Transferring money from your Chime account to your bank account should be as seamless as a quick tap on your phone. Imagine needing to move funds immediately for an urgent bill, a spontaneous purchase, or even just to have cash at hand.

You don’t want to be bogged down by complicated processes or lengthy waiting times. This guide is here to show you how to transfer money from Chime to your bank account instantly, so you can manage your finances with ease and confidence.

You’ll discover straightforward steps, tips, and insights that put you in control, ensuring your money is where you need it, when you need it. Dive in and unlock the secrets to hassle-free money transfers.

What Is Chime?

So, you’re looking to transfer money from Chime to a bank account instantly. But what exactly is Chime? If you haven’t heard about it already, Chime is a modern, mobile-focused financial technology company. It offers a refreshing alternative to traditional banking, especially for those who are tired of fees and complicated banking processes.

What Makes Chime Different?

Chime stands out by eliminating many common banking fees. Forget about monthly service charges, overdraft fees, or minimum balance requirements. This can be a game-changer for anyone looking to keep more of their hard-earned money.

Chime also emphasizes simplicity. The app is user-friendly, making it easy to manage your finances on the go. You can quickly view your account balance, monitor transactions, and yes, transfer money to other accounts.

How Does Chime Work?

Chime operates entirely online. There’s no need to visit a physical branch, which can save you time and hassle. You can set up direct deposits, which often arrive two days earlier than with traditional banks.

The app also allows you to track your spending and savings goals effortlessly. Everything you need is at your fingertips, including the ability to transfer funds instantly.

Is Chime Safe?

Security is a top priority for Chime. They use encryption and secure processes to protect your data. Your deposits are FDIC-insured up to $250,000 through their partner banks.

Chime also offers features like real-time transaction alerts and instant card blocking. This gives you control and peace of mind over your account.

Why Choose Chime For Your Banking Needs?

Consider the convenience and cost savings Chime offers. If you’re tired of traditional banking hassles, Chime can be a breath of fresh air.

With features like automatic savings, no hidden fees, and early direct deposit, it’s designed to make your financial life easier. Ask yourself: could switching to Chime improve your banking experience?

Understanding what Chime offers can help you decide if it’s the right fit for your financial needs. Ready to learn how to transfer money instantly? Let’s dive into the details!

Benefits Of Instant Transfers

Transferring money instantly from Chime to your bank account can be a real convenience. It saves time and helps manage finances efficiently. Many people find instant transfers useful in urgent situations. The benefits of instant transfers are numerous, impacting daily life positively.

Instant Access To Funds

Instant transfers provide immediate access to your money. This is especially important when you need cash quickly. No more waiting days for funds to arrive. You can handle emergencies or unexpected expenses with ease.

Improved Financial Control

Having quick access to funds boosts financial control. You can make timely payments and avoid late fees. This enhances your ability to manage budgets effectively. Money can be moved swiftly to where it is needed most.

Enhanced Convenience

Instant transfers offer superior convenience. You can transfer money anytime, anywhere. It fits seamlessly into a busy lifestyle. This flexibility makes managing finances less stressful.

Reduced Anxiety

Knowing your money can be moved instantly reduces stress. It brings peace of mind. You are prepared for unforeseen financial demands. This assurance is invaluable.

Better Money Management

Instant transfers facilitate better money management. You can quickly allocate funds to different accounts. This helps in maintaining a balanced financial status. It supports smart savings and spending habits.

Setting Up Your Chime Account

Setting up your Chime account is the first step to transferring money seamlessly. With Chime, you can quickly move funds to your bank account. Follow these steps to get started.

Creating Your Chime Account

Visit the Chime website or download the app. Click on “Get Started”. Fill out the required personal information. This includes your name and email address. Set a strong password for security. Verify your identity using the provided options. This might involve a government ID. Follow the prompts to complete your registration. Once done, log in to your new Chime account.

