Missing a car payment can be stressful. If you’re worried about how many payments you can miss before your car gets repossessed, you’re not alone.

Understanding the process can help you avoid the dreaded knock on the door from the repo man. You might be juggling bills, trying to stretch your paycheck, or dealing with unexpected expenses. Whatever the reason, it’s crucial to know what you’re up against.

You’ll discover the number of payments you can typically miss before facing repossession, why acting quickly can save you money, and how to keep your car even when times are tough. Don’t let uncertainty keep you up at night—arm yourself with knowledge and find out how to protect your investment.

Repossession Process

Missed car payments can lead to losing your vehicle. Lenders have rules. Most allow two to three missed payments. They might start the repossession process after this. Communication with your lender is key. Tell them if you have trouble paying. Some offer help or plans. This can avoid repossession. Repossession costs money. You might pay fees. Your credit score may drop. This makes future loans hard to get. Protect your car and credit. Pay on time or talk to your lender. It’s important to know your rights. Read your loan contract. It shows what the lender can do. Follow rules and avoid losing your car.

Factors Influencing Repossession

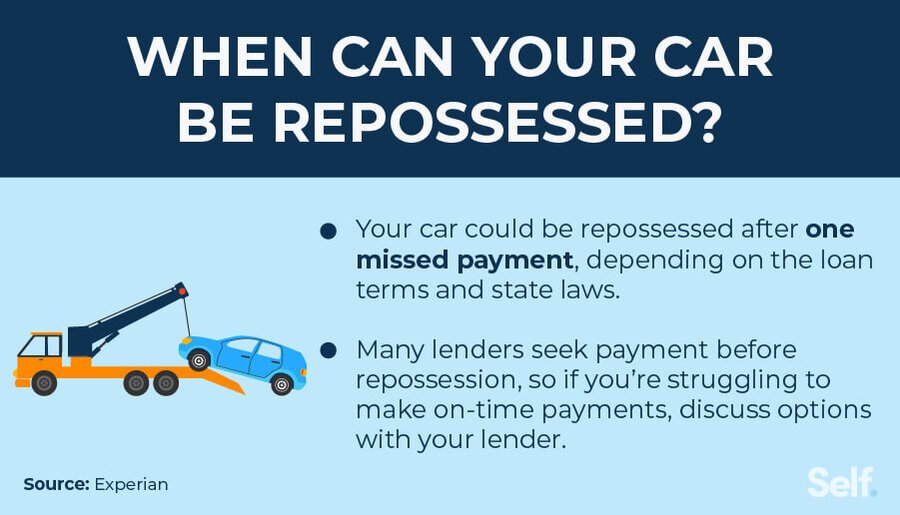

State laws can decide how soon a car is taken back. Some states allow repossession after one missed payment. Others may give more time. Lender policies also matter. Some lenders are strict. They may act quickly. Others might offer a grace period. Loan agreement terms are crucial. The agreement tells you the rules. It lists the number of missed payments allowed. Always read this document carefully. It helps you know your rights. You will avoid surprises if you do.

Typical Timeline For Repossession

Missing a car payment can be stressful. Most lenders will not act harshly right away. They might send a reminder. It’s a gentle nudge to pay soon. Interest and late fees might add up. Keep an eye on these costs. Paying on time is crucial.

Missing two payments is more serious. Lenders begin to worry more. They might call or send letters. Communication is key. Talk to the lender if you can. Making a payment plan might be possible. Ignoring calls is risky.

After two missed payments, lenders may send a final warning. This means repossession is close. Paying the missed payments can help. Some lenders offer a grace period. Use it wisely to catch up. Staying in touch with lenders is crucial.

Consequences Of Repossession

Repossession can harm your credit score. It stays on your report for years. This makes loans harder to get. Your score drops fast. Lenders might see you as risky. It’s tough to fix the damage. Pay bills on time to prevent this.

