Transferring money from your LLC to your personal account might seem like a daunting task at first. You might worry about legal implications, tax consequences, and the complexity of the process.

But what if you discovered that managing your business finances can be straightforward and stress-free? Imagine the peace of mind knowing you’re doing it right, all while safeguarding your hard-earned assets and complying with financial regulations. You’ll uncover the secrets to seamlessly moving funds from your LLC to your personal account, ensuring that every transfer is both legal and efficient.

We’ll guide you through the steps with clear, actionable advice and help you avoid common pitfalls. So, if you’re ready to take control of your finances and eliminate uncertainty, keep reading to transform the way you manage your money transfers.

Legal Considerations

Transferring money from your LLC to a personal account involves legal considerations. Understanding these considerations is crucial to avoid complications. Many business owners face challenges in this area. This section provides guidance on legal aspects to ensure compliance.

Understanding Llc Structure

An LLC, or Limited Liability Company, offers flexibility and protection. It separates personal and business assets. This structure shields personal assets from business liabilities. But mixing funds can blur these lines. Always maintain clear boundaries between business and personal finances.

Transferring funds from an LLC to a personal account requires caution. It must align with the LLC’s operating agreement. This document outlines how finances are handled. Check it before making any transfers. It helps avoid potential legal issues.

Compliance With State Laws

Each state has different laws for LLCs. These laws affect how you can transfer money. Know the specific regulations in your state. Ignorance can lead to penalties or fines. Ensure transfers comply with state requirements.

Some states require detailed records of transactions. Keep accurate records for every transfer. This documentation can protect you during audits. It also helps maintain transparency in your financial dealings.

Tax Implications

Transferring money from an LLC to a personal account might seem simple. Yet, it has tax implications that require careful consideration. Understanding these implications ensures compliance and avoids financial pitfalls. Let’s explore the impact on personal taxes and LLC tax requirements.

Impact On Personal Taxes

Transferring money impacts personal taxes. The IRS views these transfers as distributions. Distributions can be taxable income. This means you could owe more taxes. Knowing how much to set aside helps. Keep records of all transactions. They are essential for tax reporting.

Llc Tax Requirements

LLCs have specific tax requirements. The IRS treats single-member LLCs differently. They often report income on personal tax returns. Multi-member LLCs file partnership returns. Understanding these distinctions is crucial. Missteps can lead to penalties. Consult a tax professional if needed. They provide guidance and support. This ensures compliance and peace of mind.

Methods For Transferring Funds

Transferring money from an LLC to a personal account involves careful handling. Ensure compliance with tax regulations. Consider using direct transfers through your bank or digital payment services. Keep records of transactions to maintain transparency and accuracy.

