Are you curious about how to transfer money from your American Express account to your bank account? You’re not alone.

Many cardholders are eager to unlock the convenience and flexibility this feature offers. Imagine the ease of having your funds readily available in your bank account whenever you need them. This article will guide you through the entire process, breaking it down into simple steps that anyone can follow.

Discover the seamless way to manage your finances and keep your money flowing where you need it most. Ready to take control of your funds? Let’s dive in and explore the possibilities.

American Express Account Setup

Setting up an American Express account simplifies money transfers to your bank. Navigate the user-friendly interface with ease. Enjoy seamless transactions and manage finances efficiently.

Setting up your American Express account is the first step towards transferring money to your bank account with ease. Whether you’re a seasoned credit card user or new to the American Express family, getting your account up and running is a straightforward process. The initial setup is crucial as it unlocks a host of financial management tools that can make your transactions seamless and secure.

Creating An Account

Creating your American Express account is simple and doesn’t take much time. Start by visiting the American Express website or downloading their app. You’ll need to provide basic information such as your name, email address, and a secure password.

Once your details are submitted, you’ll receive a confirmation email. Be sure to check your inbox and follow the instructions provided to activate your account. Have you ever marveled at how technology simplifies financial tasks? This process is just one example.

Verifying Your Identity

Identity verification is an essential step in securing your account. American Express will ask for additional information to confirm your identity. This might include details like your Social Security number or answers to security questions.

These measures protect your account from unauthorized access. Imagine a scenario where someone else tries to set up an account using your information; identity verification acts as a barrier to such attempts.

Why is security so important to you? When you verify your identity, you ensure peace of mind, knowing your financial data is safe and secure. It’s a small step that offers immense protection, enabling you to transfer money confidently and securely.

Setting up your American Express account may seem like a routine task, but it’s the foundation for managing your finances effectively. By following these steps, you ensure a smooth and secure transaction process every time you transfer money to your bank account. Would you agree that investing a few minutes now can save you from potential headaches later?

Linking Your Bank Account

Transferring money from your American Express account to a bank is simple. First, link your bank account to your American Express account. This process ensures smooth transactions and secure transfers. Follow a few easy steps to get started.

Entering Bank Details

Begin by entering your bank details into your American Express account. You need your bank’s routing number and your account number. Double-check these numbers for accuracy. Errors can delay your transfer.

Confirming The Link

After entering your bank details, confirm the link. American Express may ask you to verify your bank account. This can involve a small deposit in your bank account. Check your bank statement for this deposit. Confirm the amount on your American Express account. This step ensures your bank account is linked correctly.

Initiating A Transfer

Transferring money from your American Express account to a bank is simple.

Whether paying bills or saving, the process is straightforward.

This guide will help you initiate a transfer with ease.

Selecting Transfer Option

Log into your American Express account.

Find the transfer section on the dashboard.

Look for the option to transfer money to a bank.

Click to select this option.

Ensure you choose the correct bank account for the transfer.

Entering Transfer Amount

Decide the amount to transfer.

Enter this amount in the specified field.

Check your account balance to avoid errors.

Ensure the amount is within your available limit.

Review the details before proceeding.

Transfer Timeframes

Transferring money from your American Express account to your bank is easy. But knowing the transfer timeframes is crucial. It helps you plan your finances better. Whether you’re dealing with standard or expedited transfers, each has its timeframe.

Standard Transfer Times

Standard transfers are the most common option. Typically, these transfers take one to three business days. The time depends on your bank’s processing speed. Most people find this timeframe suitable for regular transactions. It’s reliable and predictable.

Expedited Transfers

Expedited transfers are faster than standard ones. They usually complete within a day. This option is ideal for urgent transactions. You might face additional fees for this speed. But the quick delivery often outweighs the cost. It’s a convenient choice for those in a hurry.

Fees And Charges

When transferring money from your American Express account to a bank account, understanding fees and charges is crucial. These costs can affect the total amount you receive or pay. Knowing what to expect helps you manage your finances better and avoid surprises.

Understanding Transfer Fees

American Express, like many financial services, applies fees for transferring money to a bank account. These fees can vary based on the transfer amount, destination, and currency conversion if applicable. It’s essential to check the specific charges associated with your transaction.

For instance, a small transfer might incur a flat fee, while larger amounts could be charged a percentage of the total. Always verify the fee structure on the American Express platform before proceeding. This step ensures transparency and helps in budgeting your transactions effectively.

