Are you curious about Visa Provisioning Service and how it impacts your credit card? You’re not alone.

Many cardholders have questions about this feature and its benefits. Understanding Visa Provisioning Service can enhance your financial experience, making transactions smoother and more secure. We’ll break down what it is, how it works, and why it matters to you.

Get ready to unlock the full potential of your credit card and enjoy the convenience and peace of mind that comes with it. Let’s dive in!

Visa Provisioning Service Basics

The Visa Provisioning Service simplifies how you use your credit card. It helps to securely store your card information. This service allows you to make payments easily and safely. It also supports mobile wallets and other digital payment methods.

Many people use mobile devices for shopping. Visa Provisioning Service makes this easier. It sends your card details to your device securely. This way, you can pay without worries.

What Is Visa Provisioning?

Visa Provisioning means putting your credit card information on your mobile device. It uses a secure system to protect your data. Your card number is not stored on the device. Instead, a unique code is created for each transaction.

How Does It Work?

When you add your card to a mobile wallet, the service activates. It sends your card details to a secure server. This server then provides a digital version of your card. You use this version for payments.

Benefits Of Visa Provisioning Service

This service offers several benefits. It enhances security for your transactions. You do not share your actual card number. This reduces the risk of fraud. It also makes shopping faster and easier.

Who Can Use It?

Anyone with a Visa credit card can use this service. You only need a compatible mobile device. Many banks and financial institutions support Visa Provisioning.

Setting Up Visa Provisioning

Setting up is simple. Download a mobile wallet app that supports Visa. Follow the prompts to add your card. Once done, you can start using your card digitally.

How It Works

Understanding how Visa Provisioning Service works can enhance your experience with digital payments. It’s a system that makes your credit card transactions not only convenient but also secure. Knowing the mechanics behind it can empower you to use your card confidently.

Role Of Tokenization

Tokenization plays a crucial role in the Visa Provisioning Service. Instead of using your actual credit card number during online transactions, a unique token is generated. This token serves as a substitute, safeguarding your sensitive information.

Imagine you are shopping online. When you enter your card details, the payment processor generates a token. This token is meaningless to anyone who intercepts it, ensuring that your actual card number remains protected.

This method reduces the risk of fraud significantly. If a hacker tries to access your information, they only get a token, not your real card details. This extra layer of security gives you peace of mind.

Secure Digital Payments

Visa Provisioning Service enhances secure digital payments in various ways. It works seamlessly with mobile wallets and payment apps, making transactions quick and safe. You can make purchases with just a tap, knowing your information is secure.

Using your mobile wallet, you can pay at stores or online without revealing your card number. This convenience is coupled with advanced encryption technology that protects your data during transactions. Have you ever felt anxious about entering your card details online? With tokenization, that worry can be a thing of the past.

The service also enables real-time monitoring of transactions, which alerts you to any suspicious activities. You can take immediate action if something looks off. This proactive approach to security further enhances your confidence in using your credit card.

By understanding how Visa Provisioning Service works, you can take control of your digital payments. Feel empowered knowing that each transaction is designed with your security in mind. Are you ready to make your online shopping experience safer?

Common Use Cases

Visa Provisioning Service helps you manage your credit card details easily. It simplifies payments and makes transactions safer. Here are some common ways you can use this service.

Mobile Wallet Integration

Mobile wallets let you store your card information securely. Visa Provisioning Service connects your card to these wallets. You can pay with your phone in stores or online.

This service makes adding your card easy. You just enter your card details once. Then, you can use your mobile wallet anytime, anywhere.

Subscription Services

Many services let you subscribe for regular payments. Think of streaming, magazines, or online courses. Visa Provisioning Service makes managing these subscriptions simple.

You can add or update your card details without hassle. This ensures your subscriptions continue without interruption.

In-app Purchases

Many apps allow you to buy items directly within them. Visa Provisioning Service supports these in-app purchases. You can buy games, music, or other features easily.

Your card information stays safe. You can make purchases quickly without re-entering details.

