Are you looking to transfer money from the UK to a USA bank account but feeling overwhelmed by the process? You’re not alone.

Many people find themselves puzzled by the different options available, the fees involved, and the time it takes for the money to reach its destination. But don’t worry, you’re in the right place. In this guide, you’ll discover the simplest and most cost-effective ways to send money across the pond.

Whether it’s for personal reasons, business transactions, or supporting family and friends, knowing how to transfer money efficiently can save you both time and money. Keep reading to learn the step-by-step process and insider tips that can make your money transfer experience smooth and stress-free.

Choosing The Right Transfer Method

Transferring money internationally can be daunting. The right method ensures efficiency and cost-effectiveness. Each option has distinct features. Understanding them aids in making informed decisions.

Bank Transfers

Bank transfers are traditional and secure. Most banks offer international transfer services. The process usually involves visiting a bank branch. Alternatively, use online banking platforms. Fees might be higher compared to other methods. Transfers can take several business days. Currency exchange rates vary. Check rates before initiating a transfer.

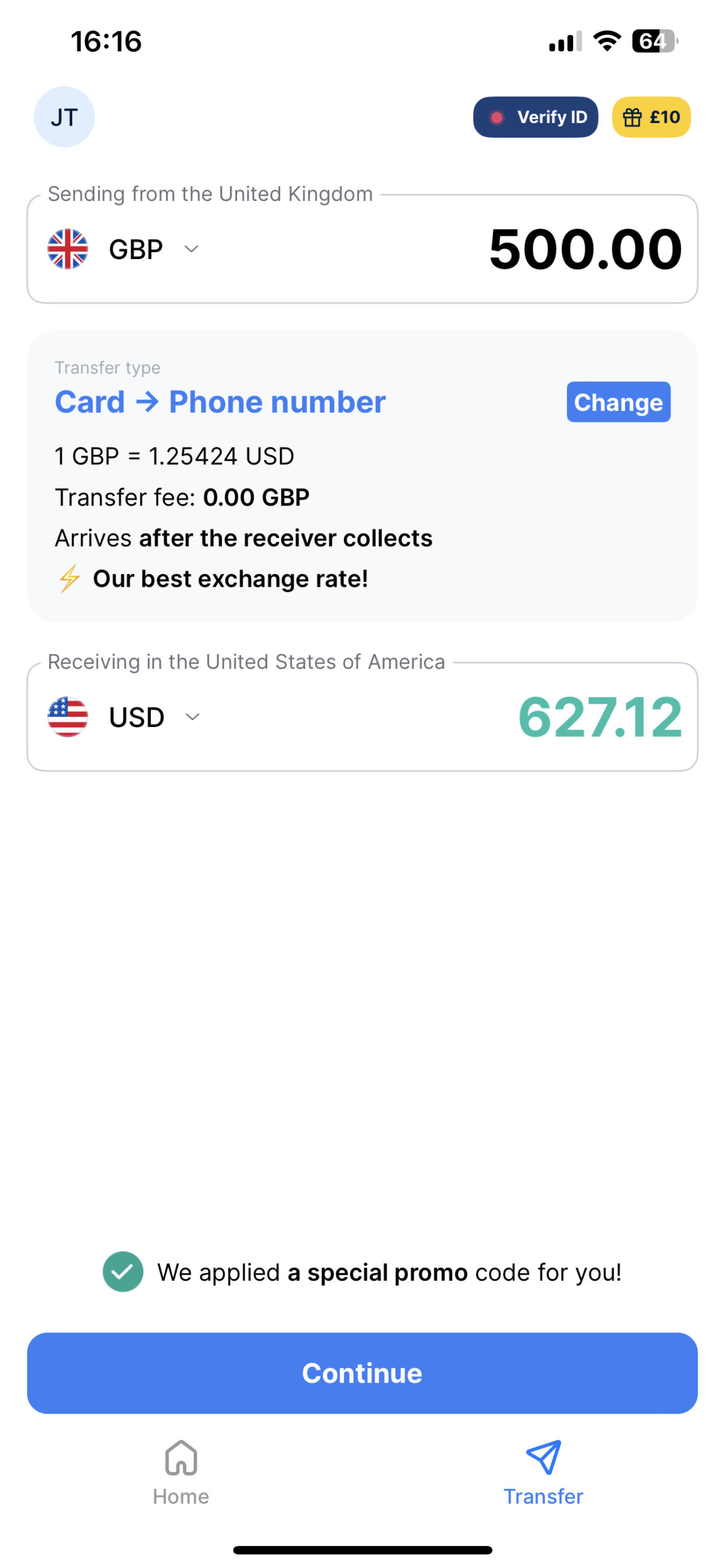

Online Payment Services

Online payment services offer convenience and speed. Platforms like PayPal and Wise are popular choices. They provide competitive exchange rates. Registration is simple and quick. Transactions are completed in minutes. Fees are generally lower than bank transfers. Ensure the recipient has an account on the same platform. Verify limits and fees before proceeding.

