Are you looking for a simple way to transfer money from your Netspend account to your bank account? You’re not alone.

Many people find themselves puzzled by the process, and it’s crucial to know the right steps to ensure your money moves safely and swiftly. Imagine the peace of mind that comes with knowing your funds are exactly where you need them, ready to use whenever you want.

In this guide, we’ll break down the process into easy-to-follow steps. By the end, you’ll feel confident handling your money transfers like a pro. Ready to take control of your finances? Let’s dive in and simplify the process for you.

Understanding Netspend

Netspend offers prepaid debit cards, making transactions easy and secure. It’s a convenient way to manage money without a traditional bank account. Users load funds, spend, and track money with ease. But how does it work? Let’s explore.

What Is Netspend?

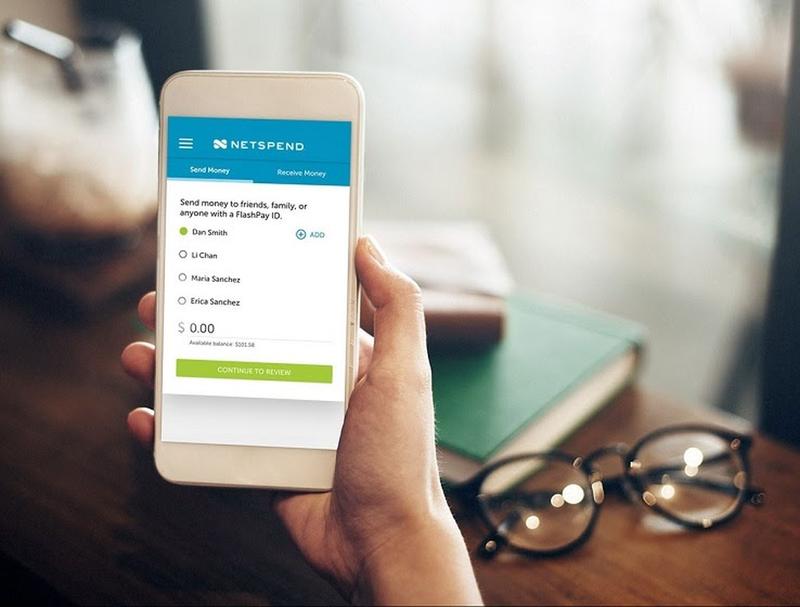

Netspend is a financial service provider that offers prepaid debit cards. It is not a bank, but it partners with banks. Users can manage money without a checking account. The service includes online account access and mobile apps.

Benefits Of Using Netspend

Netspend provides a flexible way to access funds. Users enjoy direct deposits, reducing trips to the bank. It also offers budgeting tools to track expenses. A mobile app helps users manage money on the go.

How To Set Up A Netspend Account

Setting up a Netspend account is simple. Visit the Netspend website and provide basic details. You’ll receive a card by mail. Activate the card online or via phone. Load funds to start using the card.

Ways To Load Money Onto Netspend

There are several ways to load money onto your Netspend card. Direct deposit is a popular option. Users can also load cash at retail locations. Transfers from bank accounts are possible too. Choose the method that suits your needs.

Netspend Fees And Charges

Netspend charges fees for various services. Monthly plan fees may apply. Cash reloads and ATM withdrawals might incur charges. Users should review the fee schedule. Understanding fees helps in managing costs effectively.

Security Features Of Netspend

Netspend prioritizes security. It offers fraud protection and account alerts. Users can lock the card if lost. The service uses encryption to protect data. Always keep your login details secure.

Benefits Of Transferring To A Bank Account

Transferring money from Netspend to a bank account offers several benefits. It simplifies managing your finances and enhances security. Understanding these advantages can help you make informed financial decisions.

1. Enhanced Financial Management

Transferring funds to a bank account helps track your spending. Bank accounts usually offer detailed transaction histories. This makes budgeting and monitoring expenses easier.

