Are you looking to transfer money from your Netspend account to your bank account but aren’t quite sure how to do it? You’re in the right place.

Handling finances can sometimes feel overwhelming, especially when you’re trying to navigate between different accounts. But don’t worry—you’re not alone in this. Many people are eager to discover the simplest, most effective way to move their money seamlessly. In this guide, we’ll break down the process into straightforward steps, ensuring you gain control over your financial transactions without unnecessary stress.

By the end of this article, you’ll feel confident in your ability to manage your funds with ease. Ready to unlock the secrets to hassle-free money transfers? Let’s dive in.

What Is Netspend?

Understanding Netspend is crucial for managing your finances effectively. Netspend offers prepaid debit cards, which provide a convenient way to handle money. With these cards, users can make purchases, pay bills, and receive direct deposits. It’s a financial tool designed for those who seek alternatives to traditional banking.

What Services Does Netspend Offer?

Netspend provides several services to meet diverse financial needs. These include direct deposits, online account management, and mobile app access. Users can easily load funds through various methods, ensuring flexibility. With Netspend, managing money becomes straightforward and accessible.

How Does Netspend Work?

Netspend operates by offering prepaid debit cards, which users can load with funds. These cards work like regular debit cards, allowing seamless transactions. Users can monitor their account online or via a mobile app. This setup provides a simple way to keep track of expenses.

Who Can Benefit From Netspend?

Netspend is ideal for individuals without traditional bank accounts. It serves those who need an alternative to conventional banking systems. Students, travelers, and budget-conscious individuals find it useful. The service ensures financial access without the need for a bank.

Are There Any Fees With Netspend?

Netspend charges fees for certain transactions and services. Users may encounter fees for card activation, ATM withdrawals, and monthly maintenance. Understanding these fees is essential for effective financial planning. It’s important to review the fee structure before using the service.

Benefits Of Using Netspend

Transferring money from Netspend to a bank account offers flexibility and convenience. With a few simple steps, users can easily manage their finances and ensure funds are available when needed. Netspend’s straightforward process supports efficient fund transfers, making it an accessible option for those seeking seamless financial transactions.

Netspend has become a popular choice for managing money, offering a range of benefits that cater to diverse financial needs. Whether you’re looking to simplify your budgeting process or need a reliable way to access funds, Netspend presents practical advantages that can make your financial life easier. Let’s dive into the benefits of using Netspend.

Convenience And Accessibility

Netspend offers the convenience of accessing your money anytime, anywhere. Imagine being on a vacation and needing cash urgently; with Netspend, you can withdraw funds from ATMs effortlessly.

The prepaid card system is accessible to everyone, even if you don’t have a traditional bank account. This feature ensures that you can manage your finances without the hurdles often associated with banking services.

Budgeting Made Simple

Do you find it challenging to stick to a budget? Netspend can be your ally in managing expenses. By loading a specific amount onto your card, you can control spending without the risk of overdrawing.

This prepaid approach helps you track your spending efficiently. You can even receive alerts and notifications, keeping you informed about your transactions and balance.

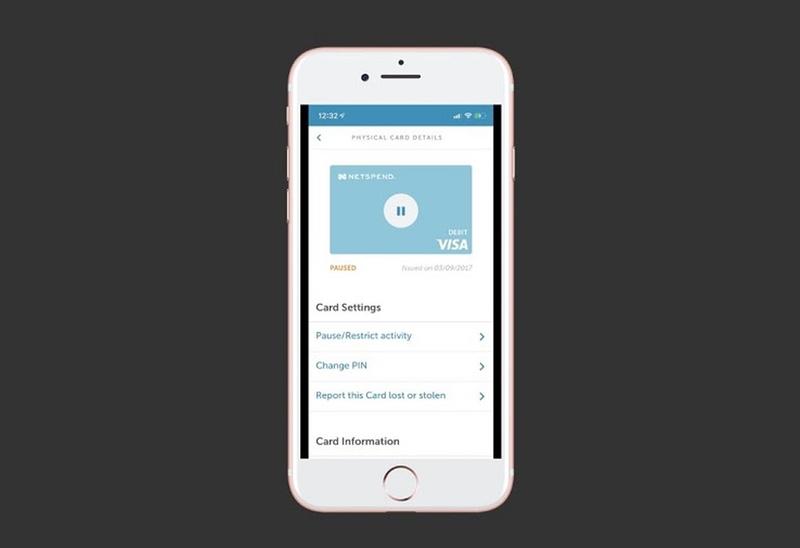

Security And Peace Of Mind

Security is a top priority with Netspend. The card is protected with PIN and encryption technology, ensuring that your money remains safe.

