Are you planning to send money to a bank account in Portugal but aren’t sure where to start? Whether you’re supporting family, paying for a service, or investing in a property, transferring money overseas can seem daunting.

The good news is, it’s simpler than you might think. By understanding a few key steps and options, you can make your transfer quickly, safely, and affordably. Dive into our guide to discover the best ways to transfer money to Portugal, ensuring your funds arrive securely and without unnecessary fees.

Your peace of mind is just a few scrolls away!

Choosing The Right Transfer Method

Transferring money to a Portugal bank account can be easy. But picking the right transfer method is crucial. This choice affects speed, cost, and convenience. Before sending money, know the options available. Each method offers unique features and benefits. Understand these options to make the best decision.

Bank Transfers

Bank transfers are a traditional method. They are secure and reliable. Many prefer them for large sums of money. Funds move directly from one bank account to another. This method takes a few days for international transfers. Fees can vary, so check with your bank first. It’s often the safest choice for high-value transactions.

Online Transfer Services

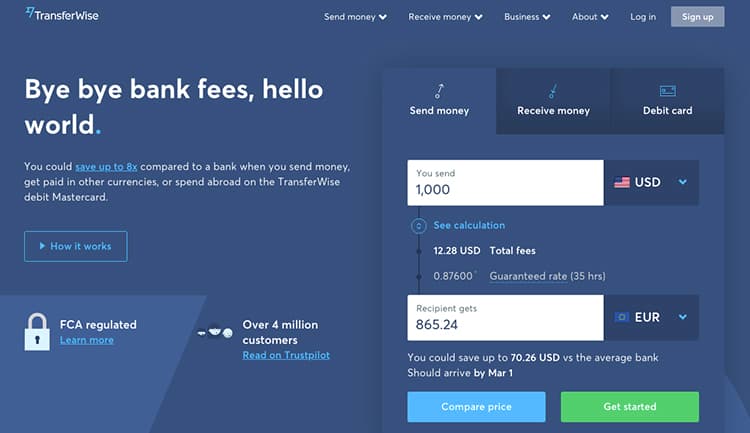

Online transfer services are gaining popularity. They offer speed and convenience. Services like PayPal or TransferWise are common. These platforms often have lower fees than banks. The process is straightforward and quick. You can send money from your computer or phone. These services are great for smaller amounts.

Mobile Payment Apps

Mobile payment apps are ideal for tech-savvy individuals. Apps like Revolut or Venmo provide easy transfers. Use your smartphone to send money in minutes. These apps offer competitive exchange rates. They are user-friendly and suitable for frequent small transfers. Ensure the app you choose supports transfers to Portugal.

Understanding Transfer Fees

Transferring money to a Portugal bank account involves understanding transfer fees. These fees can vary based on the bank and method used. It’s important to compare rates and options to ensure efficient and cost-effective transactions.

Understanding the fees associated with transferring money to a bank account in Portugal is crucial for ensuring your funds reach their destination without unnecessary costs. Whether you’re sending money to family, paying for services, or investing in property, knowing the different charges involved can help you save money. Let’s break down the components of transfer fees to give you a clearer picture.

Bank Charges

Banks can impose various fees when you transfer money internationally. These may include a flat fee per transaction or a percentage of the amount sent. It’s essential to check if your bank charges additional fees for SWIFT payments or international wire transfers.

Some banks might offer lower fees for online transactions compared to in-person services. Always inquire about these details to avoid unexpected expenses. Have you ever been surprised by a bank fee that wasn’t disclosed upfront?

