Have you ever wondered how your online transactions get from point A to point B so seamlessly? If you’ve ever made a purchase online, you’re likely relying on a system that includes a payment agent.

But what exactly is a payment agent, and why is it crucial to your everyday online shopping experience? Understanding this can unlock a new level of confidence and security in your digital transactions. Imagine knowing that behind every click, there’s a professional entity ensuring your payment reaches its destination safely and efficiently.

Ready to dive into this essential aspect of e-commerce that could change the way you view your online financial interactions? Let’s explore what a payment agent is and why it matters to you.

Role Of Payment Agents

Payment agents help people and businesses with money transfers. They work with banks and other companies. Payment agents make sure money moves safely. They also help in solving problems. This makes payments easier for everyone.

Payment agents often use technology. They use computers to track money. This helps keep money safe. They also check for mistakes. This helps people trust payment agents. Payment agents are very important for the economy.

Payment agents can also give advice. They help people understand payments. They tell people how to save money. This makes people happy. Payment agents are friendly and helpful. People like to work with payment agents.

Types Of Payment Agents

Bank-based agents help with money transfers and payments. They work through banks. People trust banks. Banks have many branches. Branches make it easy to send money. Security is strong. Banks follow rules. Many people use these agents.

Third-party providers are not banks. They help with payments. They offer flexible services. Many use apps and websites. These providers have good technology. They make payments simple. People find them fast and easy. Fees can be lower than banks.

Digital payment platforms are online. They are very popular. People use them on phones. Payments happen quickly. They offer low fees. Many platforms have easy apps. These apps help users pay fast. Security is important. Platforms work hard to keep money safe.

Functions And Services

Payment agents help with transaction processing. They make sure money moves safely. People use them to send and receive money. Payment agents handle this quickly. It helps everyone get their money on time. They work hard to keep transactions safe.

Payment agents can also change money from one currency to another. This is helpful for people in different countries. They make sure the conversion is correct. It helps people get the right amount of money. Everyone can trade without worrying. Payment agents do this job well.

Fraud is a big problem. Payment agents work to stop it. They watch for any strange activity. They have special tools to help. This keeps your money safe. No one wants their money stolen. Payment agents make sure this does not happen. They protect your money every day.

Benefits For Consumers

Payment agents make paying bills easy. No need to visit the bank. You can pay from home or work. This saves time and effort. Everyone can use it, even if they live far from the city. It’s simple and fast. Just click a button.

Using a payment agent is cheap. You don’t spend money traveling. No need to buy stamps for mailing bills. Some agents offer discounts. You save money with them. Every penny counts in savings.

Payment agents keep your money safe. They use strong security systems. Your details are protected. No one can steal them. Your payments are secure. Feel safe when paying online.

Benefits For Businesses

A payment agent helps make business tasks easier. They manage transactions smoothly. This saves time for the business. Employees can then focus on other important tasks. This boosts overall efficiency. With fewer mistakes, operations run better.

Businesses can now reach customers all over the world. Payment agents handle different currencies. This helps businesses to expand easily. Dealing with different countries becomes simple. Customers feel more confident. They trust businesses that use payment agents.

Payment agents ensure money moves quickly. Businesses receive payments faster. This means more cash on hand. They can pay bills on time. It reduces stress on finances. Better cash flow leads to business growth.

Challenges And Risks

Regulatory Compliance is a big challenge for payment agents. They must follow strict laws. These laws change often. Keeping up is hard. Mistakes can lead to fines. Staying updated is crucial. Agents need expert help.

Cybersecurity Threats are always present. Hackers try to steal data. Protecting customer information is vital. Agents use strong security systems. These systems help to block attacks. Regular checks are important.

Service Disruptions can happen anytime. Systems can fail. This stops payments from going through. Customers get upset. Quick fixes are needed. Agents must have backup plans. These plans keep services running.

