Are you looking to transfer money from Revolut to your bank account effortlessly? You’re in the right place.

Managing your finances should be simple and stress-free, and with Revolut, it can be. Whether you’re settling bills, sending money to loved ones, or just moving your funds around, knowing how to make these transfers quickly is key. This guide will walk you through the process step-by-step, ensuring you feel confident and in control.

You’ll discover the simplest ways to navigate Revolut’s features, so you can spend less time worrying about your money and more time enjoying it. Ready to take charge of your financial transactions? Let’s dive in and make your money work for you.

Setting Up Your Revolut Account

Setting up your Revolut account is a straightforward process. It allows you to transfer money seamlessly. You need to complete a few key steps first. This ensures smooth transactions later. Let’s explore how to get started.

Verifying Identity

First, download the Revolut app. It’s available on both Android and iOS. Open the app and create an account. You’ll need to verify your identity. This is crucial for security. Upload a photo of your ID. This could be a passport or driver’s license. Follow the instructions in the app. Your identity verification might take a few minutes.

Adding Bank Account Details

Next, add your bank account details. This step is essential for money transfers. Go to the ‘Accounts’ section in the app. Click on ‘Add Bank Account’. Enter your bank’s name and account number. Ensure the details are correct. Double-check the information to avoid errors. Save the details once you’re done. Your bank account is now linked to Revolut.

Initiating A Transfer

Transferring money from Revolut to a bank account is straightforward. Understanding each step makes the process seamless. Initiating a transfer involves a few simple actions.

Navigating To Transfer Section

Open the Revolut app on your device. Locate the dashboard where all options appear. Find the ‘Payments’ or ‘Transfer’ section. Click on it to proceed.

This section leads to money transfer options. You can send money to other Revolut accounts or bank accounts. Choose the bank account transfer option.