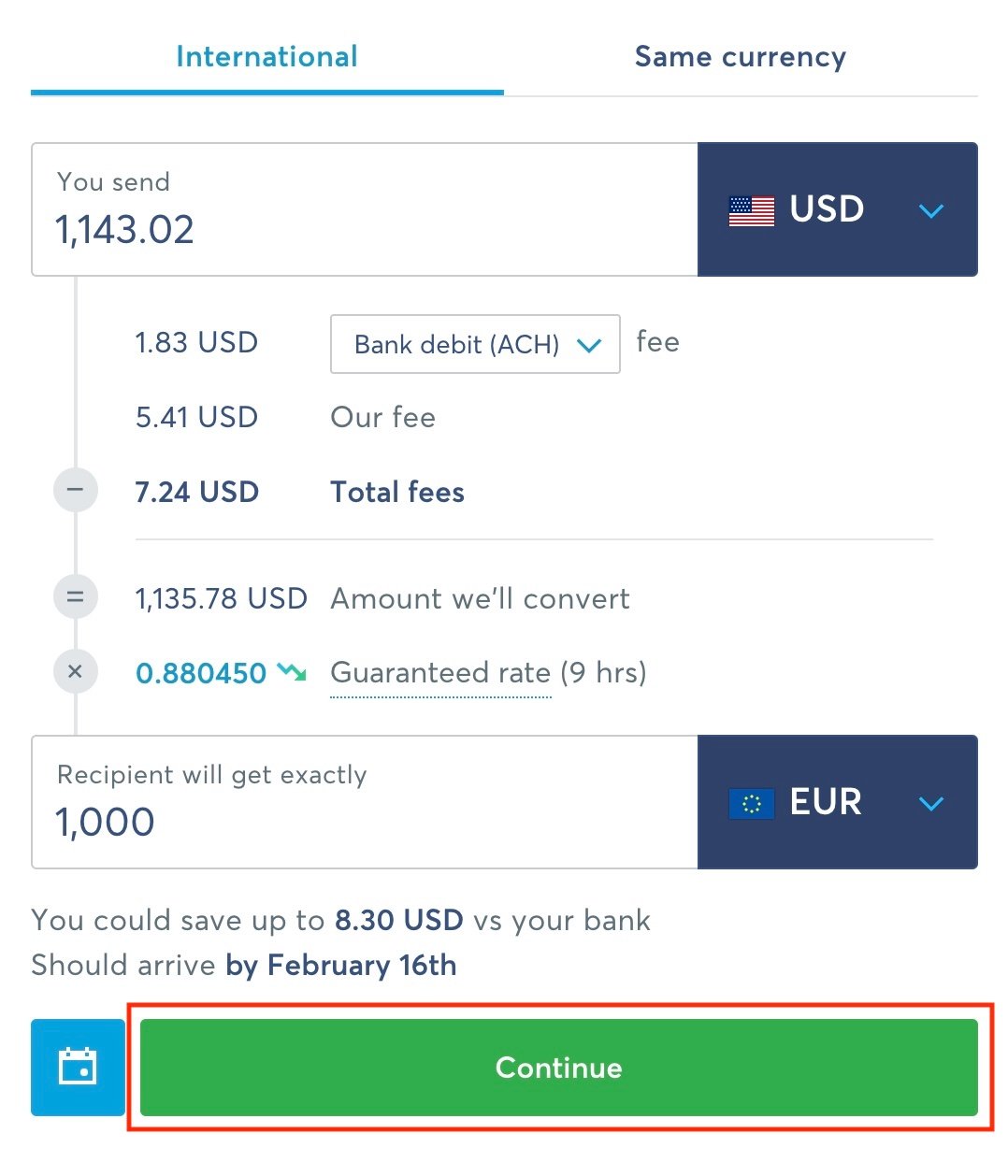

Service Provider Fees

If you choose a service provider like PayPal, Western Union, or TransferWise, keep an eye on their fees. These providers often charge a fee based on the amount you send, sometimes with a minimum or maximum limit.

Compare different services to find the most cost-effective option. Some may offer promotions or lower fees for first-time users. Have you compared service providers recently to find the best deal?

Currency Conversion Costs

Transferring money involves converting currencies, which can incur additional costs. Banks and providers might use their exchange rates, which are often less favorable than the market rate.