Consider a scenario where you lose your card; Netspend allows you to freeze your account instantly. This feature provides peace of mind, knowing you can act promptly to protect your funds.

Easy Online Shopping

Love shopping online but wary of using your bank account? Netspend cards can be used for online purchases without revealing your bank details.

This capability not only safeguards your financial information but also offers flexibility in choosing where and how you shop. Enjoy the freedom of exploring new stores without the worry of compromising sensitive data.

Direct Deposit Benefits

Netspend simplifies receiving funds with its direct deposit feature. Whether it’s your paycheck or government benefits, you can have them deposited directly onto your card.

This seamless process means no more trips to the bank. You can access your money immediately, saving time and energy for other activities.

Do these benefits make you consider using Netspend for managing your finances? With its wide-ranging advantages, Netspend stands as a practical tool for enhancing your financial experience.

Netspend Transfer Options

Netspend provides various options to transfer money to your bank account. These methods offer flexibility and convenience for users. Understanding these options can help manage your finances better.

Direct Deposit

Direct deposit is a popular choice for many Netspend users. This method allows automatic transfer of funds to your account. You can set up direct deposit with your employer. It ensures timely receipt of your salary. Direct deposit is safe and efficient. It removes the need for physical checks.

Bank Transfers

Bank transfers offer another way to move funds from Netspend. You can link your bank account to your Netspend account. This connection enables easy money transfers. You need to provide your bank details accurately. Bank transfers may take a few days to process. Ensure you check your bank’s policies for any fees.

Setting Up A Bank Account Link

Transferring money from Netspend to a bank account involves linking both accounts. This process allows easy movement of funds. Most users find it convenient for managing finances efficiently.

Setting up a bank account link with your Netspend account is a straightforward process that allows you to seamlessly transfer money. Imagine the convenience of moving funds between accounts with just a few clicks. Whether you’re paying bills or saving for a rainy day, linking your bank account can simplify your financial management.

Gathering Necessary Information

Before you begin, ensure you have all the essential details at hand. You’ll need your bank’s routing number, which is typically a nine-digit code used to identify your bank in the United States. Additionally, your bank account number will be required. This number is usually found on your checks or your bank statements.

Having these numbers ready will streamline the linking process. Double-check them to avoid any errors that could delay your setup. Have you ever typed in the wrong number and spent hours trying to fix it? Save yourself the hassle!

Steps To Link Account

Once you have the necessary information, the next step is to log into your Netspend account. Navigate to the account settings or money management section. Look for the option to add or link a bank account.

Select this option and input your bank’s routing number and your account number. Verify the information to ensure it’s correct. This step is crucial, as even a small mistake can lead to transaction issues.

After entering the details, follow any additional prompts to complete the linking process. You might need to confirm your identity or verify the account through small deposits. These steps ensure security and accuracy.

Have you ever thought about how linking accounts can make budgeting easier? With the ability to move money efficiently, you can better manage your expenses and savings. Consider the possibilities that this small setup can bring to your financial life.

Transferring Money From Netspend To Bank

Transferring money from a Netspend account to a bank account is possible. Begin by linking your bank account to your Netspend account. Follow the prompts to complete the transfer.

Transferring money from your Netspend account to a bank account might seem like a daunting task. You might wonder if it’s even possible or how long it might take. Worry not, as this process is straightforward and can be done with a few simple steps. Let’s break it down, so you can manage your finances more effectively.

Initiating The Transfer

To start, ensure your Netspend account is linked to your bank account. You might have already done this when you set up your account. If not, log in to your Netspend account and add your bank account details.

Once linked, navigate to the transfer section in your Netspend account. Select the option to transfer funds to your bank account. Enter the amount you’d like to transfer and confirm the details. It’s crucial to double-check this information to avoid any errors.

Have you ever mistakenly sent money to the wrong account? It’s a hassle you don’t want to experience. Taking a moment to verify your details can save you from unnecessary stress.

Expected Timeframe

You might be curious about how long this transfer will take. Typically, transferring funds from Netspend to a bank account can take one to three business days.

Imagine needing to pay a bill urgently. Knowing the timeframe can help you plan better and avoid late fees. It’s always wise to initiate the transfer a few days in advance if you have a deadline to meet.

Sometimes, the transfer might happen faster. It depends on your bank’s processing speed. Keep an eye on your bank account to see when the funds appear, so you can manage your budget efficiently.

Have you ever wondered why some transactions are quicker than others? It’s often a mix of bank policies and the time you initiate the transfer. Early transfers in the day can sometimes process quicker, giving you peace of mind.