Currency Exchange Services

Currency exchange services specialize in international transfers. Companies like Western Union and MoneyGram are reliable. They offer competitive rates and fast transfers. Some provide physical locations for cash transactions. Others operate online for ease of use. Compare multiple services for the best rates. Consider transaction fees and delivery times.

Understanding Exchange Rates

Transferring money from the UK to a USA bank account involves understanding exchange rates. These rates determine how much the currency is worth. Knowing this helps in getting the best value during transfers.

Transferring money from the UK to a USA bank account involves more than just a simple transaction. One crucial aspect that can significantly impact how much your recipient receives is the exchange rate. Exchange rates determine how much one currency is worth in relation to another. They fluctuate based on economic factors, so understanding them is vital to ensure you get the most value from your transfer.

Impact On Transfer Amount

Exchange rates can either work in your favor or against it. If the British Pound (GBP) is strong against the US Dollar (USD), you will get more dollars for each pound you transfer. On the flip side, if the GBP weakens, you’ll receive fewer dollars.

Imagine sending £1,000 when the exchange rate is 1.30; your recipient gets $1,300. However, if the rate drops to 1.25, they only receive $1,250. That’s a difference of $50, which could cover an extra bill or a nice dinner. Do you want to lose that just because of timing?

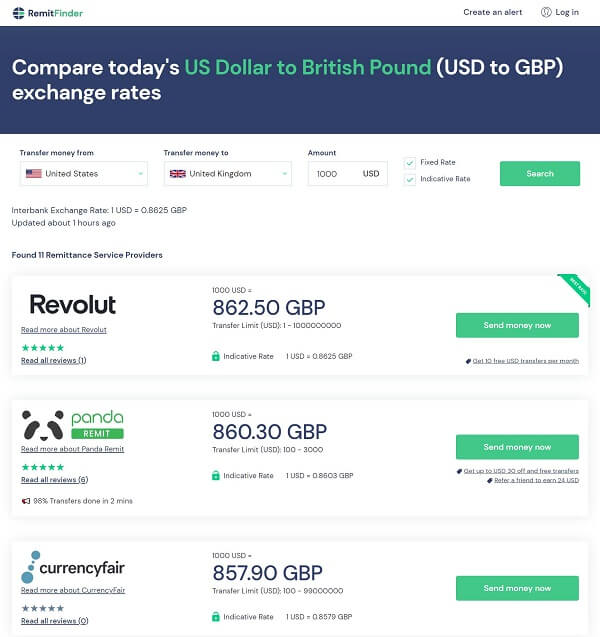

Finding The Best Rates

Finding the best exchange rate is like shopping for the best deal. Banks and money transfer services offer varying rates. Some add a markup, while others provide competitive rates.

Look for services that offer real-time rates and compare them. Online platforms often list rates from various providers. A little research can save you money, especially if you are transferring a significant amount.

Consider using rate alerts. These notify you when the exchange rate reaches your desired level. It’s a smart way to plan your transfer without constantly checking rates.

Understanding exchange rates is key to maximizing your transfer amount. Are you willing to let fluctuating rates dictate your financial decisions, or will you take control by finding the best deals?

