Are you looking for a simple way to transfer money from your TD Bank account to another bank? You’re in the right place.

Managing your finances shouldn’t be complicated, and TD Bank makes it easier than ever to move your money where it needs to go. Whether you’re paying bills, sending money to family, or handling any other financial task, knowing how to transfer money efficiently can save you time and stress.

In this guide, we’ll walk you through the steps to ensure your money transfers are smooth and secure. By the end, you’ll feel confident and in control of your banking transactions. Ready to take the hassle out of money transfers? Let’s dive in.

Setting Up Your Td Bank Account

Transferring money from your TD Bank account to another bank is simple. Log in to your online banking. Select “Transfers” from the menu. Enter the recipient’s bank details. Confirm the amount and date. Then, submit your request. Your money will be on its way.

Setting up your TD Bank account is essential for seamless money transfers. You can manage your finances and transfer funds to other bank accounts easily. The process involves online banking registration and mobile app installation. Both methods offer convenience and efficiency. Let’s dive into how you can set up your account to start transferring money.

Online Banking Registration

Begin by visiting the TD Bank website. Locate the online banking section. Click on the registration link. Provide your personal information. Ensure accuracy for smooth processing. Create a strong password. Security is key. Follow the prompts to complete registration. You will receive a confirmation email. Click the link to verify your account. Once verified, access your account online. Familiarize yourself with the features. Discover how to transfer money quickly.

Mobile App Installation

Download the TD Bank mobile app from your app store. It’s available for iOS and Android devices. Open the app after installation. Choose the registration option. Enter your account details. Use the information from your online registration. Set a secure password. Keep your data safe. The app offers easy navigation. Explore the features to understand its functionality. Transfer money with a few taps. Enjoy managing your account on the go.

Linking External Bank Accounts

Transferring money from TD Bank to another bank is straightforward. Start by linking external accounts through online banking. This process enables secure and efficient fund transfers between different financial institutions.

Linking external bank accounts can be a game-changer for those who frequently transfer money between different banks. It’s a convenient way to manage finances, ensuring smoother and quicker transactions. Whether you’re splitting bills with friends or sending money to family, linking accounts simplifies the process. But how do you get started?

Gathering Necessary Information

Before you link your accounts, you need specific details from both banks. You’ll require the account number and routing number of the external bank account. The routing number is crucial as it identifies the bank where the account is held.

Ensure you have this information readily available. Double-check for accuracy to avoid any hiccups later. Have you ever tried setting up an account, only to realize you had the wrong info? It can be frustrating, but with a little preparation, you can avoid such setbacks.

Verification Process

Once you input the necessary information, TD Bank will usually initiate a verification process. This often involves small test deposits into the external account. Keep an eye on your account for these deposits.

Are you wondering why verification is needed? It’s to confirm that the external account truly belongs to you. Check your external account and note these amounts. You’ll then need to report them back to TD Bank to complete the linking process.

Linking accounts can seem daunting, but once verified, the benefits are clear. You gain the ability to manage your finances seamlessly. Is there a specific reason you’re considering linking your accounts? Whether it’s for ease of access or better control, the process is straightforward when you know what to expect.

Initiating A Transfer

Transferring money between bank accounts is a common task. At TD Bank, this process is simple and straightforward. Initiating a transfer involves a few key steps that ensure your money reaches the right place. Let’s break down the process into manageable parts.

Choosing Transfer Type

The first step is selecting the type of transfer. TD Bank offers different options like internal or external transfers. Internal transfers move funds between your TD accounts. External transfers send money to accounts at other banks. Choose based on your needs. Understand each type to ensure the right choice.

Entering Transfer Details

Once you’ve selected the transfer type, enter the necessary details. For internal transfers, select the accounts involved. Specify the amount to transfer. For external transfers, provide the recipient’s bank details. Include the account number and routing number. Double-check everything for accuracy. This ensures smooth and error-free transfers.

