Are you wondering if you can transfer money from your Wisely card to your bank account? You’re not alone.

Many people find themselves juggling multiple financial tools and seeking the most convenient ways to manage their money. Whether you’re looking to streamline your finances or simply make your funds more accessible, understanding how to transfer money from your Wisely card to your bank account can be a game-changer.

Imagine the ease of having all your money in one place, ready to be used whenever you need it. We’ll guide you through the process step by step, making it as simple as possible. Stick around to discover how you can take control of your finances with just a few clicks.

What Is A Wisely Card?

A Wisely Card offers a simple way to manage finances digitally. Users can transfer money from their Wisely Card directly to a bank account. This feature enables easy access to funds for various transactions, ensuring convenience in handling personal finances.

In today’s fast-paced world, managing your finances efficiently is more important than ever. You might have heard of the Wisely Card, a tool that promises to make your financial transactions smoother. But what exactly is a Wisely Card, and how can it benefit you? Let’s dive into its features and see how it could fit into your financial toolkit.

###

The Wisely Card is a prepaid debit card that offers you more control over your money. Unlike traditional debit cards linked to your bank account, a Wisely Card allows you to load it with a specific amount of money. This can help you manage your spending and avoid overdraft fees.

It’s especially useful if you’re looking to separate your spending from your main bank account. Imagine having a set amount each month just for dining out or entertainment. This way, you won’t accidentally dip into your savings or bill money.

###

Who Can Use A Wisely Card?

Anyone can apply for a Wisely Card, making it accessible to a wide range of users. Whether you’re a student, a freelancer, or someone looking to budget better, this card can be a handy tool.

It’s also a great option if you don’t have a traditional bank account. You can receive direct deposits, cash checks, or add money through various locations.

###

Key Features Of The Wisely Card

The Wisely Card comes packed with features that make it user-friendly and efficient. You can easily track your spending through a mobile app. This helps you stay on top of your finances and make informed decisions.

It also offers free ATM withdrawals from a network of ATMs. This means you can access your cash without any hidden fees, which is a relief for those who frequently use ATMs.

###

Benefits Of Using A Wisely Card

One of the main benefits of the Wisely Card is the financial flexibility it offers. You can use it anywhere Visa or Mastercard is accepted, making it a versatile payment option.

Additionally, it provides a layer of security. Since it’s not directly linked to your bank account, your primary funds are safe even if your card is lost or stolen.

###

Is A Wisely Card Right For You?

Consider your financial habits and needs. Do you often overspend and wish for a way to set firm limits? Or maybe you’re looking for an easy way to manage different spending categories.

Ask yourself if you need the extra security and flexibility this card offers. If the answer is yes, a Wisely Card might be the right addition to your wallet.

Have you ever used a prepaid card before? How did it change your spending habits? Share your experiences or any questions you might have in the comments below.

Benefits Of Transferring Money

Easily transfer money from your Wisely Card to a bank account for convenient access. Save time with fast transactions. Enjoy better control over your finances and keep track of your spending with ease.

Transferring money from your Wisely card to a bank account can offer several advantages. It’s not just about convenience; it’s about creating a seamless financial experience that fits your lifestyle. Imagine the flexibility of having funds readily available in your bank account, ready to cover bills or unexpected expenses.

Access To More Financial Tools

When you transfer money to your bank account, you gain access to a wider array of financial tools. Banks offer features such as budgeting apps, savings goals, and investment options. These tools can help you manage your money more effectively, ensuring you’re on track with your financial goals.

Enhanced Security

Transferring money to your bank account can enhance the security of your funds. Banks employ sophisticated security measures to protect your money from fraud and theft. With your money safely in a bank, you can rest easier knowing your finances are in good hands.

Ease Of Payments

Having funds in your bank account simplifies the payment process for bills and purchases. You can easily set up automatic payments for utilities, rent, or subscriptions. This can prevent late fees and save you time, making your financial life more streamlined.