Future Trends

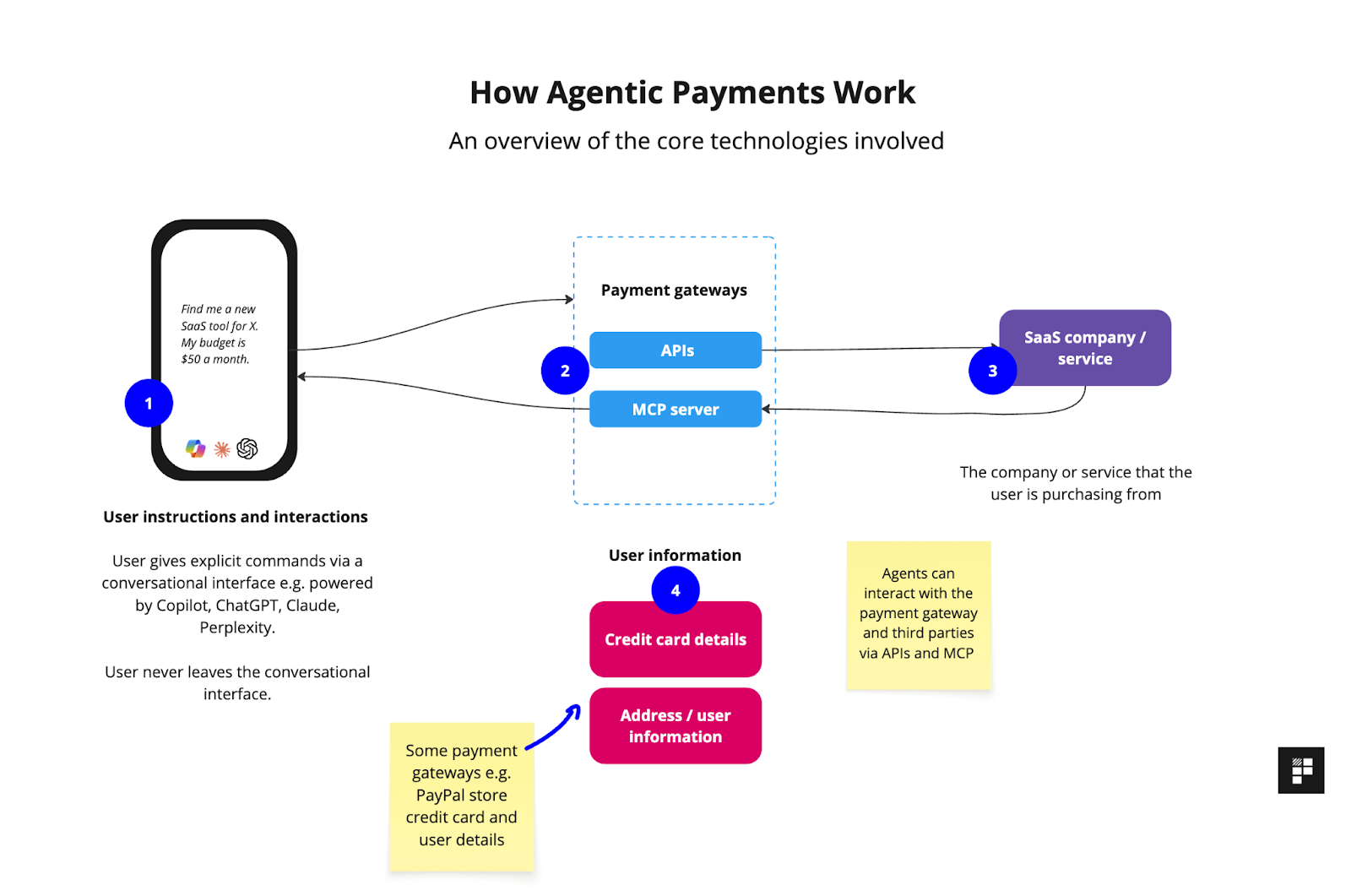

Payment agents are connecting with new technologies. They use blockchain for safe transactions. They also use AI to improve customer service. Mobile payments are growing fast. Agents are making apps for easy use. Voice payments are now possible. People can pay by talking to their phones.

Many developing countries need payment agents. Agents help them with easy payments. They offer local solutions for local needs. This creates jobs and builds the economy. Agents work with local banks. They make payments simple and fast. Internet access is increasing. This helps agents grow more.

Rules for payment agents are changing. Governments make new laws for safety. Agents follow these rules closely. Data protection is very important. Customers want their info safe. Agents work with legal experts. They make sure all rules are followed. Changes in rules can be good. They help agents improve their services.

Frequently Asked Questions

What Does A Payment Agent Do?

A payment agent facilitates financial transactions between parties. They ensure payments are processed securely and efficiently. Their role includes handling payments, managing accounts, and providing customer support. They help businesses streamline their payment processes and often work with various payment methods.

Payment agents play a crucial role in modern commerce.

How Do Payment Agents Work?

