Are you looking to transfer money from your Klarna account to your bank account but aren’t sure where to start? You’re not alone.

Many people find themselves puzzled by the process, searching for a simple, straightforward guide to get their funds moving. Imagine the relief and satisfaction of seeing your money seamlessly flow into your bank account, ready for whatever you need next.

This guide is crafted to make that vision a reality for you. By the end of this article, you’ll feel empowered and confident, armed with the knowledge to effortlessly transfer your money. Stick around to discover the step-by-step process that will make this task a breeze.

Understanding Klarna Transactions

Transferring money from Klarna to your bank account involves a few easy steps. First, log into your Klarna account. Select the transaction you wish to transfer, then follow the prompts to enter your bank details and confirm the transfer.

Understanding Klarna Transactions can feel a bit like navigating a new city. You know the landmarks, but getting from point A to point B requires a bit of guidance. Klarna is a popular service for buying now and paying later, but when it comes to transferring money to a bank account, you might find yourself asking, “How exactly does this work?”

Klarna operates by allowing you to make purchases without immediate payment. It’s a bit like having a friend lend you money until payday. The transactions are seamless when shopping, but transferring funds to your bank account involves a few more steps.

Understanding Klarna’s Payment Flow

The payment flow with Klarna starts when you make a purchase. You receive the product immediately, but the payment is deferred. Klarna pays the merchant, and then you pay Klarna. This flow can seem straightforward, but consider what happens next:

When you’re ready to transfer money from Klarna to your bank account, you need to ensure you’ve settled your balance. Any pending payments or outstanding amounts can affect the transfer process. Have you ever missed a payment deadline and had to scramble? Avoid this by keeping track of your payment schedule.

Tracking Your Klarna Transactions

Monitoring your Klarna transactions is crucial. Imagine trying to remember all your purchases without a receipt. Klarna provides a detailed transaction history in their app or website. Regularly check this to avoid surprises.

Are you aware of all your upcoming payments? By reviewing your transactions, you can plan transfers without disrupting your budget. This foresight prevents last-minute panic and ensures a smooth transfer to your bank account.

Steps To Transfer Money

Transferring money from Klarna to your bank account requires a few steps. Start by logging into your Klarna account and navigating to the payments section. Select the option to transfer funds, then follow the prompts to enter your bank details.

Is your bank information up to date? Double-checking this can save you from potential errors. Incorrect details could delay your transfer, causing unnecessary stress.

Common Challenges And Solutions

You might face challenges when transferring money. A common issue is insufficient funds due to pending payments. Always verify your balance before initiating a transfer.

Have you ever faced a delay in processing? Contact Klarna’s support team for assistance. They can guide you through any hiccups, ensuring your transfer completes successfully.

Understanding Klarna transactions is about knowing the flow and staying organized. With these insights, transferring money to your bank becomes a straightforward task. Don’t let the process overwhelm you—stay informed and in control.

Preparing For The Transfer

Transferring money from Klarna to your bank account requires preparation. Ensuring accuracy is crucial for a smooth process. Before initiating the transfer, take a few important steps. These steps help avoid errors and delays. Let’s explore the key areas to focus on.

Check Account Balance

Start by checking your Klarna account balance. This step ensures you have enough funds for the transfer. Log into your Klarna account and view your available balance. Make sure it’s sufficient for your intended transfer amount. Always keep a small buffer to cover any unexpected fees.

Verify Bank Details

Next, verify your bank account details. Double-check the account number and routing number for accuracy. Incorrect details can lead to failed transfers. Log into your bank account and confirm the details match with Klarna. Update any outdated information before proceeding.

Using The Klarna App

Transferring money from Klarna to your bank account is simple. The Klarna app makes this process even easier. You can manage your finances with a few taps. Let’s explore how to use the app efficiently.

Accessing The App

First, download the Klarna app from your app store. Open the app on your device. Log in with your credentials. If you don’t have an account, sign up quickly. Ensure your internet connection is stable. A smooth connection helps in faster processing.

