Buying a condo can be one of the most exciting investments you’ll ever make. But before you can settle into your new home, there’s a crucial question you need to answer: How much down payment do you need for a condo?

This question often leaves potential buyers puzzled and anxious, but understanding it is key to making a smart financial decision. Imagine the peace of mind that comes with knowing exactly how much you’ll need to save. Picture yourself confidently negotiating with realtors, fully informed and in control.

We’ll break down everything you need to know about down payments for condos, providing you with clear, easy-to-follow information. Whether you’re a first-time buyer or looking to upgrade your living space, gaining this knowledge will put you on the path to a successful condo purchase. So, if you’re ready to take the first step toward your new home, keep reading. Your future self will thank you.

Down Payment Basics

Buying a condo is exciting. The down payment is important. It is usually a percentage of the condo price. Most lenders ask for 20% down. This helps them feel safe. Some loans allow lower down payments. FHA loans might need only 3.5%. VA loans can need 0% down. These options are good for some buyers. But lower down payments have costs. Monthly payments might be higher. Insurance costs might increase too. It’s smart to plan well. Save money early. Know your budget. This makes buying easier.

Condo Market Trends

Urban areas have many condos. They are usually closer to work and schools. Suburban areas offer more space and quieter living. Urban condos can be expensive. People like the city life. Suburban condos may cost less. Families prefer them for more room.

New condo buildings are coming up fast. Builders focus on modern designs. These condos have smart home features. Many people want to live in these new places. They like the updated facilities. Some buildings have gyms and pools. This makes them more attractive.

Typical Down Payment Percentages

A conventional loan often needs a 20% down payment. This is a common choice for many buyers. Some lenders may accept as low as 5%. Higher down payments can lower your monthly payments. It also reduces overall loan costs. A large down payment shows financial strength. It may improve your chances of loan approval. Always check with your lender for exact requirements.

FHA loans are popular for first-time buyers. They usually require a 3.5% down payment. This is lower than most other loans. It helps people with less savings buy a home. FHA loans are backed by the government. This makes them a safer option for lenders. Always check for extra requirements. Some loans may need mortgage insurance. This adds to monthly costs.

VA loans are for veterans. They often require no down payment. This makes them an excellent choice for eligible buyers. USDA loans also offer zero down. They are for rural properties. Both options have strict rules. You must meet specific criteria. This includes income and location. These loans help people buy homes with less upfront cost. Always check if you qualify.

Factors Influencing Down Payment

Credit score is a big factor. Higher scores often mean lower down payments. Banks trust people with good scores. They might ask for less money. Lower scores can mean bigger down payments. Lenders see them as risky. They might want more upfront.

Loan terms affect payments too. Short-term loans might need bigger payments. Long-term loans could have smaller ones. Interest rates also matter. Higher rates can increase down payments.

The property location changes the down payment. City condos might need more money. Rural condos might need less. Prices differ by area. Popular places cost more. Less popular places are cheaper.

Saving Strategies

Create a simple budget. Write down all your expenses. Include rent, food, and fun. Save 10% of your money each month. Avoid buying things you don’t need. Use cash instead of credit cards. This helps you see your spending. Check your budget weekly. Adjust if needed. Find ways to cut costs. Cook at home more often. Use public transport to save on gas. Every dollar saved brings you closer to your condo goal.

Invest your savings wisely. Consider a savings account with good interest. Look into bonds for stable returns. Some people invest in stocks. They can grow your money faster. But be careful. Stocks can be risky. Think about mutual funds. They spread risk across different stocks. Talk to a financial advisor. They can guide you based on your needs. Every investment choice matters. Small steps lead to big savings.

Pros And Cons Of Larger Down Payments

Larger down payments can lower interest rates. Banks see less risk. Lower interest rates mean smaller monthly payments. Families save money over time. This helps with budgeting. Saving for a larger down payment is key. It reduces stress later. Think about your long-term goals. Interest rates affect how much you pay. A small change in rate can save thousands. It’s important to plan wisely.

Big down payments can limit cash availability. Less liquidity means fewer funds for emergencies. Money is tied up in the condo. Access to cash can be crucial. Consider your financial situation. Emergencies happen unexpectedly. Having cash on hand provides security. Balance is important. A big down payment might not be best for everyone. Evaluate your needs carefully.

Alternative Financing Options

Finding the right down payment for a condo can be challenging. Consider alternative financing options to ease the burden. Explore loans, crowdfunding, or partnerships to make condo ownership more accessible.

Gift Funds

Gift funds can help with a condo down payment. These are gifts from family or friends. They make buying a condo easier. The gift must be documented. Lenders need proof of the gift. This shows the money is not a loan. The giver must write a letter. It explains the gift. The letter is important for the lender. It helps to complete the process smoothly.