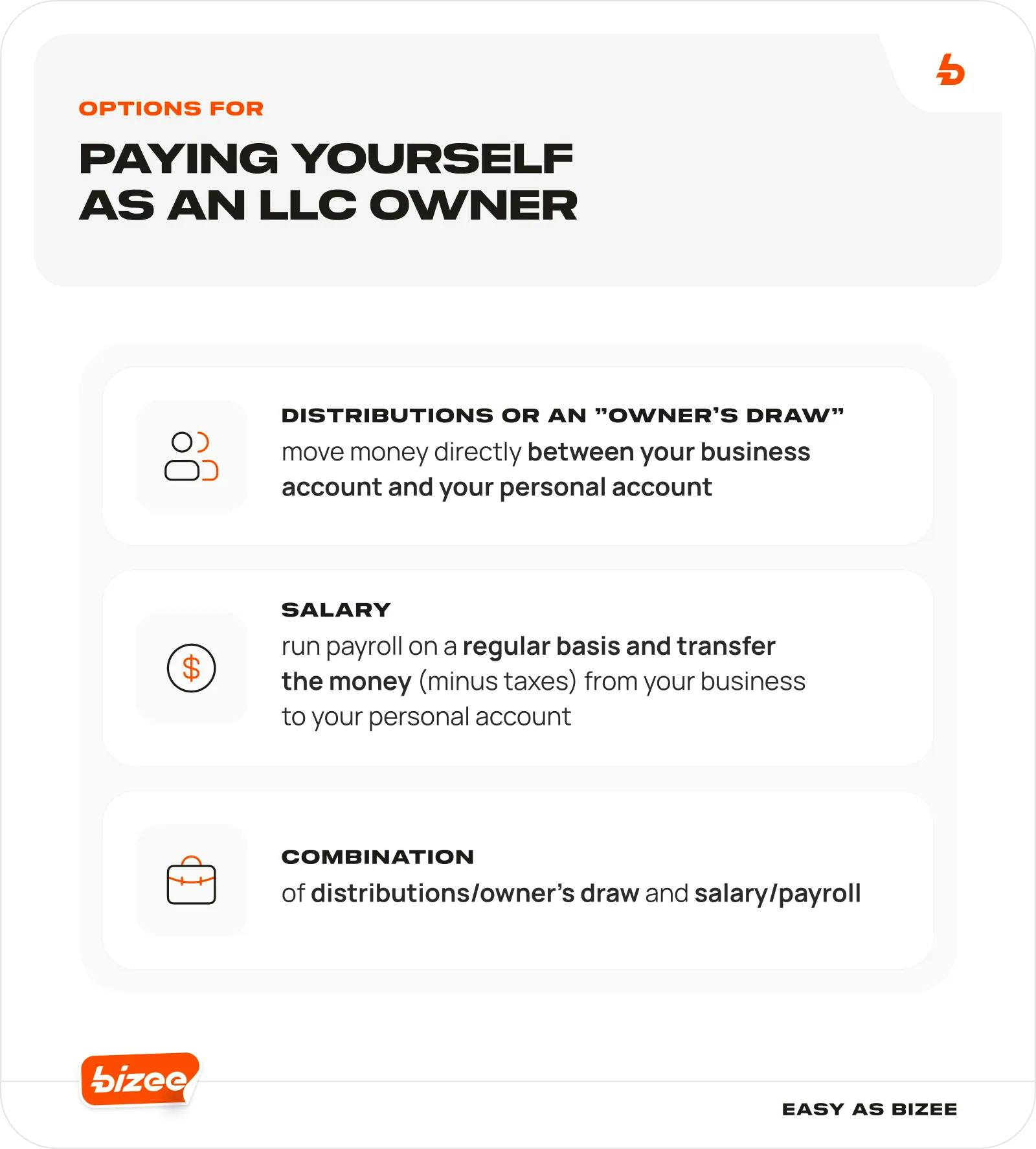

Transferring money from an LLC to a personal account requires understanding the best methods. Owners of LLCs have various options for moving funds legally and efficiently. Choosing the right method depends on your role and the financial structure of your business. Each method has specific rules and implications. Here are the main methods that owners can use:

Owner’s Draw

An owner’s draw is a simple way to transfer funds. It allows LLC owners to take money directly from the business. This method does not require payroll processing. It’s ideal for owners who need flexible access to funds. Remember, it’s not taxable as income but impacts your equity in the business.

Salary And Wages

Paying yourself a salary is another common method. This involves setting a regular payment schedule. The salary is treated as taxable income. It offers a structured approach to personal compensation. This is suitable if you want predictable payments and tax deductions.

Reimbursements

Reimbursements cover personal expenses paid with business funds. Owners can reimburse themselves for legitimate expenses. This method requires clear documentation. Keep detailed records of expenses to ensure compliance. This helps maintain transparency and proper accounting practices.

Record Keeping Practices

Transferring money from your LLC to a personal account involves careful record keeping. Proper documentation helps avoid financial mishaps and ensures compliance with regulations. Keeping accurate records is essential for both personal and business financial health. Below, we dive into best practices for documenting transfers and maintaining accurate records.

Documenting Transfers

Each transfer from your LLC to your personal account requires clear documentation. Start by noting the date and amount of each transaction. Include the purpose of the transfer to clarify its legitimacy. Use a ledger or digital tool to keep all details organized. This helps in tracking funds and provides clarity during audits.

Documenting transfers also involves noting any fees incurred. Record these alongside the transfer details. This ensures you have a complete picture of the transaction. Proper documentation aids in tax preparation and financial planning.

Maintaining Accurate Records

Accurate records are crucial for managing LLC finances. They prevent errors that could lead to costly penalties. Regular updates to your records ensure they reflect all transactions accurately. Use accounting software to automate this process. It reduces manual errors and saves time.

