Are you curious about how Scheduled Roof Payment Farmers Insurance can impact your home’s coverage? Understanding the nuances of your insurance policy can feel overwhelming, yet it’s essential for safeguarding one of your most valuable assets.

You deserve peace of mind knowing exactly what your insurance covers, especially when it comes to something as crucial as your roof. This guide will break down Scheduled Roof Payment in simple terms, so you can make informed decisions for your home and wallet.

Keep reading to uncover how this specific insurance feature could affect you and why it might just be the key to smarter home protection.

Scheduled Roof Payment Overview

Scheduled Roof Payment is a part of Farmers Insurance. It helps manage roof repair costs. This plan covers roof damage. Payment is based on the roof’s age. Older roofs get less money. Newer roofs get more money. The insurance adjusts payments. It makes sure you get a fair deal. This helps you pay less out of pocket. It is important for homeowners. Scheduled payments keep costs predictable. You know what to expect. It helps you plan better. Farmers Insurance aims to support its clients. It is a helpful service. It provides peace of mind. Scheduled Roof Payment is a smart choice. It is useful for budget planning. It simplifies roof repairs. Understanding this can save you money.

Importance For Farmers

Scheduled Roof Payment helps farmers plan for the future. It provides a way to manage costs. Roofs protect crops and animals. Damage can be expensive to fix. A scheduled payment plan is like a savings account. Farmers can pay small amounts regularly. This helps avoid large bills all at once.

Farmers feel more secure with this plan. They know they can afford repairs when needed. It also helps them budget better. They can focus on growing crops or raising animals. The plan is simple and easy to understand. Farmers can choose a plan that fits their needs. This makes life easier and less stressful.

Key Features Of Roof Payment

Scheduled Roof Payment is a special plan. It helps cover roof damage costs. Farmers Insurance offers this plan. It makes payments more predictable. This plan is great for those with older roofs. Insurance companies often worry about old roofs. They are more likely to get damaged. Scheduled payments help both parties. The homeowner and the insurer. It keeps things clear and simple.

Costs are shared between the company and the homeowner. This is important. It means less financial stress. Scheduled payments can be very helpful. Especially during emergencies. It provides peace of mind. Knowing there is help when needed. It can make a big difference.

Eligibility Criteria

Farmers Insurance offers scheduled roof payments under certain conditions. Homeowners need a policy with specific coverage for roofs. Not all types of roofs qualify. Older roofs might not be eligible. Regular inspections help ensure coverage. Damage from neglect isn’t covered. Weather-related damage is often included. Policyholders must check specific terms. Understanding the policy is important. Contacting an agent can clarify doubts.

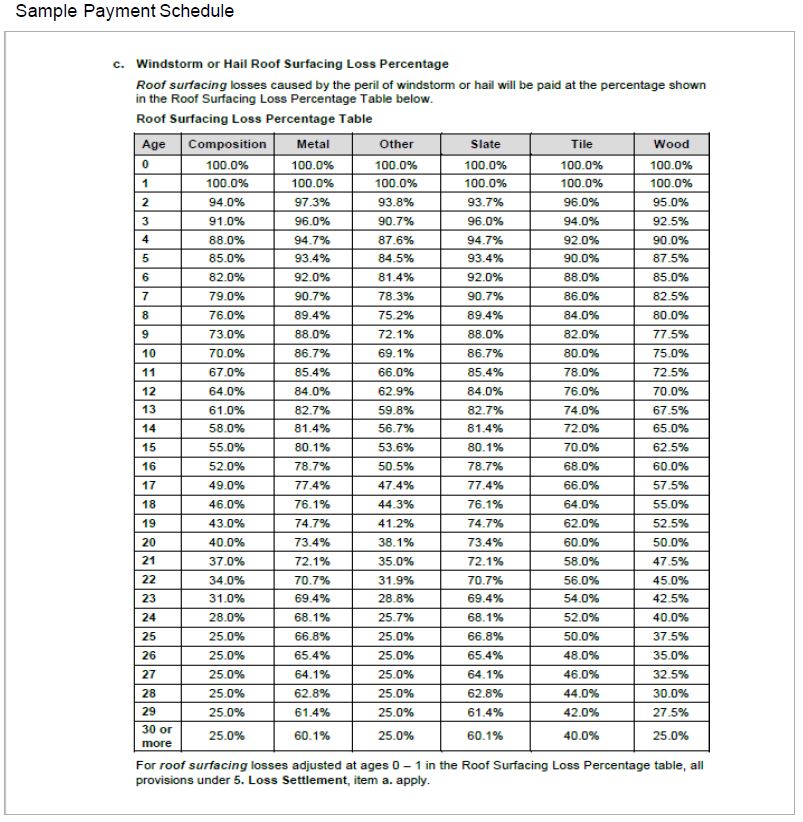

Scheduled payments depend on roof age. Newer roofs receive better coverage. Different materials may affect eligibility. Asphalt shingles often get coverage. Metal roofs may have different terms. Slate and tile may require special conditions. Policyholders should read all documents. Knowing the policy helps avoid surprises. Farmers Insurance provides details in contracts.

How Payments Are Structured

Farmers Insurance offers payments in a planned manner. You can choose different plans. Some pay in full at once. Others allow monthly payments. This helps manage your budget better. Payments are consistent and predictable. No surprise bills come your way.

