Transferring money from your bank account to your credit card can seem like a daunting task. But what if I told you it doesn’t have to be?

Imagine having the power to manage your finances with ease, eliminating the stress of impending credit card payments. You can take control of your financial health and boost your credit score. This process is simpler than you think, and mastering it could be a game-changer for your financial freedom.

Are you ready to discover how you can effortlessly transfer money from your account to your credit card? Let’s dive in and unlock the secrets to a smoother financial journey.

Understanding Account Transfers

Understanding how to transfer money from your bank account to your credit card can save you from late payment fees and high interest rates. It’s a straightforward process, yet many people overlook its importance. Let’s dive into the essentials to make this transaction hassle-free.

What Is An Account Transfer?

An account transfer involves moving funds from one account to another. In this case, you’re transferring money from your bank account directly to your credit card account. It’s similar to paying a bill online but specifically targets your credit card balance.

Why Transfer Money To Your Credit Card?

Transferring money to your credit card ensures you avoid late fees and interest charges. It maintains your credit score by showing consistent payments. But more importantly, it provides peace of mind knowing your financial obligations are met.

Steps To Transfer Money

- Log into your online banking account.

- Select the option for ‘Transfers’ or ‘Payments’.

- Enter your credit card details as the recipient.

- Specify the amount you wish to transfer.

- Confirm the transaction and note any reference number provided.

Each bank might have slightly different procedures, so be sure to read your bank’s specific instructions. Always double-check the credit card details entered to avoid errors.

Personal Insight: The Time I Missed A Payment

Once, I forgot to pay my credit card on time. I felt the sting of a late fee and higher interest. It was a costly reminder of the importance of timely transfers. From that day, I set up automatic transfers to ensure I never missed a payment again. Have you ever faced a similar issue?

Considerations Before You Transfer

Before transferring, check if there are any fees associated with the transaction. Some banks charge for transfers, so weigh the cost against potential late fees. Also, review your current bank balance to ensure you have sufficient funds.

Benefits Of Online Transfers

Online transfers are quick and convenient. You can manage them from anywhere without visiting a bank. It’s efficient and helps you stay on top of your finances. Wouldn’t you prefer handling this from the comfort of your home?

Final Thoughts

Understanding account transfers is key to maintaining financial health. By ensuring your credit card payments are made on time, you safeguard your credit score and avoid unnecessary fees. Take control of your finances today and make timely transfers a habit.

Preparing For The Transfer

Transferring money from an account to a credit card involves a few simple steps. Verify your account balance to ensure sufficient funds. Select the ‘transfer funds’ option in your banking app or website, and follow the prompts to complete the transaction.

Preparing for a money transfer from your account to a credit card requires careful planning. Taking these steps ensures a smooth transaction. Start by understanding your financial situation. This helps you avoid unnecessary fees.

###

Check Account Balance

Before transferring money, check your account balance. This confirms you have enough funds. Log into your bank account online or use a mobile app. Make sure the available balance covers the transfer amount. Keeping an eye on your balance prevents overdraft fees. It also ensures the transfer goes smoothly.

###

Review Credit Card Statement

Next, review your credit card statement. Know how much you owe on your card. Check for any pending charges or recent payments. Understanding your statement helps you decide the transfer amount. It also helps in managing your credit card debt better.

###

Gather Necessary Information

Gather all necessary information for the transfer. You need your bank account details. Also, have your credit card number ready. Know the exact amount you wish to transfer. Prepare any passwords or security codes you might need. This keeps the process quick and easy. Being prepared saves time and reduces errors.