Set a schedule for reviewing your records. Monthly checks help catch discrepancies early. Ensure all entries are consistent with bank statements. This consistency is vital for financial integrity. Accurate records also support informed business decisions.

Avoiding Common Pitfalls

Transferring money from an LLC to a personal account can be tricky. Mistakes can lead to serious issues. Understanding common pitfalls is essential. Proper management ensures smooth transactions and peace of mind. Let’s explore some common pitfalls.

Co-mingling Funds

Co-mingling funds is a frequent mistake. It means mixing personal and LLC money. This can cause confusion. It may also lead to legal issues. Keep separate accounts for personal and business. This helps maintain clear records.

Use distinct bank accounts. Track every transaction. This ensures transparency and accountability. Avoid co-mingling for smooth financial management.

Ignoring Tax Obligations

Ignoring tax obligations can be costly. Taxes are crucial for LLCs. Transferring funds without considering taxes can lead to penalties. Understand the tax implications before transferring money.

Consult a tax professional. They can provide guidance. Stay informed about tax requirements. This helps avoid unexpected liabilities. Proper planning is key.

Consulting Professionals

Consulting professionals offer guidance on moving money from an LLC to a personal account. They help navigate tax implications and legal requirements. Understanding the best practices ensures smooth, compliant transactions.

Transferring money from your LLC to your personal account is a task that requires careful consideration and adherence to legal and financial guidelines. Consulting professionals can provide the clarity and guidance you need to navigate this process smoothly. By seeking expert advice, you ensure compliance with tax laws and protect your assets.

It’s crucial to know when professional advice is needed. A small mistake can lead to significant consequences, including penalties or audits. What steps are you taking to protect your financial interests?

Hiring An Accountant

An accountant can be your best ally when transferring funds from your LLC to a personal account. They help you understand tax implications and ensure you comply with IRS guidelines.

An experienced accountant can help you categorize the transfer correctly, whether it’s a salary, distribution, or loan. They also keep your financial records organized and transparent.

Have you considered how an accountant could simplify your financial management and save you from potential pitfalls?

Seeking Legal Advice

Legal advice can be invaluable, especially if you are unsure about the implications of transferring money between accounts. Lawyers can clarify the legal framework surrounding your LLC and personal finances.

They help you understand the legal boundaries of fund transfers, ensuring you don’t inadvertently breach any laws. A legal expert can also assist in drafting necessary documentation for your transactions.

Are you aware of the legal risks involved in managing LLC finances without professional guidance?

Consulting professionals is more than just a safety net; it’s an investment in your financial health. By hiring the right experts, you position yourself and your business for success.

Frequently Asked Questions

Can I Transfer Money From Llc To Personal Account?

Yes, you can transfer money from your LLC to your personal account. It’s important to document each transaction accurately. This ensures compliance with tax regulations. Consult with an accountant to avoid potential legal issues. The transfer should be recorded as a distribution or salary.

Is Transferring Llc Funds To Personal Account Taxable?

Transferring LLC funds to a personal account may be taxable. If classified as a distribution, it might not be taxed. However, if treated as a salary, it could be subject to income tax. Always consult with a tax professional to understand your specific situation and obligations.

How To Document Llc To Personal Account Transfer?

Documenting the transfer involves recording the amount, date, and purpose. Use accounting software or maintain a ledger. This helps in maintaining clear financial records. Proper documentation ensures compliance with tax laws. Consult a financial advisor for guidance tailored to your business structure.

Are There Penalties For Improper Transfers?

Yes, there can be penalties for improper transfers. Misclassifying funds can lead to tax audits or penalties. Ensure compliance with IRS guidelines to avoid issues. Proper documentation and consulting with a tax professional can help mitigate risks. Always follow legal and financial best practices.

Conclusion

Transferring money from an LLC to a personal account needs careful steps. Follow tax rules. Keep records of every transfer. Consult a tax expert for guidance. This helps avoid issues later. Plan transfers in advance. Ensure compliance with regulations. Smooth transactions lead to peace of mind.

Proper management safeguards your business. Avoid mixing personal and business funds. Clarity in finances is crucial. Stay informed about changes in laws. This keeps you on the right track. Remember, simple steps help keep your finances healthy. Make smart choices for your business’s future.