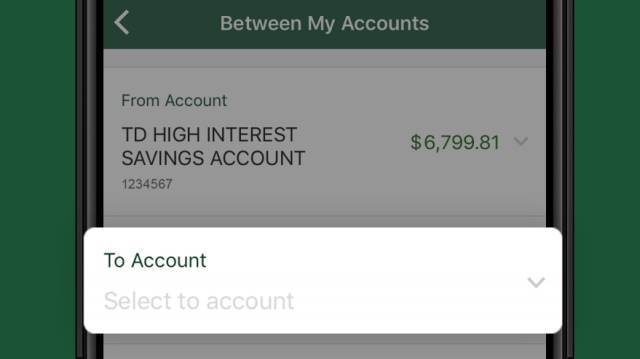

Using Td Bank’s Mobile App

Using TD Bank’s Mobile App to transfer money to another bank account is a breeze. You can do this from anywhere, anytime, using just your smartphone. The app provides a user-friendly interface that makes the process quick and efficient. Imagine being in a coffee shop, realizing you need to send money, and handling it all before your coffee gets cold. That’s the convenience TD Bank’s mobile app offers.

Navigating The App

The first step in transferring money using TD Bank’s mobile app is downloading it from your phone’s app store if you haven’t already. Once installed, log in with your credentials. The dashboard is straightforward, making it easy to find what you’re looking for.

On the main screen, you’ll see various options like viewing your account balances and recent transactions. To transfer money, click on the ‘Transfer’ button. This will guide you through the process seamlessly, even if it’s your first time.

Scheduling Transfers

Scheduling transfers is another useful feature of TD Bank’s mobile app. After selecting the ‘Transfer’ option, you can choose to send money immediately or schedule it for a future date. This flexibility lets you plan ahead without having to remember to make the transfer later.

Think about setting up a weekly transfer for your savings. You can automate this process, ensuring that you consistently save without manual intervention. Why not make your financial life easier with just a few taps?

Have you tried using the app for transfers yet? It’s surprisingly simple, and once you do it, you’ll wonder why you didn’t start sooner. The app empowers you to manage your finances effectively. What convenience could you unlock next in your financial journey?

Fees And Limits

Understand the fees and limits when transferring money from TD Bank to another bank account. Check if there are any transfer fees involved. Be aware of daily or monthly transfer limits to avoid transaction issues.

Transferring money between bank accounts can sometimes feel like navigating a maze. Understanding the fees and limits involved can make the process smoother and help you avoid surprises. Whether you’re sending funds for a monthly bill or moving savings for a big purchase, knowing what to expect with TD Bank’s transfer fees and limits is crucial. Let’s dive into the details and ensure your transactions are as efficient as possible.

Understanding Transfer Fees

When transferring money from your TD Bank account to another bank, it’s important to be aware of the potential fees. TD Bank may charge fees depending on the type of transfer you choose. For instance, domestic wire transfers often incur a higher fee than electronic transfers via ACH (Automated Clearing House).

Consider how often you transfer money and select the method that minimizes your costs. If you frequently move small amounts, ACH transfers might be more economical. Knowing the fee structure can save you money in the long run.

Daily And Monthly Limits

TD Bank imposes limits on how much money you can transfer daily and monthly. These limits are designed to protect your account from unauthorized access and fraud. It’s essential to know these limits to plan your transfers effectively.

Imagine needing to transfer a large sum for a down payment but hitting your daily limit. This could delay your plans significantly. Check TD Bank’s current limits and adjust your transactions accordingly.

If you often reach these limits, consider contacting TD Bank for options to increase them. They may have solutions that align with your financial needs. What’s your strategy for managing transfer limits effectively?

Security Measures

TD Bank ensures secure transfers with encryption and two-factor authentication. Protecting your money during transfers is their priority. Always verify account details before proceeding to avoid errors.

Transferring money between bank accounts can be a seamless experience with TD Bank, but security measures are crucial to ensure your financial safety. It’s not just about moving funds; it’s about safeguarding your information and being vigilant against potential threats. TD Bank employs robust security protocols to protect you, but understanding these measures will empower you to take proactive steps in securing your transactions.

Protecting Your Information

Your financial data is valuable. TD Bank prioritizes the security of your personal information with top-tier encryption and security technologies. You might wonder how encryption works—essentially, it scrambles your data, making it unreadable to unauthorized individuals.