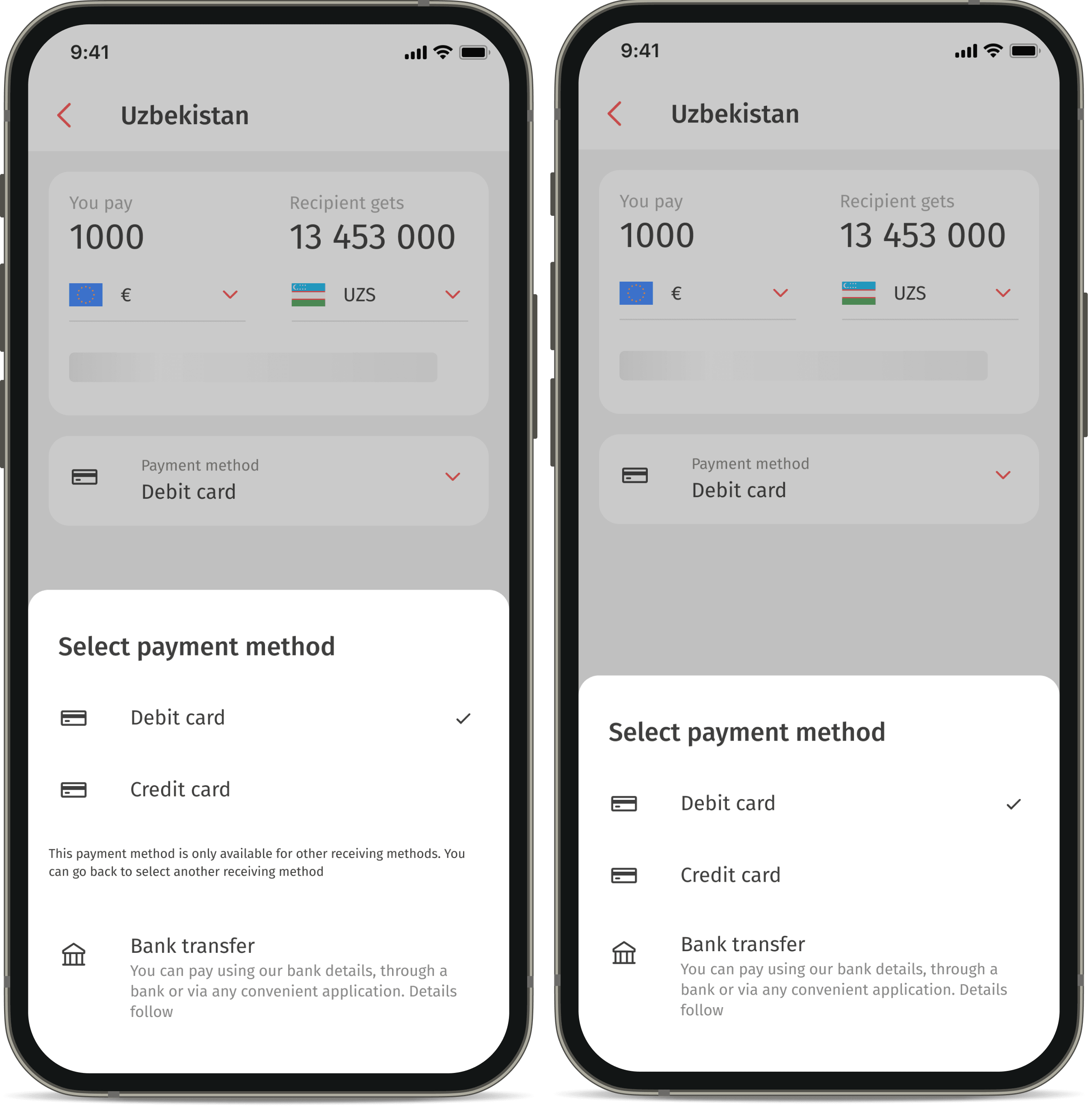

Navigating To Transfer Options

Once logged in, locate the menu icon. It’s usually at the bottom or top corner. Tap on the menu to view options. Look for the “Transfers” or “Bank Transfer” section. The name may vary slightly. Select this option to proceed with the transfer.

Follow the prompts to enter your bank details. Make sure the details are correct. Incorrect details may delay your transfer. Double-check before confirming. After entering details, confirm the transfer. You’ll receive a notification once the transfer is complete.

Initiating The Transfer

Transferring money from Klarna to a bank account is straightforward. First, log into your Klarna account. Then, select the transfer option and follow the prompts. Ensure you input the correct bank details to avoid errors.

Initiating the transfer from Klarna to your bank account can be a straightforward process if you know the steps. Why should you care about this? Because getting your money into your bank account quickly is essential for managing your finances effectively. Imagine needing the funds for an unexpected expense or an exciting opportunity. You wouldn’t want delays, right? So, let’s dive into how you can initiate this transfer smoothly.

