Are you puzzled by the term “Difficulty of Care Payments” and how they fit into your financial life? You’re not alone.

Many people wonder if these payments are considered earned income and what that means for their taxes and benefits. Understanding the intricacies of these payments is crucial, as it can impact your tax filing, eligibility for certain benefits, and even your overall financial planning.

We will unravel the mystery surrounding Difficulty of Care Payments and clarify whether they fall under the category of earned income. Stick with us, and you’ll gain the clarity you need to make informed decisions about your finances.

Defining Difficulty Of Care Payments

Difficulty of Care Payments are made for providing special care to someone with disabilities. These payments help families who give extra support at home. The government offers this money to encourage better care. It is important to know if these payments are considered earned income.

Earned income usually comes from jobs or businesses. Difficulty of Care Payments are often not taxed as earned income. This means families may not need to report them on taxes. This helps families use more of the money for care. Understanding the rules can help families make smart decisions.

Tax Implications Of Difficulty Of Care Payments

The IRS has specific rules for difficulty of care payments. These payments are often for foster care or similar services. The IRS does not see these as earned income. So, they are usually not taxed. It’s important to follow IRS rules closely. Always check the IRS website for updates.

Different states might have their own rules. Some states treat these payments as income. Others do not. It’s crucial to know your state’s guidelines. Contact a local tax advisor for help. Each state may change its rules over time. Always stay informed about these changes. This will help you avoid any tax issues.

Earned Vs. Unearned Income

Earned income is money you work for. Examples are wages and salaries. Unearned income is money you get without working. Examples include gifts and investments. Both types are important for taxes. They have different rules.

Earned income can help with tax credits. Unearned income may not. Knowing the difference is key. This knowledge helps in filing taxes correctly. It’s good to know what the tax rules say.

Tax rules treat income types differently. Earned income includes wages and tips. Unearned income covers dividends and interest. This affects how you pay taxes. Some credits need earned income. Unearned income might have different rates.

Understanding these examples helps with taxes. It ensures you pay the right amount. It also helps in planning your finances. This is important for everyone.

Legal Interpretations

Court rulings on difficulty of care payments vary widely. Judges often look at the purpose of these payments. Some courts say these payments are not earned income. Others say they are. It depends on the laws and facts. Each case is unique. Lawyers argue both sides. Judges make tough decisions.

The IRS sometimes sends notices about care payments. These notices explain tax rules. They tell you if payments are taxable. Sometimes, payments are not taxed. Other times, they are. IRS rules can change. Always check the latest updates. Follow the IRS guidelines. Pay taxes if needed.

Impact On Tax Credits And Benefits

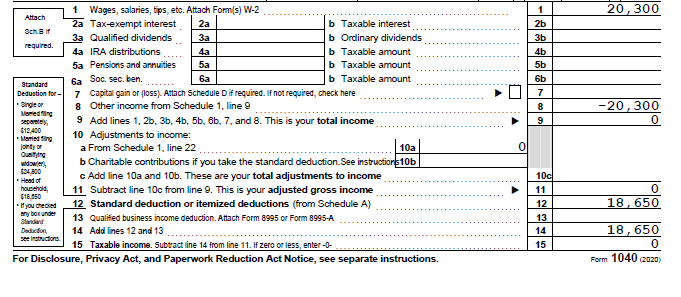

Difficulty of care payments are special payments. They are for caregivers. These payments are often not considered earned income. This is important for taxes. The Earned Income Tax Credit (EITC) needs earned income. So, difficulty of care payments might not count for EITC. This can affect if you get the credit. It is wise to check with a tax expert. They can help you understand better.

Difficulty of care payments usually don’t count as earned income. This affects Social Security benefits. Your benefits might not increase with these payments. Social Security looks at earned income to decide benefits. If the income is not counted, your benefits stay the same. You may need to plan for this. Think about talking to a Social Security expert. They can give advice on your situation.

Case Studies

Exploring the nuances of difficulty of care payments is crucial. These payments are generally not considered earned income by the IRS. Understanding their classification can impact tax responsibilities significantly.