Moreover, TD Bank uses multi-factor authentication, adding layers of security. You may have experienced this when logging in, receiving a code via text or email. By confirming your identity through multiple channels, TD Bank ensures your account is accessible only to you.

Recognizing Fraudulent Activity

Being vigilant against fraud is essential. TD Bank provides tools to help you recognize suspicious activity. Have you ever received a text alert about a transaction? These alerts are designed to notify you in real-time, allowing immediate action if something looks off.

What should you look for? Be wary of unexpected emails or calls asking for personal details. These can be phishing attempts to steal your information. TD Bank will never ask for sensitive information via unsecured channels.

It’s wise to regularly check your account statements for unfamiliar transactions. If you spot anything odd, contacting TD Bank immediately can prevent potential loss.

Do you feel equipped to handle security threats? Understanding these measures can make a significant difference in protecting your assets. Your vigilance, combined with TD Bank’s security systems, can provide peace of mind when transferring money.

Troubleshooting Common Issues

Transferring money between banks with TD Bank can sometimes be tricky. Ensure account details are correct to avoid errors. Double-check transfer limits and fees to prevent any surprises.

Transferring money between bank accounts should be a straightforward process, but occasionally, hiccups occur. Whether you’re a seasoned pro or trying your first transfer, encountering issues can be frustrating. Understanding common problems and how to resolve them can save you time and stress. Let’s dive into some of the typical challenges you might face and how to troubleshoot them effectively.

###

Failed Transactions

Failed transactions can happen due to several reasons. It might be an incorrect account number or insufficient funds. Double-check the details you’ve entered. Is every digit correct? Even a small mistake can lead to a failed transaction.

Another common issue could be related to exceeding your transfer limits. Banks often have caps on how much you can send at once. Check if you’re within your limit. If you’ve hit a snag, think about trying a smaller amount or waiting until the next day.

If all else fails, consider your internet connection. A weak or disrupted connection might hinder the transfer process. Ensure your device is connected properly and try again.

###

Contacting Customer Support

When problems persist, reaching out to customer support can be your lifeline. TD Bank has a dedicated team to help you through these issues. But, before you make that call, gather necessary information like your account number and any error messages you’ve received.

Think about how you can describe the issue clearly and concisely. Have a pen and paper ready to jot down any advice or steps they provide. It’s always helpful to keep a record of your conversation.

Customer support might guide you through troubleshooting steps or escalate the issue if needed. Remember, they’re there to help you get back on track. But have you considered alternative solutions? Sometimes, a fresh perspective can uncover an overlooked detail.

Encountering issues is part of the process, but with the right approach, you can overcome them swiftly. What strategies have you found effective in resolving banking hiccups?

Frequently Asked Questions

How To Transfer Money From Td Bank?

To transfer money from TD Bank, log in to your online banking. Navigate to the transfer section. Select the account to transfer from and to. Enter the amount, review details, and confirm the transfer. Ensure recipient details are accurate for a successful transaction.

Can I Transfer Money Internationally With Td Bank?

Yes, TD Bank allows international wire transfers. Log in to your account, choose ‘Send Money’, and select ‘International’. Enter recipient details and transfer amount. Fees apply, and processing times vary. Confirm all details before submission to avoid errors.

Are There Fees For Transferring Money At Td Bank?

TD Bank may charge fees for certain types of transfers. Domestic transfers are often free. International and wire transfers usually incur fees. Check your account terms or contact TD Bank for specific fee details. Ensure you understand all costs before initiating a transfer.

What Details Are Needed For A Td Bank Transfer?

You’ll need the recipient’s name, bank account number, and routing number. For international transfers, provide SWIFT/BIC code and recipient’s bank address. Ensure all information is accurate to avoid delays or errors. Double-check details before confirming the transaction.

Conclusion

Transferring money with TD Bank is simple and straightforward. Follow the steps provided, and your transaction will complete smoothly. Remember to double-check account details to avoid errors. TD Bank offers a reliable platform for all your banking needs. Their user-friendly interface makes the process easy for everyone.

Now, you can manage your finances with confidence. Stay informed about any fees that might apply. Keep your banking details secure while online. Happy banking with TD Bank!