Fees Associated With Transfers

Transferring money from Netspend to a bank account may incur fees. These fees can vary based on the transfer method chosen. Always check with Netspend for the latest fee details before initiating a transfer.

Transferring money from your Netspend account to a bank account can be a convenient way to manage your finances. However, understanding the fees associated with these transfers is essential to avoid unexpected costs. Whether you’re a seasoned Netspend user or new to this service, being informed about these fees will help you make smarter financial decisions.

Common Fees

When transferring money from Netspend to a bank account, you might encounter several types of fees. Transaction fees are common and can vary depending on the method of transfer. For instance, direct bank transfers might have a lower fee compared to wire transfers.

Additionally, there could be currency conversion fees if you’re transferring money across borders. Keep an eye on these charges, especially if you’re handling international transactions. These fees can quickly add up and eat into your savings.

Some banks may also charge an incoming wire fee, so it’s crucial to check with your bank beforehand. Knowing these potential costs can help you plan better and avoid surprises.

Ways To Minimize Costs

Minimizing costs when transferring money is possible with a few strategic moves. First, consider consolidating your transfers. Instead of making multiple small transfers, aim for fewer, larger transfers to cut down on transaction fees.

Another tip is to compare different transfer methods. Sometimes using an alternative service might offer a better rate or lower fee. It’s wise to explore all your options before deciding on a transfer method.

You can also consider setting up alerts for lower fees or promotional offers. Some services offer occasional discounts or reduced fees for transfers. Keeping an eye out for these opportunities can save you money in the long run.

Have you ever been surprised by a hefty fee when transferring money? It’s an experience no one enjoys. By understanding and managing these fees, you can keep more of your hard-earned money where it belongs—safely in your bank account.

Troubleshooting Common Issues

Transferring money from a Netspend account to a bank account can be tricky. Ensure your bank account is linked correctly. Contact customer service if issues arise during the transfer process.

Troubleshooting common issues when transferring money from Netspend to a bank account can save you both time and frustration. You might encounter a few hiccups along the way, but understanding these issues and having solutions ready can make the process smoother. Whether it’s a failed transaction or a delayed transfer, being prepared can ease your stress and keep your finances on track.

Failed Transactions

It’s frustrating when a transaction doesn’t go through. This could happen for several reasons. Have you double-checked the bank account details you entered? A single wrong digit could be the culprit.

Is there enough balance in your Netspend account to cover the transfer and any associated fees? Ensuring your account is sufficiently funded is essential.

Sometimes, failed transactions occur due to system outages. Consider waiting a few minutes before trying again. If the issue persists, reaching out to Netspend’s customer service can provide clarity and assistance.

Delayed Transfers

It’s not uncommon to experience delays when transferring money. While immediate transactions are often expected, they can sometimes take a few business days to complete.

Have you considered weekends and public holidays? They can extend the transfer time.

If you’ve waited longer than expected, it might be a good idea to contact your bank and Netspend to check if there’s an issue. Remember, clear communication can help resolve delays more quickly.

As you navigate these challenges, keeping these tips in mind can empower you to handle them more effectively. Have you experienced these issues before? How did you handle them? Sharing your experiences and solutions can benefit others facing similar situations.

Security Considerations

Transferring money from Netspend to a bank account requires careful attention to security. Ensure your account details are accurate. Use secure connections and trusted networks to safeguard your financial information.

Transferring money from a Netspend account to a bank account is a convenient feature that many users appreciate. However, it’s crucial to prioritize security during this process. Understanding the potential risks and how to mitigate them can safeguard your finances and personal information. Let’s delve into some essential security considerations to keep in mind.

Protecting Personal Information

Keeping your personal information secure is paramount when transferring money. Always ensure that your Netspend account information, like passwords and PINs, is strong and unique. Use a mix of letters, numbers, and symbols to create a robust password.

Regularly update your passwords and avoid using the same password across multiple platforms. This simple step can drastically reduce the risk of unauthorized access to your accounts.

Consider enabling two-factor authentication (2FA) if available. This adds an extra layer of security by requiring a second form of verification, such as a code sent to your phone. Have you ever thought about how much more secure your accounts could be with 2FA?

Recognizing Scams

Scams are a real threat in the digital world, and being vigilant can protect you from falling victim. Be wary of unsolicited emails or messages claiming to be from Netspend or your bank. These are often phishing attempts trying to steal your login details.

Never click on links or download attachments from unknown sources. Scammers use these tactics to gain access to your personal information. Always verify the authenticity of a message by contacting the institution directly through official channels.

Remember, no legitimate company will ask for your password or PIN via email or text. If something feels off, trust your instincts and investigate further. Have you ever received a suspicious message and wondered if it was a scam?