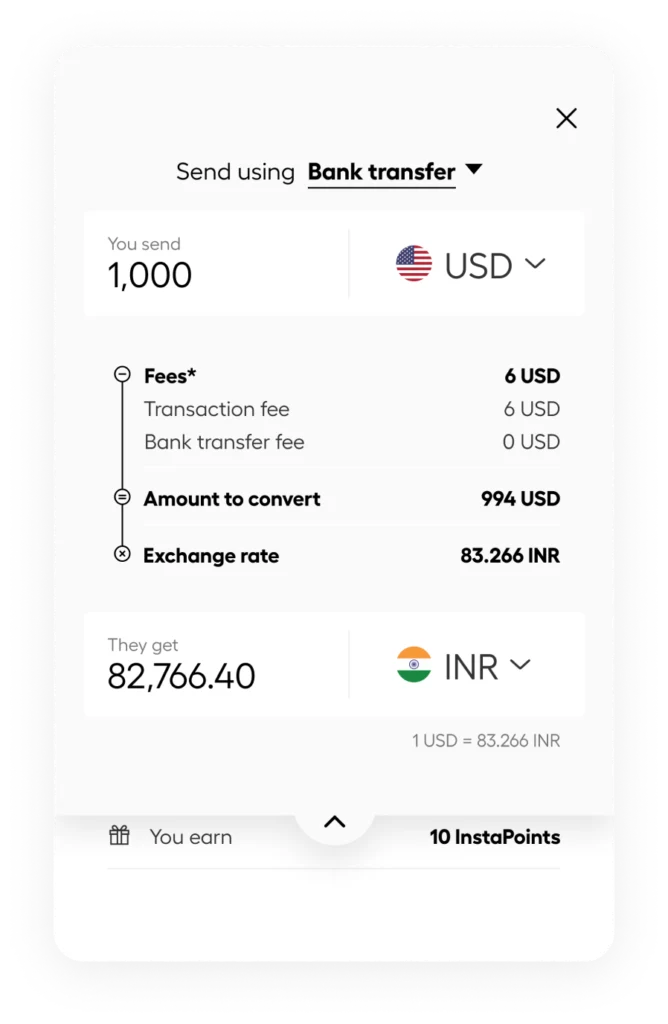

Calculating Transfer Fees

Calculate transfer fees to send money from a UK bank to a USA bank account efficiently. Compare service providers and rates to find the best option. Understand exchange rates and hidden charges to avoid surprises.

Calculating transfer fees is a crucial step when sending money from the UK to a USA bank account. Understanding these fees can save you from unexpected costs and help you choose the most economical method. It’s not just about the transfer amount; it’s about making sure your hard-earned money arrives without unnecessary deductions.

###

Hidden Costs

Transfer fees aren’t always straightforward. Some services might advertise low fees but have hidden costs that catch you off guard. For example, a friend once transferred a large sum, only to find out later that the exchange rate was significantly marked up. This hidden cost ate into the amount the recipient received. You should always check both the fees and the exchange rates to ensure transparency.

Banks and money transfer services might also charge additional processing fees. These can vary widely, so it’s crucial to read the fine print before making your transfer. Are you paying more than you should without realizing it?

###

Comparing Service Fees

Not all transfer services are created equal. Some may charge a flat fee, while others might take a percentage of your transfer amount. To illustrate, let’s compare two services:

– Service A: Charges a flat fee of £10 per transfer.

– Service B: Charges 1% of the transfer amount.

If you’re transferring £1,000, Service A would cost you £10, while Service B would take £10 as well. However, if you’re transferring £10,000, Service A remains at £10, while Service B jumps to £100.

Consider how often you transfer money and the typical amounts. This will help you choose the service that offers the best value for your needs.

By taking the time to calculate and compare these fees, you ensure that more of your money reaches its destination. What’s your strategy for avoiding high transfer fees?

Setting Up The Transfer

Transferring money from the UK to a USA bank account can seem daunting. Setting up the transfer is a crucial step. You need to ensure all details are correct. Mistakes might delay the process or incur extra fees.

Gathering Necessary Information

Start by gathering all required information. You need the recipient’s bank account number. Also, get the bank’s routing number. Double-check these numbers for accuracy. Incorrect details can lead to failed transfers.

Know the exact amount you wish to send. Consider any fees or exchange rates. These can affect the total amount received. It’s wise to consult your bank or service provider.

Entering Recipient Details

Next, enter the recipient’s details. Input their full name as registered with their bank. Use their address if required. Ensure all spelling is correct.

Fill in the bank account and routing numbers. Check each digit carefully. Even one wrong number can cause issues. A careful review can prevent errors.

Some services may ask for additional information. This might include security questions or codes. Have these ready to speed up the process.

Ensuring Security

Transferring money from the UK to a USA bank account requires secure methods. Use trusted services like banks or reputable online platforms. Always double-check details to avoid errors and ensure funds are protected.

Transferring money from the UK to a USA bank account involves more than just numbers. It’s a task that requires careful attention to security. You want your hard-earned money to reach the right place safely. How can you be sure that your transfer is secure? Let’s dive into some practical steps you can take to ensure the security of your international money transfers.

###

Using Secure Platforms

Choosing the right platform can make all the difference. Always use reputable and secure money transfer services like TransferWise or PayPal. These platforms use encryption to protect your data and money. Remember the time I almost fell for a flashy online service that promised instant transfers but had no security badges? I quickly realized it was too good to be true. Always check for security certifications and user reviews before proceeding.

When you’re on a secure website, look for a padlock symbol in the browser’s address bar. This indicates that the site is using HTTPS, a secure protocol. It’s a simple step, but it can save you from a lot of trouble.

###

Recognizing Fraudulent Activities

Awareness is your best defense against fraud. Be wary of emails or messages that ask for your banking information. Genuine companies will never ask for sensitive details through insecure channels. I once received an email claiming to be from my bank, asking me to confirm my account details. It looked convincing, but the email address was slightly off. If you ever receive such requests, contact your bank directly using official contact details.

