Bridging the financial gap between two popular platforms is a puzzle piece you're trying to find. You're probably wondering if it's possible to transfer money from Venmo to a Green Dot card. The good news is that you can indeed make this transfer, but there are a few hoops to jump through first. You'll need to link your Green Dot card to your Venmo account, and then there are potential fees and transfer limits to take into account. But what are these specifics, and how do you navigate them to guarantee a smooth transaction?

Understanding Venmo and Green Dot

To transfer money effectively, you need to first understand two key players involved in the process: Venmo, a popular peer-to-peer payment service, and Green Dot, a prepaid debit card provider. You'll want to familiarize yourself with Venmo's capabilities, such as sending and receiving funds, as well as its security features, like encryption and two-factor authentication. On the other hand, you should know how Green Dot's prepaid debit cards work, including any fees associated with loading or using the card. Understanding the terms and conditions of both services will help you navigate the transfer process safely and efficiently. By grasping the basics of Venmo and Green Dot, you'll be better equipped to make informed decisions about your money transfers.

Can You Make the Transfer

Although Venmo and Green Dot serve different purposes, you can indeed transfer money from Venmo to a Green Dot card, but there are specific requirements and limitations you should be aware of. You should link your Green Dot card to your Venmo account to initiate the transfer. It's important to review Venmo's terms of service and any applicable cardholder agreements before proceeding. When making a transfer, make sure you have a sufficient balance in your Venmo account to avoid any issues. Additionally, be mindful of any transfer-related fees or charges. Understanding the specifics of the transfer process and requirements can help guarantee a smooth and successful transfer from Venmo to your Green Dot card. Transfers can typically be completed quickly.

Transfer Options and Limitations

Once you've confirmed that you can transfer money from Venmo to a Green Dot card and reviewed the initial requirements, you'll need to understand the available transfer options and their associated limitations to complete the transaction successfully. You can initiate a transfer from your Venmo account to your Green Dot card using the Venmo app or website. However, there are limits on the amount you can transfer per transaction and per day. These limits may vary depending on your account type and the recipient's card type. You'll also need to verify that your Green Dot card is eligible to receive transfers and that the card information is up-to-date. It's crucial to review the transfer options and limitations carefully to avoid any potential issues or delays.

Green Dot Card Transfer Process

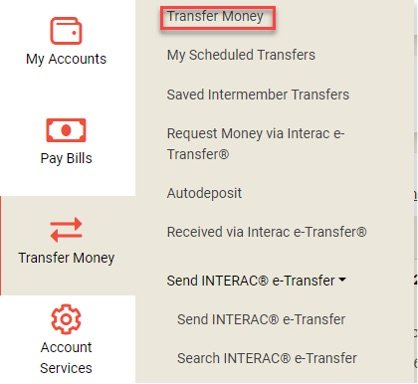

Transferring money from Venmo to a Green Dot card involves several key steps that you'll need to follow carefully to guarantee a smooth transaction. First, you'll need to add your Green Dot card to your Venmo account, which you can do by going to the Venmo app, selecting "Settings," and then "Payment Methods." From there, you can link your Green Dot card by following the prompts. Once your card is linked, you can initiate a transfer by going to the "Transfer" section of the app and selecting your Green Dot card as the recipient. You'll then need to enter the amount you want to transfer and confirm the transaction. Make sure to review the details carefully before submitting the transfer.

Potential Fees and Charges

When using Venmo to transfer money to your Green Dot card, you'll likely encounter various fees and charges that you should be aware of to avoid any unexpected deductions. You'll be charged a small transfer fee by Venmo, which typically ranges from 1% to 3% of the transfer amount. Green Dot may also charge a reload fee, which can be up to $4.95. Additionally, if you're using a credit card to fund your Venmo account, you may incur interest charges or cash advance fees. It's important to review the fee structures of both Venmo and Green Dot to understand the total costs associated with the transfer. This will help you make informed decisions and avoid any surprises.

Troubleshooting Common Issues

If you encounter problems while transferring money from Venmo to your Green Dot card, troubleshooting common issues can help you identify and resolve the error. You can start by checking if your Venmo and Green Dot accounts are linked correctly. Also, make certain that your Green Dot card is activated and has enough balance to receive the transfer. If the issue persists, check for any error messages or codes that may indicate the problem. Additionally, verify that your internet connection is stable and that the Venmo and Green Dot apps are updated to the latest versions. By methodically checking each of these potential issues, you can resolve the problem and complete the transfer successfully. This will help you avoid any potential security risks.