It’s wise to compare the exchange rates offered by different institutions. Even a small difference in rate can impact the amount received. Have you ever noticed the difference between the exchange rates offered by your bank versus an independent provider?

Understanding these fees can save you a significant amount over time. Would you rather spend that money on fees or something more enjoyable? By taking the time to evaluate your options, you ensure that more of your money reaches its intended destination.

Setting Up The Transfer

Transferring money to a Portugal bank account is straightforward. Proper steps ensure smooth transactions. This guide outlines the process to set up your transfer efficiently. Follow these steps to avoid common pitfalls and ensure your funds arrive safely.

Gathering Required Information

Before initiating a transfer, gather all necessary details. Ensure you have the recipient’s full name. Verify their bank account number and the bank’s full name. Obtain the bank’s International Bank Account Number (IBAN). Secure the Bank Identifier Code (BIC) or SWIFT code. Double-check these details for accuracy. Incorrect information may delay the process.

Entering Bank Account Details

Log into your online banking platform. Navigate to the transfer or payment section. Enter the recipient’s bank details. Include the IBAN and BIC/SWIFT code. Input the amount you wish to transfer. Ensure all information is correct before proceeding. Small errors can cause significant delays.

Checking Transfer Limits

Review your bank’s transfer limits. Some banks have daily or monthly caps. Verify if your transfer exceeds these limits. If it does, consider multiple smaller transfers. Alternatively, contact your bank for a temporary limit increase. Understanding these limits prevents unexpected complications.

Ensuring Transfer Security

Ensure safe transfers when sending money to Portugal bank accounts. Prioritize secure channels and verify all transaction details. Protect personal information to prevent unauthorized access.

Ensuring the security of your money transfer to a Portugal bank account is crucial. With the rise in online banking, security threats have become more common. Understanding how to safeguard your transactions can prevent potential risks. By focusing on key security measures, you can transfer your money with peace of mind.

Using Secure Platforms

Choose a reputable transfer service. Look for encryption features that protect your data. Secure platforms offer two-factor authentication. This adds an extra layer of security. Check for certifications that guarantee safety standards. Read reviews to see user experiences. A secure platform protects your money from unauthorized access.

Verifying Recipient Details

Double-check the recipient’s bank details. Mistakes can lead to failed transfers or money loss. Confirm the account number and bank code. Verify the recipient’s name matches the account. Ask the recipient to confirm their details. This step ensures your money reaches the correct account. Secure transfers rely on accurate information.

Monitoring For Fraud Alerts

Stay alert for suspicious activity. Many banks offer fraud monitoring services. Sign up for notifications about unusual transactions. Regularly check your account statements. Report any strange activity immediately. Fraud alerts help detect and prevent theft. Keeping a close watch on your account ensures a secure transfer process.

Tracking Your Transfer

Sending money to a Portugal bank account becomes simple with tracking tools. Monitor every step of your transfer journey easily. Stay informed with real-time updates and ensure your funds reach their destination securely.

When sending money to a Portugal bank account, ensuring your funds arrive safely and on time is crucial. Tracking your transfer provides peace of mind and helps you stay informed about the status of your transaction. It’s a simple yet effective way to monitor your money’s journey and address any issues that might arise. Let’s dive into how you can keep tabs on your transfer and ensure a smooth process.

Using Tracking Numbers

Most money transfer services provide a tracking number once you initiate a transaction. This unique identifier allows you to follow your money’s progress. Simply enter this number on the service provider’s website or app to see where your money is at any given moment.

Think of it like tracking a package. You wouldn’t send a gift without knowing when it will arrive, right? Similarly, tracking numbers provide transparency and help you plan your finances better.

Receiving Confirmation Notifications

Stay in the loop by opting for confirmation notifications. Many services offer SMS or email alerts once your transfer is processed and when it arrives at the recipient’s bank account. This keeps you informed without having to check the status manually.

Notifications can save you time and worry. If you’ve ever sent money without receiving confirmation, you know the anxiety it can cause. Alerts ensure you’re updated every step of the way, allowing you to relax knowing your funds are where they should be.