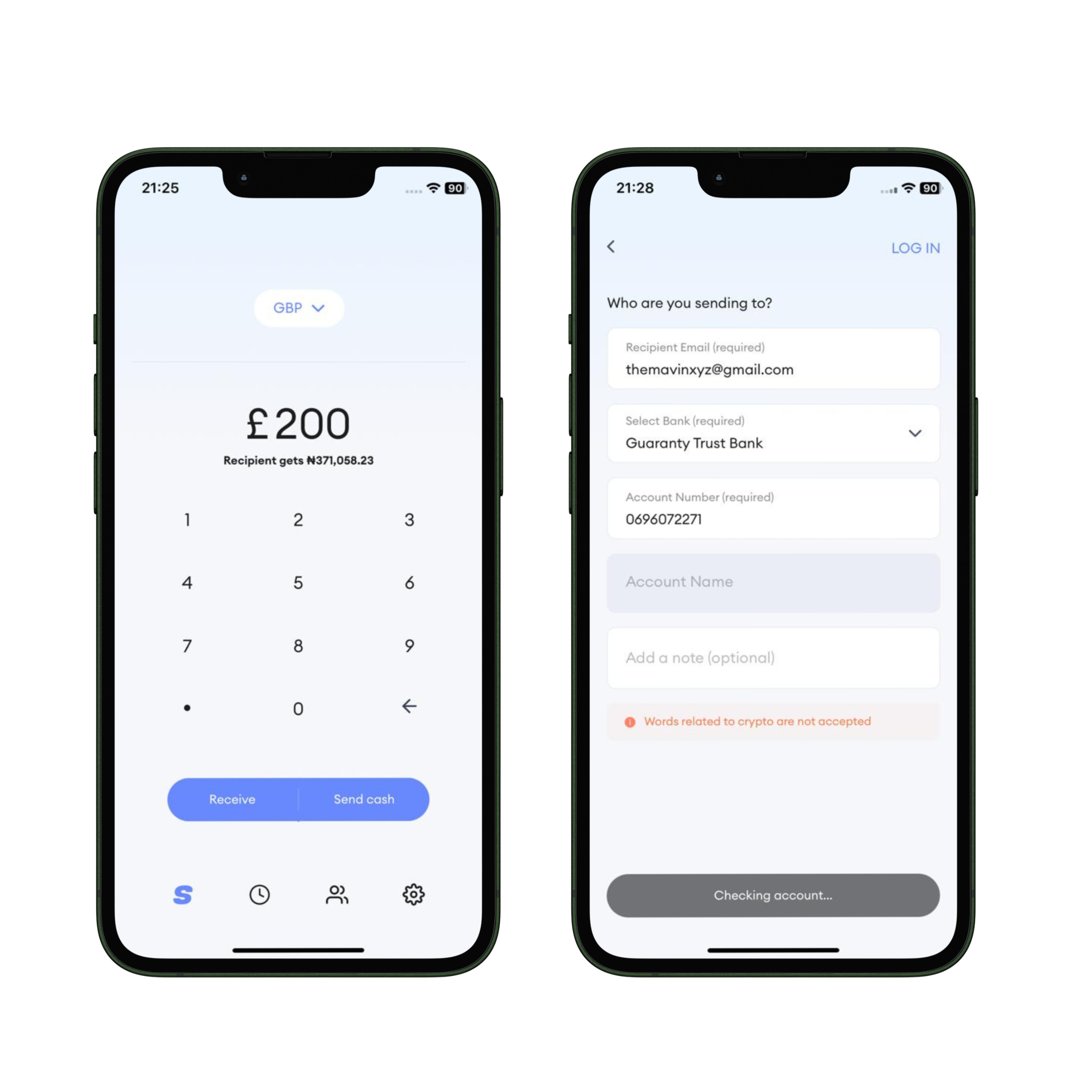

Entering Transfer Amount

Decide how much money you want to send. Enter the amount in the designated field. Ensure you have sufficient balance for the transfer.

Double-check the amount to avoid errors. Confirm the currency type if needed. Review all details before finalizing the amount.

Choosing The Recipient Bank

Transferring money from Revolut to a bank account is simple. A crucial step is choosing the right recipient bank. This decision determines how smooth your transaction will be. You need to ensure the bank details are correct. This avoids unnecessary delays or errors.

Selecting A Saved Bank Account

Revolut allows you to save bank accounts for future use. This feature saves time and reduces the hassle of entering details repeatedly. To select a saved bank account, open the Revolut app. Go to the transfer section. Choose the desired bank account from your saved list. Review the details carefully. Ensure they are accurate before proceeding.