Better Financial Management

Think about the bigger picture. Transferring money to your bank account can improve your financial management. You can track your spending, monitor transactions, and even earn interest on savings. This comprehensive view helps you make informed financial decisions.

Flexibility In Spending

Consider the flexibility that comes with transferring money to your bank account. Whether it’s a spontaneous weekend getaway or an emergency repair, having funds readily accessible in your bank allows you to act swiftly. It’s about having the freedom to handle life’s surprises with ease.

Improved Credit Opportunities

Did you know that your bank account history can influence your credit opportunities? Banks often consider your financial habits when offering credit products. By maintaining a healthy bank account balance, you may improve your chances of getting favorable credit terms.

Transferring money from your Wisely card to a bank account isn’t just a transaction; it’s a strategic move to enhance your financial stability. So, what are you waiting for? Take control of your financial future today!

Steps To Transfer Money

Transferring money from a Wisely card to a bank account is straightforward. Access the Wisely app or website, then select the transfer option. Follow the prompts to enter your bank details and confirm the transaction.

Transferring money from your Wisely Card to a bank account is not just convenient; it’s straightforward. Whether you want to save for a rainy day or pay some bills, the process can be completed in a few simple steps. You might find it surprising how easy it is to manage your finances with a few clicks. Let’s walk through the steps to ensure a smooth transfer and make the most of your Wisely Card.

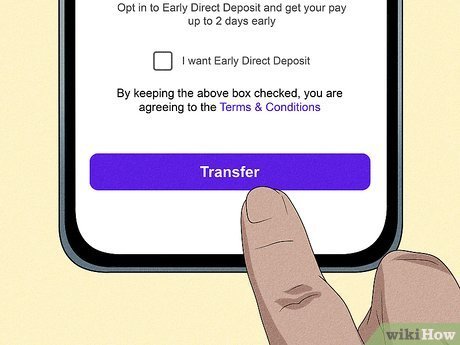

Setting Up Online Access

To start, make sure your Wisely Card is set up for online access. If you haven’t done this yet, don’t worry—it’s a simple process.

You’ll need to visit the Wisely website and create an account using your card details. Once you have online access, you can check balances, monitor transactions, and of course, initiate transfers.

Have you ever thought about how much time you could save by managing your card online? It’s like having a bank branch right in your pocket.

Linking Bank Account

Next, link your bank account to your Wisely Card. This step is crucial for transferring funds.

You’ll need your bank account number and routing number, which you can find on your checks or bank statements. Input these details on your Wisely account dashboard.

Be sure to double-check the information to avoid any errors. Imagine the peace of mind knowing your money is safely connected to your account.

Initiating The Transfer

Finally, it’s time to move your money. Navigate to the transfer section on your Wisely account.

Select the amount you wish to transfer and confirm the details. The transfer usually takes a few business days, so plan accordingly.

Isn’t it empowering to take control of your financial flow without the hassle of traditional banking queues?

By following these steps, you can easily manage your finances and ensure your money is where you need it, when you need it.

Fees And Charges

Understanding fees and charges is crucial for Wisely card users transferring money to a bank account. These fees can impact your finances significantly. Knowing what to expect helps you make informed decisions.

Fees For Transferring Money

Transferring money from your Wisely card to a bank account might incur fees. It’s vital to check for any charges before proceeding. This ensures you are not surprised by unexpected costs.

Variable Charges

Charges vary based on the transaction type. Some banks may have higher fees. Others might offer lower rates for specific transactions. Always compare costs across different platforms.

Hidden Fees

Be aware of potential hidden fees. Some services might not disclose all charges upfront. Thoroughly read the terms and conditions. This helps avoid unwanted surprises.

Transaction Limits

Transaction limits can affect fees. Larger transfers might incur higher costs. Smaller transactions might be more economical. Consider dividing larger amounts for cost efficiency.

Currency Conversion Fees

If transferring internationally, consider currency conversion fees. These can add to the total cost. Ensure you understand the conversion rates. This can save money in the long run.