Resolving Delays

Despite the best efforts, delays can happen. If your transfer takes longer than expected, having a tracking number and notifications can be invaluable. Contact customer support with your tracking details to get insights into any hold-ups.

Delays might occur due to various reasons like bank holidays or incorrect account details. By acting promptly and having the right information, you can resolve issues faster. Have you ever faced a delay? It’s frustrating, but knowing how to resolve it quickly can make all the difference.

Always ensure your information is correct before sending money. Double-check account numbers and recipient details to avoid unnecessary hitches. Being proactive can save you time and stress, ensuring your money reaches its destination smoothly.

Tips For Faster Transfers

Transferring money to a Portuguese bank account can be quick with a few smart steps. Start by choosing a reliable transfer service for speed. Verify all bank details to avoid delays.

Transferring money to a bank account in Portugal doesn’t have to be a daunting task. With the right strategies, you can ensure your money reaches its destination swiftly and securely. Whether you’re sending funds to family, paying for services, or managing international business transactions, speed is often of the essence. Here are some practical tips to accelerate your money transfers to Portugal.

Choosing The Right Time

Timing can significantly impact the speed of your transfer. Banks often process transactions more quickly during regular business hours and on weekdays. Try sending your money during these times to avoid any unnecessary delays.

Another consideration is the time zone difference. If you’re transferring from a country with a different time zone, align your transfer with Portuguese banking hours. This simple adjustment can shave hours off the transaction process.

Using Express Services

For urgent transfers, express services are your go-to option. Many banks and financial services offer express options that guarantee faster processing times. While these services might come with a higher fee, they ensure your money arrives promptly.

Consider using digital platforms or apps that specialize in quick international transfers. These services often bypass traditional banking systems, speeding up the process. Just ensure they are reputable and secure.

Avoiding Common Mistakes

Simple errors can lead to significant delays. Double-check all recipient details before hitting send. Incorrect IBAN or SWIFT codes can cause your transfer to be rejected or delayed, requiring additional time to resolve.

Be mindful of any imposed transfer limits. Splitting a large sum into smaller transfers can sometimes circumvent these limits and expedite the process. Always verify the latest policies of your bank or service provider to avoid unexpected hurdles.

Have you ever experienced a delayed transfer due to a small error? Share your experiences in the comments, and let’s help each other avoid these common pitfalls.

Frequently Asked Questions

How Can I Transfer Money To Portugal?

To transfer money to Portugal, use an international bank transfer. Provide the recipient’s IBAN and SWIFT/BIC code. Online platforms like TransferWise or PayPal are also options. Check fees and exchange rates before proceeding to ensure a cost-effective transfer.

What Are Portugal Bank Transfer Fees?

Portugal bank transfer fees vary by institution. Typically, fees range from €5 to €20 for international transfers. Online services often offer lower rates. Always check the fee structure before proceeding to avoid unexpected costs.

How Long Does A Money Transfer To Portugal Take?

A money transfer to Portugal typically takes 1-5 business days. The duration depends on the method used and the banks involved. Online services may offer faster transfers, sometimes within hours. Always verify the estimated time with your provider.

Is It Safe To Transfer Money To Portugal?

Yes, transferring money to Portugal is generally safe. Use reputable banks or online services with strong security measures. Confirm recipient details to avoid errors. Monitor transactions for any unusual activity to ensure the safety of your funds.

Conclusion

Transferring money to a Portugal bank account is straightforward. Understand the steps involved. Choose a reliable method. Consider the fees and exchange rates. Ensure you have all required details. Your transfer should be quick and safe. Many options offer convenience and security.

Trustworthy services ensure peace of mind. Planning in advance helps avoid delays. Stay informed about your chosen method. With careful planning, your money reaches its destination smoothly. Always verify recipient details before sending. This ensures a hassle-free process. Keep these tips in mind for a successful transfer.