Linking A Bank Account

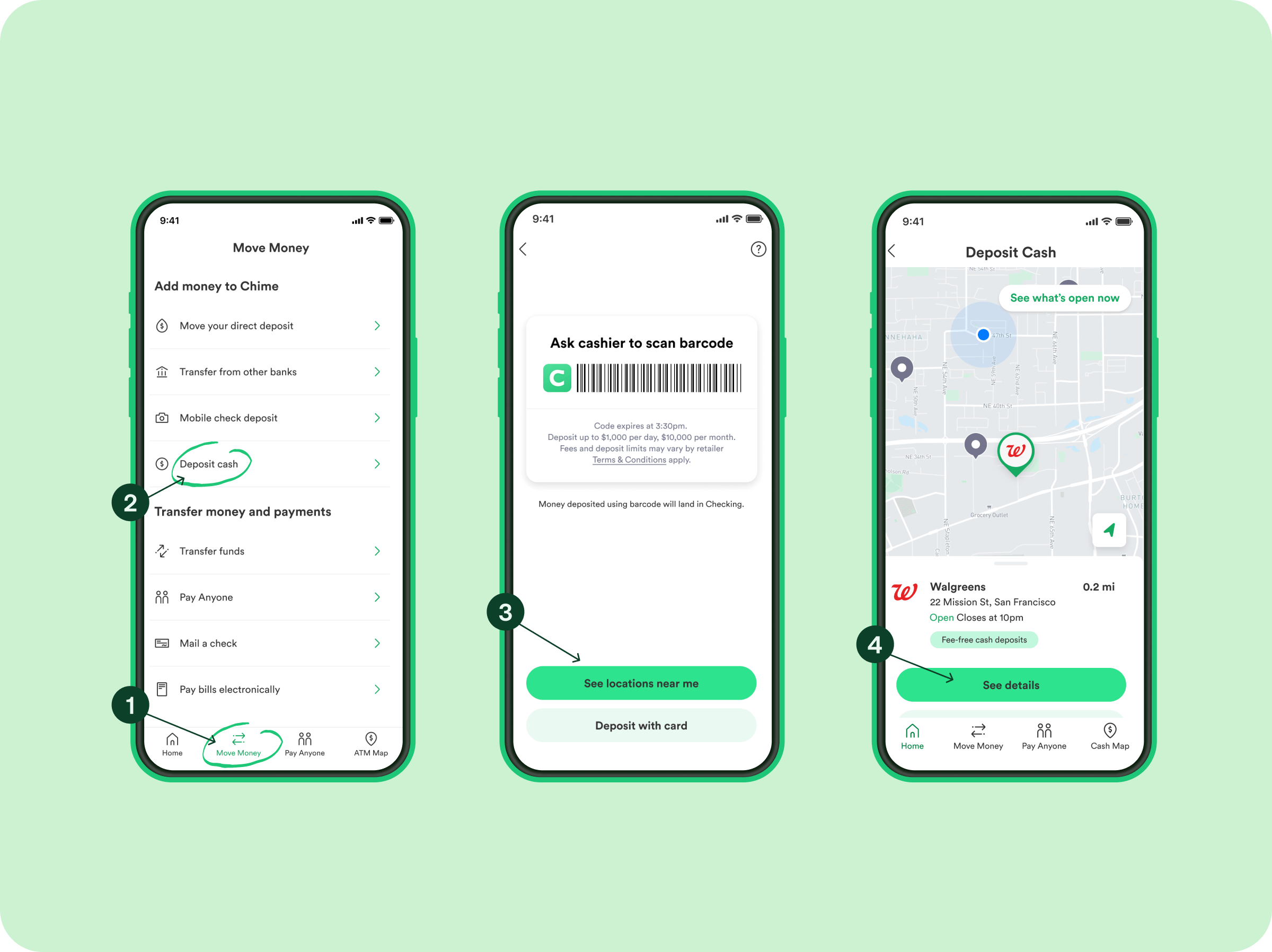

After creating your Chime account, link your bank account. Go to the “Move Money” section in the app. Select “Transfers”. Choose “Link a Bank Account”. You will see a list of banks. Find and select your bank from the list. Enter your bank login details securely. Chime will verify your bank account. You might need to confirm micro-deposits. Once verified, your bank account links to Chime. You can now transfer funds easily.

Transferring Money To A Bank Account

Transferring money from your Chime account to a bank account can be quick and hassle-free. Whether you’re paying bills, sending money to family, or just moving funds for savings, knowing how to transfer money instantly is crucial. With Chime’s user-friendly mobile app, this process becomes seamless and efficient, allowing you to manage your finances with ease. Have you ever wondered how you can make instant transfers without stress? Let’s dive into the steps!

Using The Chime Mobile App

The Chime mobile app is your go-to tool for managing financial transactions effortlessly. Its intuitive design ensures that you can navigate through features easily, even if you’re not tech-savvy. Simply download the app from your device’s app store and log in with your credentials. This app is designed to make your life easier by offering a direct pathway to transfer funds.

Once logged in, explore the app’s features. You’ll find a section dedicated to transfers. It’s amazing how technology can simplify banking, right? This section allows you to initiate the process of sending money to any linked bank account. Have you tried exploring all the features Chime offers?

Steps For Instant Transfer

Initiating an instant transfer is straightforward. Start by tapping on the ‘Move Money’ option in the app. This opens up a new window where you can choose to transfer funds. Select the bank account you want to transfer money to. It’s as simple as a few taps!

Enter the amount you wish to transfer. Double-check the figures to avoid errors. Then, hit the ‘Transfer’ button and your money is on its way. Isn’t it empowering to have such control over your finances at your fingertips?

You’ll receive a confirmation once the transfer is complete. The app keeps you updated with notifications, ensuring transparency and peace of mind. Do you feel more confident handling financial transactions with Chime now?

Chime’s instant transfer feature is a game-changer for those who need to move money quickly. Have you experienced the ease of using it yet? With this guide, managing your funds becomes less of a chore and more of an empowering activity.