Calculating payments depends on roof age and type. Older roofs might cost more. Newer roofs can be cheaper. Farmers Insurance uses these details to set amounts. They ensure you pay a fair price. Everything is clear and easy to understand. No complex math involved.

Benefits Of Scheduled Payments

Scheduled payments help plan money better. They make budgeting easy. People can set aside money each month. This helps avoid surprises. Knowing how much goes out helps control spending. Families can plan other expenses too. This gives them peace of mind.

Scheduled payments reduce risks. They make sure payments are on time. Late fees can be avoided with this method. Insurance coverage stays active. People feel safe knowing their roof is protected. It saves trouble in the long run.

Common Challenges

Insurance policies can have limits on coverage. Sometimes, the roof is not fully covered. This can mean paying more out of pocket. Policies may not cover old roofs. Some roofs may need to be replaced first. Check for exclusions in your policy. Not all damage is covered.

Filing a claim can be confusing. You need to fill out forms. Send pictures of the damage. Wait for a response from the insurance company. Sometimes, claims get denied. This can be frustrating. Call the company for help if you need it. Keep all documents safe.

Comparison With Other Insurance Options

Traditional policies often offer basic coverage. They may not include all risks. Scheduled Roof Payment Farmers Insurance is different. It provides specific roof coverage. This means better protection for your roof. Many policies only cover partial costs. Farmers Insurance covers more. This can save you money in the long run.

Comprehensive coverage means covering most risks. Scheduled Roof Payment from Farmers Insurance offers this. It protects against many damages. Bad weather, like storms, can harm roofs. This plan covers such damages. Other insurances might not cover everything. With Farmers, you get broad protection. Your roof stays safe and sound.

Tips For Farmers

Farmers can benefit from understanding Scheduled Roof Payment Farmers Insurance. This policy option helps cover roof damage, offering financial support for repairs. It’s a useful tool for protecting farm buildings from unexpected weather events. Farmers should explore this option to safeguard their investments and maintain their operations effectively.

Maximizing Benefits

Scheduled Roof Payment is helpful for farmers. It covers roof damages with insurance. Farmers should check policy details carefully. Understand what is covered. Knowing this helps in claims. Choose a good contractor for repairs. Quality work prevents future issues. Keep records of maintenance and repairs. This makes claiming easier. Farmers should ask questions if unsure. Insurance agents can provide answers.

Avoiding Pitfalls

Overlooking policy terms can be costly. Farmers must read all details. Ignoring small print leads to problems. Keep an eye on deadlines. Missing them might lose benefits. Watch for exclusions in the policy. Some damages might not be covered. Don’t assume all roof types are insured. Confirm with your agent first. Always report damage quickly. Delays can affect your claim. Stay informed about policy updates.

Future Trends

Scheduled Roof Payment Farmers Insurance offers a structured approach to roof repairs. It ensures timely payments, reducing financial strain on homeowners. This trend supports a smoother claims process and encourages proactive maintenance.

Technological Advances

New technology helps make roofs stronger and smarter. Drones can check roofs without climbing. They find damage fast and easy. Sensors tell if a roof is weak. They warn before any serious damage happens. Roofs with solar panels save energy. They help the environment too.

Policy Innovations

Insurance policies change with the times. Scheduled Roof Payment is one such change. It helps farmers manage costs better. Farmers know when to pay and how much. This plan makes payments predictable. Farmers can plan budgets easily. No more surprises in payments. This policy helps them feel secure.

Frequently Asked Questions

What Is A Scheduled Roof Payment?

A scheduled roof payment is a payment plan for roof repairs or replacements. Farmers Insurance offers this to policyholders, ensuring timely coverage for roofing expenses. It helps in managing costs effectively, especially after damage due to storms or aging. Scheduled payments can ease financial burdens for homeowners.

How Does Farmers Insurance Roof Payment Work?

Farmers Insurance provides scheduled roof payments based on policy terms. It spreads the cost of roof repairs over time. This approach helps homeowners manage their expenses better. Payments are scheduled according to agreed terms, ensuring necessary repairs are covered without immediate financial strain.

Why Choose Scheduled Roof Payments?

Scheduled roof payments offer financial flexibility for homeowners. They allow for manageable, periodic payments for roofing repairs. This option is particularly beneficial after unexpected damages. It ensures that necessary repairs are done promptly without burdening the homeowner with large, upfront costs.

Are Scheduled Roof Payments Beneficial?

Yes, scheduled roof payments are beneficial. They provide structured financial relief for roofing costs. This plan ensures timely repairs while spreading the payment over a period. Homeowners can maintain their roofs without the stress of large, immediate expenditures, making it a practical financial solution.

Conclusion

Understanding scheduled roof payment in Farmers Insurance helps plan better. This policy feature covers roof repairs or replacement. It is based on your roof’s age and condition. Knowing these details aids in making informed decisions. This knowledge ensures you are prepared for potential roof issues.

Always review your policy details carefully. Ask questions if unsure. A little effort now can prevent bigger problems later. Stay informed. Protect your home investment wisely. Remember, the right information is key to better insurance choices. Keep your roof and peace of mind secure.