Down Payment Assistance Programs

Down payment assistance programs offer help with condo purchases. They can reduce the money needed upfront. Many programs are available to first-time buyers. These programs offer grants or loans. They help to pay part of the down payment. Buyers should check local options. Each program has different rules. These programs support those with limited savings. They make owning a condo more accessible.

Legal And Financial Considerations

Buying a condo often means paying HOA fees. These fees help maintain shared areas. Pools, gyms, and gardens are examples. HOA fees vary based on services provided. Some condos charge higher fees. Others might be more affordable. It’s important to budget for these fees. They are usually paid monthly. Not paying can lead to fines. Always ask about the fees before buying.

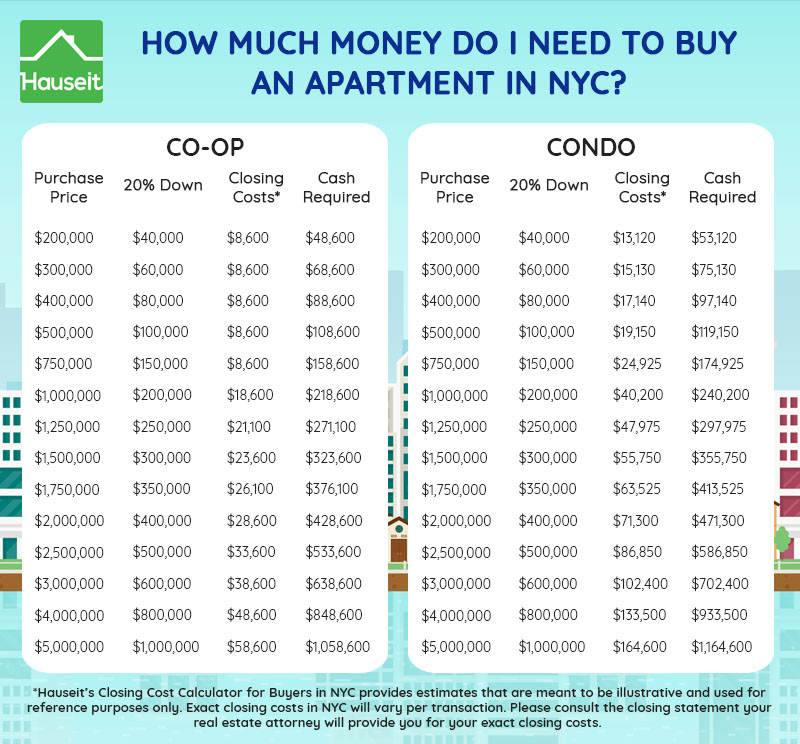

Closing costs are extra fees when buying property. They cover legal paperwork and inspections. These costs can add up quickly. It’s smart to save for them. Closing costs usually range from 2% to 5% of the price. Some sellers help with these costs. Always ask for details. Knowing these costs helps avoid surprises. Being prepared makes buying easier.

Frequently Asked Questions

What Is The Typical Down Payment For A Condo?

The typical down payment for a condo ranges from 3% to 20%. The percentage depends on the loan type and lender requirements. Some government-backed loans may offer lower down payment options. It’s essential to consult with lenders to understand specific requirements for your situation.

Can I Buy A Condo With 5% Down?

Yes, you can buy a condo with 5% down. Several lenders offer mortgage options with as low as 5% down. Ensure you meet the lender’s criteria and check if private mortgage insurance (PMI) is required. Research different lenders to find the best deal for your needs.

Are There First-time Buyer Programs For Condos?

Yes, there are first-time buyer programs for condos. Many programs offer low down payment options or grants. These programs aim to make homeownership more accessible. Check with local housing authorities or lenders for available options in your area to get the best assistance.

Does A Bigger Down Payment Affect Mortgage Rates?

Yes, a bigger down payment can affect mortgage rates. Lenders often offer better rates for larger down payments. A substantial down payment reduces the lender’s risk. It also lowers your loan amount, potentially saving you money on interest over time.

Conclusion

Choosing the right down payment is crucial for buying a condo. It impacts monthly payments and interest rates. Smaller down payments mean higher monthly costs. Larger ones can save money over time. Research and planning help make smart financial decisions.

Check your budget. Assess your savings. Every buyer’s situation is unique. Speak with a mortgage expert for personalized advice. They can guide you based on your financial goals. Consider future expenses too. Maintenance fees, taxes, and insurance add up. Make sure your choice fits your long-term plans.

Proper planning ensures a smooth home-buying experience.