Are you wondering how to transfer money from your Chime account to your bank account? You’ve come to the right place.

Managing your finances should be simple and stress-free, especially when it comes to transferring your hard-earned money between accounts. Imagine the ease of seamlessly moving your funds with just a few taps. In this guide, we’ll walk you through each step, ensuring you feel confident and in control.

No more guesswork or frustration—just straightforward solutions for your financial needs. Stick with us, and by the end of this article, you’ll be ready to transfer money like a pro.

Chime Account Basics

Understanding the Chime account basics is crucial for smooth transactions. Chime offers a user-friendly platform for managing your finances. Knowing how to transfer money from Chime to a bank account is essential. This process involves setting up your Chime account and linking your bank accounts. Both steps are simple and straightforward.

Setting Up Chime Account

Start by downloading the Chime app on your smartphone. Follow the prompts to create an account. Enter your personal information accurately. This includes your name, address, and social security number. Ensure your details match your official documents. Verify your email and phone number to complete registration. Once set up, explore the app’s features. They are designed to make banking easier.

Linking Bank Accounts

Linking your bank account to Chime is a key step. Open the Chime app and navigate to ‘Settings.’ Select ‘Link a Bank Account.’ Choose your bank from the list provided. Enter your online banking credentials securely. Chime uses encryption to protect your information. Once linked, you can transfer money easily. Ensure your bank details are correct to avoid errors. Regularly update your app for smooth transactions.

Initiating The Transfer

Transferring money from your Chime account to your bank might sound like a daunting task, but it’s a straightforward process. Whether you’re managing monthly expenses or saving for a special purchase, moving your funds efficiently is crucial. Let’s dive into how you can initiate this transfer smoothly, ensuring your money reaches its destination without a hitch.

Accessing The Transfer Feature

Start by opening your Chime app. It’s user-friendly and designed to make your life easier. If you haven’t updated your app recently, doing so might give you access to new features. Once you’re logged in, navigate to the ‘Move Money’ option. This is your gateway to transferring funds from your Chime account. Notice how Chime’s interface guides you with simple prompts. Have you ever noticed how a clean design makes everything feel less overwhelming?

Look for the ‘Transfer Funds’ button. This is usually prominently displayed. If you’re doing this for the first time, take a moment to appreciate how intuitive the app is. Chime understands that you want to get things done quickly, so the process is streamlined for your convenience.

Selecting The Destination Bank

Once you’ve accessed the transfer feature, it’s time to select where your money will go. Start by choosing your destination bank. You’ll see a list of banks you’ve linked to your Chime account. If you haven’t linked a bank yet, now’s a good time to do it. Linking your bank is a simple process that involves verifying your account details. Isn’t it reassuring to know you have control over where your money goes?

Choose the bank account you want the money transferred to. Double-check the details to ensure accuracy. Have you ever sent something to the wrong place by accident? Avoiding mistakes here saves time and potential hassle later. Confirm your selection, and you’re one step closer to completing your transfer.

Initiating a transfer doesn’t have to be complex. With Chime, the process is designed to be straightforward, ensuring you can manage your finances effortlessly. By following these steps, you’re equipped to move your money efficiently, knowing it will arrive safely at your chosen bank. What other banking tasks have you found Chime simplifies for you?

Entering Transfer Details

Transferring money from Chime to a bank account involves entering the transfer details. First, open the Chime app. Select ‘Move Money’ and then ‘Transfer Funds’. Input the necessary information, including the amount and bank account details. Confirm the transfer to complete the process.

Transferring money from your Chime account to a traditional bank account can seem daunting at first, but it’s a straightforward process. One of the most crucial steps is entering the correct transfer details. This part of the process involves specifying how much you want to transfer and ensuring all details are correct before confirming the transaction. Here’s how you can do it effortlessly and avoid common pitfalls.

Choosing Amount To Transfer

Deciding on the amount to transfer is your first step. You’ll want to make sure you’re not transferring more than what’s available in your Chime account.

Consider any upcoming expenses that might require funds to remain in your account.

Always double-check your balance before deciding on a transfer amount.

Reviewing Transfer Information

Before you finalize the transfer, take a moment to review all the details carefully.

Check the recipient bank account number and routing number to ensure they are correct. A simple typo could send your funds to the wrong account.

Verify the transfer amount to avoid sending more or less than intended.

Chime provides a summary screen before you confirm the transaction—use this opportunity to catch any mistakes.

These small steps can save you from big headaches later. Have you ever sent money to the wrong account? It’s an experience you’d rather not repeat!

By paying close attention to these details, you ensure your transfer goes smoothly.

What’s one tip you’ve learned about transferring money? Share your insights in the comments!

Finalizing The Transfer

Transferring money from your Chime account to a traditional bank is a straightforward process, but the final step is crucial to ensure everything goes smoothly. Finalizing the transfer involves confirming the transaction details and understanding the timeframes involved. Whether you’re making a one-time transfer or setting up a regular schedule, getting this part right can save you from potential hiccups. Let’s dive into how you can seamlessly wrap up your transfer.

