Navigating the world of business finances can sometimes feel like a puzzle. You’re managing your accounts, ensuring everything is balanced, and then you hit a common roadblock: transferring money from your personal account to your business account.

How do you record this transaction properly? It’s crucial for maintaining the accuracy of your financial records and ensuring your business runs smoothly. Missteps here can lead to confusion, and nobody wants that. In this blog post, you’ll discover how to make a seamless journal entry for this kind of transaction.

By understanding this process, you’ll gain confidence in your bookkeeping skills and keep your business finances in tip-top shape. Let’s dive into the details and make your accounting tasks a little less daunting.

Basics Of Journal Entries

Understanding the basics of journal entries is crucial for anyone handling financial transactions. Whether you’re a business owner or an aspiring accountant, knowing how to record a transfer from a personal account to a business account can save you from a lot of headaches. A journal entry serves as the backbone of your accounting records, capturing every financial move you make. But what exactly is a journal entry, and why is it so important?

Purpose Of Journal Entries

Journal entries are essential for maintaining accurate financial records. They document every transaction, ensuring transparency and accountability. Imagine trying to remember every purchase or transfer you made; journal entries do that for you. When you transfer money from your personal account to your business account, a journal entry records this shift, reflecting the change in both accounts.

Without journal entries, tracking your financial health becomes nearly impossible. They give you a clear picture of your business’s financial journey. Can you recall the last time you forgot about a small yet significant transaction? Journal entries prevent those costly oversights.

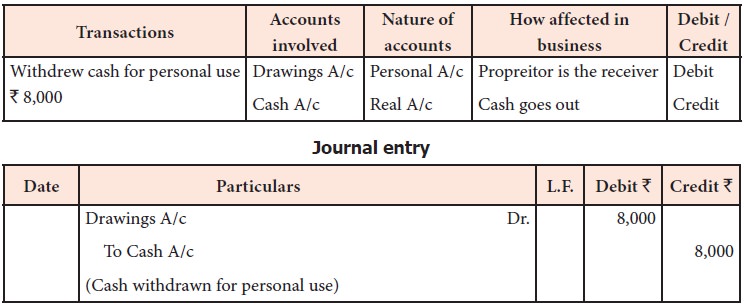

Components Of A Journal Entry

A journal entry consists of several components, each playing a vital role. The date is the first part, marking when the transaction occurred. Next, you have the accounts affected. In a transfer from a personal to a business account, both accounts are listed. Then comes the amount, specifying how much money moved between accounts.

Additionally, every journal entry includes a brief description. This helps you understand the context of each transaction. Have you ever looked at your statement and wondered about a transaction’s purpose? A detailed description in your journal entry clarifies it.

Don’t forget the debit and credit columns. These indicate how each account is impacted—one increases while the other decreases. Understanding these components ensures your journal entries are accurate and useful.

Have you ever questioned the importance of such detail in journal entries? Consider how they provide a roadmap to your financial success. Accurate entries empower you to make informed business decisions. They reflect your financial reality, guiding you toward better management and growth.

Distinguishing Personal And Business Accounts

Transferring money from a personal account to a business account involves recording a journal entry. This helps track financial movement accurately. The journal entry typically includes debiting the business account and crediting the personal account, ensuring transparency in financial transactions.

Distinguishing personal and business accounts is crucial for financial clarity. Each account type serves different purposes and has distinct characteristics. Understanding these differences helps in managing finances effectively. It also ensures proper documentation in accounting practices.

Characteristics Of Personal Accounts

Personal accounts are for individual use. They often include savings and checking accounts. These accounts are used for daily expenses and savings. Personal accounts are not meant for business transactions. They help track personal income and expenses. Privacy is a key feature of personal accounts. They are typically less regulated than business accounts. Personal accounts reflect individual financial habits.

Features Of Business Accounts

Business accounts are designed for company transactions. They handle sales, expenses, and payroll. Business accounts offer tools for financial management. They provide detailed transaction records. These accounts help separate business and personal finances. Regulations are stricter for business accounts. They require more documentation and oversight. Business accounts support financial growth and stability.

Reasons For Transferring Money

Transferring money from a personal account to a business account is common. Business owners often need to move funds to meet various financial demands. Understanding the reasons for these transfers helps manage finances better and maintain business growth.

Common Business Needs

Businesses require money for daily operations. Buying supplies, paying employees, and covering rent are some examples. These expenses are essential for running a business smoothly. Personal funds might be used to cover these costs when business revenue is low. Owners often transfer money to ensure operations continue without interruptions.

Managing Cash Flow

Cash flow management is crucial for any business. It involves tracking money coming in and going out. Sometimes, the business may face a cash shortage. This can happen due to delayed payments from clients or unexpected expenses. Transferring money from a personal account helps bridge the gap. It ensures the business has enough cash to operate efficiently.

Steps For Recording The Journal Entry

Transferring money from a personal account to a business account requires a journal entry. Start by debiting the business bank account. Then, credit the owner’s equity or capital account. This entry keeps business and personal finances separate.

