Are you a contractor looking to expand your payment options? Accepting credit card payments can open up a world of convenience for both you and your clients.

Imagine how easy it would be for your customers to pay you instantly, without the hassle of checks or cash. As you simplify the payment process, you also enhance your professional image and potentially increase your revenue. In this guide, you’ll discover practical steps and insider tips to seamlessly integrate credit card payments into your business.

Stick around to learn how this small change can lead to big rewards for your contracting business.

Why Accept Credit Card Payments

Accepting credit card payments is smart. It attracts more clients. Many people prefer using cards over cash. Cards are easy and fast. No need to handle coins or bills. Clients feel secure using their cards. Payments can be tracked easily. This helps in managing finances. You get paid quickly. No waiting for checks to clear. It saves time for you and your clients.

Credit cards offer flexibility. Clients can pay in parts. This helps them manage costs. It builds trust and makes clients happy. Happy clients return for more work. Your business grows faster. Accepting cards is simple. Just set up a card reader. Connect it to your phone or computer. It’s easy and quick.

Choosing The Right Payment Processor

Fees are very important. Look at transaction fees. Some processors have high fees. Others have low fees. Check for monthly charges. Some processors charge every month. Others don’t. Hidden costs can be a problem. Read all details carefully. Ask about setup fees. Some processors charge to start. Others don’t. Compare before choosing.

Good support is a must. Look for 24/7 help. You may need help anytime. Phone support is important. Sometimes you need to talk. Email support helps too. It solves problems fast. Live chat is useful. It helps solve issues quickly. Friendly staff is vital. They should be patient and polite. Help guides are useful. They explain step-by-step solutions.

Setting Up Your Payment System

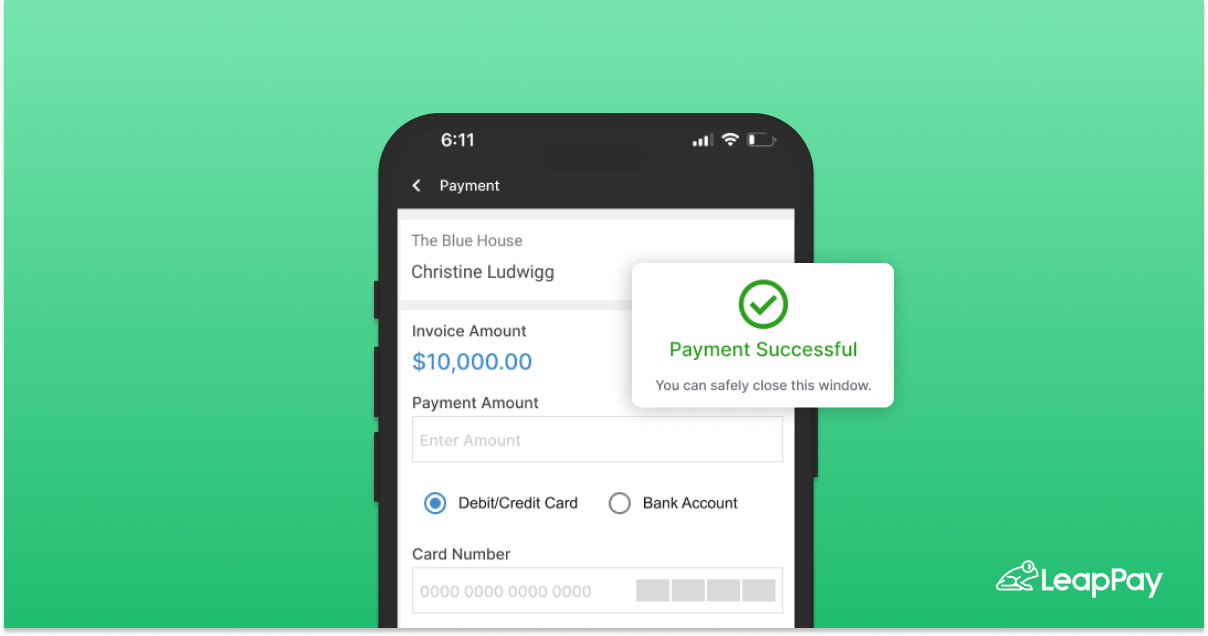

Choose a payment method that fits your work. Use tools that connect well with your business. Online platforms like PayPal or Stripe work for many. They help take payments easily. Check if they match your needs. Many services offer apps to help manage payments. Make sure your choice keeps things simple. Easy systems save time and avoid trouble.

Keeping payments safe is very important. Use secure payment gateways. They protect both you and your client. Look for tools with SSL certificates. They add a layer of safety online. Always update your systems. This helps block new threats. Passwords should be strong. Change them often to keep accounts safe. Teach yourself about security rules. It helps avoid mistakes. Safety builds trust with clients.