Transfer Timeframes

Understanding the transfer timeframes for moving funds from your Wisely card to a bank account is essential. It helps you plan your finances better. When you initiate a transfer, knowing how long it takes can reduce anxiety. This section delves into the expected timeframes, ensuring you’re well-prepared for any financial transactions.

Typical Transfer Duration

Transfers from Wisely cards usually take 1-3 business days. This is typical for most standard transactions. The process involves several checks to ensure security and accuracy. It’s important to note that weekends and holidays may extend this period.

Factors Influencing Transfer Time

Several factors can affect the transfer duration. Bank processing times play a significant role. Some banks process transactions faster than others. The time of day you initiate the transfer also matters. Transfers made late in the day might start processing the next business day.

Tips For Faster Transfers

To ensure quicker transfers, initiate transactions early in the day. Avoid weekends and holidays if possible. Check with your bank to understand their processing timelines. This knowledge can help you better plan your transfers.

Troubleshooting Common Issues

Transferring money from a Wisely card to a bank account is possible. Start by logging into your Wisely account. Follow the simple instructions to link your bank and initiate the transfer.

Transferring money from a Wisely card to a bank account can be straightforward, but sometimes issues arise that complicate the process. Knowing how to troubleshoot common problems can save you time and stress. Whether you’re dealing with incorrect bank details or facing unexpected transfer delays, understanding these hurdles can empower you to take control of your financial transactions.

###

Incorrect Bank Details

It’s easy to make a mistake when entering your bank information. A single wrong digit can derail your transfer. Double-check the bank account number and routing number before confirming the transaction. Think of it like dialing your friend’s phone number—one wrong digit can connect you to a stranger instead. If you discover an error after submitting the transfer, contact Wisely customer support immediately. They can guide you on how to rectify the issue and ensure your money goes to the correct account.

###

Transfer Delays

Waiting for a transfer can be frustrating, especially if you’re counting on the funds for an urgent payment. Transfers from Wisely to a bank account might take longer than expected due to banking hours, holidays, or technical glitches. Check if the transfer window aligns with typical banking hours. If it’s a weekend or holiday, expect delays. It might help to plan transfers on weekdays to avoid these hiccups. Should a delay occur, reach out to Wisely for a status update. They can provide insights into the delay and potential resolutions.

###

Account Verification Problems

Verification is crucial for security, but it can also be a roadblock. If your bank account isn’t properly verified, transfers might be halted. Ensure all verification steps are completed—like entering the correct verification codes sent to your email or phone. Reflect on the importance of double-checking each step, much like ensuring your travel documents are in order before a trip. If verification problems persist, contact your bank and Wisely to confirm your account details are correctly linked. This proactive step can prevent future transfer issues.

Have you ever faced unexpected issues while transferring funds? What steps did you take to resolve them? Sharing your experiences can help others navigate similar challenges, turning obstacles into opportunities for learning. Remember, every transaction is a step toward mastering your financial toolkit.

Security Considerations

Transferring money from a Wisely card to a bank account involves careful attention to security. Ensure your personal information is protected. Use secure connections and strong passwords to safeguard your financial transactions.

Transferring money from a Wisely card to a bank account is a convenient option for many. However, ensuring the security of your funds during this process is crucial. Let’s dive into some key security considerations to keep in mind when making this transfer.

###

Understanding Encryption Protocols

Encryption is a critical element in safeguarding your transaction. Wisely utilizes advanced encryption protocols to protect your data. Always ensure you’re on a secure network when accessing your account to prevent unauthorized access.

###

Verify Your Identity

Identity verification is a standard procedure in financial transactions. Wisely may request additional verification steps to confirm your identity. This might seem tedious, but it protects your account from fraudulent activities.

###

Monitor Your Account Activity

Regularly checking your account statements can help you detect any unauthorized transactions early. Set up alerts to notify you of any changes or activities in your account. This proactive approach can prevent potential security breaches.