Avoiding Hidden Costs

Hidden costs can surprise you, impacting the total amount you transfer. Some fees might not be immediately obvious, such as currency conversion charges or intermediary bank fees. These can add up, especially for international transfers.

To avoid these hidden costs, read all terms and conditions carefully. Contact American Express customer service if you have questions about potential additional charges. Being proactive can save you money and headaches down the line.

Have you ever been caught off guard by unexpected fees? Share your experiences and tips in the comments below. Your insights could help others navigate their financial transactions more smoothly.

Security Measures

Transferring money from your American Express account to your bank can be convenient, but how secure is it? Understanding the security measures in place is crucial for peace of mind. American Express prioritizes your safety, ensuring your transactions are protected at every step. Let’s dive into what makes their security robust and trustworthy.

Protecting Your Information

Your personal and financial data is precious. American Express uses advanced encryption technologies to safeguard your information. This means that when you transfer money, your details are transformed into codes that hackers can’t decipher.

Think of encryption as a vault. Once your data enters, only authorized parties can access it. It’s like having a double-lock system on your front door. You’re the keyholder, and American Express ensures no one else can sneak in.

Have you ever worried about your info being stolen online? With American Express, they constantly update their security protocols. This adaptability keeps your data secure against new threats. They also provide real-time notifications for every transaction, so you’re always informed.

Recognizing Fraud Alerts

Fraud alerts are your security watchdogs. American Express employs smart systems to detect unusual activity. If something seems off, they alert you immediately. This quick action can prevent unauthorized transactions.

Imagine you’re relaxing at home, and suddenly you get a text about a transaction you didn’t make. That’s a fraud alert, and it gives you the power to act swiftly. You can confirm or report the activity, ensuring your account remains secure.

Have you ever received a fraud alert and brushed it off? It’s tempting, but paying attention can save you from potential headaches. American Express encourages you to report suspicious activities promptly. Your vigilance combined with their security measures creates a strong defense against fraud.

Feeling secure while handling your finances is priceless. American Express’s security measures are designed to provide this assurance. Next time you transfer money, remember these protective layers are working tirelessly for you. How do you keep your financial information secure? Share your thoughts in the comments below!

Troubleshooting Issues

Encountering issues with American Express when transferring money to a bank account can be frustrating. Ensure your card is linked correctly and check for any network disruptions. Contact customer service for quick assistance if problems persist.

Troubleshooting issues while transferring money with American Express can be frustrating. Understanding the common problems and their solutions makes the process smoother. This guide will help you resolve transfer issues efficiently.

Handling Failed Transfers

Sometimes, money transfers may fail. This can happen for various reasons. Check your bank details first. Ensure they are correct and up-to-date. Incorrect details can cause transfer failures. Verify your account balance. Insufficient funds can also prevent transfers. Another reason might be a temporary glitch. Wait a few hours and try again. Always review your transaction history. This helps you track successful and failed transfers.

Contacting Customer Support

If issues persist, contacting customer support can help. American Express offers reliable support. They can guide you through the process. Explain your issue clearly. Provide all necessary details. This includes your account number and transaction ID. Patience is key. The support team might need time to investigate. They aim to resolve your issues as quickly as possible.

Alternative Transfer Options

Explore alternative transfer options with American Express, where you can easily move money to your bank account. This method ensures secure transactions, providing a reliable way to manage finances efficiently. Perfect for those seeking straightforward banking solutions.

When using American Express to transfer money to a bank account, you might want to explore some alternative options that can make the process smoother and more efficient. Sometimes, the traditional methods might not be the fastest or most convenient. Let’s dive into a couple of alternative transfer options that could save you time and potentially offer more flexibility.

Using Mobile Apps

Mobile apps have transformed the way we manage our finances. Have you tried using mobile apps to streamline your money transfers? Many banks and financial institutions now offer apps that allow you to transfer money with just a few taps.

Imagine sitting at your favorite coffee shop and realizing you need to send money to a friend. With a mobile app, you can do it instantly without having to log into your desktop. Not only does this save time, but it also means you can handle your finances on the go.

Most apps provide notifications to keep you updated on the status of your transfer. These apps often come with additional features, like the ability to track spending and manage budgets, making them a great tool for financial management.