Troubleshooting Common Issues

Transferring money from Chime to a bank account is usually simple. Yet, sometimes issues can occur. Understanding these common problems helps ensure a smooth transaction. Here’s how to troubleshoot them.

Transfer Delays

Transfer delays can frustrate users. Often, they happen due to high traffic. Banks might take longer during peak hours. Check your internet connection. A weak connection can cause delays. Confirm the transfer status in the Chime app. Sometimes, updates lag behind actual transactions.

Unlinked Accounts

An unlinked account is a common issue. Ensure your bank account is linked to Chime. Open the Chime app and go to settings. Check the linked accounts section. If your bank is not listed, link it again. You might need your bank’s routing number and account number. Double-check these details for accuracy.

Tips For Secure Transactions

Transferring money from Chime to a bank account can be simple and quick. Yet, ensuring secure transactions is crucial to protect your finances. This section offers helpful tips to make your money transfers safe. Following these steps can help prevent fraud and unauthorized access.

Check Account Details Carefully

Always verify the bank account details before transferring. A small mistake can send money to the wrong account. Double-check the account number, routing number, and the bank name. Ensure all details match the intended recipient’s account.

Use Strong Passwords

Your Chime account should have a strong password. Create a password with a mix of letters, numbers, and symbols. Avoid using common words or easy-to-guess phrases. Change your password regularly to enhance security.

Enable Two-factor Authentication

Two-factor authentication adds an extra layer of security. It requires a second step to verify your identity. This could be a code sent to your phone or email. Enable this feature to keep your account safe from hackers.

Monitor Transactions Regularly

Regularly check your account transactions for unusual activity. Report any unauthorized transactions immediately. Keeping an eye on your account helps detect fraud early. You can set up alerts to notify you of any account changes.

Use Secure Networks

Always use secure Wi-Fi connections when accessing your account. Public networks can be risky and expose your information. Avoid making transactions on shared or public computers. Use a trusted network to ensure your data is safe.

Keep Software Updated

Update your devices and apps regularly. Software updates often fix security flaws. Ensure your Chime app is the latest version. Updated software protects against new threats.

Alternatives To Chime Transfers

Transferring money from Chime to a traditional bank account is quite straightforward. However, what if you’re looking for other methods that suit your needs better? Knowing your alternatives can save time, offer better control, or even reduce fees. Let’s dive into some options that might just be the perfect fit for your financial habits.

Third-party Apps

Have you ever tried using third-party apps to move your money? Apps like PayPal, Venmo, and Cash App offer seamless transactions between accounts. They can be a lifesaver for quick transfers.

Most of these apps allow you to link multiple accounts. This means you can send money from Chime to your app and then to your bank. It’s like having a middleman without the fuss. Plus, these platforms often provide instant transfer options, albeit sometimes for a small fee.

Think about the convenience of sending money while sipping your morning coffee. Isn’t it worth exploring these apps for faster transactions?

Traditional Bank Transfers

Traditional bank transfers might sound old school, but they are reliable. Linking your Chime account to your bank for ACH transfers is straightforward. This method ensures your money lands safely and securely into your bank account.

While ACH transfers might not be instant, they are dependable. Banks have been using this method for ages, ensuring a smooth and error-free transfer. It’s peace of mind knowing your money is safe en route.

If you value reliability over speed, why not stick with what works? Sometimes the tried-and-true methods are just what you need.

When considering alternatives, ask yourself: What’s more important, speed or security? Your choice may impact how you manage your finances effectively.

Frequently Asked Questions

Can I Transfer Money Instantly From Chime?

Yes, you can transfer money instantly from Chime to a linked bank account. Simply use the “Move Money” feature on the Chime app. Ensure your bank account is verified with Chime. Transfers usually happen instantly, but can take up to two business days in some cases.

How Do I Link A Bank Account To Chime?

Linking a bank account to Chime is easy. Open the Chime app and navigate to “Settings. ” Select “Link a Bank Account” and enter your bank details. Follow the verification steps provided. Once linked, you can transfer money quickly and securely.

Are There Fees For Transferring Money From Chime?

No, Chime does not charge fees for transferring money to your bank account. Chime offers fee-free banking services. You can move funds without worrying about hidden charges. Always check your bank’s policy for any incoming transfer fees.

How Long Does A Chime Transfer Take?

Chime transfers are usually instant but may take up to two business days. Ensure your bank account is verified for seamless transactions. Delays can occur due to bank processing times. Always check with your bank for their specific transfer times.

Conclusion

Transferring money from Chime to your bank is simple and quick. Just follow the steps outlined in this guide. You’ll have your funds ready in no time. No complicated processes involved. It’s a straightforward method anyone can use. Keep your app updated to ensure seamless transactions.

Remember to double-check your details for accuracy. This ensures a smooth transfer every time. By understanding these steps, you save time and effort. Enjoy the convenience of managing your finances effortlessly. Make your transactions stress-free and efficient. Your financial journey just got easier.