A Payment of a Portion of an Accounts Payable Will Boost Cash Flow Efficiency

Are you trying to get a grip on your business finances? Managing accounts payable can often feel like navigating a maze.

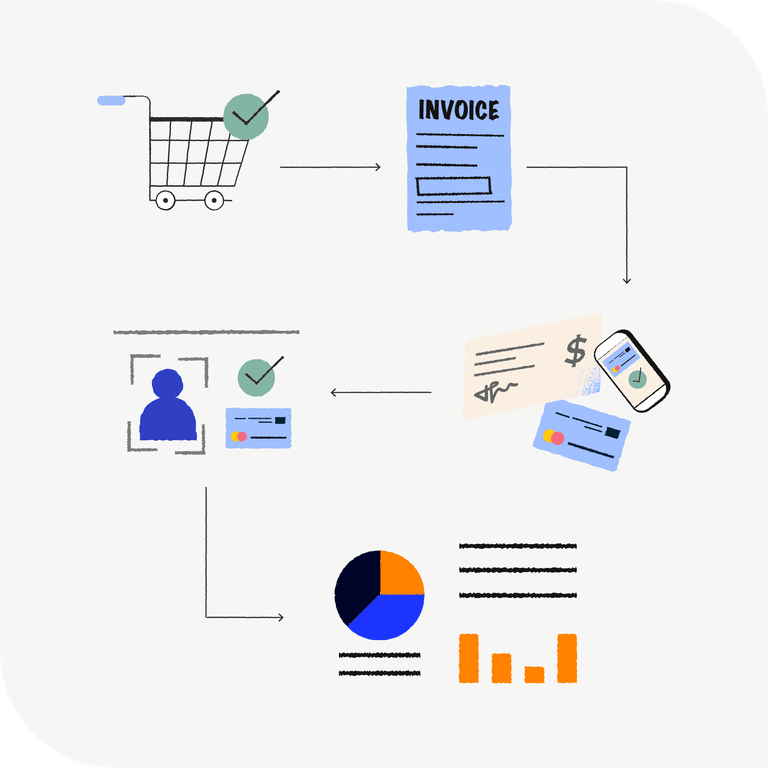

But what if I told you that making a payment on just a portion of your accounts payable could transform your cash flow and boost your business health? It’s not just about settling debts; it’s a strategic move that can enhance your financial stability.

Imagine reducing stress, gaining control, and fostering better relationships with your suppliers all with a simple, well-timed payment. Curious to learn how this approach can benefit your business? Dive into this article to uncover strategies that can make a real difference in your financial management. You’ll discover practical insights that could reshape how you handle your accounts payable, ensuring your business thrives in a competitive market.

Importance Of Managing Accounts Payable

Managing accounts payable is crucial for any business. It helps keep track of money owed to others. Paying bills on time avoids late fees. Late fees can cost a lot. Businesses need to pay suppliers. Suppliers provide goods needed for business. Paying them late can affect business relationships. Strong relationships lead to better deals. Good deals save money. Saving money is important. Proper management ensures cash flow stays healthy. Healthy cash flow means business operations run smoothly. Smooth operations mean happy customers. Happy customers come back and buy more.

Tracking accounts payable helps plan budgets. Budgets help control spending. Spending within budget prevents debt. Debt can be dangerous. It can lead to financial trouble. Keeping accounts organized is key. Organized accounts make audits easier. Easy audits save time and money. Saving time helps focus on growth. Growth leads to business success.

Impact On Cash Flow

Paying off a part of what you owe can help. Cash flow becomes better. There is less money going out. More cash stays in the business. It is easier to pay bills. Extra cash is available for other needs. This makes the business stronger. Financial health improves.

Less money owed means less worry. Stress goes down. Business leaders can focus better. They have more time and energy. Less stress leads to better decisions. Everyone works better. The team feels good. Business runs smoother. This helps the company grow.

Strategies For Efficient Payments

Paying bills can be hard. Make a list of all bills first. Sort them by date. Start with the most important ones. Paying these first keeps your business running. Utilities, rent, and important supplies should be at the top. They help keep everything going smoothly. Check your cash flow often. Make sure you have enough for each payment. Keep some money aside for emergencies. This way, you won’t face surprises.

Talk to your suppliers. Ask for better payment terms. Many suppliers are willing to help. Longer terms mean more time to pay. This can help your cash flow. Ask for discounts for early payments. Some suppliers offer this. It can save money. Keep a good relationship with suppliers. They are more likely to help you. Always pay on time if possible. This builds trust. Trust can lead to better deals in the future.

Balancing Payments And Cash Flow

Paying only a part of your bills helps save money. It keeps cash in your pocket for other needs. Overpaying can hurt your cash flow. It might leave you without enough money for other bills. Make sure to check each invoice carefully. Only pay what you owe. This keeps your business safe from mistakes. It also helps in planning future expenses wisely.

Good relationships with suppliers are very important. Paying on time makes them happy. It shows that your business is trustworthy. Sometimes, you might not have enough cash. In such cases, explain the situation to your suppliers. This honesty can help in keeping a strong bond. Suppliers may offer more time to pay. This way, your business stays in their good books.

Technological Tools

Paying part of an accounts payable reduces the company’s debt. It improves cash flow management. Businesses can better plan financial strategies.

