When you’re about to make a big purchase or sign a contract, you might come across the term “initial payment.” What does it really mean, and why is it important for you?

Imagine you’re about to buy your dream car, or you’re finally ready to own your first home. The initial payment is the first step in making these dreams a reality. It’s not just a financial transaction; it’s a commitment and a promise.

Understanding the ins and outs of initial payments can empower you to make better financial decisions, giving you peace of mind and confidence. Curious to know how this first step can affect your long-term financial health? Keep reading to discover the crucial role initial payments play and how they can impact your future.

Initial Payment Basics

An initial payment is the first sum you pay. Often, it is needed to start a deal or service. It shows your commitment to buy or receive something. The amount can vary based on what you are buying. Sometimes, it is called a down payment. This payment can reduce the total cost later. Many people use it in buying cars or houses. Paying early can help in getting better deals. Businesses like it because it reduces risk. It means you are serious about the purchase. Always check the terms before you pay. Make sure you understand how much is needed.

Purpose And Importance

An initial payment is the first amount paid for something. This payment shows your commitment. It can help you secure a good deal. Paying early can sometimes offer discounts. Sellers see initial payments as a sign of trust. They feel confident continuing the deal.

Buyers also benefit from initial payments. It helps them plan their finances. They can manage their money better. Knowing how much to pay early helps. It avoids surprises later. Initial payments are common in many deals. They help both parties feel secure.

Types Of Initial Payments

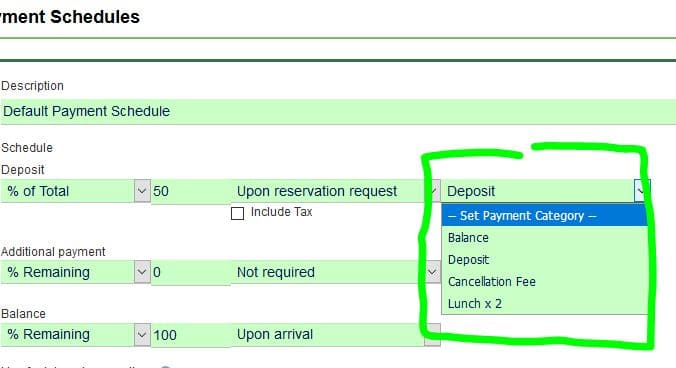

Down payments are upfront costs. They are part of a purchase price. These payments show commitment. People use them when buying big things. Like houses or cars. A bigger down payment often means better loan terms. This can make monthly payments smaller. Always plan for down payments in advance.

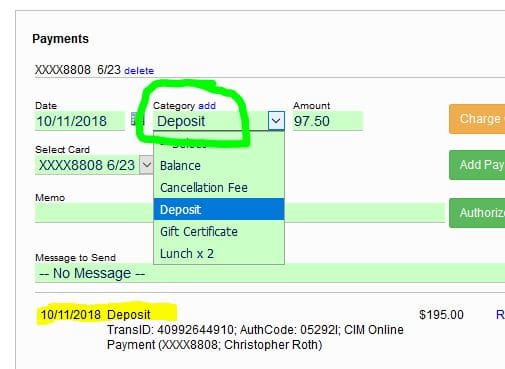

Deposits are money paid to hold something. They are used for many things. Like booking a hotel or renting an apartment. A deposit shows you are serious. It ensures you will return or pay for something later. Always check if deposits are refundable.

Advance payments are made before getting goods or services. They help secure a deal. Businesses often use them. This ensures they have funds before starting work. Advance payments build trust between buyer and seller. They are common in many industries.

How Initial Payments Work

Initial payments are important. They start the buying process. Buyers and sellers talk about them. This talk is negotiating terms. Terms mean rules for the payment. Both sides want good rules. They talk about amount and timing. Amount is how much to pay. Timing is when to pay. Good terms help both sides.

Negotiating Terms

Terms can be easy or hard. Easy terms make people happy. Hard terms need more talk. People should understand each term. Understanding makes it clear. Clear terms avoid problems. Problems can be costly. Costly means losing money. Smart people check terms. Checking terms saves money. Money matters to everyone.