Always double-check the recipient’s details before making a transfer. A small mistake can send your money to the wrong account. Confirm details like bank name, account number, and routing number with the recipient before proceeding.

Have you ever thought about setting up two-factor authentication for your accounts? It adds an extra layer of security, making it harder for unauthorized users to access your account. It might seem like a small hassle, but it can prevent major headaches.

Security is not just about using the right tools; it’s about being vigilant and informed. By taking these steps, you can ensure that your money reaches its destination safely. What strategies do you use to keep your transactions secure?

Tracking The Transfer

Sending money from the UK to a USA bank account is simple. Various online platforms offer quick transfers. Choose one, enter the recipient’s details, and follow the steps. Ensure accuracy to avoid delays.

Transferring money from the UK to a USA bank account can sometimes feel like sending a letter across the ocean. You want to ensure your funds arrive safely and promptly. Tracking the transfer is crucial, not just for peace of mind but also to manage your finances effectively. Imagine you’re waiting for a package to arrive; knowing its whereabouts at every step eases your worries.

Monitoring Transfer Status

Once you’ve initiated the transfer, you can usually track its progress through your bank’s online portal or app. This feature offers real-time updates, letting you know if your money is still in transit or has reached its destination.

Some banks even send notifications to your email or phone, keeping you in the loop. It’s reassuring to know where your money is, especially if you have bills waiting to be paid.

Estimated Transfer Time

Transfer times can vary widely depending on several factors. Some methods might offer instant transfers, while others could take up to five business days.

Your choice of transfer service plays a huge role in how quickly your money moves. It’s like choosing between express shipping and standard mail.

Consider what works best for you. Is speed more important, or are you okay with waiting a few days for a lower fee?

Understanding the timeline helps you plan better. You wouldn’t want to be caught off guard if your money takes longer than expected to arrive. How do you handle it when things don’t go as planned?

Handling Transfer Issues

Transferring money from the UK to a USA bank account can be straightforward. Use online banking platforms for quick transactions. Ensure you have the recipient’s account details to avoid errors.

Transferring money from the UK to a USA bank account can sometimes feel like navigating a maze. You want your funds to arrive safely and on time. But what happens when things go wrong? Handling transfer issues is crucial for ensuring a smooth process. Let’s dive into common problems and how to tackle them.

Common Problems

You might encounter several hurdles when transferring money internationally. One common issue is incorrect bank details. Even a tiny mistake in the account number can delay the transfer or send it to the wrong account.

Exchange rate fluctuations can also be a headache. If the rate changes significantly between the time you initiate the transfer and when it completes, you might receive less money than expected.

Another problem could be unexpected fees. Sometimes, banks or third-party services charge hidden fees that eat into your transferred amount. Have you ever been surprised by additional costs you weren’t prepared for?

Contacting Customer Support

When issues arise, reaching out to customer support is your best bet. Most banks offer 24/7 support to assist you with transfer problems. Make sure you have all your transaction details ready before calling.

It’s helpful to keep a record of who you speak to and any reference numbers they provide. This can expedite the resolution process if you need to follow up. Have you experienced long wait times or unhelpful support in the past? Don’t be afraid to escalate your issue to a supervisor if needed.

Utilizing online chat support can also be a quick way to resolve issues without the hassle of a phone call. Many banks have dedicated teams for international transfers, ensuring you receive specialized assistance. What has been your experience with online customer support?

Frequently Asked Questions

What Are The Transfer Methods Available?

You can transfer money via bank transfer, online services, or currency exchange brokers. Each method has its own fees and speed. Choose the one that best fits your needs. It’s important to compare costs and delivery times before deciding.

How Long Does A Transfer Usually Take?

A transfer typically takes 1 to 5 business days. The speed depends on the chosen method and service provider. Bank transfers may take longer than online services. Ensure you confirm the estimated time with your provider to avoid surprises.

Are There Any Fees Involved In Transferring Money?

Yes, fees vary depending on the method and provider. Banks often charge higher fees compared to online services. It’s crucial to check for hidden charges. Compare different options to find the most cost-effective way to transfer money.

How Do Exchange Rates Affect Transfers?

Exchange rates impact the amount received in USD. Rates fluctuate daily, affecting transfer costs. Use providers with competitive rates to maximize your transfer amount. It’s advisable to monitor rates and choose the best time for your transaction.

Conclusion

Transferring money from the UK to the USA can be simple. Start by choosing a reliable method. Banks, online services, or apps are available. Each has its own pros and cons. Consider fees, speed, and security. Make sure to enter the correct details.

Double-check account numbers and names. This prevents errors and delays. With careful planning, the process becomes smoother. Always stay informed about exchange rates. This helps save money. Now, you can confidently transfer money across borders. Keep your transactions safe and efficient.