Missing car payments can lead to financial trouble. You may owe more money. Fees can add up quickly. Interest rates might rise. Debt can pile up. Paying off the car becomes harder. Budgeting gets tight.

The car can be taken away if payments are missed. This is called repossession. You lose your vehicle and transportation. Getting to work becomes difficult. Daily life can be disrupted. Buying another car might not be easy.

Avoiding Repossession

Talking to your lender can be very helpful. They might offer solutions. Explain your situation clearly. Show your willingness to pay. This can help in avoiding car repossession. Many lenders appreciate honesty and effort. They may provide temporary solutions. Always keep records of your communication. It can be useful later.

Loan modification can make payments easier. Lenders may change your payment plan. This could lower your monthly payment. It might extend your loan term. This means more time to pay. Modification can provide financial relief. Always ask your lender about this option. It can be a good solution for many.

Refinancing is another choice. It involves getting a new loan. This pays off your old loan. The new loan might have a lower interest rate. This can reduce your monthly payment. It can make payments more affordable. Talk to your lender about refinancing options. Many people find this helps them a lot.

Legal Rights And Protections

Missing car payments can lead to repossession after two or three missed payments. Lenders usually outline their terms. Always review your loan agreement to know your rights.

Consumer Protection Laws

Consumer protection laws guard people from unfair practices. These laws can help when facing repossession. They ensure fairness in loan agreements and repossession processes. Lenders must follow these laws strictly. If they don’t, they face penalties. It’s important to know these laws to protect yourself.

Right To Reinstate Loan

Reinstating your loan is possible in some states. This means you can bring your loan current. You pay the missed payments and fees. This option helps avoid repossession. It’s vital to act quickly. The faster you pay, the better the chances of keeping your car.

Right To Redeem Vehicle

Redemption lets you reclaim your car. You pay off the entire loan balance. This includes any fees and charges. It’s a last resort option. It requires a large amount of money. Knowing your rights can save your vehicle. Always ask your lender about this option.

Alternatives To Repossession

Voluntary repossession means returning your car to the lender. This can be a smart choice if you can’t pay anymore. It might hurt your credit score, but less than forced repossession. Talk to your lender before making this move. They may offer help or new payment plans. Always ask questions and know the facts.

Debt counseling services help people who struggle with money. They offer advice to manage your debts better. Experts teach you how to budget and save. They may talk to lenders on your behalf. This could lead to new payment plans. Learning from them can prevent future issues.

Selling your car is another choice. Use the money to pay off your loan. This keeps your credit score safe. It’s better than repossession. Find a good buyer or trade it in. Check car value before selling. Use online tools to know the worth.

Frequently Asked Questions

How Many Payments Can I Miss Before Repossession?

Typically, lenders may start repossession after two or three missed payments. However, this depends on your loan agreement. Communicate with your lender to explore options. Early action can prevent repossession and protect your credit score.

What Happens After My Car Is Repossessed?

After repossession, the lender may sell the vehicle to recover the loan balance. You might still owe a deficiency balance if the sale doesn’t cover the full amount. It’s crucial to understand your rights and seek legal advice if necessary.

Can I Negotiate With My Lender To Avoid Repossession?

Yes, lenders often allow negotiations to avoid repossession. Options may include loan modification, deferment, or refinancing. Contact your lender as soon as you anticipate difficulty making payments. Early communication is key.

Is A Grace Period Offered For Car Payments?

Some lenders offer a grace period of 10-15 days after the due date. This varies by lender and loan agreement. Always check the terms of your loan to understand your specific grace period and avoid late fees.

Conclusion

Understanding missed car payments is crucial. Avoiding repossession is vital for peace of mind. Consistent communication with your lender can help. Acting early can prevent problems. Financial challenges happen. Know your options and plan wisely. Create a budget. Stick to it.

Explore refinancing or loan modification. These steps can ease financial pressure. Remember, being proactive is key. Protect your credit score. Secure your financial future. Stay informed and make timely payments. This knowledge empowers you. Stay ahead and keep your car.