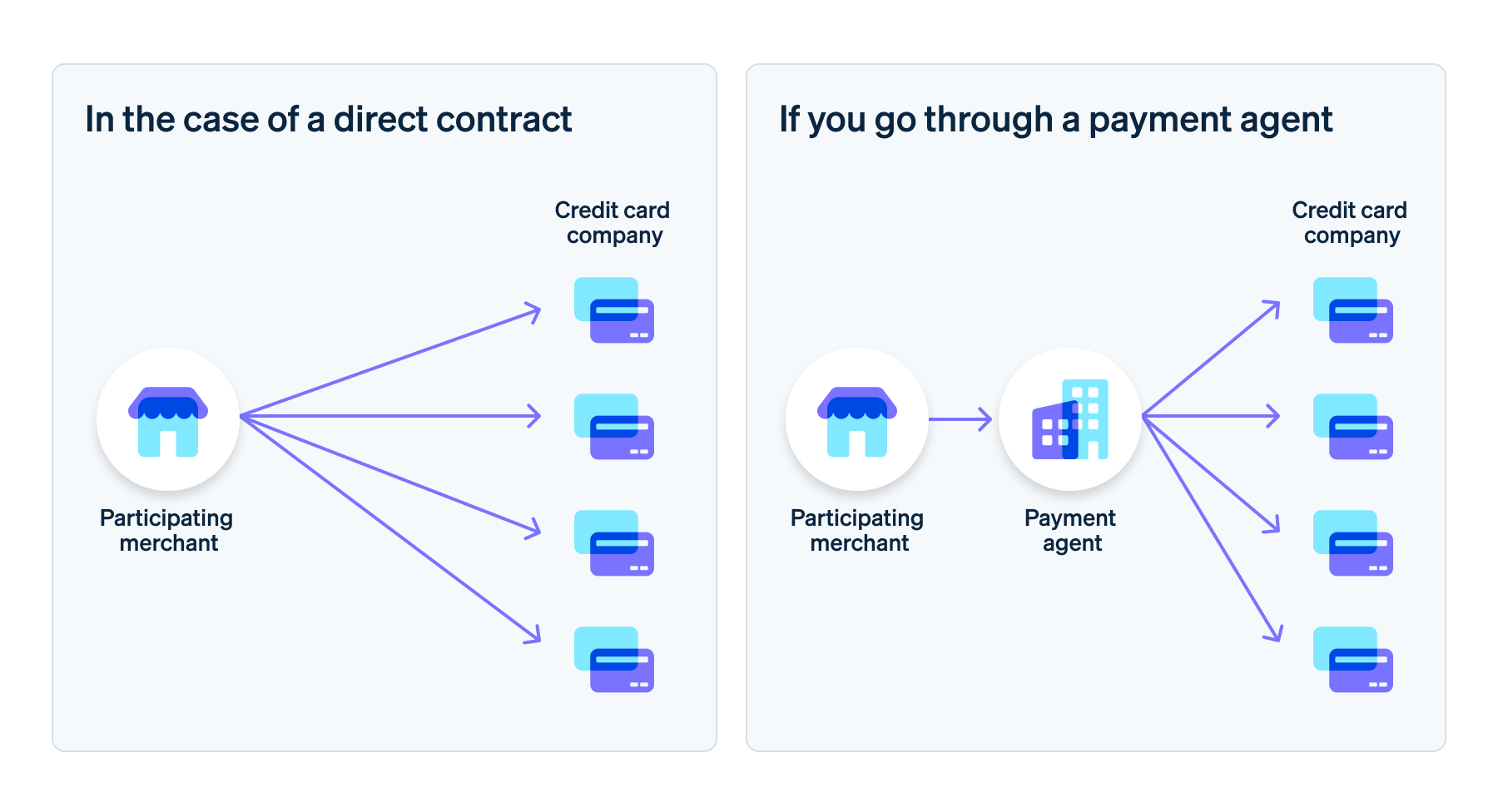

Payment agents work by acting as intermediaries in financial transactions. They connect businesses with payment networks to process payments. They ensure secure and timely transactions between buyers and sellers. Payment agents use technology to verify, authorize, and complete payments. They also offer reporting and reconciliation services.

Why Use A Payment Agent?

Using a payment agent offers several advantages. They provide secure and efficient payment processing solutions. Payment agents help businesses expand their payment options. They ensure compliance with financial regulations and reduce fraud risks. By using a payment agent, businesses can focus on growth while ensuring seamless transactions.

What Are The Benefits Of Payment Agents?

Payment agents offer several benefits to businesses. They simplify payment processing and enhance security. Agents provide access to multiple payment methods, increasing customer satisfaction. They ensure regulatory compliance and reduce fraud risks. Their services allow businesses to focus on core activities, improving efficiency and profitability.

Conclusion

Payment agents simplify transactions, making payments easier. They handle complex payment processes. This helps businesses focus on their core activities. Users gain convenience and security. Payment agents ensure smooth, reliable transactions. They bridge gaps between payers and recipients. Understanding their role can benefit your financial dealings.

Choose wisely when selecting a payment agent. Their services can impact your business operations significantly. Research options to find the best fit. Consider costs, security, and ease of use. With a good payment agent, transactions can be stress-free. Stay informed and make smart financial decisions.