Have you ever found yourself daydreaming about owning your own home? The thought of having a place to call your own is exciting, but the process of getting there can feel overwhelming.

One of the biggest hurdles you’ll face is gathering enough money for a down payment. But did you know there’s more to it than just saving up? The timing of when that money needs to be in your account could make or break your home buying plans.

Understanding the specifics of how long your down payment needs to sit in your bank account is crucial. This knowledge can give you a significant advantage, potentially saving you time, stress, and even money. Imagine the peace of mind you’ll have knowing you’re fully prepared when the time comes to make one of the biggest investments of your life. We’ll unravel the mystery behind the timing of your down payment, ensuring you are armed with the information you need to make your home buying journey as smooth as possible. So, are you ready to take control of your home buying dreams? Let’s dive in and find out!

:max_bytes(150000):strip_icc()/how-much-do-we-need-as-a-down-payment-to-buy-a-home-1798252_FINAL-d436ccb9c27f4ced9c60c70eb01a4fdb.png)

Importance Of Down Payments

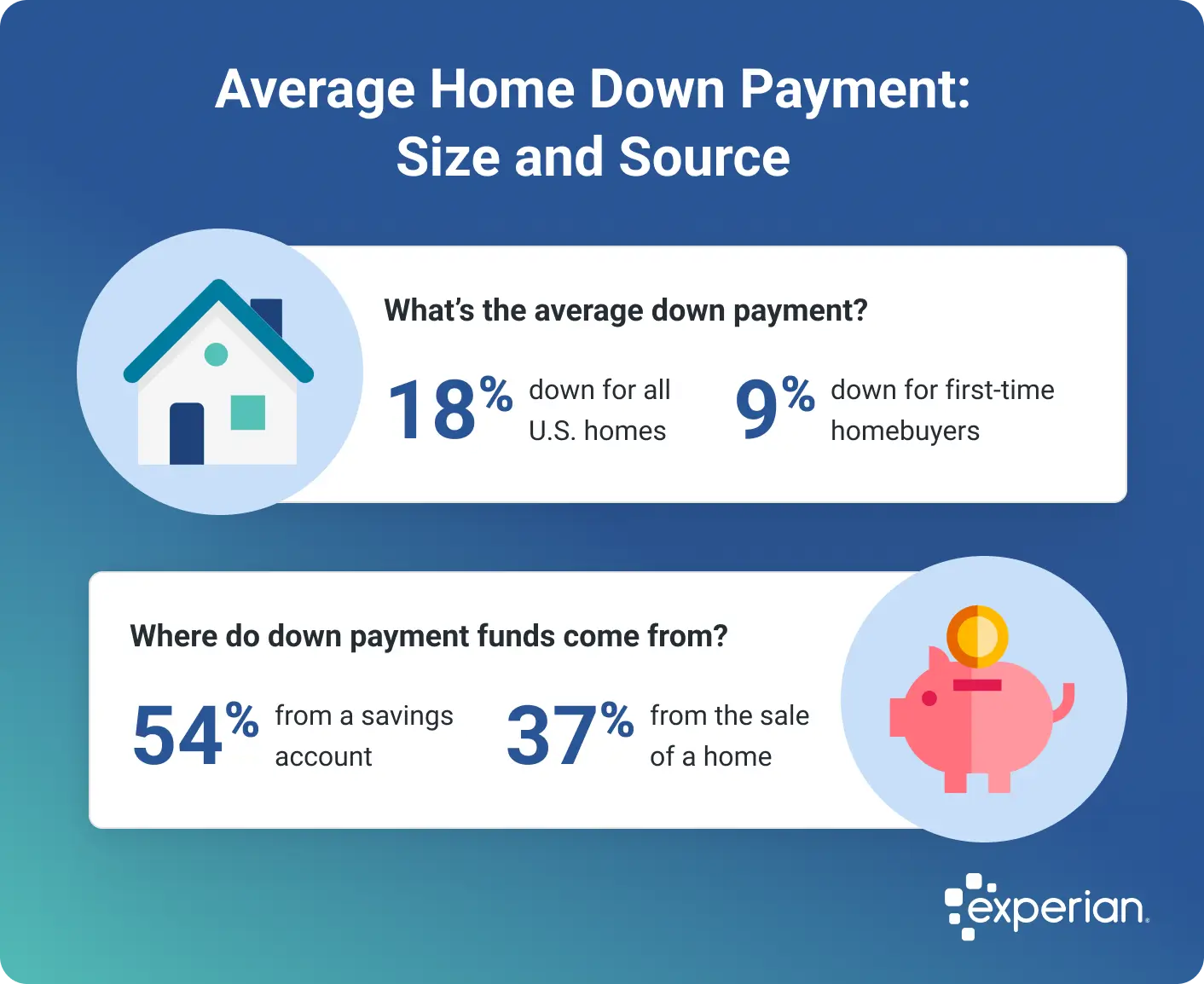

Down payments show lenders that buyers are serious. They reduce loan risks. A bigger down payment can lower monthly payments. It might also help to get better interest rates. Some loans need at least 20% down. Other loans need less. Saving money for a down payment takes time. Money should be in the account before applying for a loan. Banks like to see stable accounts. This shows you handle money well. Keeping funds in the account for months is smart. It helps in the loan process. Down payments play a big role in buying homes.

