Have you ever seen the phrase “Payment Released” and wondered what it actually means for you? Maybe it appeared in an email from a vendor, on an invoice, or in your online banking notifications.

Understanding this phrase can be crucial, especially if you’re managing finances or waiting for a payment to come through. It might signal good news or require immediate attention, but it’s important to know why. We’ll dive into the meaning behind “Payment Released” and explore what it signifies for your transactions.

Stick around to discover how this simple phrase can impact your financial flow and what steps you might need to take next.

Defining Payment Released

The term payment released indicates that money has been sent. This usually occurs after a transaction is completed. It means the funds are no longer held by the sender. The receiver can access and use the money. Often, this step follows after verifying transaction details. No more waiting for the funds. Instant access is granted once payment is released. This term is common in business and finance. It provides assurance to both parties. Ensures that the agreed amount is delivered.

Payment release can also be linked to contracts. It signals fulfillment of terms. Parties can trust the process. It adds transparency to financial dealings. Understanding this term is crucial. It helps in managing transactions effectively. Everyone involved knows when funds are available. This makes planning easier.

Process Of Payment Release

The first step is checking the payment details. This ensures that the payment amount is correct. A secure system verifies the payment method. This step prevents errors and fraud. The recipient’s details are also verified. This makes sure the money goes to the right person. It is important for smooth transactions.

After payment, the product must reach the buyer. Delivery confirmation is needed. This shows the item has been received. Both seller and buyer check delivery status. It ensures satisfaction for both parties. Tracking numbers and receipts help in this process.

Final approval comes after all checks. This means the payment is ready to release. The bank or service provider gives this final nod. Once approved, the recipient gets the money. This step marks the end of the process. It confirms everything is in order.

Common Scenarios

Payment released means the buyer has paid the seller. The money is sent after a purchase. The seller can now send the item. Both parties are happy. The process is safe and secure. The marketplace handles the transaction. They make sure everything is fair. Everyone gets what they want. The buyer gets the item. The seller gets the money.

On freelance sites, payment released means the client has approved the work. The freelancer gets paid for their job. The money moves from the client’s account to the freelancer’s account. Both feel good about the work done. The platform ensures a smooth transaction. The client is satisfied. The freelancer is rewarded. Trust grows between them. Both can focus on their tasks.

In real estate, payment released means the buyer’s money is given to the seller. This happens after all papers are signed. The property now belongs to the buyer. The seller gets their money. The transaction is complete. Both parties feel secure. Everything is legal and checked. Trust is important here. The process is well-organized.

Impacts On Sellers

Payment released means sellers get their money. This helps with cash flow. Money comes in. Sellers can pay for things. They can buy more goods. They can pay workers. When money is released, sellers feel better. They can plan better. They know when money comes. This helps them manage their business.

Buyers trust sellers more when money is released. Trust grows stronger. Sellers build credibility. Buyers feel safe. They want to buy more. Trust helps sellers get more sales. Credibility is important for business. Sellers become known as reliable. This helps their reputation. Good reputation means more customers.

Impacts On Buyers

Payment released means the buyer’s money is now with the seller. This gives the seller a green light to ship the item. It assures that the buyer has paid. Buyers feel safe with this process. It builds trust. It also makes sure that the seller gets paid only when the buyer is happy. This is crucial for good business.

Sometimes, payment release can be slow. This can be due to bank issues. Or maybe online platform checks. This delay can make buyers worried. They might think the seller won’t ship. Or wonder where their money went. It’s important to know delays happen. But they are usually fixed quickly. Patience is key here.

Potential Challenges

Understanding ‘Payment Released’ can be tricky, posing challenges for businesses and individuals. It involves ensuring funds transfer correctly, verifying successful transaction completion, and addressing potential delays or errors. Payment discrepancies may lead to confusion, requiring careful monitoring and resolution to maintain financial stability.

Payment Delays

Payment delays can cause stress. Money might not arrive on time. Bills need paying. People worry. Delays happen for many reasons. Sometimes banks are slow. Other times, errors occur. It’s frustrating for everyone. Waiting feels endless. People rely on these payments. Plans might change because of delays. Patience is hard during these times. Everyone wants their money quickly. Understanding delays helps a little. Solutions are needed for quick payments.

Disputed Transactions

Disputed transactions cause confusion. Money might go missing. People ask questions. Was the transaction correct? Mistakes can happen. Disputes lead to stress. Both sides want their money. Resolution is important. Trust is crucial in transactions. Disputes can damage trust. Solutions must be fair. Everyone wants a quick fix. Communication helps during disputes. Listening is key. Resolving disputes is vital for peace. Keep records to avoid disputes.

Best Practices

Always use simple words when talking about payments. Make sure everyone understands what “payment released” means. Explain it in clear terms. This helps avoid confusion. People will trust you more. It’s important to be honest and open. Tell them when they will get their money. Communication is key.

