing out on possible savings.

By diving into this article, you’ll gain clarity on whether these payments can be tax-deductible and how they might affect your financial planning. Stay with us, and let’s uncover the truth behind HOA payments and tax deductions, so you can make informed decisions with confidence.

Understanding Hoa Payments

Homeowners pay HOA fees. These fees help keep neighborhoods nice. They cover things like landscaping and pool maintenance. Sometimes they pay for security too. Every month, homeowners send money to the HOA. The amount can change. It depends on the community’s needs.

HOA fees keep the neighborhood clean. They pay for nice parks. They cover street lights and signs. Fees fix roads and sidewalks. The money makes the community safe and pretty. Homeowners enjoy better living. Their property value stays high. Everyone shares these costs. It helps the whole neighborhood.

Tax Deduction Basics

A tax deduction reduces the amount of income that is taxable. It helps people pay less money in taxes. By lowering taxable income, deductions can save money.

There are different types of deductions. Each has its own rules. Understanding these rules is important. This helps in planning finances better.

Many expenses can be deductible. Some common ones include mortgage interest, property taxes, and medical expenses. Charitable donations also count.

Education costs may be deductible too. Some work-related expenses might qualify. Always check with tax rules. These rules tell if expenses are deductible.

Hoa Payments And Tax Deductions

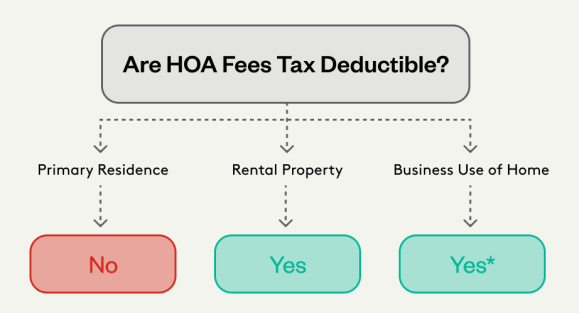

HOA payments for primary residences are usually not tax deductible. They are seen as a living expense. For investment properties, things are different. You might deduct HOA fees. This is possible if the property earns rental income. It is important to keep records of all payments. This helps when filing taxes. Always check with a tax expert for advice. Rules can change.

The IRS has specific rules on HOA fees. For rentals, these fees may be a deductible expense. For personal use homes, the rules are strict. Fees are usually not deductible. It’s good to understand these rules clearly. Mistakes can lead to problems. Using a tax advisor can be helpful. They provide guidance on these matters. Always stay informed about current guidelines.

Scenarios For Deductibility

HOA fees for rental properties can be deducted. These fees are considered a business expense. It’s important to keep records. Show proof these payments are for rental property. This helps during tax filing. Check with a tax expert. Rules can change over time. Always stay updated. It ensures correct filing.

Deducting HOA fees for home offices is tricky. Only the part used for business is deductible. Calculate the percentage of home office use. This percentage applies to HOA fees. Keep accurate records. Provide proof of business use. This protects against IRS issues. Consult a tax advisor. They offer guidance. Always follow legal guidelines.

How To Claim Deductible Hoa Fees

Gather all HOA payment receipts. Keep them safe. You will need them.

Proof of payment is important. It shows your expenses.

Also, collect any letters or notices from the HOA.

They might be useful. Save everything in one place.

This makes it easier to find later.

Use the tax software to help. It can guide you.

Make sure all your information is accurate.

Double-check the numbers. Mistakes can lead to delays.

If you’re unsure, ask a tax expert. They can offer advice.

It’s better to be safe. Ensure you file on time.

Missing deadlines can cost money.

Common Misconceptions

Many people think HOA fees are tax deductible. This is a myth. HOA fees are not deductible on personal tax returns. They are seen as regular expenses. Some say paying HOA fees saves taxes. This is wrong. Only rental properties can deduct HOA fees. Homeowners cannot deduct these fees.

Tax rules can be confusing. Many people misinterpret them. Homeowners must understand the rules. Tax deductions apply to rental properties only. Homeowners are often mistaken. They believe they can deduct HOA fees. This is not true. HOA fees are like maintenance costs. They are not deductible for personal use.

Consulting Tax Professionals

Consulting tax professionals can clarify whether HOA payments qualify for tax deductions. Understanding these rules helps manage finances better. Homeowners might find valuable guidance on what expenses are deductible, ensuring they stay compliant while potentially reducing their tax burden.

When To Seek Advice

Understanding tax rules can be tricky. Many people feel confused. Consulting a tax professional helps you know what to do. They explain tax rules in simple words. You learn what payments are tax deductible. Homeowners Association (HOA) payments are often a question. A tax expert knows the answer. They give clear advice. You avoid mistakes with their help. No need to guess. Get advice early. This saves time and worry.

Benefits Of Professional Guidance

Experts make taxes easy. They give correct information. You learn without stress. Professionals know the latest tax laws. They help you make smart choices. You save money with good advice. Experts can spot possible deductions. They know what works best for you. You get peace of mind. Asking a pro is worth it. Avoid tax troubles with their help.

Frequently Asked Questions

Are Hoa Payments Tax Deductible?

HOA payments are generally not tax deductible. They are considered personal expenses. However, if you rent out your property, you may be able to deduct HOA fees as a rental expense. Always consult with a tax professional to understand specific circumstances and potential deductions.

Can Hoa Fees Be A Business Expense?

Yes, HOA fees can be a business expense if the property is used for business purposes. For rental properties, these fees are typically deductible. Ensure to document everything clearly and consult with a tax advisor to confirm eligibility for deductions based on your specific situation.

Are Special Assessments Tax Deductible?

Special assessments are usually not tax deductible for personal residences. They might be deductible for rental properties as part of your rental expenses. Always check with a tax professional to verify your eligibility for such deductions based on your unique financial scenario.

Do Hoa Fees Increase Property Tax?

HOA fees do not directly affect property taxes. Property taxes are determined by the local government based on the property’s assessed value. However, community improvements funded by HOA fees might indirectly impact property values, potentially influencing future property tax assessments.

Conclusion

Determining if HOA payments are tax deductible can be tricky. Each situation is unique. Generally, personal HOA fees are not deductible. Yet, rental properties might offer exceptions. It’s vital to consult a tax expert. They can guide you based on your specifics.

Keep records of your payments. Stay informed about tax laws. They can change. Understanding the basics helps you make smart decisions. Always seek professional advice for accuracy. Don’t leave money on the table. Proper knowledge ensures you’re not missing potential deductions.

Stay proactive with your finances. It pays off in the long run.