Impact On Financing

Initial payments affect financing. Financing means borrowing money. Banks look at payments. Payments show buyer’s strength. Strong buyers get better loans. Better loans have lower rates. Lower rates mean less money paid. Weak payments can cause issues. Banks may not give loans. Loans help buy big things. Big things are houses or cars.

Benefits Of Initial Payments

Initial payments can help save money. Paying a part early can lower the total cost. Sellers often offer discounts for this. This makes products cheaper. People can buy things for less money. It helps in managing money better.

Paying a first amount can secure a purchase. It shows you want the product. Sellers hold the item for you. This ensures it is not sold to others. Your purchase is safe. You can relax knowing your item is reserved.

Challenges And Considerations

Initial payments need careful planning. Families should track expenses. This helps in avoiding overspending. Make a list of all monthly costs. Include rent, food, and bills. Save some money for emergencies. This way, you are ready for surprises. It’s smart to balance spending and saving. Keep an eye on unexpected costs. This can affect your budget.

Initial payments can be risky. Sometimes, unexpected costs arise. These can strain your budget. Some payments may be higher than expected. This can lead to financial stress. Ensure you understand terms before agreeing. This reduces surprises. Not knowing details can be costly. Plan ahead to avoid risks. This helps in staying financially safe.

Initial Payments In Different Industries

Buying a house needs an initial payment. This is often called a down payment. It shows the buyer is serious. The amount can be big. Usually, it is a percentage of the price. Banks often ask for this payment. It helps reduce risk. Buyers must save up for it.

Cars often need an initial payment too. This can lower monthly bills. Dealers use it to check if buyers can pay. A larger payment might mean better loan terms. Many people save for this payment. It is important when buying a car.

Some stores ask for an initial payment. Especially for costly items. It can be a part of layaway plans. This payment helps secure the item. Buyers pay the rest over time. It is popular for furniture and electronics. This way, people can buy big items.

Tips For Managing Initial Payments

Create a budget to know your income and spending. This helps in setting aside money for the initial payment. Save regularly by putting a little money away each month. Use a separate account for these savings to avoid using them by mistake. Cut down on extra spending. This means buying only what you need. Making a list before shopping can help. Track your spending daily. This way, you will know where your money goes.

Read contracts carefully before signing. Check for any hidden fees. Ask questions if something is not clear. Know the terms of payment. Some contracts may have special rules. Keep a copy of every contract you sign. This helps if there is a problem later. Get advice from someone who knows about contracts. They can help explain difficult words.

Frequently Asked Questions

What Is An Initial Payment?

An initial payment is the first amount paid when entering a financial agreement. It’s often required to secure a purchase or service. This payment can be a deposit or down payment, depending on the context. It signifies a commitment between the buyer and seller.

Why Is An Initial Payment Required?

An initial payment secures the buyer’s commitment to the transaction. It provides assurance to the seller about the buyer’s intent. This payment helps cover initial costs and reduces financial risk for the seller. It often facilitates the start of a project or delivery of a service.

How Does An Initial Payment Work?

An initial payment is made at the start of a transaction. It can be a percentage of the total cost or a fixed amount. This payment is usually deducted from the final total. It ensures both parties have a stake in the agreement’s success.

Are Initial Payments Refundable?

The refundability of an initial payment depends on the agreement’s terms. Some initial payments are non-refundable, especially if costs have been incurred. Always review the contract carefully for refund policies. It’s important to understand your rights and obligations before making a payment.

Conclusion

Understanding initial payments is crucial in financial planning. They set the stage. Help you manage budgets. Offer clarity in transactions. Knowing their role simplifies decisions. Enhances trust between parties. Initial payments provide a clear starting point. They reduce financial surprises.

Help avoid future complications. Whether buying a car or a house, initial payments matter. They reflect commitment. Encourage transparency. Remember, clear communication is key. Always ask questions if unsure. This ensures you make informed choices. Initial payments, though small, play a big role.

They are the first step in many financial journeys.