Imagine making a purchase without the worry of paying for it all at once. With Afterpay, you can do just that.

Have you ever wondered how you could spread out your payments over time without the stress of interest piling up? This guide on how to do monthly payments on Afterpay is here to help you. You’ll discover a simple, stress-free way to manage your finances while still enjoying the things you love.

Dive in, and you’ll learn how to make your shopping experience smoother and more manageable. Feel the relief of financial flexibility and see how Afterpay can be your new best friend in making payments a breeze. Ready to transform your shopping experience? Let’s get started!

What Is Afterpay?

Afterpay helps you buy now and pay later. You can shop online or in stores. It splits your bill into four easy payments. Pay every two weeks. No extra fees if you pay on time. Simple and clear.

Download the Afterpay app to get started. Sign up with your email. Choose Afterpay at checkout. It’s easy to track your spending. Manage your payments in the app. Set reminders to pay. Stay on top of your budget.

Use Afterpay at many stores. Look for the Afterpay logo. It’s a popular choice for shoppers. Enjoy buying without stress. Keep your money safe. Happy shopping!

Setting Up Your Afterpay Account

First, visit the Afterpay website. Find the sign-up button and click it. Enter your email and create a password. Make sure your password is strong. Next, fill in your personal details. This includes your name and address. Double-check your information for accuracy. Click “Create Account” to finish. Your account is now ready!

Start by going to your account settings. Find the payment methods section. You can link a debit or credit card. Click on “Add Payment Method”. Enter your card details. Make sure they are correct. Save the details to link the card. Now, you can use Afterpay to shop easily.

Understanding Monthly Payments

Afterpay lets you split your payment into four equal parts. Pay the first part when you buy. The other three parts come every two weeks. This means you can pay over six weeks. No interest, no extra fees if you pay on time. Just pay a late fee if you miss a payment. It’s simple and helps you manage your money. Know what you owe and when you owe it.

Monthly payments make buying easier. You can get what you need now. Pay over time without stress. This helps with budgeting. No need to pay all at once. Keep more money in your pocket each month. It’s like a plan that fits your life. Easy to understand, easy to use.

Choosing Your Purchase

Find stores that work with Afterpay. Many popular retailers are participating. It’s easy to browse through their online shops. Look for brands you love. See what they have to offer. It’s fun to explore new collections. Many sites let you filter for Afterpay availability. This makes shopping easier. Discover items that fit your budget. Make sure your favorite store accepts Afterpay.

Adding items to your cart is simple. Pick the products you want. Add them one by one. Ensure the total is within your limit. Check your cart before checkout. Make sure everything is correct. You can remove items if needed. Double-check the prices and details. Get ready to use Afterpay for payment.

Checkout Process With Afterpay

Choose the items you want. Add them to your cart. At checkout, look for the Afterpay option. Click on it. This is your first step to pay later.

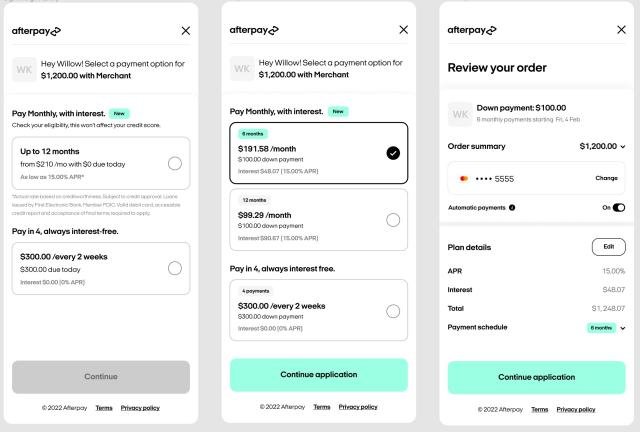

After selecting Afterpay, see your payment plan. Check the payment schedule. Make sure it fits your budget. Confirm your plan. Now, you are ready to pay in parts.

Payments will be spread out. Pay every two weeks. Remember, there are no interest charges. Keep an eye on your payment dates. This helps you avoid extra fees.

Managing Monthly Payments

Set reminders for payments. Use your phone or calendar. Mark the due date clearly. This helps you remember to pay on time. Avoid late fees by paying early. Use apps to send alerts. Apps can remind you about payments. Stay organized and stress-free. No need to worry about missing payments. Take control of your schedule. Keep your finances in check.

Change payment dates if needed. Contact Afterpay for help. They can assist you. They offer flexible options. You can choose a new date. Make sure it suits your budget. Plan ahead to avoid issues. Adjusting dates is easy. Just follow the steps. Keep track of changes. Stay informed about new schedules. Manage your payments wisely.

Handling Missed Payments

Missing a payment can lead to late fees. These fees are added to your account. Paying late often increases the penalty. It is best to pay on time. This avoids extra charges. Keeping track helps avoid missed payments.

Sometimes you need help. Contacting Afterpay support is easy. Use their website for details. Talk to them about problems. They can help sort issues. It is important to explain clearly. This makes solving problems faster. Support can give advice on payments. They are there to help.

Tips For Successful Use

Set a clear budget to manage your Afterpay payments. Know the total cost and divide it into four equal parts. This helps in planning your spending. Never spend more than you can afford. Always keep a small buffer for unexpected expenses. A simple budget keeps you from missing payments. Stick to your budget to avoid extra fees.

Use a calendar to track payment dates. Mark each payment day clearly. This way, you always know what’s due. Set reminders on your phone. Alerts can help you pay on time. Being organized avoids missed payments. Consistent tracking builds good habits. You stay stress-free and in control.

Frequently Asked Questions

How Does Afterpay Monthly Payment Work?

Afterpay allows you to split purchases into monthly payments. You can make purchases and pay over time. Payments are automatically deducted from your linked card. It’s an interest-free service, making it easier to manage finances. Remember to check your spending limit before purchasing.

Can I Change My Afterpay Payment Schedule?

No, Afterpay does not allow changing the payment schedule. Payments are automatically scheduled every two weeks. It ensures you stay on track with repayments. You can, however, pay off your balance early if desired. Always review your payment plan before confirming a purchase.

Are There Fees For Missed Afterpay Payments?

Yes, Afterpay charges fees for missed payments. If a payment fails, you’ll incur a late fee. Ensure sufficient funds in your account to avoid fees. Late fees can add up, affecting your credit score. It’s crucial to manage your payments responsibly with Afterpay.

Is Using Afterpay Safe For Online Shopping?

Yes, Afterpay is safe for online shopping. It uses advanced security measures to protect your information. Your financial details remain private and secure. Many reputable retailers offer Afterpay as a payment option. Always ensure you shop from trusted online stores when using Afterpay.

Conclusion

Using Afterpay for monthly payments is simple and convenient. It helps manage budgets without stress. Always check your payment schedule. Stay aware of due dates. This avoids unnecessary late fees. Remember, Afterpay is a tool for responsible spending. It offers flexibility, but discipline is key.

Plan your purchases wisely. This ensures you enjoy the benefits without overspending. Keep track of your spending habits. This helps in maintaining financial health. With these tips, Afterpay can be a useful budgeting partner. Enjoy shopping smartly and wisely.