Have you ever hired a contractor and found yourself wondering how long they have to collect payment from you? Or perhaps you’re a contractor yourself, unsure about the timeline for invoicing your clients.

Understanding the time frame for payment collection is crucial for maintaining a smooth financial relationship between contractors and clients. It ensures that you’re neither caught off guard by a surprise bill nor left hanging waiting for the money you’re owed.

We’ll uncover the common practices and legal guidelines surrounding payment collection for contractors. By the end, you’ll have a clear picture of what to expect, empowering you to handle your financial dealings with confidence and peace of mind. Keep reading to ensure you’re both compliant and efficient in your transactions, ultimately saving you time, stress, and potentially costly misunderstandings.

Legal Timeframes For Payment Collection

Contractors often agree on payment terms with clients. These terms tell when to expect money. Usually, the terms are between 30 to 90 days. Some contracts have strict rules. Others allow more time. Understanding these terms is key. It helps contractors plan their finances.

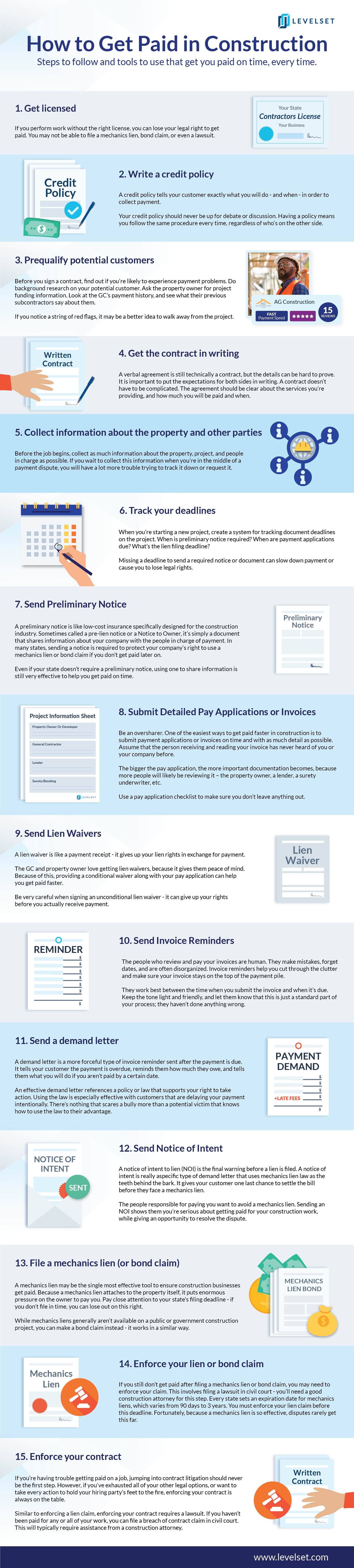

Lien rights protect contractors. They can claim a lien if not paid. Deadlines are crucial. Missing them can mean losing rights. Each state has its own rules. Some states give 60 days to file. Others give 90 days. Contractors must know their state’s rules. This knowledge ensures they get paid on time. It avoids legal problems too.

Factors Affecting Payment Deadlines

Contracts are important for payment terms. They tell the deadline for payments. Clear contracts avoid confusion. They help both sides know their duties. Some agreements give 30 days for payment. Others might give more or less time. Always read the contract carefully. This helps to know what is expected. Missing a deadline can cause problems. Paying late might mean extra fees. Sometimes, contracts have special rules. These rules can change the payment time. Always ask questions if the contract is unclear.

Each state has its own rules. These rules say how long to wait for payment. Some states have very strict laws. They might say pay within 15 days. Others might give more time. It is important to know your state’s law. This helps avoid mistakes. Not following state rules can lead to fines. Contractors should always check state rules. Knowing them helps in getting paid on time. Always stay informed about changes. This keeps you on the right path.

Impact Of Delayed Payments

Financial Consequences can be severe for contractors. They may struggle to pay bills. Late payments can hurt their cash flow. It affects their ability to buy materials. Contractors might face penalties for late payments. They could lose trust with clients. This impacts their reputation badly. Some may need loans to stay afloat. Paying interest adds to their costs. Their profits can shrink over time. Contractors need timely payments.