###

Entering Transfer Amount

First things first, you need to decide on the amount you wish to transfer. Is it your full balance or just a portion? Access your Klarna account and navigate to the transfer section. Here, you’ll find the option to enter the amount. Be precise. Double-check your balance to ensure you have enough funds for the transfer. Have you ever been in a situation where you miscalculated your available balance? It’s a common mistake, but verifying your amount can save you from unnecessary frustration.

###

Confirming Transfer Details

Once you’ve entered the amount, it’s time to review the transfer details. You’ll see your bank account information displayed. Does everything look correct? If you spot any errors, update them before proceeding. Why is this crucial? Imagine sending money to the wrong account—it’s a headache you can avoid with a quick check. After confirming the details, you can proceed with confidence. Ever hesitated before hitting ‘confirm’? It’s natural, but knowing your details are correct can ease that worry.

Taking these steps carefully ensures that your transfer is initiated without a hitch. Have you ever faced issues with online transfers? This process aims to minimize such hassles. As you go through it, think about how this knowledge empowers you to manage your finances more efficiently.

Monitoring Transfer Status

Transferring money from Klarna to your bank account involves a few easy steps. First, log into your Klarna account and locate the transfer option. Follow the on-screen instructions to complete the process efficiently and securely.

Transferring money from Klarna to your bank account can be a smooth process, but it’s crucial to keep an eye on the transfer status. Monitoring your money’s journey helps you stay informed and reassured. Have you ever anxiously waited for a transfer, wondering if everything is on track? Understanding how to monitor the transfer status effectively can save you from unnecessary stress.

Checking Transfer Confirmation

Once you’ve initiated the transfer, Klarna typically sends a confirmation email or notification. Look for this confirmation in your email inbox or Klarna app notifications. It serves as the first reassurance that your transfer has been successfully initiated.

Make sure to double-check the details in the confirmation. Is the amount correct? Are the bank account details accurate? This is your chance to catch any mistakes before they become problems.

Tracking Transfer Progress

After confirming the transfer, you’ll want to track its progress. Klarna often provides a transaction ID or reference number. Keep this number handy—it’s your key to tracking the transfer.

Use Klarna’s app or website to check the status. The transfer might show stages like “Processing” or “Completed.” Seeing each stage can provide peace of mind, letting you know your money is on the move.

But what if the status seems stuck? Don’t panic. Transfers can take time due to bank processing schedules. If you’re worried, reach out to Klarna’s support for clarification.

By being proactive and vigilant, you can ensure a smooth transfer experience. Have you ever faced any hiccups during a transfer? How did you handle it? Sharing experiences can lead to valuable insights.

Troubleshooting Common Issues

Transferring money from Klarna to your bank account should be a seamless process, but sometimes hiccups occur. These can range from delayed transfers to incorrect bank details. Understanding and troubleshooting these common issues can save you time and frustration. If you’ve ever felt the anxiety of waiting for a transfer to complete or realized you’ve entered the wrong details, this guide will help you navigate these challenges with ease.

Delayed Transfers

It’s not uncommon to experience delays when transferring money from Klarna. These delays can be due to several factors, such as bank processing times or technical glitches. Always check if there are any scheduled maintenance activities on Klarna’s platform that might affect processing times.

If your transfer is taking longer than expected, consider checking your email for any notifications from Klarna about the status of your transfer. It’s also wise to contact Klarna’s customer service for real-time updates. They can provide insight into whether the issue is on their end or with your bank.

Have you ever been in a situation where your money seemed to disappear into a digital void? Staying proactive and informed is key. Regularly checking your transaction history can help you catch any anomalies early.

Incorrect Bank Details

Entering incorrect bank details is a common mistake that can lead to failed transfers. Ensure your bank account number and routing number are correct before proceeding with the transaction. Even a small typo can cause significant issues.

If you realize the mistake after initiating the transfer, immediately contact Klarna’s support team. They might be able to halt the transaction or redirect funds to the correct account. Don’t wait until the transfer fails, as this can complicate the resolution process.

Have you ever felt the panic of realizing you entered the wrong details? Double-checking your input can prevent that sinking feeling. Consider keeping a note of your bank details for quick and accurate reference during transactions.

Understanding these common issues and how to resolve them can enhance your experience with Klarna. Are there other aspects of money transfers you’re curious about? Share your thoughts and questions; let’s tackle them together!

Security Tips

Transferring money from Klarna to a bank account requires careful attention to security. Online transactions can expose personal information to potential threats. Following security tips helps ensure safe money transfers. Protect your data and avoid scams by understanding key security measures.

Protecting Personal Information

Always use strong, unique passwords for your Klarna account. Avoid using easily guessed words or numbers. Regularly update your passwords to enhance security. Enable two-factor authentication for an added layer of protection. This requires a second form of verification, like a code sent to your phone.