Popular Payment Platforms For Contractors

PayPal is a trusted payment service. It is simple to use. Contractors can receive payments quickly. Many clients prefer PayPal. It is known worldwide. Transactions are smooth and fast. PayPal offers protection for buyers and sellers. Fees are clear and reasonable. Accepting credit cards is easy with PayPal. Payments can be received from anywhere.

Square offers easy credit card payments. It is great for small businesses. Square has a sleek card reader. Contractors can use it on their phones. Payments are processed fast. Fees are straightforward. Square deposits money in your bank. It is safe and secure. Square helps keep track of sales. It is a popular choice for many.

Stripe is powerful for contractors. It supports online payments. Credit card processing is efficient. Stripe is developer-friendly. Many websites use Stripe. It handles payments securely. Fees are competitive. Contractors can customize payment options. Stripe integrates with many platforms. It is reliable and trusted.

Steps To Process Payments

Always make a clear and simple invoice for your work. Write down the services you provided. Add the cost of each service. Don’t forget to put your business name and contact details. Make sure the due date is clear. This helps the customer to pay on time. You can use tools like QuickBooks or FreshBooks. They help in making professional invoices.

Keep track of all your transactions. It is important to know who has paid. This helps you manage your money better. Use a spreadsheet or accounting software. Write down each payment you get. Include the date, amount, and payer’s name. This way, you can see your income clearly. It also helps in finding any missing payments.

Managing Fees And Costs

Credit card payments have transaction fees

Contractors should plan for processing costs

Ensuring Security And Fraud Prevention

Protecting Client Information is very important. Use strong passwords for online accounts. Encrypt all sensitive data. Keep software updated regularly. Avoid sharing passwords with others. Store documents in secure places. Always use secure networks. Avoid public Wi-Fi for transactions. Monitor accounts for suspicious activity. Report any fraud immediately. Notify clients about security measures. Clients feel safe with good security. Trust is essential for business.

Identifying Fraudulent Transactions helps prevent losses. Look for unusual spending patterns. Check transaction details carefully. Verify client identities before processing. Be wary of large unexpected payments. Watch for repeated small transactions. Use alert systems for strange behavior. Contact banks for suspicious transactions. Train staff to recognize warning signs. Fraud can happen anytime. Stay vigilant always.

Legal And Tax Considerations

Accurate records are very important. They help track your income and expenses. Use a notebook or a computer. Write down every payment you get. Note the date, amount, and payer. This makes things easy. You can check later if needed. Keep all receipts and invoices too. They are proof of your business activities.

Report all your earnings to the tax office. It’s important to be honest. Pay the right amount of taxes. Use the records you kept. They will help you know what to report. This is important for your business. It keeps everything fair and legal.

Enhancing Customer Experience

Customers like to choose how to pay. Providing multiple payment options helps everyone. Credit cards, debit cards, and online payments are popular. Easy payment methods make customers happy. Happy customers return again. They might even tell friends about you. This can bring more work.

Always give a receipt for every payment. It shows trust and care. Customers like to know their money is safe. A receipt is proof. It makes them feel secure. Send a confirmation email after each payment. Include details like amount and date. Customers appreciate clear records.

Frequently Asked Questions

How Can Contractors Accept Credit Card Payments?

Contractors can accept credit card payments by using mobile payment apps, online invoicing platforms, or merchant accounts. These methods streamline transactions, ensuring timely payments and improved cash flow. Mobile apps and platforms like Square or PayPal offer easy integration and user-friendly interfaces for efficient payment processing.

What Are The Benefits Of Accepting Credit Cards?

Accepting credit cards offers numerous benefits, including increased sales, improved cash flow, and enhanced customer convenience. It also reduces payment delays and potential bounced checks. Credit card payments can help build a professional image, attracting more clients and providing a seamless transaction experience for both parties.

Are Credit Card Processing Fees High For Contractors?

Credit card processing fees vary but are generally manageable for contractors. Fees typically range from 2% to 3% per transaction. Some providers offer competitive rates and tailored packages. It’s essential to compare different services to find the best fit for your business needs and budget.

What Equipment Is Needed For Credit Card Payments?

Contractors need a card reader or mobile payment terminal to accept credit card payments. Many providers offer compact, easy-to-use card readers that connect to smartphones or tablets. These devices are affordable and provide secure transactions, ensuring a smooth payment process for both contractors and clients.

Conclusion

Accepting credit card payments boosts your contractor business. Makes transactions simple. Clients enjoy the convenience. Set up secure systems. Use trusted payment processors. Keep fees in mind. Regularly review your payment options. Stay updated with technology. Offer multiple payment methods.

Ensure smooth payment experiences for clients. Maintain clear communication about payment terms. Simplify your billing process. Happy clients lead to repeat business. More payments mean more growth. Implement these strategies today. Watch your business thrive.