Are you looking to transfer money from your personal account to your business account but unsure of the best way to do it? You’re not alone.

Navigating the world of finances can be daunting, especially when it involves moving funds between accounts. But don’t worry—it’s easier than you might think. By understanding the right steps and knowing the pitfalls to avoid, you can make the process smooth and efficient.

Imagine the peace of mind you’ll have when your business finances are in perfect order and you can focus on what really matters: growing your business. Dive into this guide, and discover how to handle your money transfers with confidence and ease. Your business deserves the best, and so do you.

Legal Considerations

Understanding legal considerations is crucial when transferring money from personal to business accounts. These transactions can be complex, and adhering to the legal framework is essential. Missteps may lead to complications or penalties. Awareness of regulations and compliance is vital for smooth operations.

Understanding Business Structure

The business structure influences how funds can be transferred legally. Sole proprietorships have fewer restrictions compared to corporations. Corporations require documentation and board approvals. Each structure has unique legal requirements. Knowing your business type helps in determining the legal procedure.

Transferring funds has tax implications. Personal contributions to a business may be seen as income or loans. Proper classification ensures accurate tax reporting. Consult a tax professional for guidance. Avoid penalties and ensure compliance with tax laws.

Documentation And Record-keeping

Documentation is vital for legal compliance. Record every transfer with details like date, amount, and purpose. Proper records prevent legal issues. They also assist in audits and financial reviews. Consistent record-keeping is a key aspect of business management.

Compliance With Banking Regulations

Banks have specific rules for money transfers. Follow these to avoid disruptions. Understand the bank’s policies related to business transactions. Ensure that transfers align with banking regulations. This prevents any legal hiccups with your financial institution.

Consulting Legal Professionals

Legal professionals offer invaluable advice on fund transfers. They guide you through complex legal landscapes. Their expertise ensures that your transactions are lawful. Seeking legal advice is a proactive step in safeguarding your business interests.

Understanding Account Types

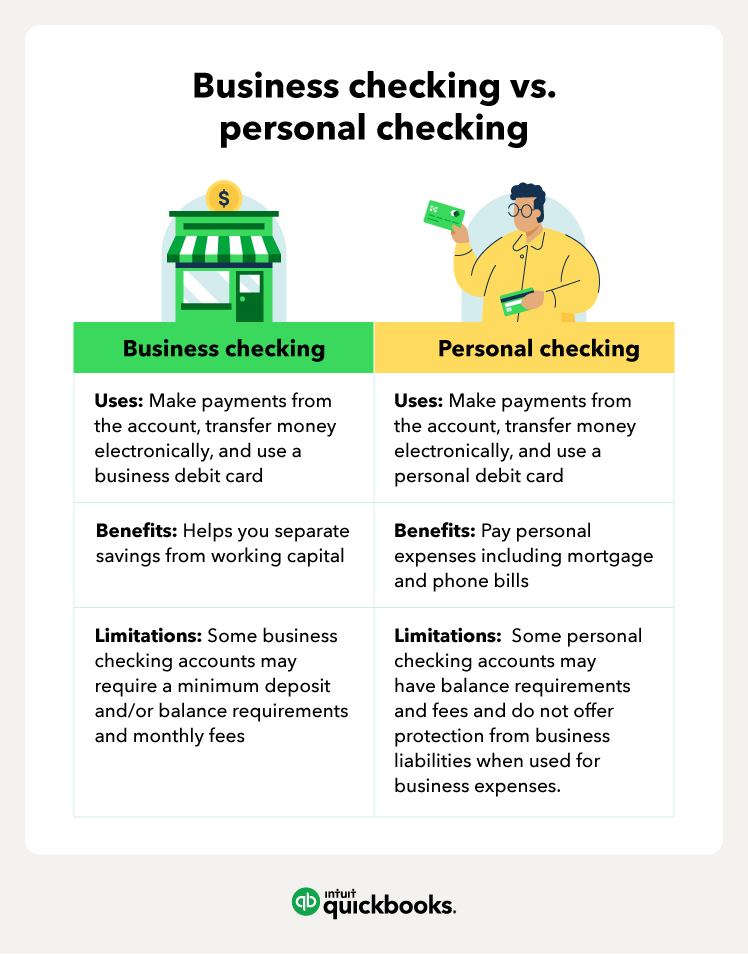

Understanding the different types of accounts is crucial for money transfers. It helps in making informed decisions and avoiding unnecessary fees. Personal and business accounts serve unique purposes, so knowing their differences is vital.

