Are you curious about the financial world and how money moves around? Have you ever heard the term “private transfer payment” and wondered what it really means?

You’re not alone. Understanding these payments can be a game-changer for your financial literacy. They play a crucial role in the economy, and knowing how they work can empower you to make smarter money decisions. We’ll simplify the concept and help you identify which of the following is a private transfer payment.

By the end, you’ll not only grasp the idea but also see its relevance in your daily life. Ready to unlock this financial mystery? Keep reading to uncover the insights you need.

Private Transfer Payment Defined

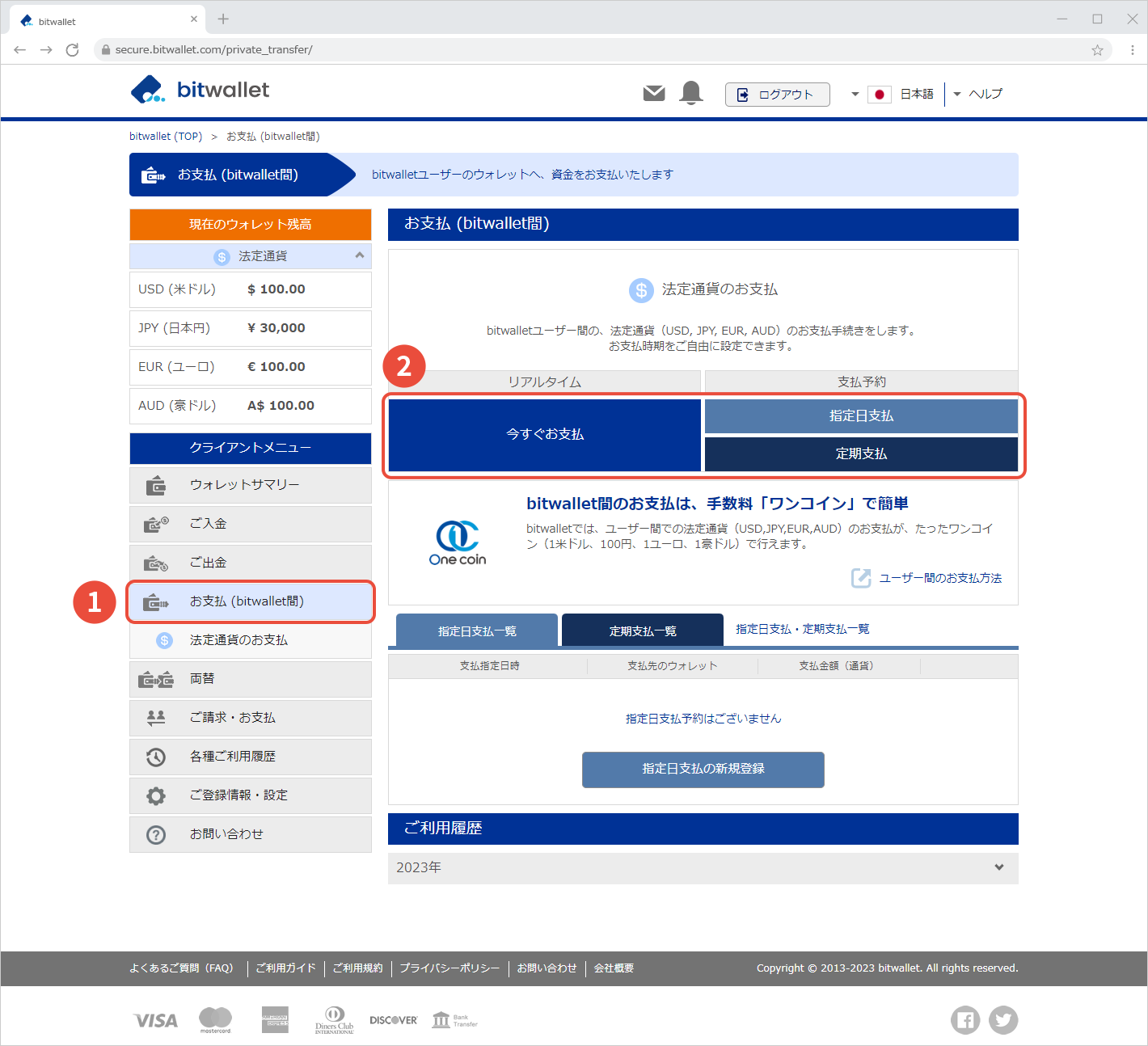

Private transfer payments happen between individuals or families. These payments are not made by the government. A common example is money given by parents to their children. Gifts and inheritances are also private transfer payments. They are voluntary and do not require a service in return. Such payments can help family members in need. They are important for supporting loved ones. Private transfer payments are personal and direct. They do not go through any business or organization. Remember, these payments are not loans. No repayment is expected. They are simply gifts to help others. Private transfer payments can make a big difference in someone’s life.