Transferring money from your personal account to your business account might seem straightforward, but accurately recording this transaction in your financial records is crucial. It ensures your books are balanced and provides transparency for tax purposes. This process involves identifying the accounts involved, determining the transfer amount, and recording the debit and credit entries. Let’s break down these steps so you can confidently manage your finances.

Identifying The Accounts Involved

The first step is recognizing which accounts are affected by the transaction. In this case, your personal account and your business account are involved.

Your personal account is where the money is initially located, and your business account is where the money is headed.

You might wonder why it’s important to distinguish these accounts. It ensures clarity in your financial records and helps avoid confusion during audits or tax filing.

Determining The Transfer Amount

Next, you need to decide how much money you’re transferring. This amount should be based on your business needs and personal budget.

Consider what your business requires and what you can afford to transfer without affecting your personal finances.

Reflect on your business goals: Do you need the funds to purchase inventory or cover unexpected expenses? Being strategic about the amount can save you from future financial stress.

Recording The Debit And Credit

Now comes the part where you record the transaction, which involves debiting and crediting the appropriate accounts.

You will debit your personal account, reducing its balance, and credit your business account, increasing its balance.

Think of it as a simple addition and subtraction in your financial records. If you have ever balanced a checkbook, you’re halfway there!

Remember, accuracy here is critical—missteps can lead to discrepancies that might haunt you during tax season. Do you have a system in place that ensures you never miss a detail?

By following these steps, you can ensure your financial records are accurate and your business is well-funded. Now, it’s your turn to implement these practices and see how they streamline your financial management.

Impact On Financial Statements

Transferring money from a personal account to a business account impacts financial statements by increasing both assets and capital. The transaction is recorded as a debit to the business account and a credit to the owner’s equity, reflecting personal investment.

This entry ensures accurate financial tracking for business growth.

Transferring money from your personal account to your business account can significantly impact your financial statements. It’s not just a simple transaction; it affects how your business is perceived financially. Understanding these changes can help you make better decisions and ensure your financial health remains intact.

###

Changes In Assets And Liabilities

When you transfer money from your personal account to your business account, you are increasing the assets of your business. This boost in cash is reflected on your balance sheet under current assets. It’s a positive sign, showing potential investors or lenders that your business is well-funded.

However, it’s essential to remember that this transfer does not impact your liabilities directly. But if this money is used to pay off business debts, it can indirectly reduce liabilities. This can strengthen your business’s financial position, making it more appealing to stakeholders.

###

Effects On Equity

This transfer directly influences your equity. By contributing personal funds, you increase your owner’s equity or capital in the business. This move showcases your commitment and confidence in your business venture, which can be reassuring to partners and investors.

Yet, it’s crucial to record this transaction correctly in your journal entries. Misrecording can lead to discrepancies, affecting how your equity is portrayed in financial reports. Have you ever considered how a simple error could lead to a misinterpretation of your financial standing?

Understanding these impacts can help you strategically manage your finances. It’s not just about moving money; it’s about aligning your financial actions with your business goals. As you manage your accounts, think about how each transaction reflects on your business’s story.

Common Mistakes To Avoid

Mistakes often occur when recording money transfers between accounts. Incorrectly categorizing transactions can lead to inaccurate financial records. Always ensure the journal entry reflects the transfer correctly as a transaction between personal and business accounts.

Transferring money from a personal account to a business account might seem straightforward. But the process is riddled with potential pitfalls that could complicate your financial records. Understanding common mistakes can help you maintain clear and accurate accounting books.

###

Incorrect Account Selection

One frequent error is selecting the wrong accounts. It’s crucial to choose the correct personal account and the appropriate business account for the transfer. Imagine mistakenly transferring funds to a vendor account instead of your business account. This simple error can lead to confusion and mismanagement of funds. Always double-check account numbers and names. A few extra minutes of verification can save hours of correction.

###

Misrecording Debit And Credit

Another common mistake is misrecording debits and credits. When you transfer money, your personal account should show a debit, and your business account should show a credit. Incorrectly flipping these entries can misrepresent your financial position. I once recorded a business expense as a personal one, leading to a discrepancy in my financial reports. Ensure each entry reflects the transaction accurately. Ask yourself: does this entry clearly depict the flow of money?

Being vigilant about these errors can make your accounting process smoother. Have you ever encountered these mistakes? How did you resolve them? Share your thoughts in the comments below. Your experiences might just help someone else avoid a similar blunder.

Best Practices For Accurate Entries

Ensure precise journal entries for transferring money between personal and business accounts. Record the transaction date and amount. Clearly label accounts to avoid confusion.

Transferring money from a personal account to a business account involves more than just moving funds. Accurate journal entries are crucial to keep financial records clean and avoid confusion during audits. Mistakes can lead to inaccurate financial reports, which can impact your business decisions.