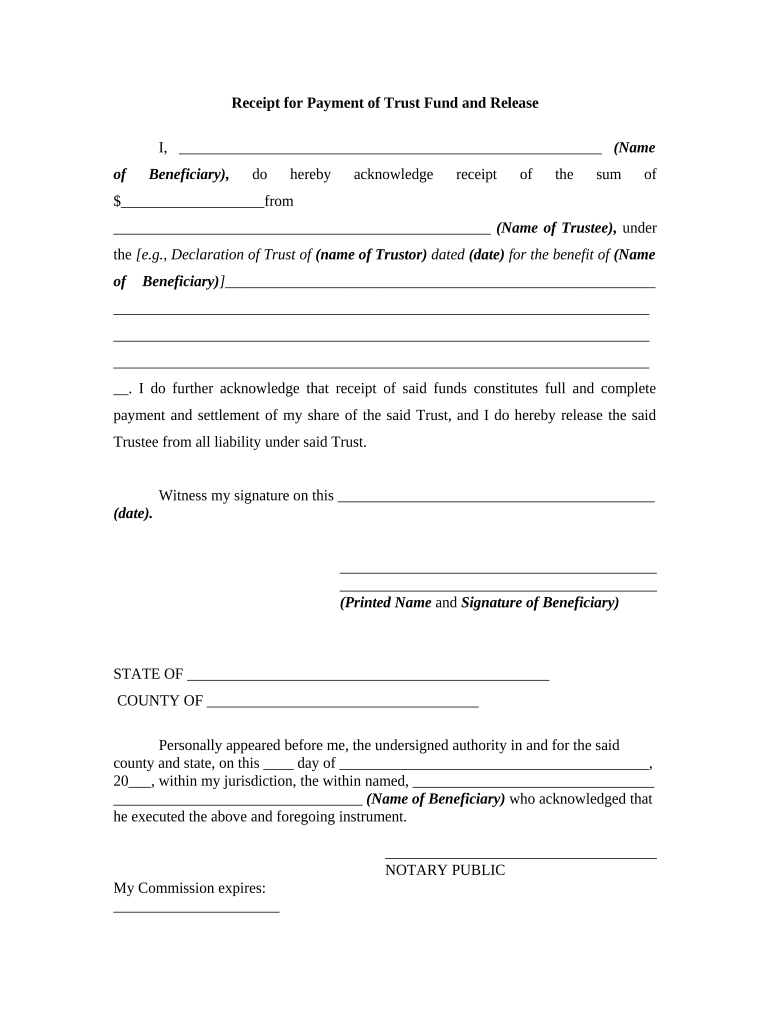

Escrow services keep money safe. They hold funds until work is done. This makes transactions safer. Both parties agree on terms. Payment is released once work is finished. Escrow helps build trust between buyers and sellers. It reduces risks. You don’t need to worry about losing money.

Future Trends

Blockchain is a new technology. It can make payments safer. A blockchain is a chain of blocks. Each block has information. This information is about payments. Blocks are linked together. No one can change them easily. This makes them secure. Many people trust blockchain. It can help stop fraud. It can make payments faster. This is why blockchain is important. It might be used more in the future.

Automation is making tasks easy. Automated payment systems are tools. They make payments faster. These systems help send money quickly. They do not need humans to work. This saves time. It also saves money. Banks and companies like them. They use them a lot. These systems help avoid mistakes. They are very reliable. Many people will use them soon.

Frequently Asked Questions

What Does “payment Released” Mean?

“Payment released” indicates that funds have been transferred to the recipient. It’s a confirmation that the payment process is complete. The recipient can now access and use the funds. This term is commonly used in financial transactions, including online purchases and freelance payments.

Why Is My Payment Not Released?

A payment might not be released due to pending verification. Other reasons could include insufficient funds or incorrect payment details. Ensure all information is accurate and any necessary approvals are completed. Contact your payment provider for specific issues.

How Long Does Payment Release Take?

The time for payment release varies by payment method. Bank transfers might take several days, while digital payments are often instant. Processing times may also depend on weekends and holidays. Always check with your payment provider for specific timelines.

Can Payment Release Be Reversed?

Yes, a payment release can sometimes be reversed. This usually happens if there’s an error or dispute. Contact your payment provider promptly if a reversal is necessary. Each provider will have specific policies and procedures for reversing transactions.

Conclusion

Understanding “Payment Released” is crucial for financial transactions. It signals that funds are on their way. This phrase means the money has left the payer’s account. Soon, it will arrive in the recipient’s account. Patience is key, as banks may take time.

Always verify with your bank for updates. Knowing these steps helps prevent confusion. It makes financial dealings smoother and more predictable. Stay informed to manage your finances better. This knowledge ensures you stay on top of your transactions.