Personal Accounts

Personal accounts cater to individual banking needs. They handle everyday transactions like paying bills and receiving salaries. These accounts offer flexibility for personal expenses.

Business Accounts

Business accounts are designed for company transactions. They manage business income, expenses, and other financial activities. These accounts help in keeping business finances separate from personal funds.

Importance Of Separation

Separating personal and business finances is essential. It simplifies accounting and ensures clear financial records. This separation also makes tax filing easier.

Regulations And Compliance

Business accounts must comply with specific regulations. These rules protect against fraud and ensure transparency. Following them is vital for legal and financial security.

Choosing The Right Account

Choosing the right account involves understanding your needs. Evaluate transaction types, fees, and services offered. A well-chosen account supports your financial goals.

Bank Policies

Transferring money from a personal to a business account requires adherence to bank policies. Ensure funds are for legitimate business purposes. Consult your bank for any specific requirements or fees.

Transferring money from your personal account to your business account might seem straightforward, but bank policies can add layers of complexity to the process. Each bank has unique rules and guidelines that dictate how you can transfer funds. Understanding these policies can save you time and prevent potential hiccups in managing your business finances.

###

Understanding Transaction Limits

Banks often impose transaction limits for transfers between personal and business accounts. These limits can vary significantly from one bank to another. Knowing your bank’s limits can help you plan your transfers more effectively.

Imagine needing to pay a large supplier invoice but hitting a cap on your transfer amount. It’s important to ask, does your bank allow for adjustment of these limits?

###

Transfer Fees And Charges

Fees are a common aspect of transferring money between accounts. Some banks might charge a flat fee, while others might take a percentage of the transfer amount. These charges can add up, especially if you make frequent transfers.

Check if your bank offers fee waivers or discounts for certain types of accounts or under specific conditions. Is there a way to minimize these fees to keep more money in your business?

###

Processing Time Considerations

The time it takes for a transfer to process can vary widely. Some transfers might be immediate, while others could take several business days.

Understanding this timeline is crucial, especially if you have time-sensitive payments. Do you know how long your bank takes to process these transfers?

###

Security And Verification Procedures

Banks prioritize security, which can mean additional verification steps for transfers. This could include multifactor authentication or even direct confirmation with a bank representative.

While these steps can seem cumbersome, they protect your funds from unauthorized access. Are you prepared for the potential delays these procedures might cause?

###

Documentation And Record Keeping

Keeping accurate records of your transfers is essential for both personal and business accounting. Banks may require specific documentation for large transfers or unusual transactions.

Ensure you have all necessary paperwork ready to avoid delays. Could better record-keeping streamline your transfer process and enhance your business operations?

###

Reviewing Bank Policies Regularly

Bank policies can change, impacting how you manage your transfers. Regularly reviewing your bank’s policies can help you stay informed and avoid unexpected surprises.

Have you checked your bank’s policies lately? Staying updated could be the key to smooth financial management in your business.

Understanding and navigating these bank policies effectively can make transferring funds smoother and more efficient. Keep these points in mind to manage your business finances with ease.

Choosing The Right Transfer Method

Transferring money from a personal account to a business account requires careful method selection. Online banking offers speed and convenience, while checks provide a tangible record. Evaluate fees and processing times to ensure the chosen method aligns with your business needs.

Transferring money from your personal account to a business account is a crucial task for any entrepreneur. Choosing the right transfer method can not only save you time but also avoid unnecessary fees. With multiple options available, how do you decide which is best for your situation? This decision often boils down to speed, cost, and convenience. Let’s take a closer look at some common methods.

