Imagine this: You’ve just made an online purchase, and moments later, you receive a confirmation email stating, “Your payment has been processed.” But what does that really mean for you and your transaction?

Understanding the nuances of a processed payment can be crucial, especially in a world where digital transactions are part of your daily routine. It’s not just about money leaving your account; it’s about ensuring your payment journey is smooth and secure.

By diving into what a processed payment entails, you gain peace of mind and confidence in your financial interactions. Keep reading to unravel the mystery behind processed payments and see how it impacts you directly.

Processed Payment Definition

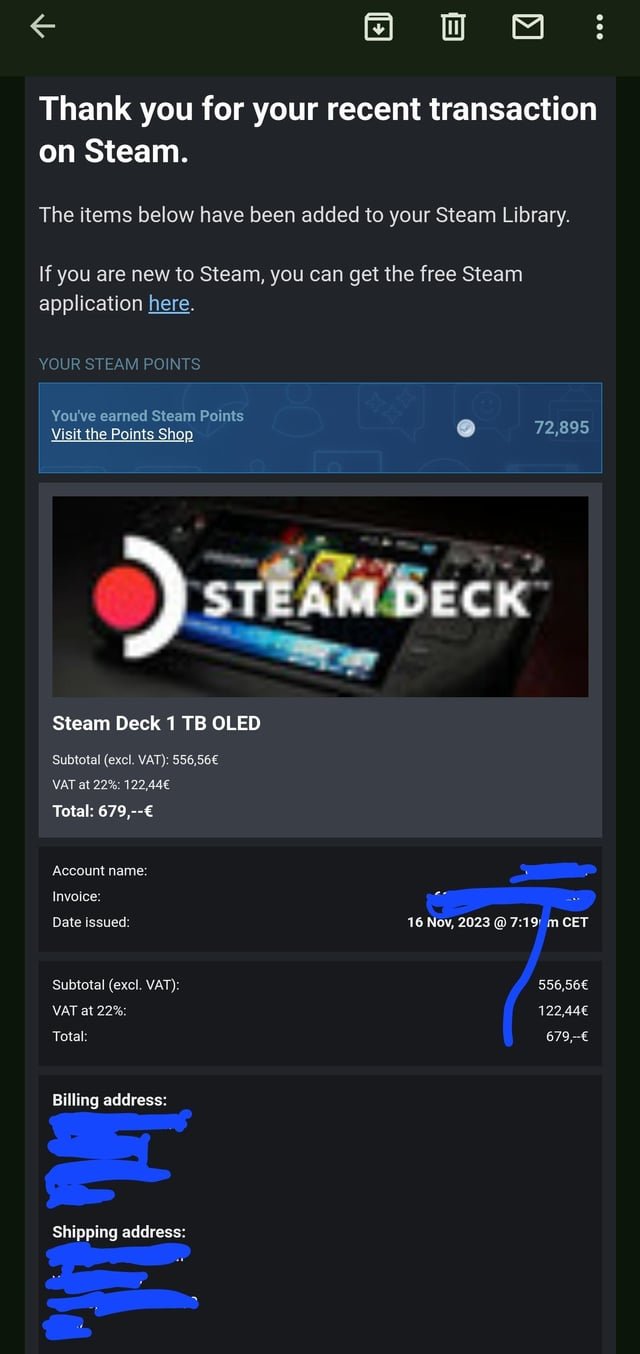

A processed payment means money has been sent successfully. It involves several steps, like checking funds and confirming details. First, the bank or service checks if funds are available. Then, they verify the account details. If all is correct, the payment is sent to the receiver’s account. This can take minutes or a few days. Quick payments are common with digital systems. Sometimes, banks may hold payments for review. This ensures security and prevents errors. Once processed, the money is ready for use.

Steps In Payment Processing

The first step is authorization. The cardholder gives their card details. The payment system checks if there is enough money. This step stops fraud. It makes sure the card is real. If the check is good, the payment is approved.

Authentication adds more safety. It checks if the user is the card owner. Sometimes a code is sent to the user’s phone. The user must enter this code. This step ensures the right person uses the card.

During clearing, banks talk to each other. They share payment info. The transaction is marked as complete. This is like a promise to pay. It happens after the authorization.

