Have you ever found yourself facing unexpected car repairs, wondering how you’ll manage the costs? Auto body work isn’t just a luxury—sometimes, it’s a necessity.

But the financial burden can be overwhelming. So, what do you do when your vehicle needs urgent attention, but your bank account isn’t quite ready? Here’s the good news: many auto body shops understand your dilemma and offer flexible payment plans.

Imagine getting your car fixed without the stress of a hefty upfront payment. Sounds enticing, right? We’ll explore how payment plans work at auto body shops and how they can benefit you. Stay with us to discover how you can keep your car in top shape without breaking the bank.

Auto Body Shop Payment Options

Many auto body shops offer different payment plans. Payment options can help customers manage repair costs. Some shops let you pay in installments. This means you pay a little each month. It’s easier for people with tight budgets. Interest rates may apply, so check first. Some shops work with financing companies. This can offer more flexible terms. Always ask about fees or extra charges. Choose a plan that fits your budget. Credit cards are also accepted by most shops. Some shops offer discounts for cash payments. Be sure to ask what options are available. Payment plans can make car repairs less stressful.

Benefits Of Payment Plans

Payment plans help manage large repair costs with ease. They break down expenses into smaller parts. This makes payments more manageable. Many people find this helpful. It reduces financial stress. You don’t have to pay everything at once. Instead, you pay a little every month. This can suit many budgets. It makes fixing your car less scary.

Many shops offer flexible terms. You can choose a plan that fits you. Some might offer interest-free options. This means you pay no extra fees. Others might have low-interest rates. Always check the terms before you agree. Choosing the right plan helps keep your finances safe. It’s good to have options.

Types Of Payment Plans

Auto body shops often offer payment plans for their services. These plans help customers manage repair costs more easily. Flexible options like monthly installments are common, making it easier for car owners to afford necessary repairs without upfront payments.

In-house Financing

Auto body shops may offer in-house financing for repairs. This means the shop allows you to pay over time. It can be easier for people with limited credit. You might pay a small amount each month. Always ask about interest rates. Some shops might not charge any interest. Others may have higher rates. Check the terms before agreeing. You want to know how long the payments will last. Make sure the plan fits your budget.

Third-party Financing

Third-party financing involves borrowing money from outside lenders. These lenders cover repair costs upfront. You repay them monthly. This option might have better rates. Shops often partner with lenders for this. They help you apply for loans. Approval depends on your credit score. Higher scores mean better terms. Sometimes, shops offer deals with these lenders. Always read the contract carefully. Understand what you are agreeing to.

Credit Card Payments

Credit cards are another way to pay for repairs. Many shops accept them. This option can be convenient. You might earn rewards or cashback. But be careful of high interest rates. Paying off the balance quickly is smart. Compare card benefits before using one. Some cards offer 0% interest for months. It’s good to know your credit limit. Ensure your card can cover the repair costs.

Choosing The Right Plan

Think about your money needs first. Can you pay a lot at once? Or do you need smaller payments? Budgeting helps you decide. Use a calculator to check your monthly costs. Keep some money for other needs too.

Different shops offer different rates. Some may have higher interest rates. Others may be lower. Always compare these rates before deciding. Even a small difference matters. It can save you money over time.

Read the terms carefully. Are there any hidden fees? Check the length of the payment plan. Shorter plans often cost less in the end. But, longer plans mean smaller payments each month. Choose what fits your needs best.

Common Challenges

Auto body shops often have strict approval processes for payment plans. They might ask for many documents. Some shops might need proof of income. Others might check your credit history. This can make it hard for people with poor credit. Approval can take time. Patience is key.

Some payment plans come with hidden fees. It’s important to read the agreement. Look for extra charges. Fees can make the cost much higher. Ask questions if unsure about any charge. Always know what you are paying for.

Payment plans can affect your credit score. Paying late can lower your score. A low credit score makes future loans harder. It’s important to pay on time. Keeping a good score helps in the long run.

Tips For Negotiating Payment Plans

Clear communication is key. Ask about payment plans early. Be polite and direct. Share your budget needs. Request if they offer flexible plans. Understanding each other helps build trust. This can lead to better deals.

Being a loyal customer can be a big advantage. Mention your history with the shop. Tell them about your previous visits. Show your appreciation for their service. Loyalty can sometimes get special offers. This might include a payment plan.

Ask about possible discounts. Some shops offer deals for specific repairs. Check if there are seasonal discounts. Group discounts might be available. Explore all options. Discounts can reduce the total cost. This makes payment plans easier.

Alternatives To Payment Plans

Building savings can help pay for auto body repairs. An emergency fund is important. It helps during car accidents. Saving little by little is key. Start with small amounts. Over time, it grows big. This fund gives peace of mind. It’s good to be prepared.

Insurance can cover repair costs. Auto body shops work with insurance. After an accident, file a claim. The shop may fix your car. Insurance can pay most costs. This eases financial stress. Check your policy details. Know what is covered.

Personal loans are another option. Banks offer these loans. They help pay for repairs. Interest rates vary. Compare different banks. Choose the best rate. Pay back over time. It’s important to read terms carefully. Understand your repayment plan.

Frequently Asked Questions

Do Auto Body Shops Offer Financing Options?