Credit: www.reddit.com

Benefits For Cardholders

The Visa Provisioning Service offers many advantages for cardholders. These benefits include better security and easier payment methods. Understanding these benefits can help you feel safer and more confident when using your card.

Enhanced Security

Security is crucial for anyone using a credit card. With Visa Provisioning Service, your card information stays safe. This service uses advanced technology to protect your details.

Transactions are tokenized. This means your real card number is hidden. Only a unique token is used for each transaction. This makes it harder for thieves to access your information.

In case of theft or loss, you can quickly disable your card. This quick action helps protect your finances. The service also monitors transactions for unusual activity. You will be alerted if something seems off.

Convenience In Payments

Visa Provisioning Service makes payments easier. You can store your card details securely with different merchants. This allows for quick checkouts without entering your information each time.

Mobile payments become seamless with this service. You can pay using your smartphone or smartwatch. Just tap and go. It saves time and effort.

Managing subscriptions is also simpler. You can easily update your card information across services. No more hassle of missing payments.

Potential Concerns

Understanding the Visa Provisioning Service on your credit card is important, but it’s equally crucial to recognize the potential concerns that come with it. While this service offers convenience, it also raises valid issues that you should consider before fully embracing its features. Let’s dive into some of these concerns.

Privacy Issues

Your privacy is paramount, especially when it comes to financial transactions. The Visa Provisioning Service stores sensitive information, which could be a target for cybercriminals. Have you ever wondered how securely your data is being handled?

When you use this service, your card details are shared with various merchants. This sharing raises questions about how that information is stored and who has access to it. If a data breach occurs, could your personal information be at risk?

Being cautious is wise. Regularly review your account statements for any suspicious activities. Consider using strong, unique passwords and enabling two-factor authentication for added security.