In settlement, the money moves. The customer’s bank sends money to the seller’s bank. This is the final step. The seller now has the money. The payment process is now finished.

Types Of Payment Processing Systems

Credit cards are easy to use. Many people use them daily. They work fast. Swipe, tap, or insert the card. Enter a PIN if needed. The money is taken from your credit line. This process is quick and secure. Stores love credit cards. They help you buy things easily.

ACH stands for Automated Clearing House. It moves money between banks. Slow but safe. It takes a few days. No cards or cash needed. Just bank accounts. Used for bills or salaries. Trusted by many for big payments.

Mobile payments are on phones. Easy and fast. Use apps like PayPal or Apple Pay. Tap your phone to pay. Safe and convenient. No need for cash or cards. Perfect for quick buys. Many stores accept them now.

Key Players In Payment Processing

Merchants sell goods and services. They accept money from customers. They use payment systems to process payments. Merchants need a bank account. This helps to receive money fast. Good payment systems keep business safe.

Payment gateways help money move. They connect merchants and banks. Security is a top job for them. Payment gateways check details. They make sure money is safe. Gateways work with cards and online payments. They are important for merchants.

Financial institutions are banks and credit unions. They hold and move money. They give loans and manage accounts. Financial institutions help payment systems work. They make sure payments reach merchants. They keep money safe.

Benefits Of Processed Payments

Processed payments make things faster. They speed up the whole process. This means less waiting time. People can focus on other tasks. Time is saved, and work gets done quickly.

They also bring enhanced security. This keeps money safe. It stops bad people from stealing. Everyone feels safer with this system. Trust is built with secure transactions.

Better cash flow is another benefit. Money moves smoothly. There are fewer delays. Businesses can plan better with steady money. Everything becomes more predictable and stable.

Challenges In Payment Processing

Fraud is a big problem for payments. Scammers try to steal money. They use fake cards and identities. Security measures help stop them. But fraudsters find new ways. Detecting fraud is hard. It needs constant attention.

Technical problems can stop payments. Systems can crash. Network issues can delay transactions. Software bugs are common. Payments may fail or get lost. Fixing these takes time. They need skilled people to solve.

Rules control how payments work. Regulations change often. Companies must follow them. Non-compliance leads to fines. It requires constant updates. Legal requirements are complex. Businesses must stay informed to avoid penalties.

Future Trends In Payment Processing

People use contactless payments with cards or phones. They tap on machines. It’s quick and easy. No need for cash or pins. Many stores have these now. It’s safer too. Germ-free payments. This way of paying is growing fast. More people use it every day.

Blockchain keeps money safe and secure. It uses special codes. These codes are hard to break. People trust blockchain for payments. It’s used for digital money like Bitcoin. This technology is new. It’s changing how payments work. Many like its security features.

Artificial Intelligence helps in payments. It makes systems smart. AI checks transactions for mistakes. It stops bad payments from happening. This technology learns fast. It gets better over time. Banks and stores use AI now. It helps in making payments smooth.

Frequently Asked Questions

What Is A Processed Payment?

A processed payment means a transaction has been completed successfully. It indicates that funds have been transferred from the payer to the recipient. This stage confirms the payment has been approved and recorded by the financial institutions involved.

How Long Do Payment Processing Times Take?

Payment processing times can vary based on the method used. Credit card transactions are typically instant or within a few hours. Bank transfers may take 1-3 business days. Factors like weekends or holidays can also affect processing times.

Why Is My Payment Still Processing?

A payment might still be processing due to several reasons. These include bank verification, technical issues, or fraud checks. It could also be delayed due to weekends or public holidays, when banks might not process payments.

Can A Processed Payment Be Reversed?

Yes, a processed payment can be reversed in some cases. This is often referred to as a chargeback or refund. The payer needs to contact their bank or payment provider to initiate this process, which may have specific terms and conditions.

Conclusion

Understanding processed payments is crucial for managing finances effectively. It means your transaction is completed. Funds are moved from your account to the seller’s. This process involves several steps but happens quickly. Knowing this helps avoid confusion and ensures smooth purchases.

Always check your statements for accuracy. Stay informed to manage your money better. This knowledge empowers you in everyday transactions. Keep learning about financial terms for smarter choices. It simplifies life and reduces stress. Remember, processed payments are just part of a bigger financial picture.