Never share your Klarna login details with anyone. Keep your banking information private. Store sensitive data in a secure location. Utilize secure internet connections, especially during transactions. Public Wi-Fi can expose your information to hackers.

Recognizing Fraudulent Activities

Be cautious of unexpected emails or messages. Scammers often pose as legitimate entities. Verify any communication claiming to be from Klarna. Check for spelling errors or suspicious links in emails. Genuine companies will never ask for your password.

Monitor your account activity regularly. Look for any unauthorized transactions. Report suspicious activities to Klarna immediately. Stay informed about common scams and phishing techniques. Knowledge is your best defense against fraud.

Faqs

Transferring money from Klarna to a bank account involves a few straightforward steps. First, access your Klarna account and select the option to transfer funds. Follow the on-screen instructions to input your bank details, ensuring accuracy for a successful transaction.

Navigating financial transactions can sometimes feel like a puzzle, especially when it involves transferring money from one platform to another. If you’re curious about how to transfer money from Klarna to your bank account, you’re not alone. Many people have similar questions, and having clear answers can make the process much smoother. Below, you’ll find some of the most frequently asked questions about this process.

How Do I Initiate A Transfer From Klarna To My Bank Account?

To start a transfer, ensure your Klarna account is linked to your bank account. You can usually find the transfer option within Klarna’s mobile app or website under the ‘Payments’ or ‘Account’ section. Follow the prompts to enter the amount you wish to transfer and confirm the transaction.

Is There A Fee For Transferring Money From Klarna?

Most of the time, Klarna does not charge a fee for transferring money to your bank account. However, it’s always wise to check your bank’s policy, as they might have their own fees for incoming transfers. You wouldn’t want to be surprised by unexpected charges.

How Long Does It Take For The Transfer To Complete?

Transfers from Klarna to your bank account can take anywhere from a few hours to a few days. The time largely depends on your bank’s processing times. Have you ever experienced longer wait times with your bank? It might be good to check with them if delays are common.

What Should I Do If The Transfer Fails?

If your transfer fails, double-check that your bank details are correct. Errors in account numbers or sort codes can cause issues. If everything seems correct and the problem persists, contact Klarna’s customer service for assistance. They can provide specific guidance based on your transaction history.

Can I Cancel A Transfer Once It Has Been Initiated?

Once a transfer is in progress, it’s generally irreversible. This is why it’s crucial to verify all details before confirming the transaction. If you realize an error immediately, contact Klarna support as soon as possible—they might be able to help if the transfer hasn’t been processed yet.

Are There Any Limits On How Much I Can Transfer?

Klarna might have limits on the amount you can transfer at once or within a day. These limits can vary based on your account’s verification status. Have you ever had to split a transaction because of limits? It’s a good reminder to check your account’s settings.

As you explore these FAQs, remember that staying informed can save you time and prevent potential headaches. Have you ever found yourself stuck in a financial conundrum because of missing details? Always make sure to have all the information at your fingertips.

Frequently Asked Questions

How Can I Transfer Money From Klarna?

To transfer money from Klarna, log into your Klarna account. Navigate to the transfer section. Select your bank account as the destination. Enter the amount you wish to transfer and confirm the transaction. The funds will be processed and sent to your bank account promptly.

Is It Safe To Transfer Money Via Klarna?

Yes, transferring money via Klarna is safe. Klarna uses advanced encryption and security protocols to protect your transactions. Always ensure you are logged into the official Klarna app or website. Avoid sharing personal information with unauthorized sources to maintain security.

Are There Fees For Transferring Money From Klarna?

Klarna typically does not charge fees for transferring money to a bank account. However, your bank may impose transaction fees. Check with your bank for any applicable fees. Klarna’s terms may also change, so it’s best to review them before transferring money.

How Long Does Klarna Transfer Take?

Klarna transfers usually take 1-3 business days. However, the exact time may vary based on your bank’s processing speed. Ensure your bank account details are accurate to avoid delays. For faster processing, initiate transfers during business hours.

Conclusion

Transferring money from Klarna to a bank account is simple. Follow the steps outlined here. Ensure your bank details are accurate. This avoids delays and errors. Klarna provides a reliable way to manage funds. Regular transfers keep your finances organized.

Always check your account for updates. This ensures everything is on track. Understanding these steps boosts confidence. It makes money management easier. Stay informed about any Klarna updates. This helps you adapt quickly. Remember, managing your finances well is essential.

Keep learning and stay proactive. Your financial health depends on it.