Confirming The Transaction

Before you hit the final button, double-check all the details. Are you sure about the amount you’re transferring? Verify the bank account number and routing number to avoid any errors. A small mistake can lead to delays or, worse, sending money to the wrong account.

Once confirmed, Chime will usually send a notification to your email or app. This confirmation reassures you that the transaction is in process. It’s like getting a receipt after a purchase. Always keep this notification handy for your records.

Understanding Transfer Timeframes

Now that you’ve confirmed the transaction, you might wonder, “How long will it take for the money to arrive?” Typically, transfers from Chime to a bank account can take anywhere from a few hours to a couple of days. Understanding this timeframe helps you plan better, especially if you’re transferring money for bills or essential purchases.

Consider this: a friend once told me how she transferred money on a Friday afternoon, thinking it would arrive by Saturday. To her surprise, it wasn’t processed until Monday morning. This taught her to always factor in weekends and holidays when planning transfers.

Curious about the exact timeframe? You can usually find this information in the Chime app or website. Knowing this can prevent unnecessary stress and help you make informed decisions.

What’s your experience with transfer times? Have you ever been caught off guard by a delay? Share your story in the comments below. Your insights could help others navigate their financial transfers more smoothly.

Troubleshooting Common Issues

Transferring money from Chime to a bank account should be simple. But sometimes, problems arise. These issues can cause stress and delays. Understanding common problems helps in finding quick solutions. Below, we discuss ways to resolve these issues efficiently.

Resolving Transfer Delays

Transfer delays might happen due to several reasons. First, check your bank account details. Ensure all information is correct. Incorrect details often cause delays. Next, verify your internet connection. A weak connection can disrupt the process.

Sometimes, Chime may have technical issues. Visit their status page for updates. If everything seems fine, wait for a few hours. Transfers can take time during high traffic periods.

Contacting Chime Support

If problems persist, reach out to Chime support. They can offer solutions and guidance. Contact them through the Chime app. Use the support section for faster assistance.

Explain your issue clearly. Provide relevant details like transaction ID. This helps them understand the problem better. You can also visit Chime’s official website. Check their FAQ section for common questions.

Security Tips

Transferring money from Chime to a bank account is a straightforward process. Yet, ensuring security during this transaction is crucial. Protecting your financial data should be a priority. Being aware of potential threats can save you from losing money. This section covers key security tips to keep your funds safe.

Protecting Personal Information

Keep your login details private. Do not share your Chime password. Use strong passwords with a mix of letters and numbers. Change passwords regularly to prevent unauthorized access. Enable two-factor authentication for added security. Secure your mobile device with a password or fingerprint.

Beware of phishing emails asking for your details. Never click on suspicious links in messages. Always verify the sender’s identity. Use secure internet connections for transactions. Public Wi-Fi can be risky for financial activities.

Recognizing Fraudulent Activity

Monitor your account for unusual activities. Look for transactions you did not authorize. Report any suspicious activity immediately. Be cautious of messages claiming you won money. Scammers often use this trick to steal your information.

Know the signs of fraud. Fake websites may ask for your personal data. Verify website URLs before entering any information. Trust only the official Chime app and website. Secure your account by understanding common fraud methods. Stay informed to protect your finances.

Alternative Transfer Methods

Transferring money from Chime to a bank account is straightforward, but sometimes, exploring alternative transfer methods can offer more flexibility and convenience. These methods can be particularly useful if you face any glitches with direct transfers or simply want to leverage different platforms for better options. Let’s dive into some practical methods you can use to transfer your money smoothly.