Types Of Transfer Payments

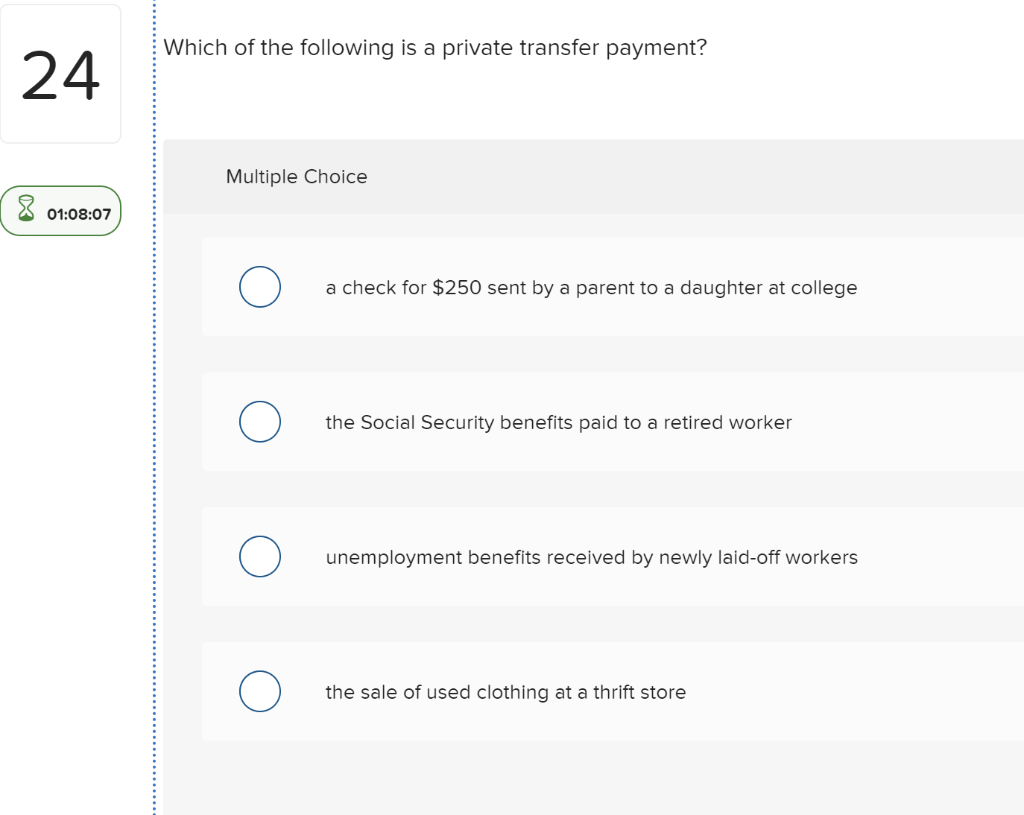

Transfer payments move money from one group to another. Public transfers are from the government. Examples include Social Security and unemployment benefits. These help people in need. Private transfers are personal. They happen between individuals or families. Gift money is one example. Inheritance is another. These payments are private. No government involvement. Public transfers are more common. Everyone knows about them. Private ones are quieter. They are personal. The difference is clear.

Private transfers happen often. Parents give money to kids. This is a private transfer. Birthday money is another example. It’s personal and private. Family loans are common too. No banks needed. Just family members. Charity donations can be private. People give money or goods. No government link. These payments stay private. They are from one person to another. Each is a voluntary act. It’s not public business.

Characteristics Of Private Transfers

Private transfer payments are often given by choice. People decide to give money or gifts. They are not forced to do so. These payments can be from a person to another person. For example, parents giving money to their children. It is all about helping someone else. There is no need for a return. Such payments help people who need support. They bring happiness to both sides.

