Are you dreaming of owning a mobile home but unsure about the financial commitment? Understanding the monthly payment is crucial for making an informed decision.

Whether you’re looking for affordability, flexibility, or a chance to personalize your living space, mobile homes can be an excellent option. But how much will it actually cost you each month? You might be surprised to learn that it’s not as straightforward as you think.

Dive into this guide to uncover the factors that influence your monthly mobile home payment and discover how to keep it within your budget. Don’t let uncertainty hold you back—equip yourself with the knowledge to turn your dream into reality.

Factors Influencing Mobile Home Payments

Home Purchase Price greatly affects monthly payments. Lower prices mean smaller payments. Higher prices lead to bigger payments.

Down Payment Impact is crucial. Bigger down payments reduce monthly costs. Smaller down payments increase monthly payments.

Loan Interest Rates can change payments. High rates increase monthly costs. Low rates decrease payments.

Loan Term Length is important. Short terms mean higher monthly payments. Long terms mean lower payments.

Home Location and Community Fees play a role. Some areas have high fees. This increases monthly payments. Other places have lower fees. This decreases costs.

Loan Types For Mobile Homes

Chattel loans are for personal property. Mobile homes fit this category. These loans are not for land. The interest rates can be high. Payments depend on the loan amount. Shorter loan terms mean higher payments. Longer terms may lower them. Down payments are usually required. These loans offer flexibility but can be costly.

FHA loans are backed by the government. These loans need a lower down payment. They have fixed interest rates. Monthly payments can be lower. The home must meet certain standards. This can help families with less money. Not all lenders offer FHA loans. Always check if your home qualifies.

VA loans are for veterans. No down payment is needed. Interest rates are usually lower. Payments are often affordable. These loans have special benefits. Only veterans can apply for these loans. The mobile home must be a primary residence. VA loans are a great option for eligible veterans.

Personal loans can be used for mobile homes. These loans do not require property as collateral. Interest rates can vary. Payments depend on the lender. Loan terms can be short or long. Personal loans are flexible. Always compare rates before choosing. They can be a convenient option.

Calculating Monthly Payments

The principal is the main loan amount. Interest is extra money paid to the bank. Together, they form the monthly payment. You pay less if the interest rate is low. Paying more each month can also make the loan shorter.

Taxes are fees paid to the government. They help with local services. Insurance protects your home. It covers damage costs. Both are added to the monthly payment. This keeps your home safe and legal.

Living in a mobile home park might have extra fees. These are for community services. Maintenance fees keep the park clean and safe. Paying these ensures a good living space. Always check these fees before moving in.

Improving Loan Terms

Boosting your credit score helps lower mobile home payments. Pay bills on time. Reduce debts. Avoid new credit cards. Monitor your credit report. Fix errors quickly. A good score means better loan offers.

Talk to lenders. Ask for better rates. Tell them about your credit score. Show stable income. Be honest. Lenders like trusted borrowers. Lower rates make payments smaller. Every dollar counts.

