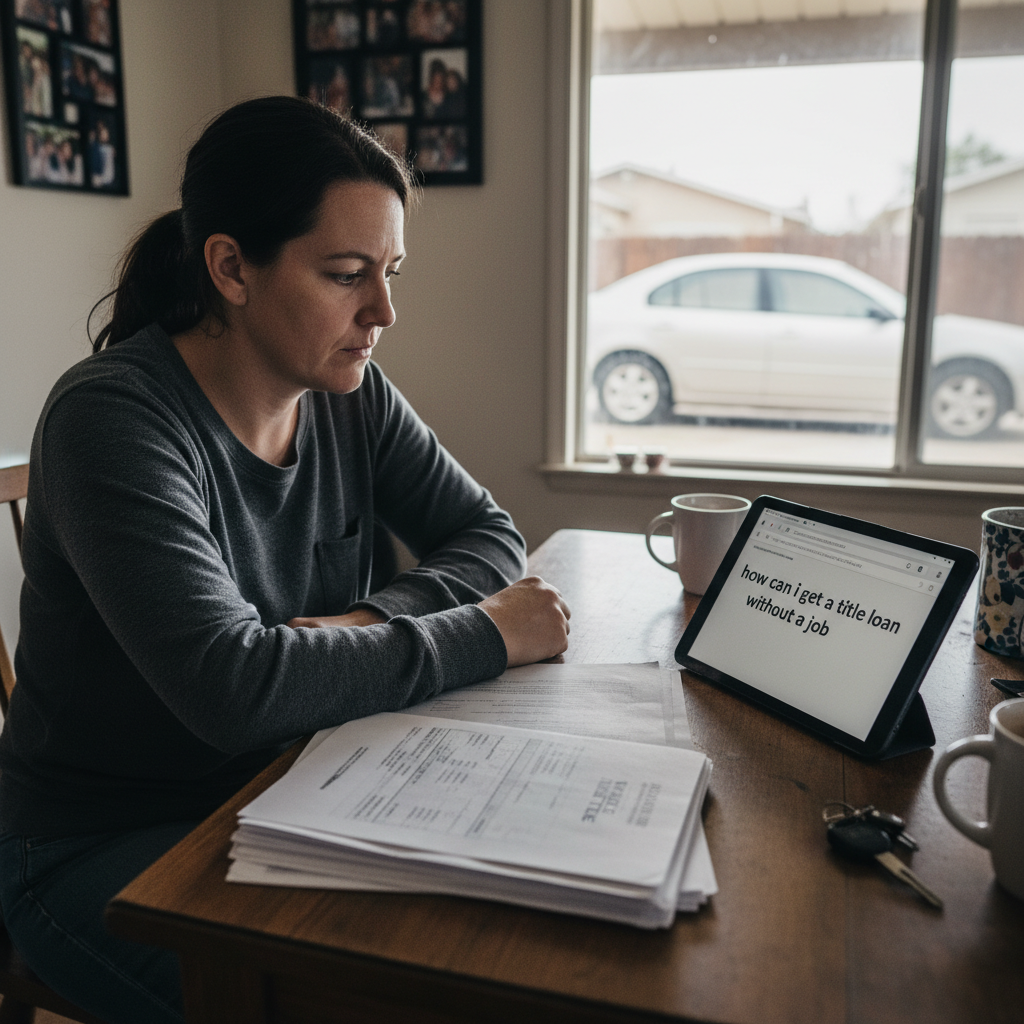

Getting a title loan without a job is possible, but it may require alternative documentation or collateral. Lenders often look for other forms of income or assets to secure the loan. By understanding your options and preparing effectively, you can navigate the process more smoothly. This article will guide you through the various strategies and considerations that can help you qualify for a title loan even if you are currently unemployed.

Understand Title Loans and Their Requirements

Title loans are a type of secured loan that allows borrowers to use their vehicle as collateral. This means that the lender holds the title to your vehicle until the loan is repaid. The primary requirements for obtaining a title loan include proof of ownership of the vehicle and a clear title—meaning there are no liens or outstanding debts against it. Additionally, lenders may require documentation to verify your identity and residence, as well as a vehicle inspection to assess its condition and value. Since title loans are secured by an asset, they generally have less stringent eligibility criteria compared to unsecured loans. However, the absence of a job can complicate the approval process, making it essential to explore alternative income sources and present a compelling case to lenders.

Explore Alternative Income Sources

When applying for a title loan without a job, showcasing alternative income sources can significantly strengthen your application. Common examples include social security benefits, disability payments, rental income from investment properties, or even child support. These forms of income are typically stable and can serve as a reliable indicator of your ability to repay the loan. Additionally, if you have engaged in freelance work or side gigs, documenting this income can further bolster your case. For example, if you are a graphic designer or a tutor who has consistent clients, providing contracts or payment records can demonstrate financial stability. Be prepared to present bank statements or other proof of income to the lender, as this will help establish your capability to manage loan repayments despite your unemployment status.