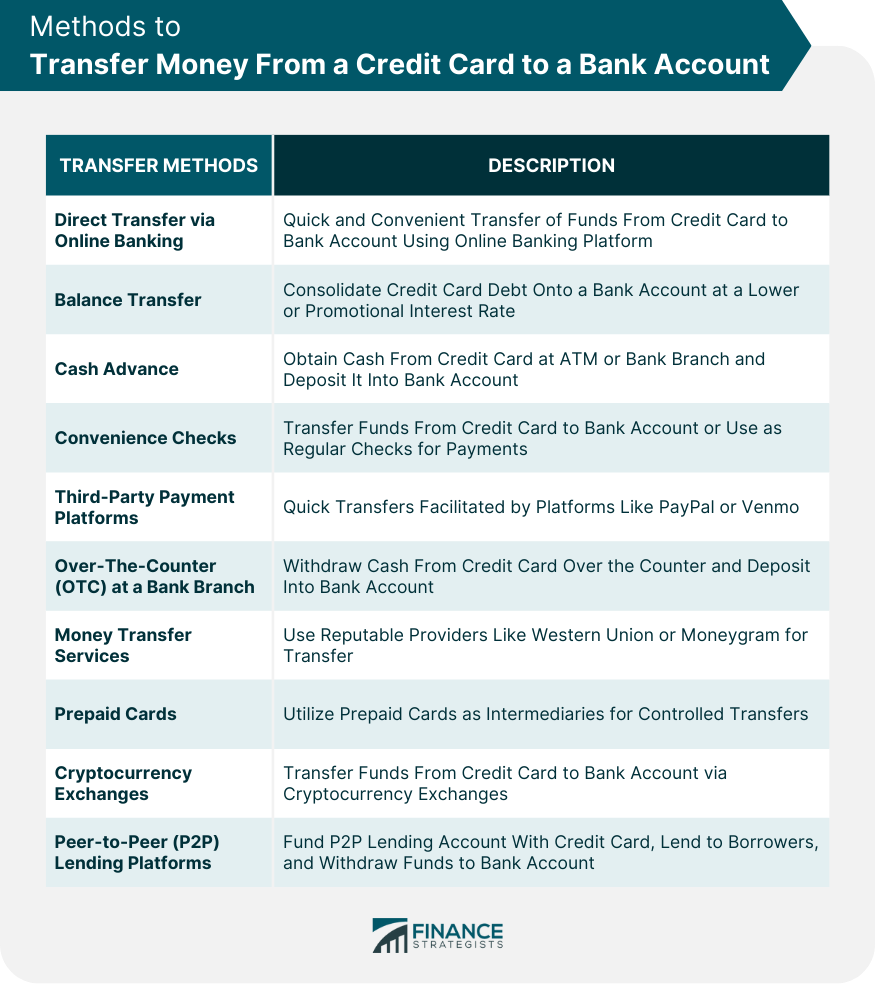

Choosing The Right Transfer Method

Transferring money from your account to your credit card can be a simple task, but choosing the right method can make a significant difference in terms of convenience and speed. With various options available, it’s essential to understand which method aligns with your lifestyle and needs. Let’s explore some of the most popular ways to make these transfers effectively.

Online Banking Options

Online banking platforms offer a seamless way to transfer money. Log into your bank’s website, locate the transfer or payment section, and follow the prompts to move funds to your credit card account. The process is often straightforward, allowing you to complete a transfer in just a few clicks.

Many people find online banking convenient as it can be done from the comfort of their own home. It’s also a great option if you want to keep track of your transactions digitally. Have you ever considered how much time you save by avoiding bank queues?

Mobile Banking Apps

If you’re always on the go, mobile banking apps might be your best friend. These apps are designed for easy navigation, enabling you to transfer money directly from your smartphone. Simply open the app, select your transfer option, and enter the necessary details.

Mobile apps often come with additional features, such as transaction alerts and balance updates. This can be particularly useful if you want to stay informed about your financial activities. Imagine receiving a notification the moment your credit card payment is processed—peace of mind at your fingertips.

In-person Transactions

For those who prefer a more personal touch, in-person transactions at your local bank branch might be appealing. Speak directly with a bank representative who can guide you through the process. This method ensures that all your questions are answered on the spot.

While it may take more time than online or mobile options, in-person transactions can be beneficial if you need expert advice. Have you ever walked out of a bank feeling more confident about your financial decisions? Sometimes, a face-to-face conversation is all it takes.

Each transfer method has its own set of advantages. Consider your lifestyle and preferences when choosing how to manage your funds. What matters most to you: convenience, speed, or personal interaction?

Step-by-step Transfer Guide

Transferring money from your bank account to your credit card is simple. Follow this guide to complete your transfer smoothly. Each step is straightforward and easy to understand. Let’s get started.

Log Into Your Account

Begin by accessing your online banking portal. Use your username and password to log in. Ensure your details are correct to avoid any issues.

Select Transfer Option

Once logged in, navigate to the transfer section. This is usually found in the main menu. Choose the option to transfer money to your credit card.

Enter Transfer Details

Input the amount you wish to transfer. Double-check the credit card number and other required details. Accuracy is crucial to ensure your money reaches the right place.

Confirm Transaction

Review all entered information carefully. Confirm the transaction once you are satisfied. You may receive a confirmation message shortly.

Following these steps ensures a smooth transfer process. Remember to keep your banking information secure at all times.

Monitoring The Transfer Status

Monitoring the transfer status is vital when sending money to a credit card. It ensures your funds reach the intended destination securely and promptly. In this section, we will explore how to monitor your transfer status effectively. Learn how to check confirmation messages and track the transaction in your account history.