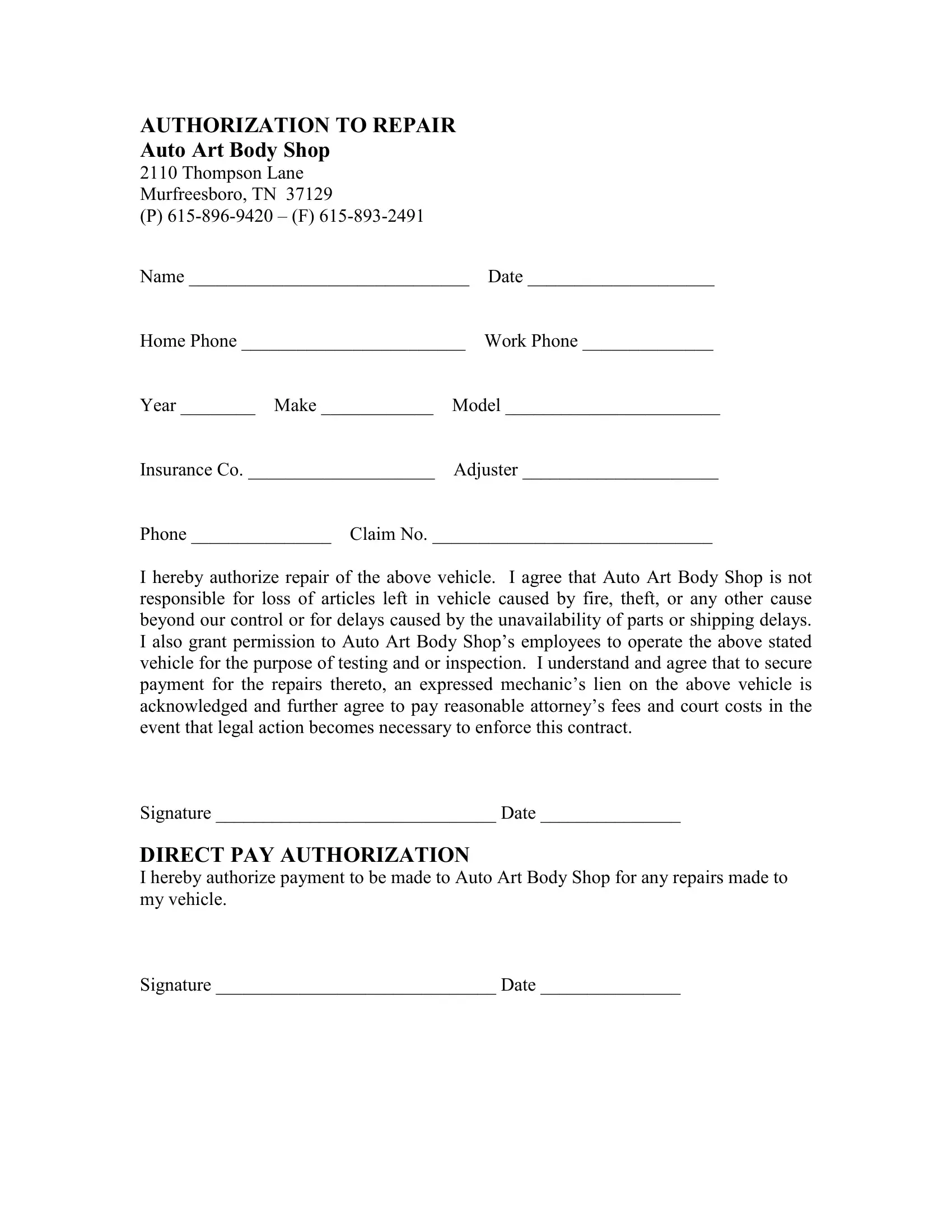

Yes, many auto body shops offer financing options. These plans help customers manage repair costs. Financing may include interest-free periods or low-interest rates. It’s best to inquire directly with the shop. They can provide specific details tailored to your needs.

Can I Pay In Installments For Car Repairs?

Yes, many auto body shops allow installment payments. This makes managing repair costs easier for customers. Terms and conditions can vary, so ask your shop. Some shops might offer flexible payment plans. It’s a good idea to discuss options before proceeding with repairs.

What Are The Benefits Of Payment Plans For Repairs?

Payment plans offer several benefits for car repairs. They make expensive repairs more affordable over time. Customers can manage their budgets without large upfront costs. Payment plans often come with flexible terms. This flexibility can be tailored to individual financial situations.

Are There Interest Charges On Auto Repair Payment Plans?

Interest charges can vary with each payment plan. Some auto body shops offer interest-free plans. Others might charge low-interest rates. It’s important to read the terms carefully. Discuss with the shop to understand any potential interest costs involved.

Conclusion

Auto body shops often offer payment plans. These plans ease financial stress. Customers can fix their cars without immediate full payment. Flexible options make repairs affordable for many. Always ask about payment plans before repairs. Compare options to find the best fit.

This helps in making informed decisions. Auto body shops understand customer needs. Many provide tailored solutions. Consider discussing payment plans during your initial visit. This ensures clarity and peace of mind. Remember, getting your car fixed is important. Payment flexibility adds convenience and affordability.