Have you ever been gifted a down payment for your home? It’s a generous gesture, often from a family member or close friend, but what happens if you decide to pay it back?

You might be wondering if there are any consequences or benefits to returning this financial gift. Understanding the implications can be crucial for your financial planning and peace of mind. We’ll explore the ins and outs of reimbursing a gifted down payment, delving into how it might affect your taxes, your relationship with the giver, and even your mortgage process.

You’ll discover insights that may help you make a well-informed decision, ensuring you don’t overlook any hidden details. Keep reading to uncover the surprising facts and tips that could influence your next step.

Gifted Down Payments Explained

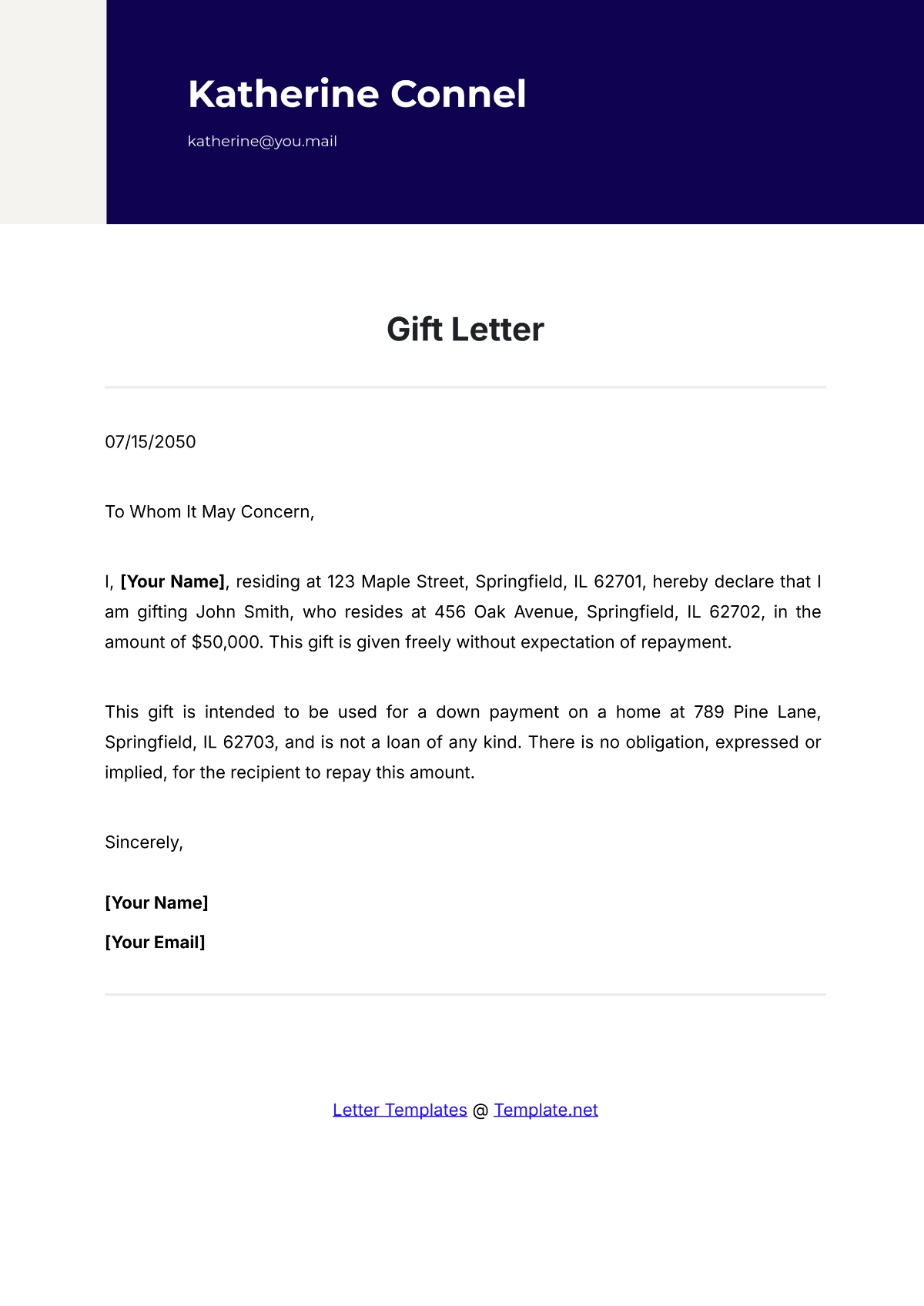

A gifted down payment means money given to help buy a house. Family usually gives this money. It is not a loan. You do not pay it back. The gift should be free of debts. Lenders ask for proof. This is a gift letter. It states the money is a gift. No repayment is needed.