Gather Necessary Documentation

Gathering the right documentation is a crucial step when applying for a title loan without a job. Essential documents typically include your vehicle title, a government-issued identification (such as a driver’s license or passport), and proof of income. In addition to these, you should compile a comprehensive list of your expenses, including rent or mortgage payments, utilities, and other financial obligations. This information can help lenders gauge your overall financial situation and may improve your chances of approval. It’s advisable to have these documents organized and ready for submission, as promptness can enhance your credibility in the eyes of the lender. Furthermore, being transparent about your financial situation, including any challenges you are facing, can foster a more trusting relationship with the lender.

Research Lenders That Accept Non-Traditional Income

Not all lenders are created equal, especially when it comes to assessing applicants without traditional employment. Look for lenders that specialize in working with unemployed borrowers or those with alternative income sources. Local credit unions, online lenders, and specialized title loan companies may be more flexible in their requirements. Take the time to compare offers from multiple lenders, focusing on interest rates, loan terms, and fees. Some lenders may even offer pre-qualification, allowing you to assess your options without impacting your credit score. By doing thorough research and selecting a lender that understands your unique situation, you can increase your likelihood of approval and secure more favorable loan terms.

Be Prepared for Higher Interest Rates

One of the trade-offs of obtaining a title loan without a job is the likelihood of facing higher interest rates. Lenders often perceive unemployed borrowers as higher-risk clients, which can lead to increased rates to mitigate their risk. It’s essential to evaluate how much you are willing to pay in interest and whether you can comfortably manage the repayment terms. To make informed decisions, consider creating a detailed budget that includes your projected monthly loan payments along with your existing expenses. This exercise can help you determine whether you can afford the loan without jeopardizing your financial well-being. If the terms are not favorable, it may be worth exploring other borrowing options before committing to a title loan.

Consider Co-Signing Options

If you have a friend or family member with a stable income, consider asking them to co-sign your loan. A co-signer can significantly enhance your chances of approval, as they provide additional security for the lender by agreeing to repay the loan if you default. This arrangement can lead to lower interest rates and more favorable loan terms. However, it’s crucial to approach this option with caution; ensure that both you and your co-signer fully understand the implications of the loan agreement. Open communication about repayment plans and financial responsibilities is essential to maintain trust and avoid potential conflicts.

Evaluate Alternatives to Title Loans

While title loans can provide quick cash, they are not the only option available. Exploring alternative borrowing methods may lead to better financial outcomes. Personal loans from banks or credit unions, for instance, often come with lower interest rates and more favorable terms compared to title loans. Additionally, consider credit lines or peer-to-peer lending platforms that could offer flexible repayment options. Furthermore, local community assistance programs may provide financial aid or resources to those in need, particularly during challenging times. Researching these alternatives can empower you to make informed choices and avoid falling into a cycle of debt.

Navigating the process of securing a title loan without a job can be challenging, but it’s not impossible. By understanding your options, preparing the necessary documentation, and exploring alternative income sources, you can increase your chances of approval. Remember to research lenders thoroughly and consider the financial implications of the loan. If you find yourself in need of immediate funds, take these steps and reach out to potential lenders to discuss your situation. By being proactive and informed, you can find a solution that meets your financial needs while safeguarding your future.

Frequently Asked Questions

How can I qualify for a title loan without a job?

Qualifying for a title loan without a job is possible by demonstrating alternative sources of income. Lenders may accept income from disability benefits, unemployment benefits, retirement funds, or savings as proof of your ability to repay the loan. Additionally, having a clear title to your vehicle with a good condition can significantly strengthen your application, as lenders primarily focus on the asset’s value.

What documents do I need to apply for a title loan if I’m unemployed?

When applying for a title loan without being employed, you’ll typically need to provide several key documents. These include the vehicle title in your name, a government-issued ID, proof of income (like bank statements or benefit letters), and vehicle registration. Some lenders may also require photos of the vehicle to assess its condition and value.

Why would a lender approve a title loan for someone without a job?

Lenders may approve title loans for individuals without a job because the loan is secured by the borrower’s vehicle title. This reduces the lender’s risk, as they can repossess the vehicle if the borrower defaults. Additionally, if the borrower can show alternative income sources or a strong credit history, lenders may be more willing to provide the loan.

What are the risks of getting a title loan without a job?

The risks of obtaining a title loan without a job include the potential for high-interest rates and the possibility of losing your vehicle if you fail to repay the loan. Since title loans are often short-term, borrowers may find themselves in a cycle of debt if they cannot meet repayment deadlines. It’s crucial to assess your financial situation and ensure that you can manage the payments before proceeding.

Which lenders offer title loans to unemployed individuals?

There are several lenders that specifically cater to unemployed individuals seeking title loans. Online title loan companies often have more flexible qualification criteria compared to traditional banks. It’s advisable to research and compare different lenders to find those with favorable terms, low fees, and positive customer reviews to ensure a trustworthy borrowing experience.

References

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-title-loan-en-2020/

- https://www.nerdwallet.com/article/loans/title-loans

- https://www.bankrate.com/loans/title-loans/

- https://www.investopedia.com/terms/t/title-loan.asp

- ConsumerReports.org – Page not found error – Consumer Reports