Electronic Transfers

Electronic transfers are one of the simplest and most convenient ways to move money. Most banks offer online services where you can transfer funds with just a few clicks. Imagine sitting at your desk, effortlessly managing finances without stepping into a bank.

This method is usually free or has minimal fees, making it ideal for frequent transfers. However, always double-check the daily transfer limits set by your bank. Have you ever tried scheduling an electronic transfer only to find it exceeds your bank’s limit? Being aware of these restrictions can save you from unexpected delays.

Wire Transfers

Wire transfers offer a reliable and fast way to send money, especially for large sums. They are known for their speed, often completing transfers within the same business day. But this convenience comes at a price—wire transfer fees can be quite high.

Reflect on the time you needed to urgently transfer a significant amount to your business account. Wire transfers might have been your go-to option despite the cost. Always weigh the urgency against the fees and consider if the transaction truly needs that speed.

Checks

Writing a check is a traditional method that still holds relevance today. While not as instantaneous as electronic or wire transfers, checks can be practical for those who prefer a tangible transaction record.

Have you ever written a check to transfer funds, only to realize you need to wait several days for it to clear? This delay can impact your business operations. Use checks for non-urgent transfers or when you want a paper trail for accounting purposes.

Choosing the right method isn’t just about convenience; it’s about making informed decisions that align with your business needs. So, which transfer method aligns with your priorities?

Maintaining Accurate Records

Maintaining accurate records ensures a smooth flow of financial operations. It protects your business from potential discrepancies. When transferring money from a personal to a business account, precise documentation is key. It helps in future audits and financial reviews. Maintaining clear records also aids in understanding financial health. This practice keeps your business finances organized and compliant with regulations.

Transaction Documentation

Document every money transfer between accounts. Use a consistent method to record each transaction. Write down details like amount, date, and purpose. Keep receipts and bank statements as evidence. This makes it easier to track financial activities. Proper documentation helps resolve any disputes. It also supports transparency in business operations.

Accounting Software

Utilize accounting software to maintain accurate records. Software automates the documentation process. It reduces human error and saves time. Many tools sync with your bank account. This provides real-time updates on transactions. Choose software that fits your business needs. It should be user-friendly and affordable. Software often offers reporting features. These features help analyze financial data easily.

Tax Implications

Transferring money from a personal to a business account may trigger tax implications. This transaction can be seen as an investment or loan, affecting taxable income and financial records. Consult a tax professional to ensure compliance with regulations and proper documentation.

Transferring money from your personal to your business account can seem like a simple task. However, it comes with tax implications that you need to be aware of. Whether you’re a seasoned entrepreneur or just starting your business journey, understanding these implications is crucial. It not only saves you from potential pitfalls but also ensures you stay on the right side of tax regulations.

Tax Reporting

When you move funds between your personal and business accounts, it’s important to report these transactions accurately. Misreporting can lead to unwanted attention from tax authorities.

Make sure to keep detailed records of all transfers. This includes the amount, date, and purpose of each transaction. A simple spreadsheet can work wonders in organizing this information.

Have you ever thought about how a small mistake in tax reporting can snowball into bigger issues? Ensure that your business transactions are distinct from personal ones to avoid confusion.

Avoiding Tax Penalties

Nobody wants to face tax penalties. They can be costly and stressful. Understanding the rules surrounding your transactions can help you steer clear of these penalties.

One way to avoid penalties is to consult with a tax professional. They can provide guidance tailored to your situation.

Have you considered how timely reporting and professional advice could save you from paying extra taxes?

Another practical tip is to set up regular audits of your accounts. This ensures everything is in order and helps catch any discrepancies early.

Reflecting on your experiences, how have you ensured compliance in your business finances? Small steps today can prevent larger issues tomorrow.

By paying attention to these aspects, you ensure that transferring money between accounts doesn’t become a tax nightmare.

Ensuring Compliance

Transferring money from a personal to a business account requires careful attention to compliance. Ensure records are accurate and transparent. Consult financial experts to avoid legal issues and maintain business integrity.