Third-party Services

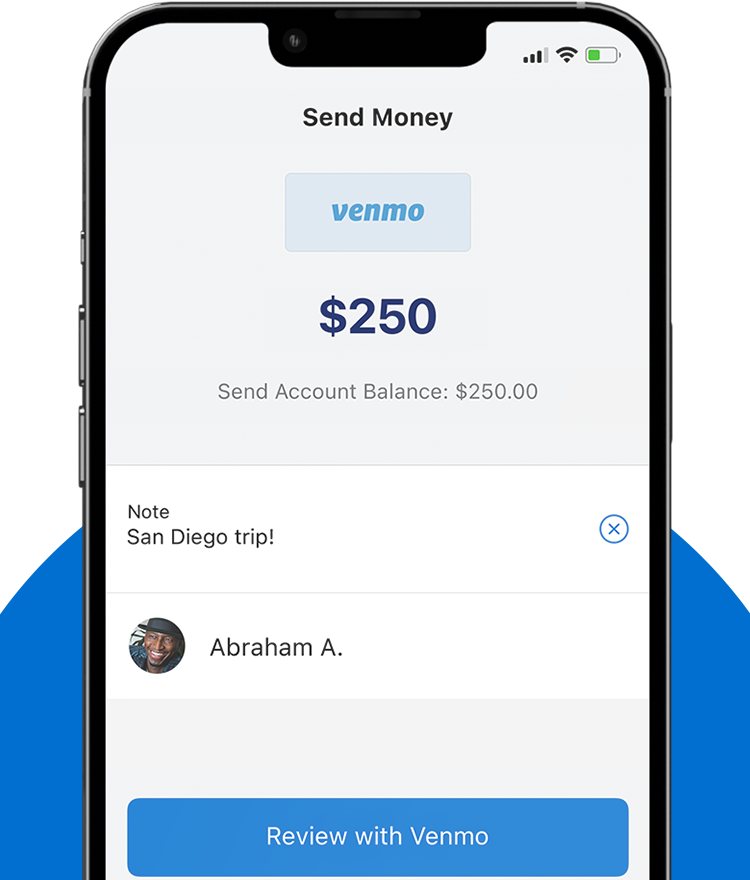

Have you ever considered using third-party services for money transfers? Services like PayPal, Venmo, and Zelle offer competitive advantages over traditional methods.

These platforms often provide faster transfer times and lower fees. You can link your American Express card to these services and transfer funds directly to your bank account or to someone else’s account.

Using third-party services can be a game-changer if you’re looking for speed. They also offer a user-friendly interface that simplifies the process, even for those who aren’t tech-savvy. However, make sure to review any associated fees or limits to ensure they align with your needs.

These options can enhance your financial flexibility. Have you explored these yet? Each has its unique benefits and can be a great addition to your financial toolkit.

Frequently Asked Questions

How Do I Transfer Money From American Express To Bank?

To transfer money from American Express to a bank, log into your account. Navigate to the ‘Transfer’ section. Enter the bank details and the amount to transfer. Confirm the transaction to complete the process. Ensure your bank accepts transfers from American Express.

Is There A Fee For Transferring Money?

Yes, American Express may charge a fee for transferring money to a bank account. The fee varies depending on the transfer method and amount. Check your account for specific fee details before initiating the transfer. Always review any potential charges beforehand to avoid unexpected costs.

How Long Does A Transfer Take?

A transfer from American Express to a bank usually takes 1-3 business days. Processing time can vary based on the bank’s policies. Delays may occur due to bank holidays or other factors. Always check with your bank for precise timing information and plan accordingly.

Can I Transfer Money Internationally?

Yes, American Express allows international money transfers. You may need to provide additional details for international transactions. Fees and processing times might differ from domestic transfers. Confirm any requirements with American Express beforehand to ensure a smooth transaction process.

Conclusion

Transferring money from American Express to a bank account is simple. Follow the steps and you can do it easily. It offers convenience for managing your funds. You can access your money when you need it. Understanding the process helps in planning your finances better.

This method saves time and avoids hassles. Always ensure your details are correct for smooth transfers. Knowing this option expands your financial flexibility. It’s a useful tool for handling your money efficiently. Use it wisely to keep your financial life stress-free.

References

- American Express

- American Express: Bank 2.0

- [B] American Express: The People Who Built the Great Financial Empire

- [B] Expressing America

- … ANALYSIS OF TWO AMERICAN NETWORK PAYMENT PROCESSOR COMPANIES: A CASE STUDY OF AMERICAN EXPRESS …