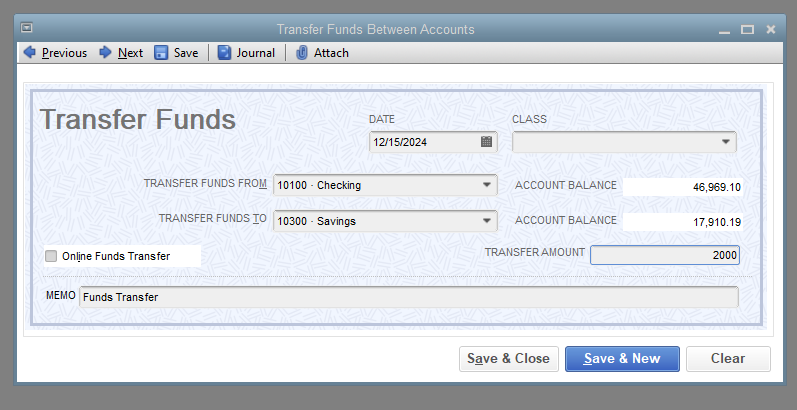

Using Accounting Software

Using accounting software simplifies journal entries significantly. With automated entries, you minimize human errors, ensuring your financial data remains accurate.

Most software allows you to set up recurring transactions, saving time and reducing the risk of missing an entry. This is particularly helpful if you frequently transfer funds between accounts.

Moreover, accounting software often includes features like automated alerts and reminders. These tools help you stay on top of your transactions and ensure you don’t overlook any critical entries.

Regular Reconciliation

Regular reconciliation is key to maintaining accurate financial records. Reconcile your accounts monthly to catch any discrepancies early. This practice helps ensure that your journal entries reflect actual transactions.

During reconciliation, compare your journal entries with bank statements. This comparison helps identify errors or omissions quickly, allowing you to correct them before they impact your financial reporting.

Ask yourself: when was the last time you reconciled your accounts? Regular reconciliation not only keeps your books accurate but also provides peace of mind knowing your financial records are reliable.

By following these best practices, you can ensure that your journal entries for transferring money between personal and business accounts remain precise. Accurate entries not only simplify your accounting processes but also set the foundation for sound financial management.

Legal And Tax Considerations

Transferring money from a personal account to a business account requires careful journal entry documentation. Accurate records are crucial for legal compliance and correct tax reporting. Ensure all transactions reflect the proper account movements to avoid financial discrepancies and maintain transparency.

Transferring money from a personal account to a business account might seem straightforward, but it involves important legal and tax considerations. Understanding these aspects can prevent future complications and ensure that your business operates smoothly within legal boundaries. Whether you’re a budding entrepreneur or a seasoned business owner, being aware of these factors is crucial for maintaining a transparent and compliant financial system.

Compliance With Regulations

Regulatory compliance is a key aspect of transferring funds between personal and business accounts. Each jurisdiction has specific rules governing such transactions, and failing to comply can lead to penalties. Ensure that your financial records accurately reflect these transfers to avoid any legal issues.

It’s essential to maintain a clear distinction between personal and business finances. This separation not only simplifies accounting but also protects your personal assets. Have you ever faced a situation where mixing finances led to confusion? Keeping them distinct ensures clarity and compliance.

Implications For Tax Reporting

Transferring money into your business account has tax implications that you need to consider. Such transfers may be viewed as capital contributions or loans, each with different tax treatments. It’s wise to consult with a tax professional to understand how these transactions affect your tax obligations.

Accurate record-keeping is vital for correct tax reporting. Document every transfer with detailed notes about its purpose and nature. This practice not only aids in tax preparation but also provides clarity during audits.

Have you thought about how these transfers impact your tax returns? Neglecting these details can lead to inaccuracies that result in penalties or missed tax advantages. Ensuring that each transaction is properly documented and reported can save you from potential headaches and fines.

In summary, while transferring money between personal and business accounts might seem routine, it requires careful attention to legal and tax matters. By ensuring compliance and understanding tax implications, you safeguard your business against potential pitfalls.

Frequently Asked Questions

How Do You Record Personal To Business Transfers?

To record a transfer from a personal account to a business account, create a journal entry. Debit the business account to increase it, and credit the personal account to decrease it. This ensures accurate financial reporting and maintains clear separation between personal and business finances.

Is It Legal To Transfer Money To A Business Account?

Yes, transferring money from a personal account to a business account is legal. It’s essential for funding business operations. Proper documentation and journal entries are crucial to avoid legal issues and ensure compliance with tax regulations. Always consult with a financial advisor for specific legal guidance.

Why Maintain Separate Personal And Business Accounts?

Maintaining separate accounts simplifies financial tracking and ensures legal compliance. It helps in accurate accounting and tax reporting. Mixing finances can lead to complications, audits, and legal issues. Clear separation also enhances financial transparency and aids in better financial management.

What Are The Tax Implications Of Money Transfers?

Transferring funds from a personal to a business account generally has no immediate tax implications. However, proper documentation is vital. Misclassifying personal expenses as business expenses can lead to tax issues. Always consult a tax professional for advice tailored to your situation.

Conclusion

Transferring money between accounts is crucial for business tracking. Journal entries help keep financial records clear. They ensure transparency and accuracy. Always record the date, amount, and purpose of the transfer. Use consistent format for these entries. This practice aids in financial management and audit processes.

It prevents confusion and errors. Regularly update your books for better insights. This will help in understanding business performance. Stay organized and proactive with your bookkeeping. Sound financial habits build a strong foundation for success. Keep learning and adapting for effective financial management.