###

Use Strong Passwords

A strong password is your first line of defense against hackers. Use a mix of letters, numbers, and symbols, and avoid easily guessed passwords like birthdays. Consider using a password manager to keep track of your credentials.

###

Be Aware Of Phishing Scams

Phishing scams can trick you into providing sensitive information. Be cautious of emails or messages that ask for your account details. Always verify the source before clicking on any links or providing personal information.

###

Enable Two-factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your account. Even if someone gets your password, they can’t access your account without the second factor. This could be a code sent to your phone or an authentication app.

###

Contact Customer Support For Assistance

If you notice suspicious activity or have concerns about your account’s security, reach out to Wisely’s customer support. They can provide guidance and assistance to secure your account. Don’t hesitate to ask questions—they’re there to help you.

Security is not just about preventing breaches; it’s about peace of mind. How confident are you in your current security measures? Taking these steps can ensure that your money transfer process is as safe as possible.

Alternatives To Bank Transfers

Transferring money from a Wisely Card to a bank account is possible through various methods. Users can link their card to a bank account and initiate transfers. Exploring these options ensures a seamless financial experience without relying solely on bank transfers.

When you need to move money from your Wisely Card, bank transfers aren’t your only option. With digital wallets and various financial services on the rise, there are multiple ways to manage your funds efficiently. Let’s dive into some practical alternatives that might suit your needs better.