Unauthorized Transactions

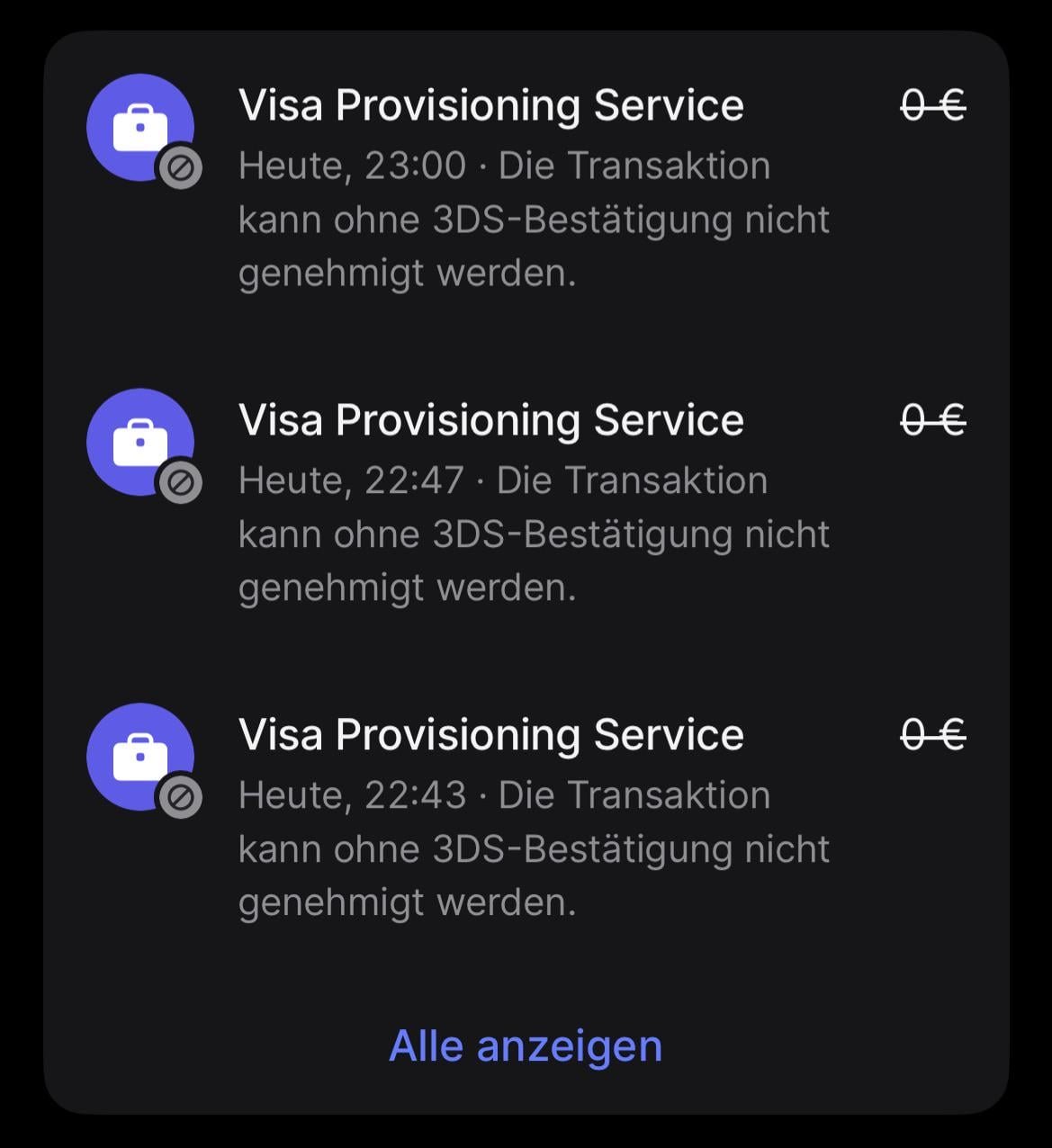

Unauthorized transactions can be a nightmare. With the Visa Provisioning Service, the ease of making purchases can sometimes lead to mistakes or fraud. How would you feel if you noticed a charge on your account that you didn’t authorize?

Even though Visa has measures in place to protect you, it’s essential to remain vigilant. Monitor your transactions closely and report any discrepancies immediately. Quick action can make a significant difference in resolving issues.

Educate yourself about the dispute resolution process. Knowing how to contest a charge can save you time and stress. Protecting your finances starts with being proactive.

In the end, while the Visa Provisioning Service offers convenience, it’s vital to remain aware of the potential concerns. Being informed and cautious can help you enjoy the benefits while minimizing the risks.

How To Identify Visa Provisioning Service Charges

Visa Provisioning Service lets you add your credit card to mobile wallets. To find service charges, check your bank statement or contact customer service. Look for any fees labeled as provisioning or mobile payments. Understanding these charges helps you manage your finances better.

Identifying Visa Provisioning Service charges on your credit card statement can be a bit tricky. These charges might appear unexpectedly, and understanding what they are can save you from confusion and potential financial mismanagement. Let’s break down how you can spot these charges effectively.

Checking Your Statement

Start by closely examining your credit card statement. Visa Provisioning Service charges may not be labeled clearly, so look for terms like “Visa Provisioning” or similar phrases.

– Look for Dates: Check the dates of the transactions. If there’s a charge that doesn’t match your spending habits, take note.

– Review Descriptions: Sometimes, the description next to the charge can provide more context.

– Frequency of Charges: If you see this charge appear regularly, it’s essential to understand why. Regular, unexplained charges could indicate a subscription or service you forgot about.

If you’re unsure about a particular charge, don’t hesitate to dig deeper. Your statement is a goldmine of information about your spending habits.

Contacting Your Bank

If you can’t identify a charge after reviewing your statement, reach out to your bank. Customer service representatives are trained to help you understand your transactions.

– Have Your Information Ready: When you call, have your credit card number and details of the charge on hand. This will streamline the process.

– Ask Specific Questions: Don’t shy away from asking direct questions. Inquire about the charge’s origin and if it’s tied to any services you may have signed up for.

– Request Documentation: If necessary, ask for documentation that explains the charge. A reputable bank should be able to provide this without hassle.

Understanding these charges can help you manage your finances better. Are you keeping an eye on your credit card transactions regularly? Taking a proactive approach could save you from unnecessary stress.