Check Confirmation Messages

Once you initiate a transfer, check for confirmation messages. These messages provide essential details about your transaction. You might receive them through email or SMS. Verify the transaction amount and recipient details. This helps ensure everything is correct.

Track Transaction In Account History

After receiving a confirmation message, track the transaction in your account history. Log into your online banking account. Navigate to the transactions section. Look for the recent transfer entry. Confirm the transaction status and date. This process gives you peace of mind.

Troubleshooting Common Issues

Transferring money from your account to a credit card can be simple. Yet, sometimes issues arise. Understanding these common problems can help you navigate them smoothly.

Failed Transactions

Failed transactions are frustrating. They might occur due to system errors. Often, insufficient funds cause these failures. Double-check your account balance. Ensure you have enough to cover the transfer. Sometimes, network issues disrupt transfers. Retry after a few minutes. If problems persist, contact your bank for assistance.

Incorrect Details Entered

Entering incorrect details is a common mistake. Check the credit card number carefully. Ensure it matches the correct card. Verify the expiration date and CVV code. Small errors can stop your transaction. Review all information before submitting. This reduces the chances of errors.

Delays In Processing

Delays in processing can be puzzling. Some banks take longer to process transfers. Processing times vary between institutions. Transfers might not be instant. Expect a delay of a few hours or days. Monitor your transaction status. If delays exceed expected times, reach out to your bank.

Security Tips For Safe Transfers

Transferring money from your account to a credit card? Prioritize security. Online transactions offer convenience. Yet, they come with risks. Protect yourself with simple security measures. These tips ensure your money stays safe.

Protecting Personal Information

Keep your personal information private. Share details only on trusted sites. Use strong, unique passwords. Change them regularly. Avoid using the same password across sites. Enable two-factor authentication. This adds an extra layer of security. It keeps your accounts safe from unauthorized access.

Secure Internet Connections

Use secure internet connections for transactions. Avoid public Wi-Fi networks. They lack security and are easily hacked. Use a VPN for an extra layer of protection. Ensure websites are secure. Look for “https” in the URL. A padlock icon indicates a secure site. Your data remains protected during transfers.

Regular Account Monitoring

Regularly check your account statements. Monitor for unauthorized transactions. Report suspicious activity immediately. Set up alerts for your accounts. Receive notifications for large transactions. This keeps you informed. It helps you catch issues early. Ensure your contact information is updated. So, you receive all alerts promptly.

Benefits Of Regular Transfers

Transferring money from a bank account to a credit card can offer many advantages. Regular transfers can lead to better financial management. They can prevent unnecessary stress and financial complications. Understanding these benefits can help in making informed financial decisions.

Avoiding Late Fees

Paying credit card bills on time helps avoid late fees. Regular transfers ensure payments are never missed. This keeps extra charges away, saving money in the long run. Timely payments build a strong financial routine.

Improving Credit Score

A good credit score opens doors to financial opportunities. Regular payments on your credit card boost your score. This shows lenders you are responsible with money. A higher credit score can lead to better loan offers.

Managing Finances Better

Regular transfers help in tracking spending patterns. Knowing where money goes aids in budgeting. It brings clarity to financial habits. This makes managing monthly expenses easier and less stressful.

Frequently Asked Questions

How Do I Transfer Money To A Credit Card?

To transfer money to a credit card, log into your online banking account. Select the transfer option, choose your credit card as the recipient, and enter the amount. Confirm the transaction details before completing the process. Ensure your bank supports this feature and check for any associated fees.

Can I Use Online Banking For Transfers?

Yes, online banking is a convenient way to transfer money to a credit card. Most banks offer this feature on their platforms. Simply log in, navigate to the transfer section, and follow the prompts. Always verify the details before confirming the transaction to avoid errors.

Are There Fees For Transferring Money?

Fees may apply when transferring money to a credit card. These fees vary depending on your bank and credit card issuer. Always check with your bank for specific charges and conditions. Understanding these costs can help you manage your finances more effectively.

How Long Does A Transfer Take?

Transfers to a credit card typically take 1-3 business days. The exact time depends on your bank and credit card issuer. Some banks offer instant transfers, but they might incur extra fees. Always check your bank’s policy for accurate timing details.

Conclusion

Transferring money to a credit card is simple and useful. It helps manage finances better. Always check fees before you transfer. Make sure your account has enough funds. This avoids extra charges. Use your bank’s app for quick transfers. It’s convenient and safe.

Keep track of your transactions regularly. This helps in budgeting and planning. Remember, timely payments enhance your credit score. Understanding these steps saves time and stress. Achieve financial peace with organized money management. Stay informed and make wise choices for your financial health.