Transferring money from your personal account to a business account is a task that demands careful attention to compliance. It’s not just about moving funds; it’s about adhering to regulations and maintaining the integrity of your financial practices. Compliance ensures that you are not only safeguarding your business but also avoiding potential legal pitfalls. Let’s explore how you can ensure compliance when transferring money to your business account.

Regulatory Guidelines

Understanding the regulatory guidelines is crucial when transferring funds. Each region has its own rules governing financial transactions. You should familiarize yourself with these regulations to avoid penalties.

Consult with a financial advisor or legal expert to gain clarity on these guidelines. They can provide insights into tax implications and reporting requirements. This step is essential to ensure that your transfers are transparent and lawful.

Internal Controls

Establishing internal controls is another key aspect of ensuring compliance. These controls help monitor and document transactions within your business. They act as a safeguard against errors and fraudulent activities.

Implement a system to track all transfers, detailing the amount, purpose, and date. This record-keeping is vital for audit purposes and helps maintain financial clarity. Regularly review these controls to ensure they are functioning effectively.

Have you ever faced challenges in maintaining compliance during fund transfers? Share your thoughts and experiences in the comments below.

Best Practices

Transferring money between personal and business accounts requires careful planning. Best practices ensure smooth financial operations and compliance. Following these practices helps avoid complications with taxes and accounting.

Consistent Record-keeping

Keep detailed records of every transaction. Use a digital ledger or accounting software. Record the date, amount, and purpose of each transfer. This makes tax season easier. It also helps in case of an audit. Consistent records build a clear financial history. This is crucial for both personal and business accounts.

Regular Financial Reviews

Schedule regular reviews of your financial activities. Monthly or quarterly checks are ideal. This helps identify any irregularities in transactions. Regular reviews keep your financial health in check. They also ensure that your business stays on track. Make adjustments as needed based on these reviews. This proactive approach supports sound financial management.

Common Mistakes

Transferring money between personal and business accounts can be tricky. Many make mistakes that can lead to issues. Understanding these errors helps in avoiding them. This section highlights common mistakes.

Mixing Personal And Business Funds

Mixing personal and business funds is a frequent error. It blurs financial boundaries. Keeping accounts separate is crucial for clarity. This mistake complicates record-keeping. It can lead to inaccurate financial reporting. Separate accounts ensure better tracking of expenses. They help in maintaining financial integrity.

Ignoring Tax Obligations

Tax obligations are often overlooked. Many don’t consider the tax implications of transfers. This oversight can lead to penalties. It’s vital to understand tax responsibilities. Consult a tax professional if unsure. Proper documentation of transfers is essential. It ensures compliance with tax laws.

Frequently Asked Questions

How To Transfer Money To A Business Account?

Transferring money to a business account involves logging into your personal bank account. Select the transfer option, enter the business account details, and specify the amount. Confirm the transaction to complete the transfer. Always ensure the business account information is accurate to avoid errors.

Are There Fees For Transferring Money?

Fees for transferring money depend on your bank’s policies. Some banks charge for external transfers, while internal transfers might be free. It’s advisable to check with your bank for any applicable fees. Always consider these fees when planning your financial transactions.

Is It Legal To Transfer Money?

Yes, transferring money from a personal to a business account is legal. Ensure that the transaction complies with tax laws and financial regulations. It’s important to maintain accurate records for auditing purposes. Consult a financial advisor if you’re unsure about any legal implications.

Can I Transfer Money Online?

Yes, online transfers are a convenient option for moving money to a business account. Use your bank’s online platform or mobile app for quick transactions. Online transfers usually offer fast processing times and easy tracking. Ensure your online banking details are secure to prevent unauthorized access.

Conclusion

Transferring money to a business account may seem complex. But it’s simple with the right steps. Keep records of each transaction. This helps in managing finances better. Choose a method that suits your needs. Online transfers are fast and convenient.

Understand the rules and limits of your bank. This prevents any surprises later. Always consult with a financial advisor for big transfers. They provide valuable insights. Stay informed and make smart choices. This ensures smooth financial operations. Manage funds wisely and help your business grow.

Successful money management is key.