Are you ready to take control of your finances and make informed decisions about your mortgage? Understanding how much you’ll pay each month can feel overwhelming, but what if I told you there’s a simple way to calculate your mortgage payment using a tool you already know and love?

With Google Sheets, you can easily break down your mortgage costs and plan your financial future with confidence. In this guide, you’ll discover step-by-step instructions that transform complex calculations into manageable tasks. Imagine the peace of mind you’ll feel knowing exactly what to expect each month.

Dive in, and learn how to harness the power of Google Sheets to master your mortgage payments effortlessly!

Setting Up Google Sheets

Start by opening Google Sheets. Click on the Blank option to create a new spreadsheet. Name your sheet for easy reference. Choose a clear name like “Mortgage Calculator”. This helps keep things organized.

Use columns for different data types. Label columns as Loan Amount, Interest Rate, and Loan Term. This makes it easy to input data. Each column should have a clear header. Type numbers below these headers. These numbers will help in calculations.

Mortgage Payment Basics

The principal is the loan amount you borrow. It’s the base of your loan. The interest is the fee for borrowing money. It’s a percentage of the principal. You pay both with each mortgage payment. Over time, the principal decreases. The interest amount also drops. This is because it’s based on the remaining principal.

Loan terms tell how long you’ll pay the loan. They can be 15 or 30 years. A shorter term means higher monthly payments. But, you pay less interest over time. A longer term has lower monthly payments. Yet, you pay more interest in total. It’s important to choose wisely. Your budget matters.

Using The Pmt Function

The PMT function helps in calculating mortgage payments. It’s easy to use. The syntax is PMT(rate, nper, pv). Here, rate is the interest rate. nper stands for the number of payments. pv is the present value or loan amount. All inputs are necessary for the function to work.

Open Google Sheets on your computer. Click on a cell where you want the result. Type =PMT and open a bracket. Fill in the details: rate, nper, pv. Close the bracket and press Enter. The result shows your monthly payment. Ensure all values are correct. Double-check for any errors. It’s that simple!

Inputting Loan Details

Start by typing the loan amount into a cell in Google Sheets. This is the total money borrowed from the bank. Use numbers only, no commas or symbols. Make sure the amount is correct. Double-check for mistakes. This helps in getting the right results.

Enter the interest rate in another cell. It is the percentage charged by the bank. Write it as a decimal. For example, 5% becomes 0.05. This is important for the calculation. Without it, the payment won’t be accurate. Stay careful with the decimal point.

Next, add the loan duration in years. Place it in a separate cell. This shows how long you have to pay back. Longer duration means smaller payments. Shorter duration means larger payments. Always use whole numbers. No fractions or words here.

Calculating Monthly Payment

Use Google Sheets to find your mortgage payment. Type in the loan amount, interest rate, and loan term. Use the formula =PMT(rate/12, term12, -loan_amount). This gives you the monthly payment.

Payment can be monthly, weekly, or bi-weekly. Change the formula for this. For weekly, change rate/12 to rate/52. Change term12 to term52. For bi-weekly, use rate/26 and term26. This helps you see different options.

Check your work to be sure. Compare with an online calculator. Make sure the numbers match. Errors can happen. Double-check all inputs. Keep your sheet updated. This will help you trust your results.

