Are you scratching your head over whether the payment card settlement you’ve heard about is the real deal? You’re not alone.

With countless offers and schemes floating around, it’s tough to know what’s legit and what’s a scam. This isn’t just about money—it’s about peace of mind. Imagine the relief in knowing your financial transactions are secure and trustworthy. We’ll unravel the mystery of payment card settlements, diving deep into what makes them credible or questionable.

Don’t let uncertainty cloud your judgment any longer. Let’s get to the bottom of it together, ensuring you make informed decisions that safeguard your financial future.

Payment Card Settlement Basics

Payment card settlements happen after a legal decision. They involve money given to affected people. These people used a specific card. They may have been charged extra fees. Companies pay to settle claims. This helps avoid long court cases.

Settlements are often fair. They help people get some money back. It’s important to read all details. This tells you if you get money. Sometimes, documents must be signed. This shows agreement with the terms.

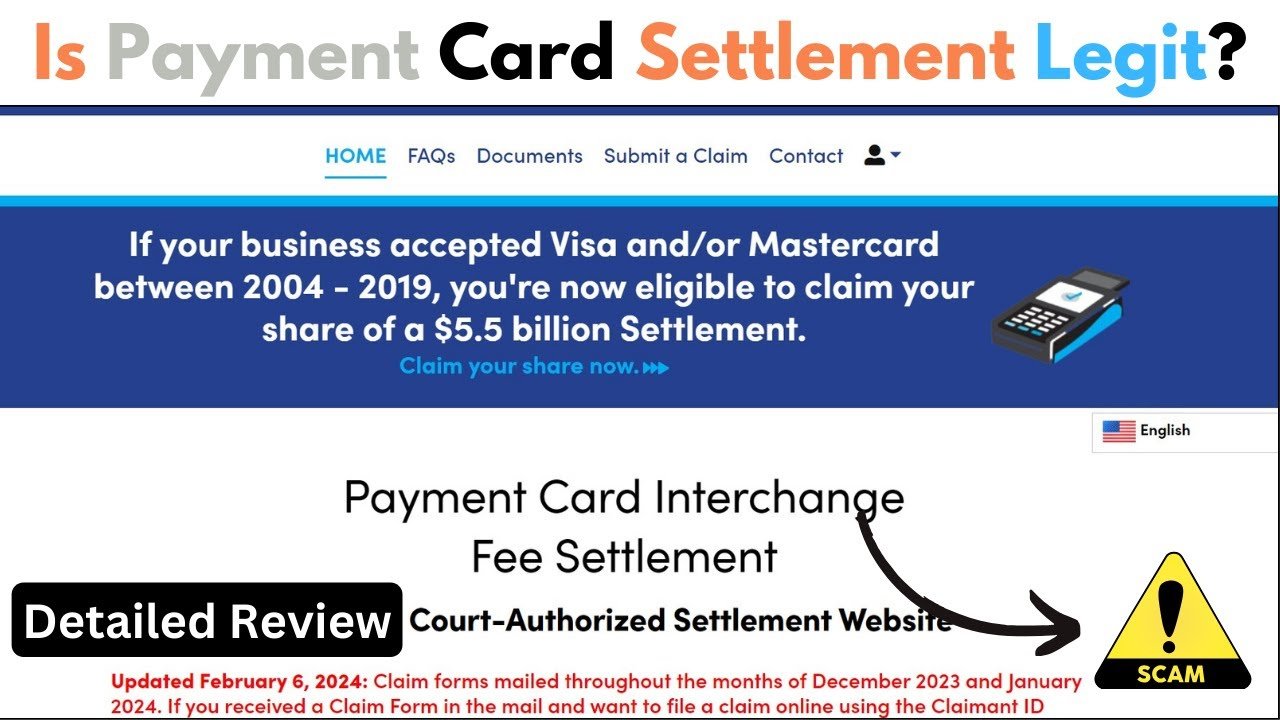

Not all settlements are legit. Be careful of scams. Always check with trusted sources. They can tell if the settlement is real. This keeps you safe from tricks.

How Settlements Work

Settlements happen after a transaction is made with a payment card. The merchant sends the transaction details to their bank. The bank checks the details. Then, the bank requests payment from the customer’s bank. The customer’s bank approves or denies the request. If approved, funds move to the merchant’s bank. This completes the settlement process.

Several key players are involved in card settlements. Merchants sell goods or services. Banks handle money transfers. Payment processors manage the transaction details. Card networks ensure security. Each player has an important role. They work together to ensure smooth transactions. Without them, the system would fail. This collaboration keeps payments secure and efficient.

Legitimacy Of Payment Card Settlements

Payment card settlements follow a strict legal framework. Laws protect both consumers and businesses. Every transaction must be clear and fair.