Project Delays are another issue. Without money, work slows down. Workers may leave if not paid. This causes delays in project timelines. Materials can be hard to buy. Equipment might not be available. Work quality can drop. Clients might get upset. Projects can go over budget. Deadlines can be missed. Everyone involved may face stress. Timely payments help prevent these problems.

Strategies For Timely Payment Collection

Contractors often face challenges in payment collection. Timely strategies are crucial. Contracts usually specify payment terms, but local laws may influence collection deadlines. Understanding these factors helps contractors ensure they receive payments within the allowed timeframe, safeguarding their business operations.

Effective Communication

Clear communication helps contractors collect payment on time. Talk with clients often. Use simple words. Make sure clients know what they owe. Send reminders by email or text. Ask if they have questions. Keep messages polite and friendly. Listening is also important. Hear what clients say. Solve their problems quickly. Good communication builds trust. Trust leads to fast payments.

Documentation And Record Keeping

Keeping records is key for timely payments. Write down every job detail. Note dates and amounts. Use easy-to-read formats. Keep receipts and invoices. Show clients these records if needed. This stops confusion. Clear records help prove work is done. It makes payment collection simple. Contractors should store records safely. Use digital files or paper folders. Well-kept records speed up payment processes.

Legal Recourse For Unpaid Invoices

Contractors often have limited time to collect unpaid invoices. Typically, the timeframe can range from 90 days to a few years, depending on local laws. Missing this deadline may result in losing the right to collect payment. Understanding these deadlines is crucial for contractors to secure their earnings.

Filing A Mechanics Lien

A mechanics lien is a tool contractors can use. It helps ensure payment for work done. Filing this lien puts a claim on a property. This claim is for unpaid work or materials. The lien warns property owners to pay. Without payment, the property might be sold. The sale pays the contractor. This process varies by state. Each state has different rules and timelines. Understanding these rules is crucial.

Pursuing Legal Action

Another option is to take legal action. This involves going to court. A judge will listen to the case. The court can order payment for the work. This process can be long and costly. It is important to have proof of the unpaid work. Contracts, invoices, and emails can help. These documents show what was agreed and done. A lawyer can help guide this process. Legal action should be the last step.

Best Practices For Contractors

Good terms help contractors get paid on time. Clear payment terms are important. Make sure the contract is easy to understand. Set a due date for payments. Talk about late fees. This can help you get paid faster. Agree on payment methods. Some clients prefer checks. Others like online payments. Clear terms keep everyone happy.

Payment tools can help a lot. Use invoices to remind clients to pay. Send them on time. Payment apps can track payments. Apps like PayPal are helpful. They make paying easy. Some tools send alerts for late payments. Tracking tools help see who paid and who didn’t. This keeps payment organized.

Frequently Asked Questions

How Long Do Contractors Have To Invoice Clients?

Contractors typically have up to 90 days to invoice clients. This period can vary based on contract terms and local laws. Always check the contract for specific invoicing deadlines. Timely invoicing helps ensure prompt payment and avoids disputes.

What Is The Payment Collection Timeframe For Contractors?

The payment collection timeframe varies by contract and state laws. Generally, it’s between 30 to 90 days after invoicing. It’s crucial to review your contract for specific payment terms. Adhering to these terms ensures smooth transactions.

Can Contractors Charge Late Fees For Overdue Payments?

Yes, contractors can charge late fees if outlined in the contract. It’s important to specify the fee percentage and grace period. This encourages timely payments and compensates for delays. Ensure clients are aware of this clause.

What Happens If A Contractor Doesn’t Collect Payment In Time?

If a contractor doesn’t collect payment in time, they may face cash flow issues. Legal action might be necessary to recover funds. Reviewing contract terms and maintaining open communication with clients can prevent such issues.

Conclusion

Understanding payment timelines is crucial for contractors. Clear agreements prevent disputes. Always check state laws for specific deadlines. Knowing your rights helps in collecting payments on time. Communicate effectively with clients to avoid misunderstandings. Keep records of all transactions for proof.

Timely invoicing plays a vital role. Late payments can disrupt cash flow. Contractors should follow up persistently but politely. Seek legal advice if payments delay excessively. Awareness empowers contractors to manage finances better. Stay informed and proactive to ensure smooth payment processes.

This knowledge safeguards your business and maintains good client relationships.