Paying back a gifted down payment changes its nature. It becomes a loan. Loans need repayment. This affects your mortgage process. Lenders may change terms. Interest rates could rise. Always ensure clear communication. This helps avoid confusion. Know all rules before deciding.

Legal Implications

Paying back a gifted down payment can have tax effects. Gifts over a certain amount may need to be reported. This is because they can be taxed. Keeping track of these payments is important. Tax rules can be tricky. It’s best to consult a tax expert. They can help avoid problems. Tax laws change often. Staying updated is crucial. Always keep records of payments. This helps with future taxes.

Sometimes, paying back a gift can create contractual obligations. This means you might have to follow certain rules. These rules can be written or verbal. It’s important to understand them fully. Breaking these can lead to issues. Reading and understanding contracts is key. Always ask questions if unsure. Contracts are legally binding. Ensure everything is clear before signing. Misunderstandings can cause problems later.

Financial Impact

Paying back a gifted down payment can affect your credit score. It might lower your score if you take a loan to pay it back. Loans increase your debt. More debt can make your score go down. Paying on time is important. Late payments can hurt your score more. Keep track of what you owe. This helps manage your credit well.

Paying back the gift can change your mortgage terms. Lenders may see you as a risk. This might lead to higher interest rates. Higher rates mean more money over time. Read the terms carefully. Know what you are agreeing to. Make sure you understand the costs involved. Being informed helps you make smart choices.

Emotional And Relational Effects

Paying back a gifted down payment can change family relationships. It might cause feelings of mistrust or hurt. A gift is often seen as a sign of love and support. When it’s paid back, it may feel more like a loan. This can lead to misunderstandings. Family members might feel less close. Some may even feel betrayed. Conversations can become tense and awkward. Such changes can impact family gatherings and events.

Returning money can affect friendships. Friends might feel unappreciated or offended. It’s important to talk about feelings openly. This helps to avoid conflicts. Gifts are usually given with trust and kindness. Paying back might send a different message. Some friends may worry about financial issues. Others may feel the friendship is not genuine. These feelings can change how friends interact. They may choose to spend less time together.

Alternatives To Repayment

Changing the gift terms can help. You and the giver can discuss new terms. Both parties must agree. This way, you avoid paying back in cash. You might offer services instead. Maybe help with chores. Or provide some other support. This keeps the gift spirit alive. Amendments should be clear. Write them down if needed. This avoids future confusion.

Financial advisors can provide help. They know the laws. They understand financial matters. They might suggest creative solutions. This can include setting up a payment plan. Or finding other ways to settle. Advisors help you stay fair. They ensure you follow rules. This can protect both sides. Seeking advice is wise. It prevents unwanted problems.

Case Studies

Some people pay back a gifted down payment. It can bring changes. One family paid back their parents’ gift. They felt more financially free. Another couple faced issues. Their gift came with strings attached. Paying it back helped them. They felt less pressured and more independent.

Paying back a gift can be good. It can clear misunderstandings. People learn about money management. Some realize the importance of independence. Others see the value of open communication. Always talk before making decisions. Consider all options.

Frequently Asked Questions

Is Paying Back A Gifted Down Payment Legal?

Paying back a gifted down payment is generally not legal. Lenders require the down payment to be a true gift. It must not be a loan disguised as a gift. Always consult with a legal advisor or mortgage professional to understand the implications and adhere to lender requirements.

Can Repaying A Gifted Down Payment Affect My Mortgage?

Yes, repaying a gifted down payment can affect your mortgage. It may violate lender rules and result in mortgage denial. Lenders require a genuine gift, not a concealed loan. Ensure all financial contributions are transparent and compliant with lender policies to avoid complications.

What Are The Risks Of Repaying A Gifted Down Payment?

Repaying a gifted down payment carries several risks. It can jeopardize mortgage approval and lead to legal issues. Lenders may view it as a loan rather than a gift. Always clarify the nature of financial contributions to avoid misunderstandings and maintain compliance with lender requirements.

How Do Lenders Verify Gifted Down Payments?

Lenders verify gifted down payments through documentation. This includes a gift letter from the donor, bank statements, and proof of transfer. They ensure the gift is genuine and not a loan. Transparency and accurate documentation are essential to satisfy lender requirements and ensure smooth mortgage processing.

Conclusion

Repaying a gifted down payment can affect your financial stability. It might reduce your monthly budget, leading to tighter finances. Always communicate with the gift giver about repayment expectations. Consider legal agreements for clarity and trust. Check if your mortgage allows repayment of such gifts.

Understand potential tax implications. Consult a financial advisor for informed decisions. Manage your finances wisely to avoid future stress. Building a plan ensures smooth repayment without strain. Remember, clear communication is key. Keep all parties informed and document every step.

This approach secures peace of mind for everyone involved.