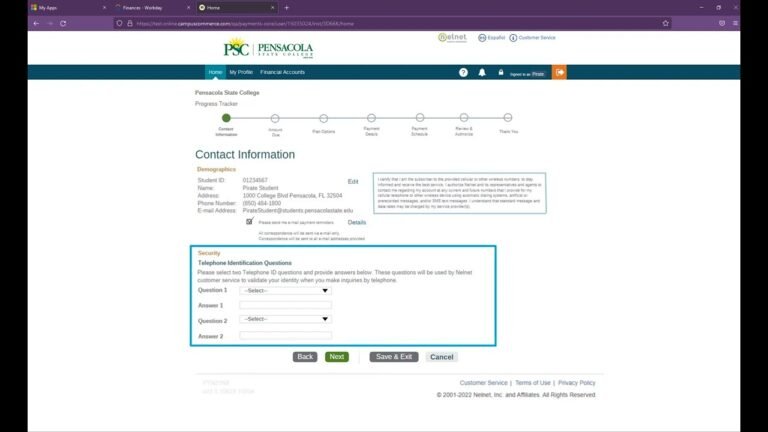

Automated Payment Systems

Many businesses use automated payment systems to manage bills. These systems save time and reduce errors. Companies can schedule payments with ease. No need to remember due dates. Bills are paid on time. This helps keep good relationships with suppliers. It’s also safe. The system keeps data secure. Small errors can be fixed quickly. Money is saved by reducing mistakes.

Data Analytics For Cash Flow

Data analytics helps track cash flow. It shows where money is going. This helps in planning budgets. Companies can see if they have enough cash. They can adjust spending as needed. Analyzing data helps make smart decisions. It helps in predicting future cash needs. Businesses use this data to stay strong. Keeping cash flow steady is important. It helps in growing the business. Analytics make this easier.

:max_bytes(150000):strip_icc()/Currentportionlongtermdebt_final-f0e9680318e3457b98d7ecfeb0f761a4.png)

Benefits Of Partial Payments

Partial payments help maintain cash flow. Businesses keep more funds available. This supports important expenses. Emergencies need quick cash. Partial payments offer that. Avoid full payments if possible. Save cash for future needs. It’s a smart move.

Flexible payments offer more control. Companies can adjust payment amounts. This improves budgeting. Future costs become manageable. Businesses stay strong with flexible funds. Less risk is involved. Keep options open with partial payments. It’s a safer plan.

Case Studies

Several businesses have adopted strategies to manage accounts payable. One company used part payments to reduce debt. This allowed them to keep more cash in hand. Another firm paid small portions of their bills. They focused on maintaining good relations with suppliers. Both businesses saw positive results. They managed to improve their financial health.

Companies realized the importance of communication with suppliers. Clear terms were set for payments. This helped avoid misunderstandings. Businesses found that smaller payments were easier to manage. They learned to balance payments and cash reserves. Paying portions of bills led to better planning. Firms saw the need to monitor cash flow closely.

Frequently Asked Questions

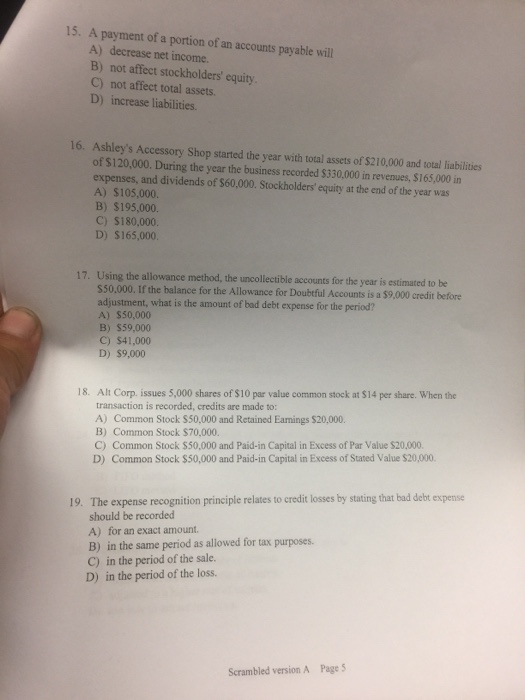

What Is An Accounts Payable Payment?

An accounts payable payment is a financial transaction to settle a company’s debts. It involves paying suppliers or vendors for goods and services received. This payment reduces the outstanding liability on the company’s balance sheet. Timely payments are crucial to maintain good supplier relationships and avoid late fees.

How Does Partial Payment Affect Accounts Payable?

A partial payment reduces the total outstanding balance of an account payable. It shows a company’s intent to settle its debts while managing cash flow. Suppliers may appreciate partial payments as a sign of good faith. However, the remaining balance will still need to be paid in the future.

Why Make A Partial Payment On Accounts Payable?

Partial payments help manage a company’s cash flow effectively. They allow businesses to maintain supplier relationships and avoid late fees. This approach also enables companies to allocate funds to other necessary expenses. It demonstrates financial responsibility while ensuring ongoing operations are not disrupted.

What Are The Benefits Of Paying A Portion Early?

Paying a portion early improves supplier relationships and can lead to better credit terms. It demonstrates financial responsibility and commitment to settling debts. Early payments may also qualify for discounts, saving the business money. This strategy helps in maintaining a positive business reputation.

Conclusion

Paying a portion of accounts payable impacts your business finances. It reduces outstanding debts and improves creditworthiness. Timely payments build trust with suppliers. This can lead to better terms in the future. Managing payables wisely ensures smooth cash flow. Avoid late fees and penalties by staying organized.

Always track your financial commitments. Make informed decisions to maintain a healthy balance. Clear communication with vendors is key. It fosters strong business relationships. Remember, consistent payments support business growth and stability. Keep your financial health in check for long-term success.