2. Improved Security

Banks provide robust security measures to protect your money. They offer fraud alerts and secure login systems. This reduces the risk of unauthorized access to your funds.

3. Access to Additional Financial Services

Bank accounts often come with extra services. These include loans, credit cards, and investment options. Transferring money to a bank can provide access to these benefits.

4. Convenience in Transactions

Bank accounts facilitate easy money transfers and payments. You can pay bills and transfer money electronically. This convenience saves time and effort.

5. Interest Earnings

Some bank accounts offer interest on your balance. Keeping money in a bank can earn you extra income. This is not possible with Netspend alone.

Setting Up Your Netspend Account

Transferring money from Netspend to a bank account is simple. First, log into your Netspend account online. Then, follow the instructions to link your bank account. Once linked, you can easily move funds between accounts.

Setting up your Netspend account is the essential first step in transferring money to a bank account. Whether you’re new to Netspend or looking to streamline your financial transactions, getting your account ready is crucial. You’ll find that with a few simple steps, you can navigate the world of digital money transfers with ease.

Creating An Online Account

To begin, you need an online Netspend account. This acts as your digital hub for all transactions. Signing up is straightforward—visit the Netspend website and click on ‘Sign Up’ or ‘Create Account’.

Have your personal details handy. You’ll need your full name, address, and email. Once you’ve filled out the form, you’ll receive an email confirmation. Check your inbox and click the link to activate your account.

This confirmation secures your account and prepares you for the next step. Once logged in, explore the interface. Familiarize yourself with the dashboard; it’s where you’ll manage your funds and transactions.

Linking Your Bank Account

Linking your bank account is the bridge to transferring funds effortlessly. You start by logging into your Netspend account. Navigate to the ‘Add Bank Account’ section.

You’ll be asked for your bank’s routing number and your account number. These numbers ensure your transactions are secure and directed to the correct account.

After entering the details, you might wonder: How safe is this? Netspend uses encryption to keep your information secure. It’s like locking your valuables in a safe. Once linked, you can initiate transfers with confidence.

Sometimes, verification is required. Your bank might send a small test deposit to confirm the connection. Check your bank account for this deposit and follow instructions to complete the linking process.

Once set up, transferring money becomes a breeze. Imagine the convenience of moving funds with just a few clicks. So, why wait? Set up your Netspend account today and make your financial management a seamless part of your routine.

Transfer Methods

Transferring money from a Netspend card to a bank account is simple. There are several methods you can choose from. Each method offers unique benefits that cater to your needs. Understanding these methods helps you decide the best option for you.

Direct Transfer Via Netspend

Netspend allows direct transfers to linked bank accounts. This is the most straightforward option. First, ensure your bank account is linked to your Netspend account. You can do this in the account settings. Once linked, transferring funds becomes easy. Log into your Netspend account online. Navigate to the transfer section. Follow the prompts to send money to your bank account. The transfer usually processes within one to three business days.

Using External Payment Services

External services like PayPal or Venmo can also facilitate transfers. First, link your Netspend card to the service. Then, transfer funds from Netspend to the service account. Once transferred, move the money to your bank account. This method may incur fees. It provides flexibility if direct transfers are not available. Using external services may take longer to process. Check with the service provider for specific transfer times.

Step-by-step Transfer Process

Transferring money from Netspend to a bank account is simple and secure. Follow these easy steps to complete your transfer quickly. With clear instructions, you can ensure your funds move safely. Let’s dive into the process.

Logging Into Your Account

Start by visiting the Netspend website. Enter your username and password. Click “Log In” to access your account. Ensure your connection is secure. This helps protect your information.

Initiating The Transfer

Once logged in, find the “Transfer” option. Click on it to begin. Choose the option to transfer to a bank account. Enter your bank account details. Double-check for any errors. This step is crucial to avoid mistakes.

Confirming Transfer Details

Review the transfer details carefully. Check the amount and bank account information. If everything looks correct, click “Confirm.” This final step completes the process. You will receive a confirmation message. Keep it for your records.