Lender Requirements

Lenders often have rules about down payment funds. The money usually needs to be in the account for a set time. This is often called the seasoning period. The standard time is usually 60 to 90 days. This lets lenders see a clear record of funds. It shows money is not borrowed at the last minute.

Each lender may have different rules. Some might want money in the account for longer. Others may have shorter timeframes. Checking with the lender is always best. They will give clear instructions. The goal is to prove the money is yours. Lenders want to see stable finances. This helps them trust borrowers more.

Seasoning Of Funds

Seasoning means money stays in the bank for some time. This time is often two months. Banks need to see this money in your account. It helps them trust you. Seasoning shows the money is truly yours. It is not a loan or gift. It also helps banks see your saving habits.

Seasoning is important for banks. It proves you can manage your money well. Banks want to see stable finances. They check this before giving you a loan. Seasoned funds make banks happy. It reduces risk for them. It shows you are ready to buy a home. Without seasoned funds, banks might not trust you. It makes buying a home harder.

Types Of Acceptable Funds

Personal savings is a common way to gather funds. Banks often prefer this method. It shows you are responsible with money. Savings should be in your account for a few months. This proves the money is yours. It also shows your ability to manage funds.

Sometimes, family or friends give money as gifts. These gifts can help with down payments. A gift letter is often needed. This letter states the money is a gift, not a loan. Grants are also helpful. They come from programs that support home buying. Always check the rules for using these funds.

Sell items to gather money. This includes selling cars or furniture. The money from sales can be used for down payments. Keep records of all sales. Banks will need proof of these transactions. This helps verify the funds are legitimate. Selling items can be a smart way to raise needed cash.

Documenting Your Down Payment

Lenders often want to see your bank statements. These show your savings. They check if you have enough money. It’s important to have the money in your account early. This can be for a few months. It helps show stability and reliability.

Sometimes family gives you a gift for the payment. You need a gift letter. This letter tells the lender it’s a gift, not a loan. It should include the giver’s name. Also, the amount gifted and the relationship to you. This helps clarify the source of funds.

If you sold something to get the money, keep the sale receipts. These receipts prove where the money came from. It’s important to show all the details. This includes the item sold and the amount received. It helps build trust with lenders.

Potential Challenges

Unseasoned funds can cause worry for lenders. These funds are new in your account. They might not feel safe about them. Lenders like to see money that has been in the account for a while. This shows stability.

Money that comes from unknown sources is risky. If money suddenly appears, it raises questions. Lenders want proof of where the money came from. They need to know if it is legal.

Large deposits close to buying time can be a problem. It makes lenders suspicious. They might think the money is borrowed. Proof of funds is essential.

Accounts with irregular activity might seem unsafe. Lenders prefer steady accounts. They trust regular deposits and withdrawals. Clear records help build trust.

Unseasoned funds might delay loan approval. Lenders need time to verify the money’s source. They might ask for extra documents.

Tips For Preparing Your Down Payment

Start saving as soon as possible. Set a clear goal for your down payment. Calculate how much you need. Budget each month to reach your target. Cut unnecessary expenses to save more. Look for extra income opportunities. Every little bit helps.

Research different savings accounts. Some offer higher interest. This can grow your money faster. Automate your savings transfers. This ensures you don’t forget. Watch your money grow over time. Feel proud as your savings increase.

Track all your deposits. Use a spreadsheet or notebook. Write down every transaction. Keep receipts safe. You’ll need them for proof later. Lenders often ask for history. Show them you are responsible.

Update your records regularly. This helps you see progress. It also shows where you can improve. Stay organized. This makes the process easier. Feel confident when talking to lenders. You have all the information ready.

Frequently Asked Questions

How Long Should Down Payment Be In Account?

The down payment should ideally be in your account for at least 60 days. Lenders often require this to verify the source of funds. This period is known as “seasoning. ” It helps ensure that the money isn’t borrowed, maintaining the integrity of the lending process.

Why Do Lenders Check The Down Payment Source?

Lenders check to verify that your down payment isn’t from a loan. They want to ensure you can afford the mortgage independently. This process reduces the risk of default. Ensuring funds are seasoned helps lenders assess your financial stability and ability to meet repayment obligations.

Can A Recent Deposit Affect My Mortgage Approval?

Yes, recent large deposits can affect mortgage approval. Lenders need to trace any large deposits to confirm their source. Untraceable funds may lead to complications. It’s essential to provide documentation for any recent deposits, ensuring transparency in your financial transactions.

What If My Down Payment Is A Gift?

If your down payment is a gift, provide a gift letter. This letter should state that the money is a gift, not a loan. Both you and the donor must sign it. This documentation helps lenders verify that the funds are legitimate and won’t affect your mortgage obligations.

Conclusion

Understanding the timing for a down payment is crucial. Keep funds in your account for at least two months. This reassures lenders about your financial stability. Consistent account activity strengthens your application. Plan ahead to meet this requirement. It avoids unnecessary stress during home buying.

Remember, each lender may have different rules. Check with them early in the process. Being prepared saves time and effort. It also enhances your chances of approval. Stay organized and informed. This helps you make the best decisions. Happy home buying!