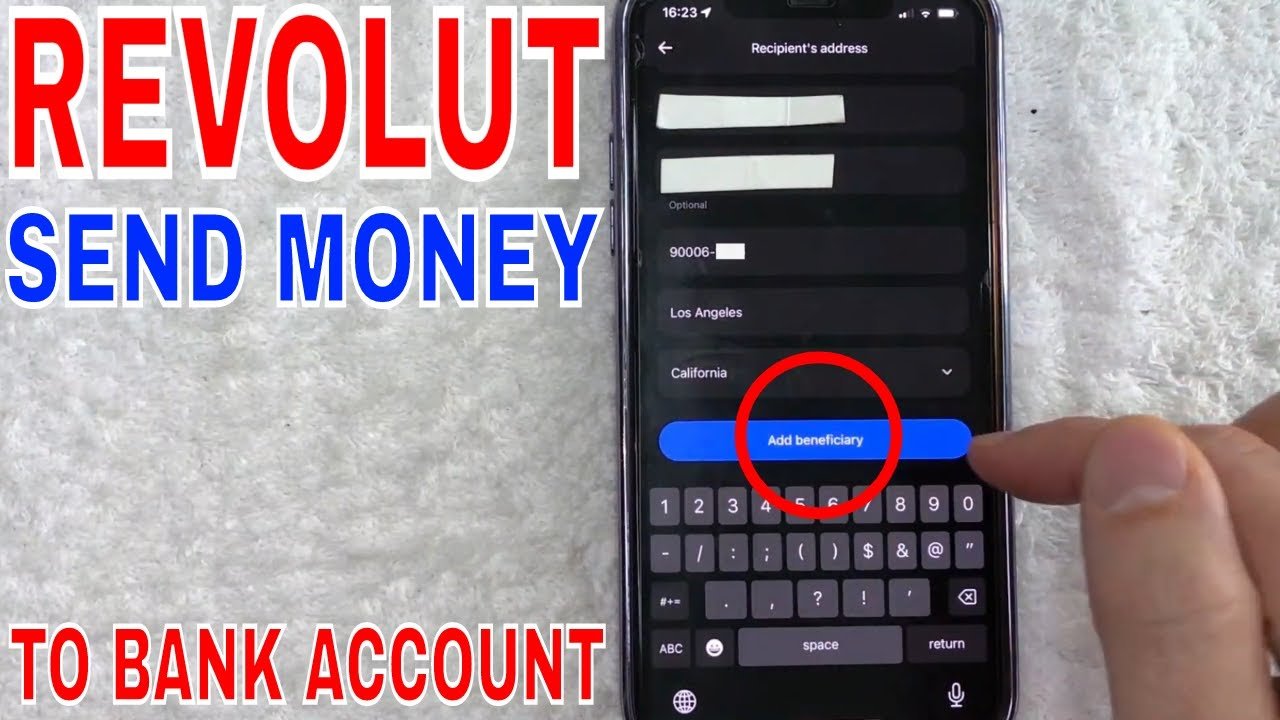

Adding A New Bank Account

Adding a new bank account is straightforward. First, open the Revolut app. Navigate to the transfer section. Click on the option to add a new account. Enter the bank’s name and account details. Double-check all information for accuracy. Incorrect details can lead to transaction failures. After confirming, save the new account for future transfers.

Reviewing And Confirming The Transfer

Double-check the details before finalizing the transfer from Revolut to your bank account. Ensure the amount and bank details are correct to avoid errors. Confirming these steps guarantees a smooth transaction.

Transferring money from Revolut to your bank account is a straightforward process. However, reviewing and confirming the transfer are crucial steps to ensure accuracy and security. Imagine you’re about to send funds for a family emergency or an important bill payment; a slight oversight can lead to significant inconveniences. So, how can you make sure your money lands exactly where it’s meant to go? Let’s dive into the essential steps you need to take before hitting ‘send’.

Checking Transfer Details

Before confirming your transfer, ensure all details are correct. Double-check the recipient’s bank account number and sort code.

Mistakes here can lead to your funds disappearing into the wrong account. You wouldn’t want your rent money accidentally ending up in someone else’s account, right?

Verify the amount you’re transferring. A typo could mean sending more than intended, leaving your balance lower than expected.

Confirming The Transfer

Once you’re confident the details are accurate, proceed to confirm the transfer. Revolut makes this step simple with a clear confirmation button.

But pause for a moment. Is this transfer urgent? Should you use a faster transfer option? Consider these questions to avoid unnecessary delays.

After confirmation, you’ll receive a notification about the transfer status. Keep this for your records—it’s proof of your transaction.

As you reflect on these steps, think about how much peace of mind it brings knowing your funds are safely transferred. Have you ever faced a hiccup with transferring money? Share your experience and let others learn from your story.

Understanding Transfer Fees

Transferring money from Revolut to a bank account involves understanding associated transfer fees. This process ensures seamless movement of funds while considering potential charges. Familiarize yourself with Revolut’s fee structure to manage costs effectively.

Understanding transfer fees is crucial when sending money from Revolut to a bank account. Fees can affect the total amount transferred. Being aware of these fees helps in planning your finances better. Below, we explore the fee structure and share tips to minimize costs.

Fee Structure Overview

Revolut uses different fee structures for transfers. Transfers in the same currency often have no fees. Cross-currency transfers might incur charges. The fees depend on the exchange rate and the amount sent. Premium and Metal plan users usually enjoy lower fees. Always check the app for the most current fee details.