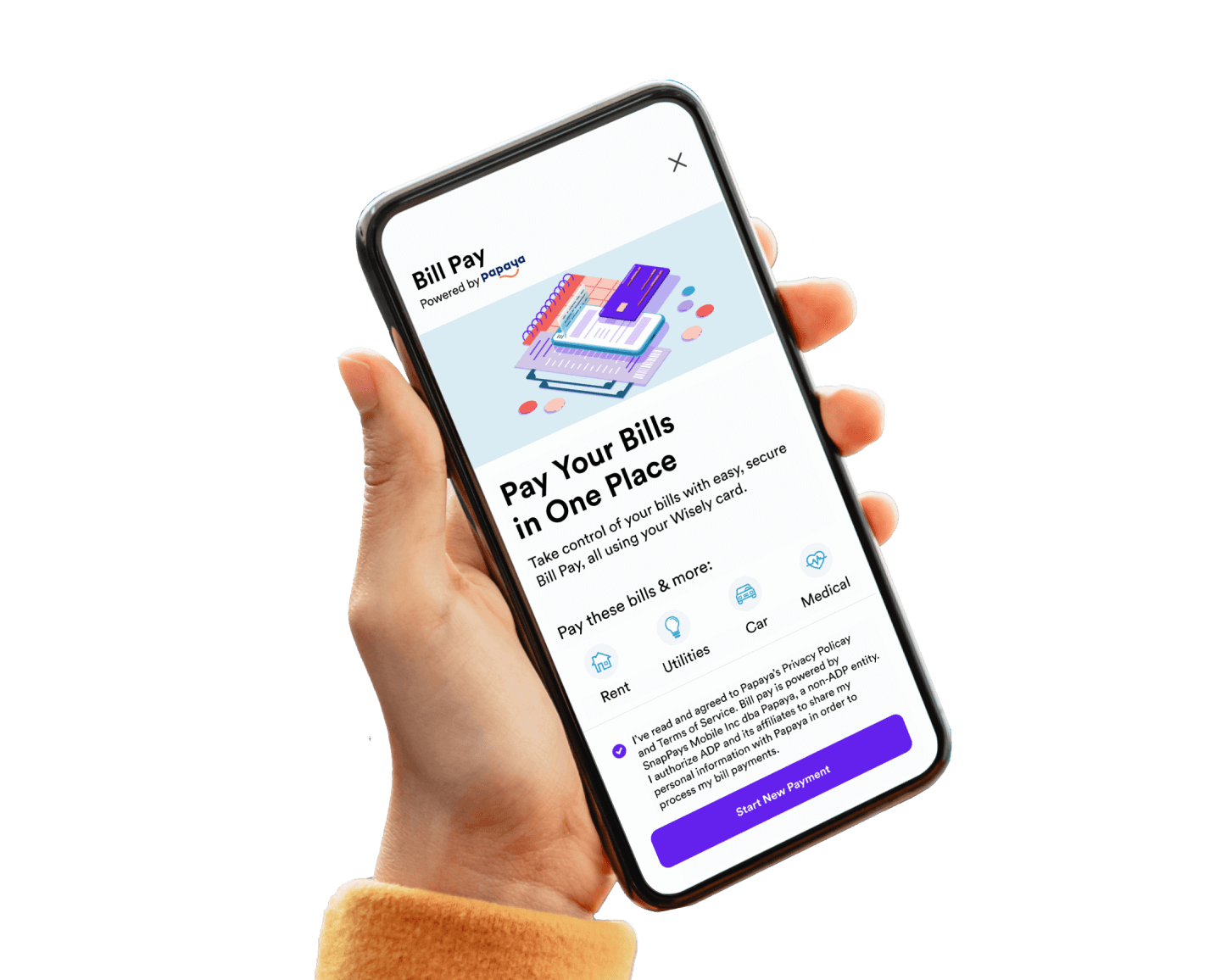

Use Digital Wallets

Digital wallets like PayPal, Venmo, or Cash App offer a straightforward way to transfer your funds. Simply link your Wisely Card to these platforms, and you can send money to friends or make purchases online. It’s a fast and convenient method that often bypasses the need for a traditional bank account.

Shop With Your Wisely Card

Consider using your Wisely Card directly for purchases. Whether you’re buying groceries or shopping online, this card functions like any debit card. This approach not only saves you the hassle of transferring money but also keeps your transactions simple and direct.

Cash Withdrawal

If you prefer cash, you can withdraw money from your Wisely Card at ATMs. Many ATMs allow you to take out cash without any fees if you use the ones in your network. This is particularly useful if you need cash on hand and want to avoid any digital transfer.

Peer-to-peer Transfers

Have a friend or family member who uses the same financial service? You can transfer funds directly to them, and they can either give you cash or transfer it to their bank account for you. It’s a quick way to get your money where it needs to be without waiting for bank processing times.

Purchase Money Orders

Money orders are another viable option. You can buy them with your Wisely Card and then deposit the money order into your bank account. It’s a more traditional method, but it can be effective if you prefer not to link your card to online services.

Consider how these alternatives fit into your daily life. Do they offer more flexibility or convenience? Explore these options and find what works best for your financial habits. Have you tried any of these methods, and how did they work out for you?

Frequently Asked Questions

How To Transfer Money From Wisely Card?

To transfer money from your Wisely Card to a bank account, log into the Wisely app. Select “Transfer Money” and enter your bank account details. Follow the prompts to complete the transfer. Ensure your bank account is linked for a seamless transaction.

Are There Fees For Transferring From Wisely Card?

Transferring money from a Wisely Card to a bank account is usually free. However, check for any potential fees from your bank. Always confirm with Wisely’s terms to ensure no hidden charges apply to your transaction.

How Long Does A Wisely Transfer Take?

Transfers from a Wisely Card to a bank account typically take 1-3 business days. Processing times may vary based on your bank’s policies. For the quickest service, initiate transfers during business hours.

Can I Transfer To Any Bank Account?

Yes, you can transfer funds to any linked bank account from your Wisely Card. Ensure that your bank account is correctly linked to avoid transfer issues. Always double-check account details before confirming the transaction.

Conclusion

Transferring money from a Wisely card to a bank account is simple. Follow the steps provided by Wisely. Ensure you have linked your bank account correctly. This ensures a smooth transaction process. Regularly check for any updates from Wisely. This keeps you informed of any changes.

Always prioritize security while handling transactions. Monitor your account for any discrepancies. Feel confident in managing your finances efficiently. With the right steps, money transfers can be hassle-free. Remember, staying informed is key. Make sure you understand all terms and conditions.

This will help you avoid any unnecessary issues.