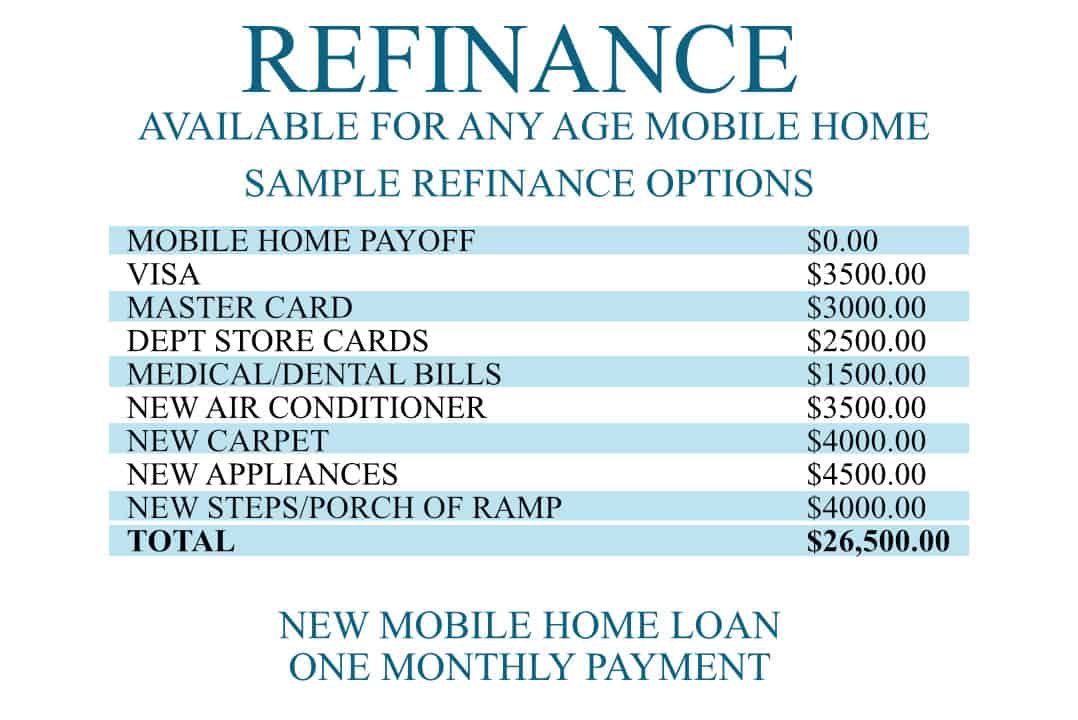

Refinancing can cut monthly costs. Check current interest rates. Compare lenders. Choose the best offer. Refinancing might have fees. Calculate if savings are worth it. It helps if rates drop.

Comparing Mobile Home Vs. Traditional Home Payments

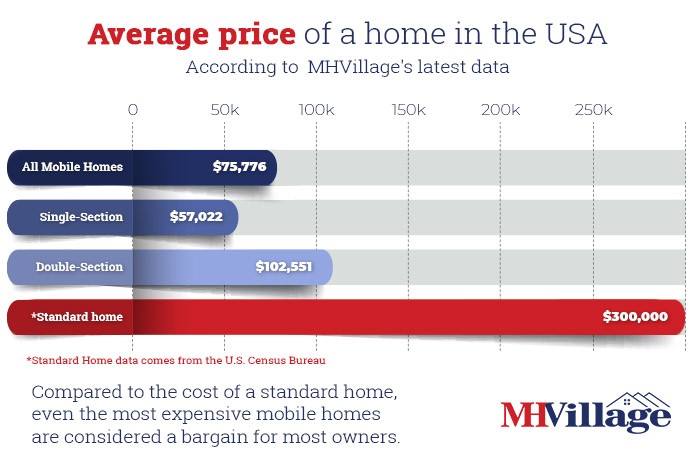

Mobile homes often cost less than traditional homes. This means lower monthly payments. Traditional homes need large down payments. Mobile homes usually need smaller ones. Taxes are also lower for mobile homes. This can save you money every year. Traditional homes may have high property taxes. Choose wisely based on your budget.

Owning a mobile home is different. The land might not be yours. Renting land can add costs. Traditional homes usually include the land. This can be a better investment. Mobile homes can lose value over time. Traditional homes often gain value. Think about your long-term goals.

Mobile homes offer more flexibility. You can move them to new places. This is good if you need to relocate. Traditional homes are fixed. Moving means selling and buying again. Mobile homes can make moving easier. Consider your lifestyle and future plans.

Tips For Affordable Mobile Home Payments

Creating a clear budget helps manage mobile home payments. Track income and expenses every month. This reveals spending habits. Save a bit each week. Even small amounts grow big with time. Use banks that offer good savings rates. This boosts your savings further. Avoid spending on unnecessary things. Stick to your budget plan.

Government programs help people with mobile home costs. Check for housing grants or low-interest loans. Some programs are designed for first-time buyers. They make payments easier. Visit government websites for details. Call local housing offices for information. Assistance can lower monthly payments. It makes owning a mobile home affordable.

Location affects mobile home costs. Some areas have cheaper land fees. Research on affordable locations before buying. Look at safety and schools nearby. These factors matter too. A good spot saves money in the long run. Compare different places for the best choice. You might find a perfect location at a lower cost.

Frequently Asked Questions

What Factors Affect Mobile Home Monthly Payments?

