Are you curious about how certain payments can make a difference in the care you provide? If you’re involved in caring for someone with special needs, you might have heard of “Difficulty of Care Payments.”

These payments can play a significant role in easing the financial burden associated with providing care at home. But what exactly are they, and how can they benefit you? Understanding the ins and outs of these payments could empower you to make informed financial decisions and ensure you’re getting the support you deserve.

Stick around, and we’ll unravel the mystery behind Difficulty of Care Payments, exploring what they are, who can receive them, and how they can impact your life. Your journey to financial clarity and enhanced caregiving begins here.

Definition Of Difficulty Of Care Payments

Difficulty of Care Payments are given to caregivers for helping someone at home. These payments are for those who face special challenges. This can be due to a person’s disability or behavioral issues. Caregivers make life easier for these individuals. They provide support and care that is not easy. This payment is a way to thank them for their hard work.

Many families rely on these payments. It helps them manage expenses related to care. It also gives caregivers a sense of recognition. Without this support, life would be more difficult for many. It’s important to understand how these payments help both caregivers and families.

Eligibility Criteria

Qualifying caregivers must meet certain guidelines. First, they should provide care at home. This care must be for someone with special needs. The caregiver can be a family member. They must live in the same house as the care recipient. They should also not be paid as a professional caregiver. These rules help ensure fair payments.

Eligible care recipients must have specific needs. They may have a disability or chronic illness. They need daily help with tasks. These tasks include eating, dressing, and bathing. The care recipient must live in the caregiver’s home. This is to ensure constant support. Payments are meant to assist in these care duties.

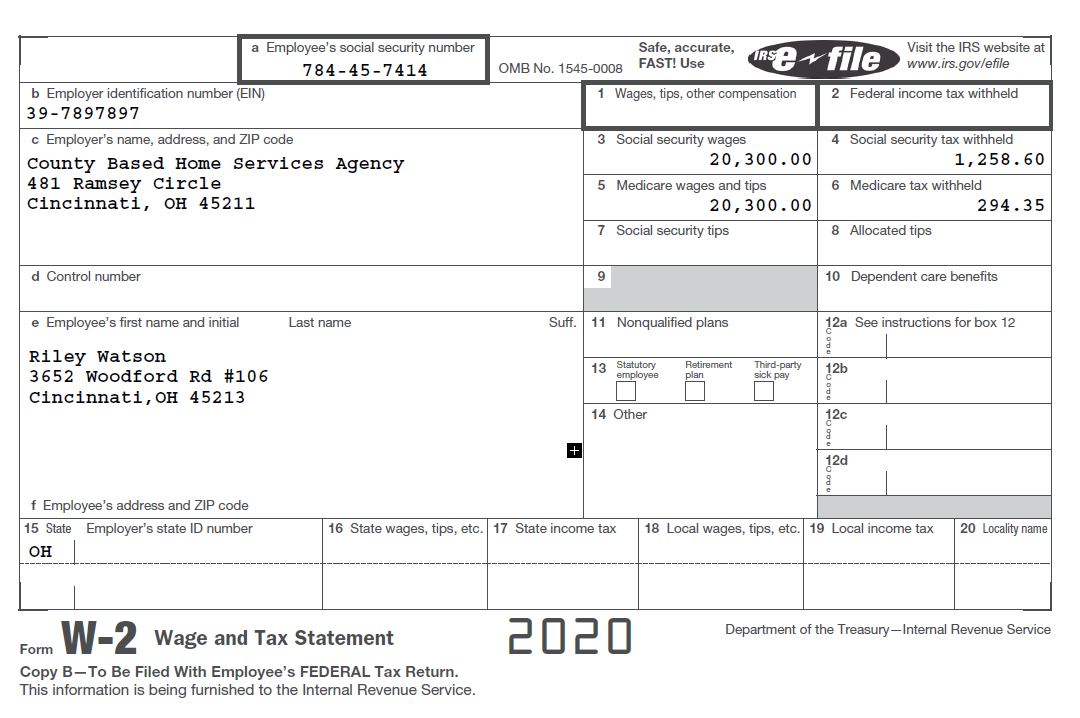

Tax Implications

Difficulty of care payments can be excluded from federal income tax. This is true for caregivers living with the care recipient. These payments are made to help with care needs. They are considered non-taxable income under certain conditions. It’s important for caregivers to check if they qualify. The IRS provides guidelines for these exclusions.