Companies must follow these rules. They ensure all payments are safe. This protects you from fraud. Always check if a company follows these rules.

Many think payment card settlements are not safe. This is not true.

Some believe they lose money. Others think fees are too high. In reality, most fees are small. They cover service costs.

Always read the terms. Understand what you agree to. Settlements are designed to be fair.

Benefits Of Card Settlements

Card settlements help people manage debt better. They often pay less than the full amount owed. This saves money. Card settlements can improve credit scores over time. Less debt means better financial health. People can avoid stressful collection calls. Less stress makes life happier. Consumers gain control over their finances. Freedom from debt is empowering.

Merchants enjoy quick payments through settlements. This improves cash flow. They save time as disputes reduce. Less time spent on disputes means more focus on business. Settlements encourage customer loyalty. Happy customers return more often. Merchants can avoid costly legal battles. Legal battles are expensive and time-consuming. Settlements lead to smoother transactions. Smooth transactions build trust between merchants and consumers.

Potential Drawbacks

Consumers might face unexpected fees or charges. These can appear on credit card bills. Sometimes, these charges are hard to understand. Some people may find it hard to get refunds. This can lead to frustration and confusion. Personal information might not be safe. This can cause worries about identity theft. People should check their statements often. This helps in spotting errors early.

Merchants face their own set of problems. There can be high processing fees. These fees eat into profits. Sometimes, payments are delayed. This can hurt a business’s cash flow. Merchants also need to keep data safe. A data breach can cause big issues. It can hurt a business’s reputation. Keeping up with security rules is important. It can be a lot of work.

Spotting Red Flags

Scammers use tricky ways. They often promise big savings. They ask for personal details. Watch out for unusual fees. Their emails may have poor spelling. They might use urgent language. Be careful of links. Fake websites look real. Always check the website name. Trust your gut if something feels wrong.

Keep your card details safe. Use trusted websites. Check for secure symbols like a lock. Always read user reviews. Update your passwords often. Don’t share private information online. Use two-factor authentication. Be aware of phishing emails. Contact your bank for advice. Be alert and stay informed.

Real-world Examples

Payment card settlements can be successful for companies. They often recover lost funds. Many businesses have received money back. One example is Visa. They had a settlement worth millions. It was a big win for them. Another example is MasterCard. They settled disputes with banks. This helped them recover money. These cases show that settlements can work.

Successful Settlements

Visa’s case showed positive results. It proved settlements could be legit. They got back a lot of money. MasterCard also had a good outcome. Their settlement was successful. This helped many banks and users. It brought back trust in the system.

Notable Scandals

Some payment card settlements faced scandals. They had issues with transparency. Many people questioned their fairness. One scandal involved hidden fees. Another scandal was about false charges. These scandals made users cautious. They wanted more clarity and honesty. Such scandals hurt trust in settlements.

Future Of Payment Card Settlements

Payment card settlements are changing fast. Digital payments are growing. People use cards more for shopping. New ways to pay are coming. Contactless payments are popular. They are quick and easy. Mobile wallets are also in demand. People like using phones to pay. These trends show a big shift.

Technology makes card payments safer. Encryption protects data. It stops bad people from stealing. Biometrics, like fingerprints, add extra safety. AI helps find fraud fast. It keeps payments secure. Blockchain is another tech. It adds trust and transparency. These tools make payments better. They keep money safe and easy.

Frequently Asked Questions

What Is Payment Card Settlement?

Payment card settlement is a process where card transactions are finalized. The transaction funds are transferred from the cardholder’s bank to the merchant’s account. It ensures merchants receive payment for goods or services sold.

How Does Payment Card Settlement Work?

Payment card settlement involves multiple steps. After a purchase, transaction data is sent for authorization. Once approved, funds are transferred from the cardholder’s bank to the merchant’s account. This completes the transaction.

Is Payment Card Settlement Safe?

Yes, payment card settlement is generally safe. It involves secure protocols and encryption to protect transaction data. Financial institutions follow strict regulations to ensure security and prevent fraud during the settlement process.

Why Is Payment Card Settlement Important?

Payment card settlement is crucial for merchants. It ensures they receive funds for transactions. Without settlement, merchants wouldn’t be compensated for their goods or services, impacting their cash flow and business operations.

Conclusion

Deciding if payment card settlement is legit requires careful research. Check reviews and testimonials. Trustworthy sources help verify legitimacy. Always ensure the company is registered and compliant. Look for transparency in fees and terms. Protect your personal information and finances.

Ask questions if something seems unclear. Remember, informed decisions lead to safer choices. Stay vigilant. Keep your financial safety a top priority. It’s essential to rely on trusted services. This ensures peace of mind.