Steps To Manage Or Disable The Service

Managing or disabling the Visa Provisioning Service is simple. Follow these steps to ensure your credit card settings match your needs. Adjustments can help with security and convenience.

Adjusting Mobile Wallet Settings

First, open your mobile wallet app. Look for the settings menu. You may find an option for payment methods. Here, you can see if your card is linked.

If you want to disable the Visa Provisioning Service, select your card. Choose the option to remove or disable it. Confirm your choice to ensure changes are saved.

Bank Support Assistance

If you face any issues, contact your bank’s customer support. They can guide you through the process. Have your card information ready for faster assistance.

Support can also help with questions about your account. They are there to ensure your card works the way you want.

Credit: www.reddit.com

Future Of Visa Provisioning Service

Visa Provisioning Service allows you to add your credit card to digital wallets easily. It simplifies online and in-store payments. With this service, managing your card is quick and secure, ensuring a smooth shopping experience.

The future of the Visa Provisioning Service looks bright and full of potential as digital payments continue to evolve. With more people relying on their credit cards for everyday transactions, understanding how Visa Provisioning Service will adapt is crucial. This service not only simplifies payment methods but also enhances security, making it a cornerstone of the digital payment landscape.

Growing Digital Payment Trends

The shift towards digital payments is undeniable. More consumers are using mobile wallets and contactless payments than ever before. This trend is driven by convenience and the need for quick transactions.

Consider how you pay for your morning coffee. Instead of fumbling with cash or cards, tapping your phone to pay saves time and effort. This ease of use fuels the growth of digital payment solutions.

Visa Provisioning Service is at the forefront of this change. It allows for seamless integration of your credit card information into various digital wallets. The result? A smoother transaction experience that you can trust.

Innovations In Payment Security

As digital payments grow, so do concerns about security. You want to know your financial information is safe. Visa is addressing this through advanced security measures integrated into their provisioning service.

Tokenization is one of the key innovations. It replaces your actual credit card number with a unique identifier, reducing the risk of fraud. Imagine shopping online without the fear of your card information being stolen.

Additionally, biometric authentication is becoming more common. Using your fingerprint or facial recognition adds another layer of security. You can feel confident that your transactions are protected.

Have you ever wondered how these advancements can make your shopping experience even better? With ongoing improvements in Visa Provisioning Service, you can expect faster, safer transactions in the near future. Stay tuned for what’s next in the world of digital payments!

Credit: www.reddit.com

Frequently Asked Questions

What Is Visa Provisioning Service?

Visa Provisioning Service is a technology that securely stores and manages cardholder information. It allows for the digital issuance of credit cards. This service ensures that your card details are safely shared with merchants and payment platforms. It enhances convenience and security for online and mobile transactions.

How Does Visa Provisioning Service Work?

Visa Provisioning Service works by tokenizing your card information. This means your card details are replaced with a unique identifier or token. When you make a transaction, this token is used instead of your actual card number. This process protects your sensitive information during online payments.

What Are The Benefits Of Visa Provisioning Service?

The benefits of Visa Provisioning Service include enhanced security and convenience. It reduces the risk of fraud by using tokens instead of actual card numbers. Additionally, it simplifies the checkout process for online and mobile purchases. You can enjoy a seamless payment experience without compromising your personal information.

Is Visa Provisioning Service Safe To Use?

Yes, Visa Provisioning Service is safe to use. It employs advanced encryption and tokenization techniques to protect your data. Your actual card information is not shared with merchants, minimizing the risk of unauthorized access. This makes online transactions much safer for consumers.

Conclusion

Visa Provisioning Service offers easy and secure ways to manage your card. It allows you to connect your credit card to digital wallets and payment apps. This service enhances convenience for online and in-store purchases. Understanding how it works can help you make better financial choices.

Take advantage of this service to simplify your shopping experience. Stay informed about updates and features. Your credit card can be a powerful tool with the right knowledge. Use Visa Provisioning Service to make your payments faster and safer.