Real-life Scenarios

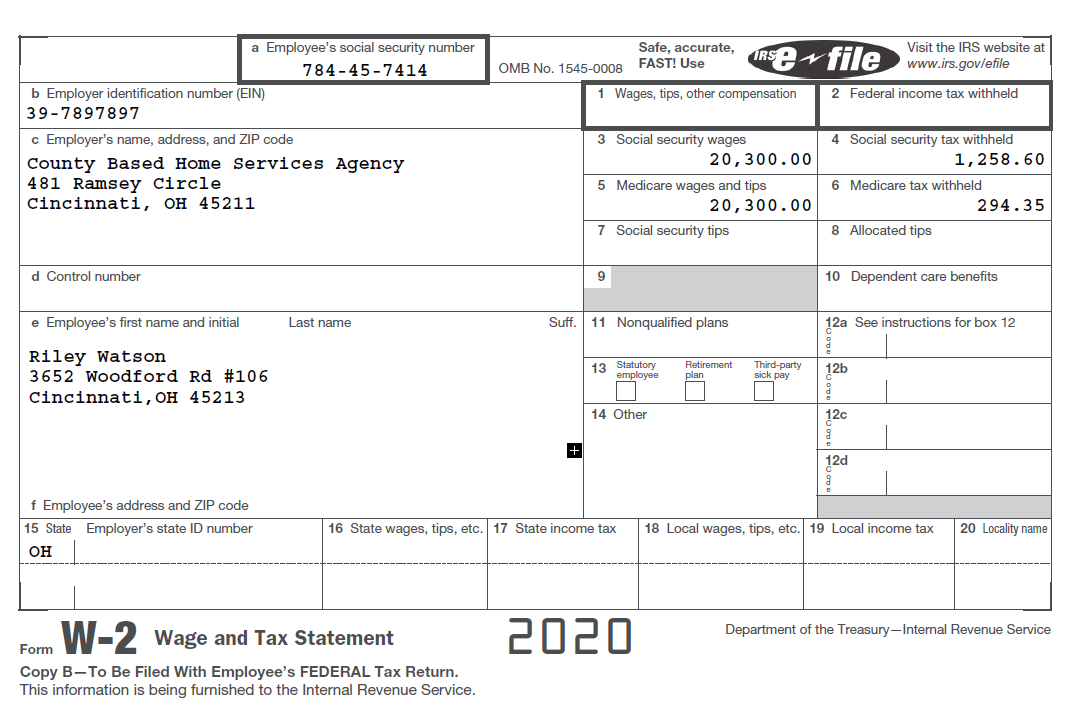

Families face unique challenges with care payments. One family cared for a child with special needs. They received difficulty of care payments. These payments helped cover medical costs. The family wondered if these payments were earned income. They asked an expert for advice.

Another scenario involved a caregiver for an elderly parent. The caregiver received payments for daily support. They were unsure about tax rules. They learned payments are not always considered earned income.

Lessons Learned

Care payments can be confusing. Families often need clear answers. They should consult tax professionals. Experts help understand income rules. Families benefit from knowing these payments’ status.

Seeking Professional Advice

Understanding tax rules can be hard. Especially with care payments. Getting help from a tax professional is smart. They make sure you follow the law. Avoid mistakes in your tax forms. This can save you money.

- Are care payments taxable?

- What forms do I need?

- Can I claim deductions?

- How do payments affect my tax bracket?

- Is there a difference between state and federal rules?

Frequently Asked Questions

What Are Difficulty Of Care Payments?

Difficulty of care payments are made to caregivers for providing essential services to individuals with disabilities. These payments aim to compensate for the additional challenges faced. They are often excluded from taxable income under specific conditions, making them beneficial for caregivers.

Are Difficulty Of Care Payments Taxable?

Generally, difficulty of care payments are not considered taxable income. The IRS allows these payments to be excluded from taxable income if specific conditions are met. This exclusion helps caregivers by reducing their taxable income.

Do Difficulty Of Care Payments Count As Earned Income?

No, difficulty of care payments are not considered earned income. They are typically excluded from income calculations for tax purposes. This distinction can impact eligibility for certain tax credits and benefits.

How Do Difficulty Of Care Payments Affect Taxes?

Difficulty of care payments usually don’t affect taxes as they are often non-taxable. Caregivers should ensure they meet the IRS criteria for exclusion. This can help in reducing taxable income and potentially increasing eligibility for tax credits.

Conclusion

Understanding difficulty of care payments is crucial. These payments impact financial decisions. They are not considered earned income. This knowledge helps with tax planning. Individuals can avoid surprises during tax season. It’s important to stay informed. Consult a tax professional for personalized advice.

Rules can vary by location. Always keep updated with current regulations. Knowing these details ensures smoother financial management. Stay proactive and make informed choices. This aids in effective financial planning. Remember, proper understanding leads to better financial health. Your future self will thank you.