Tips To Minimize Fees

Choose to transfer during weekdays. Weekends might have higher exchange rates. Consider upgrading to a Premium or Metal plan. These plans offer reduced fees. Transfer in the same currency whenever possible. This avoids currency conversion fees. Monitor exchange rates for favorable conditions. This can help in saving costs.

Tracking Transfer Status

Revolut offers an easy way to transfer money to your bank account. Simply track the transfer status through the app. This ensures you stay informed about your transaction’s progress, providing peace of mind.

Transferring money from Revolut to a bank account is straightforward, but knowing how to track the transfer status can save you from unnecessary worry. You’re not alone if you find yourself eagerly waiting for the funds to appear. Understanding how to check the status can help you plan your finances better. Let’s dive into the simple steps and timeframes associated with tracking your transfer.

Using Revolut App

The Revolut app makes tracking your transfer status easy and intuitive.

Open the app and navigate to the ‘Payments’ section. Here, you’ll see a list of your recent transactions.

Select the transfer you’re curious about to see its status. It’s displayed as ‘Pending’, ‘Completed’, or ‘Failed’. Knowing this lets you decide your next steps. If the status is pending longer than expected, contacting Revolut support through the app is a good idea.

Expected Transfer Timeframes

Understanding how long a transfer usually takes can help manage your expectations.

Typically, transferring money from Revolut to a bank account can take anywhere from a few minutes to a couple of days. Standard transfers usually complete within 1-3 business days.

However, some transfers can be instant, especially if you’re sending money to a bank account within the same country. If you’re transferring funds internationally, be prepared for longer wait times due to varying banking processes.

Have you ever experienced a faster-than-expected transfer? It’s like finding an extra hour in your day, giving you peace of mind and financial flexibility.

Knowing these timeframes helps you plan better, reducing stress and keeping your financial activities smooth.

Use this knowledge to ensure your transfers are timely and efficient, just like you planned.

Troubleshooting Common Issues

Transferring money from Revolut to a bank account should be simple. Yet, sometimes issues arise that can cause frustration. Understanding common problems helps avoid delays and ensure smooth transactions. Let’s explore some frequent issues and their solutions.

Delayed Transfers

Money transfers can sometimes take longer than expected. This delay might be due to bank processing times. Banks often need time to verify transactions for security reasons. Check the transfer status in your Revolut app. It provides updates on your transaction’s progress. Ensure your internet connection is stable. Poor connectivity can halt the transfer process.

Incorrect Bank Details

Entering wrong bank information can stop a transaction. Double-check all bank details before confirming a transfer. This includes the account number and sort code. Mistakes in these numbers can send money to the wrong account. Revolut cannot retrieve funds sent to incorrect accounts easily. Correcting errors quickly reduces complications.

Frequently Asked Questions

How To Transfer Money From Revolut To A Bank?

To transfer money from Revolut to a bank, open the app and select ‘Payments’. Choose ‘Send’ and input the bank account details. Confirm the transaction to complete the transfer. Ensure the recipient’s details are correct to avoid issues.

Are There Fees For Transferring Money From Revolut?

Revolut typically offers free transfers to bank accounts, especially within the same currency. However, cross-border or currency exchanges may incur fees. Check the app for specific fee details related to your transaction.

How Long Does A Revolut Transfer Take?

Revolut transfers usually take one to three business days. The speed depends on the recipient’s bank processing times. Instant transfers are possible with certain banks. Always verify with your bank for precise timelines.

Can I Transfer Money Internationally With Revolut?

Yes, Revolut supports international money transfers. You can send funds to over 30 countries in various currencies. Exchange rates are competitive, but check for any applicable fees or charges before proceeding.

Conclusion

Transferring money from Revolut to a bank account is straightforward. Follow the steps, and your funds will transfer safely. Remember to double-check the details before confirming. It prevents errors and delays. Revolut offers a fast way to move money. It’s a handy tool for everyday financial needs.

Always keep track of your transactions. It helps manage your finances better. With these tips, you can easily transfer funds. Enjoy the convenience and flexibility Revolut provides. It’s a practical solution for managing your money. Give it a try today for a seamless experience.