Private transfers happen without government help. The money comes from individuals or families. This keeps the process simple and direct. Friends or family often make these payments. They help each other in times of need. The government has no role in these transactions. This makes private transfers easy and quick. They are a personal way to support loved ones.

Common Examples

Gifts are given by one person to another. They are private transfer payments. People give gifts for birthdays or holidays. Donations help those in need. Donors give money or items. Both are not payments for work.

Inheritance is money or property received from a relative. When a person passes away, their belongings may be transferred. These are private transfer payments. They are not earned through work or services.

Personal transfers occur between family or friends. People send money to help others. It can be for emergencies or regular support. These are private transfer payments. Not connected to business or jobs.

Economic Impact

Private transfer payments can help families. They can change how money is shared. Rich families might help poorer ones. This can make income gaps smaller. It helps share wealth more evenly. But not all families get help. Some may not have rich relatives. This means not everyone benefits. It depends on family ties.

Families often rely on these payments. They help with school fees and bills. Elderly parents may need them for care. Children get school supplies. These payments make families feel secure. They act as a safety net. But it is not the same for all. Some families get more help. Others may get less. This support varies a lot.

Distinguishing Features

Private transfer payments are different from public ones. They usually come from individuals or families. A good example is money given as a gift. These payments do not involve government funds. They are often personal and private. This makes them unique compared to public payments.

Private payments have legal implications. They may require written agreements. This ensures both parties understand the terms. Financial implications are also important. Private payments can affect tax calculations. They may not have the same benefits as public funds. Understanding these implications is crucial for financial planning.

Private transfer payments may have tax consequences. Some payments may not be taxed. Others could be taxable. It depends on the amount and purpose. Gifts below a certain amount may be tax-free. Larger sums might need to be reported. It’s important to know the rules. This helps avoid unexpected tax bills. Always check with a tax expert for advice.

Misconceptions

Many people mix up private transfer payments with public ones. Private transfers are payments between individuals. They aren’t from the government. Public transfers come from government aid. Examples include Social Security or welfare. Private payments include gifts or family support. These can cause confusion. They seem similar but are very different.

Financial reports often show private transfers incorrectly. They might label them as income. This is a mistake. Private transfers are not earnings. They are personal exchanges. Mislabeling can affect tax records. It may lead to wrong tax calculations. Understanding the difference is crucial for accurate reports. Clear records prevent errors.

Case Studies

Private transfer payments often confuse people. Birthday gifts are a good example. These gifts are not part of business deals. They are personal and have no strings attached. Charity donations can also be private. They help others but are not for profit. Understanding these helps identify private transfers.

Sometimes, people mix up payment types. Loan repayments are often mistaken. They are not private transfers. Loans involve contracts and interest. This is different from simple gifts. Insurance payouts also get confused. They follow claims and agreements. Knowing these differences helps in correct identification.

Frequently Asked Questions

What Is A Private Transfer Payment?

A private transfer payment is a non-governmental financial transaction. It involves money transferred between individuals or organizations. Examples include gifts, inheritances, or charitable donations. These payments do not involve the exchange of goods or services. They are typically made voluntarily without any legal obligation.

How Do Private Transfers Differ From Public Transfers?

Private transfers are voluntary and involve individuals or organizations. Public transfers are government payments, like welfare. Private transfers don’t require service exchange, while public transfers often support economic welfare. Examples of public transfers include unemployment benefits and social security payments.

Are Gifts Considered Private Transfer Payments?

Yes, gifts are considered private transfer payments. They are voluntary financial transactions between individuals. Gifts don’t involve the exchange of goods or services. They are typically given without any legal obligation. Gifts can be monetary or non-monetary, like property or personal items.

Do Private Transfers Impact The Economy?

Private transfers can impact the economy by redistributing wealth. They can influence consumer spending and saving behaviors. However, their overall economic impact is generally less significant than public transfers. Private transfers can support individuals during financial hardships, indirectly affecting economic stability.

Conclusion

Understanding private transfer payments is crucial for financial literacy. These payments include gifts, donations, and allowances. They flow directly from one individual to another. No government or business involvement. Recognizing these can aid in better personal finance management. Such payments are vital for household support and personal needs.

Knowing their nature helps in identifying income sources. It’s important to differentiate them from public transfer payments. This knowledge boosts financial awareness. Stay informed to manage finances effectively. Simple yet essential for everyday financial decisions.