State rules for difficulty of care payments vary. Some states may tax these payments. Others might not. Caregivers should check their state’s tax rules. This helps in understanding their tax responsibilities. Knowing state-specific rules is crucial. It ensures proper tax filing. Always consult with a tax professional if unsure. They can give tailored advice for your situation.

Benefits For Caregivers

Difficulty of Care Payments provide financial relief for caregivers. Caregivers often face many costs. These payments help with medical bills. They also assist with living expenses. Financial stress can be very hard. This relief makes life a bit easier. It allows caregivers to focus more on care. Less worry about money. More time for loved ones.

Long-term care needs constant support. Difficulty of Care Payments provide this support. They ensure caregivers can continue their work. Caring for others requires many hours. These payments help caregivers keep going. They offer steady aid over time. Caregivers can plan better. They can think about future needs. Knowing support is there brings peace.

Application Process

To start, gather all needed papers. Birth certificate and Social Security card are must-haves. Proof of income is also important. Include any medical records if needed. These show why care is needed. Make sure all papers are up-to-date. Old papers may not work. Double-check for errors. Mistakes can delay the process.

First, get the application form. Fill it out completely. Answer all questions. Use a black or blue pen. Neat writing helps. Next, attach required documents. Mail the packet to the right address. Always keep a copy for yourself. Wait for a reply. This can take some time. Keep track of all dates.

Common Challenges

Difficulty of care payments can be tax exempt. Some people find this confusing. The rules can change often. It’s important to know the latest rules. These payments are for caregivers. They help people with special needs. The IRS has rules for these payments. Not everyone knows about these rules. Some people pay taxes unnecessarily. Understanding the rules can save money. Tax advisors can help. They know the rules well. Asking them can be useful. This can make tax time easier.

Applying for these payments involves many forms. Some forms are hard to understand. They have many questions. Filling them takes time. Mistakes can delay approval. It’s crucial to be careful. Double-check all answers. Instructions can be confusing. Ask for help if needed. Many people face this challenge. Experts can guide you through the process. They can explain each step. This makes the process smoother. Get help early to avoid problems.

Resources For Assistance

Government agencies offer help for families needing care payments. They provide support through various programs. Families can access financial aid and resources. It’s important to contact them directly. Each agency has different requirements. Some might require specific paperwork. Others may need proof of income. It’s best to inquire about each program. Agencies also provide guidance on eligibility. They help with applications and answer questions. Assistance varies by region. Be sure to check local agency offerings.

Non-profit organizations work to support families in need. They offer help with care payments. Many provide free or low-cost services. They often have volunteers who assist families. Some organizations offer counseling or advice. These groups may have partnerships with government agencies. They help connect families with resources. Non-profits sometimes have special funding. This can help families with financial challenges. It’s a good idea to research local non-profits. They often have helpful programs.

Frequently Asked Questions

What Are Difficulty Of Care Payments?

Difficulty of Care Payments are financial compensations for caregivers. They are provided for individuals who care for those with special needs in their homes. This helps support caregivers by acknowledging the unique challenges they face. These payments are often tax-exempt, making them a beneficial resource for many families.

How Are These Payments Determined?

The determination of Difficulty of Care Payments is based on specific criteria. These include the level of care required and the individual’s needs. Local or state agencies typically assess these factors. They ensure that caregivers receive appropriate compensation for their dedicated services.

Are Difficulty Of Care Payments Taxable?

No, Difficulty of Care Payments are generally not taxable. The IRS considers these payments as non-taxable income. This exemption applies when the care is provided in the caregiver’s home. However, it’s advisable to consult a tax professional for personalized advice.

Who Qualifies For Difficulty Of Care Payments?

Caregivers of individuals with special needs qualify for these payments. The individuals must live with the caregiver full-time. The care provided should cater to their unique health or developmental challenges. Verification by relevant authorities is often required to establish eligibility.

Conclusion

Difficulty of Care Payments offer vital support for caregivers. They provide financial relief for those caring for loved ones. Understanding these payments helps manage caregiving duties better. It eases stress and allows focus on providing quality care. The process may seem complex, but patience is key.

Seek guidance if needed to navigate requirements. Proper knowledge ensures caregivers receive deserved assistance. These payments acknowledge the hard work and dedication involved in caregiving. They make a difference in the lives of both caregivers and recipients. Stay informed and make the most of available resources.