Using Third-party Apps

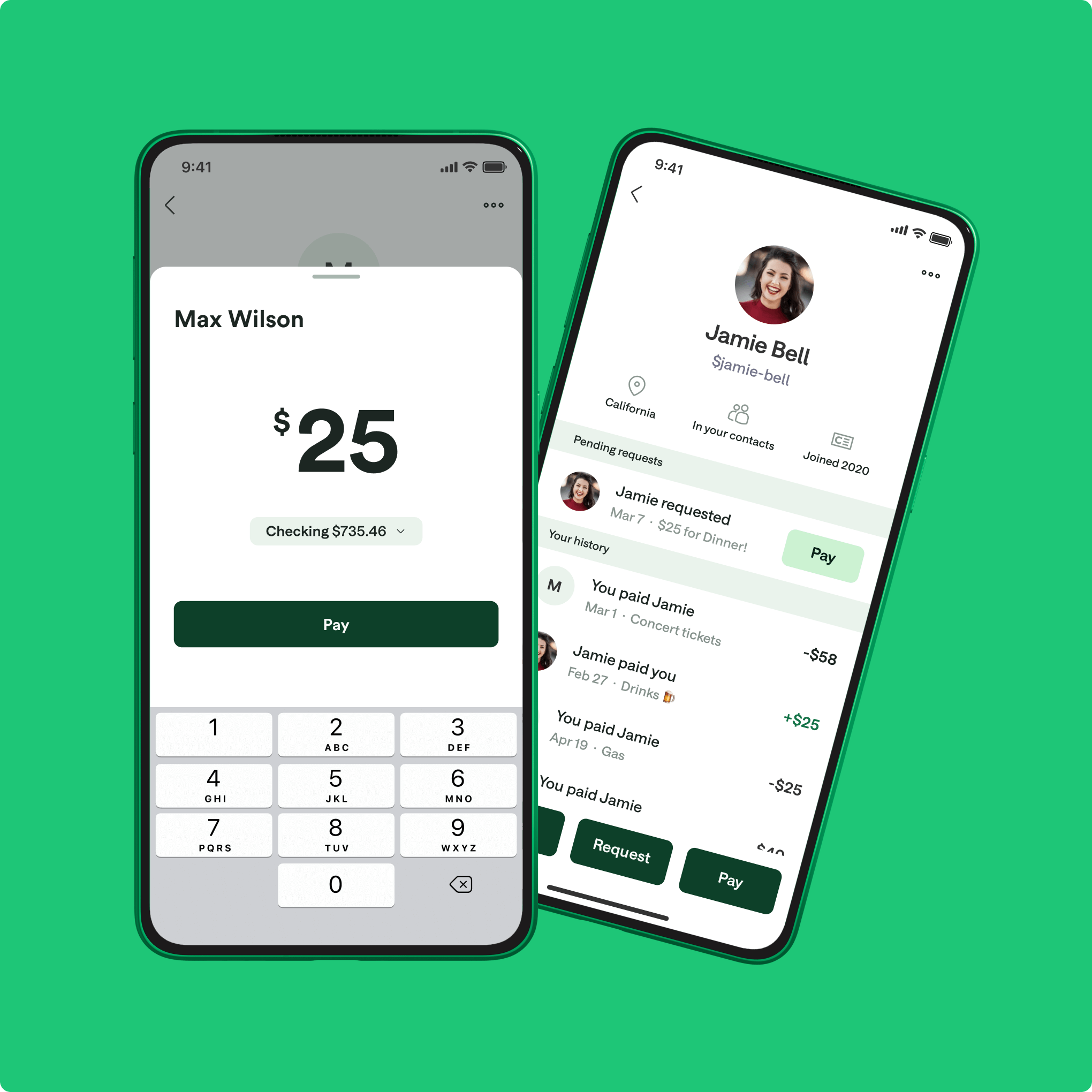

Third-party apps like Venmo, PayPal, or Cash App can be lifesavers when traditional transfers hit a snag. These apps allow you to link your Chime account, providing an alternative pathway for your funds. Imagine needing to send money urgently; having these apps handy could mean the difference between frustration and relief.

Start by downloading your preferred app and create an account. Add your Chime details, and you’re set. Transfers might incur small fees, but the speed and convenience often outweigh the costs. Have you tried this method yet, or are you still relying solely on direct transfers?

Exploring Other Financial Services

Beyond third-party apps, consider the broader landscape of financial services. Credit unions or digital banks sometimes offer unique features like reduced fees for transfers. They can be an unexpected ally in your financial journey, opening doors to faster transactions.

Research local options or online platforms that might offer benefits aligning with your needs. You might find a service that not only simplifies transfers but enhances your overall financial strategy. Have you ever thought about how these services could change your financial habits?

By branching out and using alternative transfer methods, you can enhance your financial flexibility and ensure your funds reach their intended destination efficiently. Whether it’s using an app or exploring new financial services, you’re taking control and broadening your options.

Frequently Asked Questions

How Do I Link Chime To My Bank Account?

To link Chime to a bank account, go to your Chime app and select “Settings. ” Choose “Link a Bank Account” and follow the prompts. You’ll need your bank account details, including routing and account numbers. This allows seamless money transfers between Chime and your bank.

How Long Does Chime Transfer Take?

Chime transfers typically take 1-3 business days to complete. The exact timing may depend on the receiving bank’s processing times. Ensure all account details are correct to avoid delays. Transfers initiated during weekends or holidays might take longer to process.

Are Chime Transfers To Banks Free?

Yes, transferring money from Chime to a bank account is free. Chime does not charge fees for standard transfers. However, always check with your bank for any potential receiving fees. This feature makes Chime a cost-effective option for managing finances.

Can I Transfer Money Using Chime Website?

No, transfers from Chime must be initiated via the mobile app. The app offers user-friendly navigation and secure transaction processes. Ensure your app is updated for optimal performance. This approach enhances security and convenience for Chime users.

Conclusion

Transferring money from Chime to your bank account is simple. Follow the steps outlined, and you’ll find it easy. Always check your details before confirming the transfer. This ensures your money reaches the right place. Chime’s user-friendly app makes the process smooth.

You can manage your finances efficiently. Remember to keep your banking information secure. Avoid sharing it with others. Stay informed about any updates in Chime’s policies. This keeps you prepared for any changes. With a little practice, transferring funds becomes second nature.

Enjoy the convenience and control over your money.