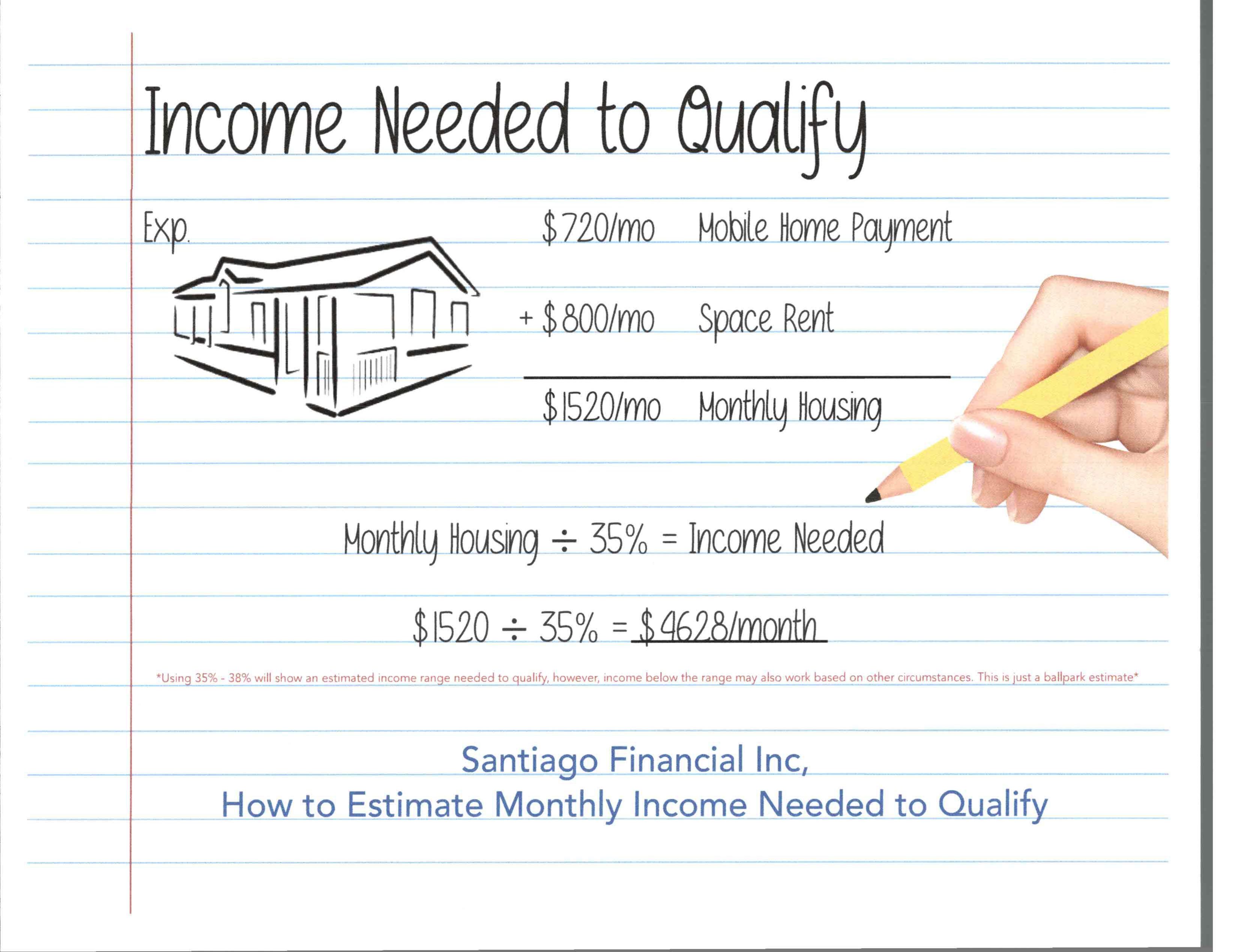

Mobile home monthly payments depend on several factors. These include the home’s purchase price, interest rate, loan term, and down payment. Additional costs like insurance and taxes also impact the overall monthly payment. Understanding these components helps in estimating a more accurate monthly payment for a mobile home.

Are Mobile Home Loans Different From Traditional Mortgages?

Yes, mobile home loans differ from traditional mortgages. Mobile homes are often considered personal property, not real estate. This difference affects the loan terms and interest rates. Mobile home loans may have higher interest rates and shorter terms compared to traditional home mortgages.

Can You Refinance A Mobile Home Loan?

Yes, refinancing a mobile home loan is possible. Refinancing can help lower your monthly payments by securing a lower interest rate. It may also extend the loan term, reducing monthly costs. However, eligibility depends on factors like credit score and the mobile home’s age and condition.

What Is The Typical Loan Term For A Mobile Home?

The typical loan term for a mobile home ranges from 15 to 30 years. Shorter terms may result in higher monthly payments but less interest paid over time. Longer terms can lower monthly payments but increase the total interest paid over the life of the loan.

Conclusion

Understanding mobile home payments makes budgeting easier. Monthly costs vary greatly. Factors like location, loan terms, and insurance impact payments. Research thoroughly before deciding. Compare different financing options. Stay within your budget limits. A good plan helps avoid financial stress.

Always review loan terms carefully. Consult experts if needed. Your financial well-being is important. Make informed choices for a stress-free living. Remember, knowing your costs helps you plan better. Stay informed and choose wisely. A comfortable home awaits with the right planning.