Ensuring the security of your financial transactions is not just about protecting your money, but also your peace of mind. By staying informed and cautious, you can enjoy the convenience of transferring money without unnecessary worry.

Alternatives To Netspend Transfers

Transferring money from Netspend to a bank account is possible with a few steps. Use the Netspend website or app to link your bank account. Then, initiate the transfer process to move your funds securely and efficiently.

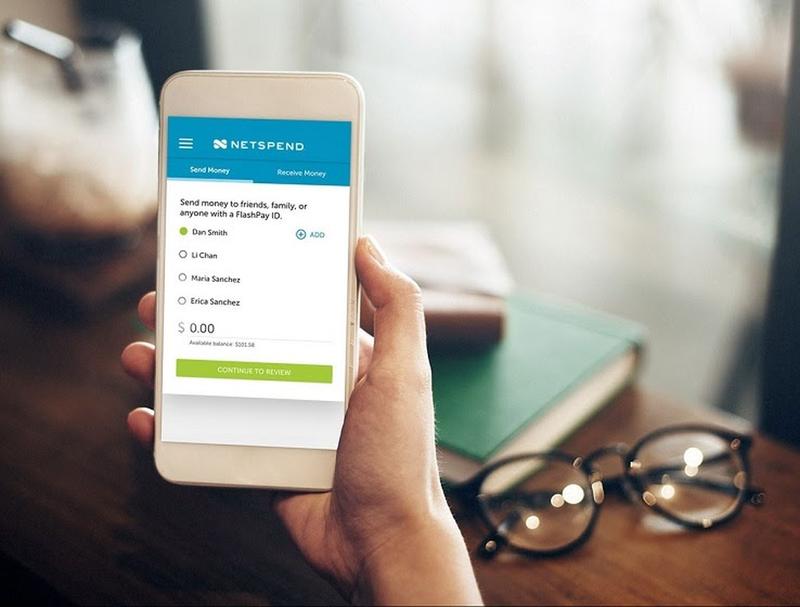

When seeking ways to transfer money from Netspend to a bank account, exploring alternatives can be beneficial. Many users prefer options offering flexibility and convenience. Discovering other prepaid cards or digital wallets can enhance your financial transactions. These alternatives provide ease and can cater to various needs. Below, explore two popular options that serve as effective alternatives to Netspend transfers.

Other Prepaid Cards

Prepaid cards are a versatile choice for managing funds. They allow users to load money and use it securely. These cards often come with fewer restrictions than traditional bank accounts. Many prepaid cards support direct transfers to bank accounts. This feature makes them a practical option for users seeking simplicity. Prepaid cards usually charge lower fees for transactions. Some popular prepaid cards include PayPal Prepaid MasterCard and American Express Serve.

Digital Wallets

Digital wallets provide modern solutions for money management. They offer users the ability to store funds electronically. With digital wallets, transferring money to bank accounts is swift. Users enjoy the convenience of managing finances through apps. Popular digital wallets include PayPal, Venmo, and Google Pay. These platforms often have user-friendly interfaces. They enable seamless transfers with minimal effort. Digital wallets also support linking with multiple accounts for flexibility.

Frequently Asked Questions

How Do I Transfer Money From Netspend To A Bank Account?

To transfer money, log into your Netspend account. Navigate to the “Transfer” section and select “Transfer to Bank. ” Enter your bank account details and amount. Confirm the transaction. Processing time may vary, often taking 1-3 business days.

Are There Fees For Transferring From Netspend?

Netspend may charge a fee for transferring funds to a bank account. Fees depend on the transfer method and account type. Check your account terms and conditions for specific charges. Always review fees before confirming any transaction.

How Long Does Netspend Transfer Take?

Netspend transfers typically take 1-3 business days to complete. The time depends on bank processing times and transaction method. Ensure your bank details are correct to avoid delays. Check your bank account regularly for updates.

Can I Transfer Money Using Netspend App?

Yes, you can transfer money using the Netspend app. Log in, select “Transfer,” and choose “Transfer to Bank. ” Enter your bank details and confirm the transaction. The app offers a convenient way to manage transfers on the go.

Conclusion

Transferring money from Netspend to a bank account is simple. Follow the steps outlined. Ensure you have all the necessary account details ready. This process makes managing your finances more convenient. Always check for any fees involved in the transfer.

Understanding these can help you avoid surprises. The process is quick and efficient. Many users find it helpful. It’s a great way to access your funds easily. Keep these tips in mind for a smooth experience. Your financial transactions just got easier.

Enjoy the convenience of Netspend transfers.