Troubleshooting Common Issues

Transferring money from Netspend to a bank account can be simple. Start by linking your bank account to your Netspend card. Follow prompts to initiate the transfer, ensuring all details are correct to avoid errors.

Transferring money from Netspend to a bank account should be a straightforward process, but sometimes things don’t go as planned. You might encounter issues that can delay or even prevent your transfer. Understanding these common problems can save you time and frustration. Let’s dive into some typical troubleshooting challenges you might face and how to resolve them.

Incorrect Account Details

Entering incorrect account details is a common mistake that can lead to transfer failures. Always double-check the account number and routing number before initiating a transfer.

Imagine you’re in a hurry and accidentally swap a digit in your account number. This simple error can send your money to the wrong account or halt the process altogether. To avoid this, ensure you carefully input and verify each digit.

Consider writing down the details or saving them securely on your device. Having accurate information at your fingertips can make all the difference.

Transfer Delays

Transfer delays can be frustrating, especially if you’re counting on the money to meet a deadline. These delays might occur due to bank processing times or system maintenance.

Have you ever waited for funds to clear, only to find they’re still pending days later? If this happens, check if there are any bank holidays or weekends that might affect processing times.

It’s also a good idea to reach out to Netspend customer service if your transfer seems unusually delayed. They can provide insights or escalate the issue for faster resolution.

Remember, patience and due diligence can help ensure your transactions go smoothly. Have you encountered any other issues while transferring money? Share your experiences in the comments below!

Security Tips

Transferring money from Netspend to a bank account involves more than just clicking a few buttons. Ensuring your security during the process is paramount. With increasing digital threats, protecting your personal information and recognizing fraudulent activities is crucial. Let’s dive into these security tips to keep your transactions safe.

Protecting Your Personal Information

Your personal data is valuable. Always use strong passwords for your Netspend account. Avoid using easy-to-guess combinations. Update your passwords regularly. Enable two-factor authentication if available. This adds an extra layer of security.

Be cautious of phishing emails or messages. They often look genuine but aim to steal your information. Verify the sender’s email address. Do not click on suspicious links. Always log in directly through the official Netspend website.

Recognizing Fraudulent Activities

Fraudulent activities can be subtle. Monitor your account transactions regularly. Look for any unexpected changes. Report any unusual activity immediately. Stay informed about common scams targeting Netspend users.

Be wary of unsolicited calls asking for your account details. Legitimate organizations will never ask for sensitive information over the phone. Educate yourself on common fraud tactics. This knowledge empowers you to stay vigilant.

Frequently Asked Questions

How Can I Link Netspend To My Bank Account?

To link Netspend to your bank, log into your Netspend account. Navigate to the ‘Transfer Money’ section. Follow prompts to add your bank details. Ensure all information matches your bank records. This setup enables seamless money transfers.

Is There A Fee For Transferring From Netspend?

Transferring money from Netspend to a bank may incur fees. The fee varies depending on your account type and transaction amount. It’s best to check Netspend’s official website or contact customer service for detailed information.

How Long Does A Netspend Transfer Take?

A Netspend transfer to a bank account usually takes 1 to 3 business days. The speed depends on your bank’s processing times. Always check with both Netspend and your bank for precise timelines.

Can I Transfer Money From Netspend To Any Bank?

Yes, you can transfer money from Netspend to most U. S. banks. Ensure your bank account details are correct. It’s crucial to verify your bank’s compatibility with Netspend for smooth transactions.

Conclusion

Transferring money from Netspend to a bank account is simple. Follow the steps provided. Ensure your Netspend account and bank details are correct. Always check for any fees involved. Keep track of your transfer status online. Contact customer service if issues arise.

It’s essential to understand your bank’s policies. Make sure your bank accepts such transfers. Regularly update your account information. This helps avoid any delays. Use secure internet connections for transactions. Avoid public Wi-Fi networks. Stay informed about Netspend updates. This ensures a smooth transfer process.

Happy banking!