Exploring Additional Features

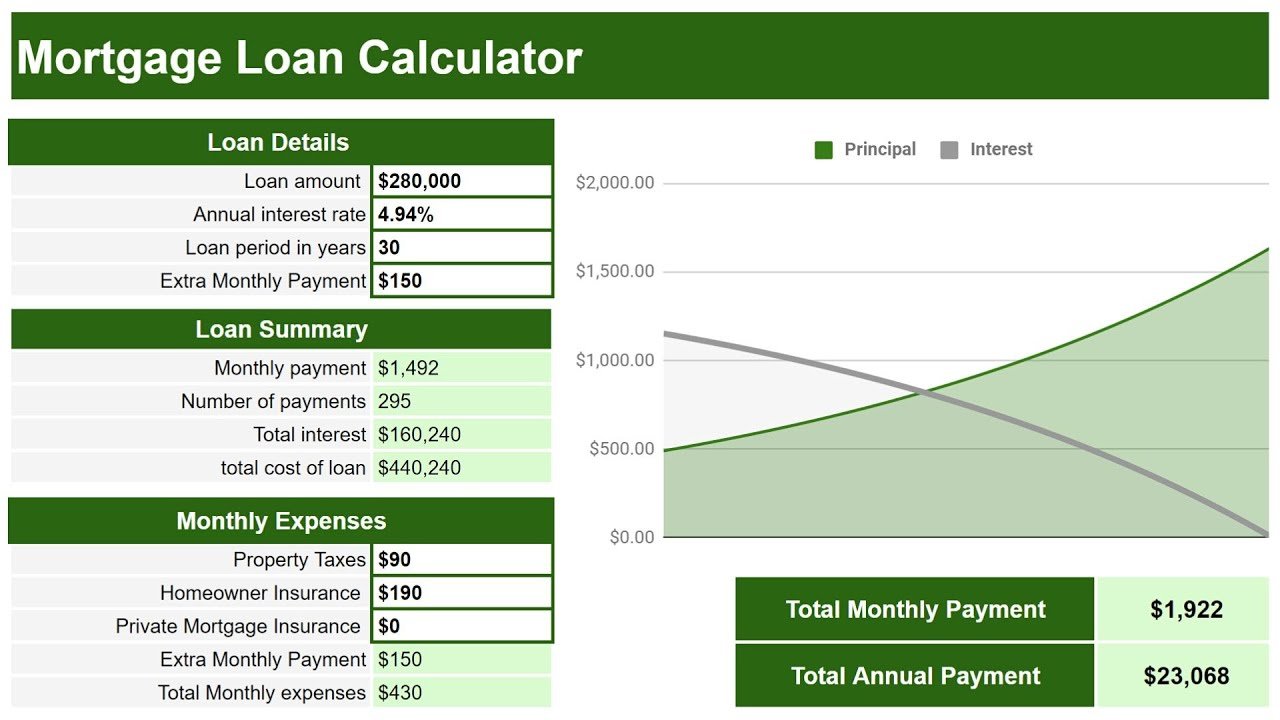

Discover extra tools in Google Sheets for calculating mortgage payments easily. Use built-in functions to create a clear payment plan. Adjust variables like interest rates and loan terms to see different outcomes.

Creating A Payment Schedule

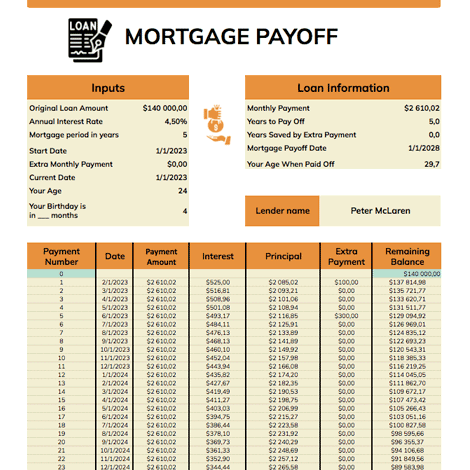

Payment schedules help plan better. Start by setting up columns. Label them as Date, Payment Amount, and Remaining Balance. Enter your monthly payment in the first row. Use Google Sheets formulas to update the balance. Each month, subtract the payment from the balance. Copy and paste to fill the rows. This creates a clear schedule.

Adding Extra Payments

Add extra payments to reduce debt faster. Create a new column titled Extra Payments. Enter the amount you plan to pay each month. Use formulas to adjust the balance. Extra payments reduce interest over time. Track these payments to see changes in balance. This helps in managing finances better.

Troubleshooting Common Issues

Calculating mortgage payments in Google Sheets involves using simple formulas. Input loan amount, interest rate, and term length. Use the PMT function to compute the monthly payment automatically, helping you track finances with ease.

Formula Errors

Formula errors can confuse users. Ensure your formula syntax is correct. Check for extra spaces and wrong symbols. A missing parenthesis can cause problems. Verify each part of the formula. Use Google Sheets help for guidance. Correct formulas ensure accurate results.

Incorrect Results

Incorrect results are frustrating. Check input values first. Make sure interest rates and loan amounts are accurate. Double-check the number format in the cells. Ensure the formula is referencing the right cells. Small mistakes can lead to big errors. Review your steps carefully.

Frequently Asked Questions

How Do I Use Google Sheets For Mortgage Calculation?

Google Sheets simplifies mortgage calculations using built-in functions. Use the PMT function to calculate monthly payments. Input the loan amount, interest rate, and loan term. This function returns the exact monthly payment, helping you efficiently manage your budget.

What Is The Pmt Function In Google Sheets?

The PMT function in Google Sheets calculates the periodic payment for a loan. It requires inputs like interest rate, number of periods, and loan amount. This function is essential for determining your monthly mortgage payments accurately.

Can I Create A Mortgage Payment Schedule In Sheets?

Yes, you can create a mortgage payment schedule in Google Sheets. Use functions like PMT, PPMT, and IPMT. These functions help you calculate principal and interest amounts over time. Customize the schedule by adjusting loan terms and interest rates.

Is Google Sheets Accurate For Mortgage Calculations?

Google Sheets is accurate for mortgage calculations when using the correct functions. The PMT, PPMT, and IPMT functions provide precise results. Ensure inputs like interest rates and loan terms are correct for accurate outcomes.

Conclusion

Calculating mortgage payments in Google Sheets is straightforward. The steps are simple. Input loan details, interest rate, and term. Use built-in functions to compute results. This method saves time and ensures accuracy. No need for complex software. Just your Google account and a bit of practice.

The process becomes second nature with use. Now, you can manage payments effectively. Keep track of finances with ease. Your mortgage calculations are just a few clicks away. Enjoy the simplicity and control Google Sheets offers. Happy calculating!