Transferring money from your Wisely Card to your bank account can feel like unlocking a new level of financial freedom. Imagine the convenience of having your funds exactly where you need them, when you need them.

Whether you’re looking to pay bills, save for a future goal, or simply manage your finances more efficiently, understanding how to transfer money seamlessly is key. This guide is designed to make the process simple and stress-free for you. By the end of this article, you’ll feel empowered and equipped with the knowledge to handle your finances with ease.

Let’s dive in and explore how you can make the most of your Wisely Card by effortlessly moving your money to your bank account.

What Is A Wisely Card?

A Wisely Card allows you to manage finances easily. You can transfer money from your Wisely Card to a bank account. This provides flexibility and convenience for handling your funds securely.

Have you ever wondered how a Wisely Card works? It’s more than just another piece of plastic in your wallet. A Wisely Card is a versatile financial tool that can help you manage your money more effectively. Whether you’re looking to receive your paycheck, make purchases, or transfer funds, a Wisely Card offers a convenient solution.

###

Understanding The Wisely Card

The Wisely Card is a prepaid card that acts like a debit card but without the need for a traditional bank account. It’s designed to give you easy access to your funds while providing flexibility in how you spend them. Think of it as a bridge between traditional banking and digital payment solutions.

###

Features And Benefits

One of the standout features of the Wisely Card is its direct deposit capability. You can have your paycheck deposited directly onto your card, which can save you a trip to the bank. Plus, it often means you get your money faster.

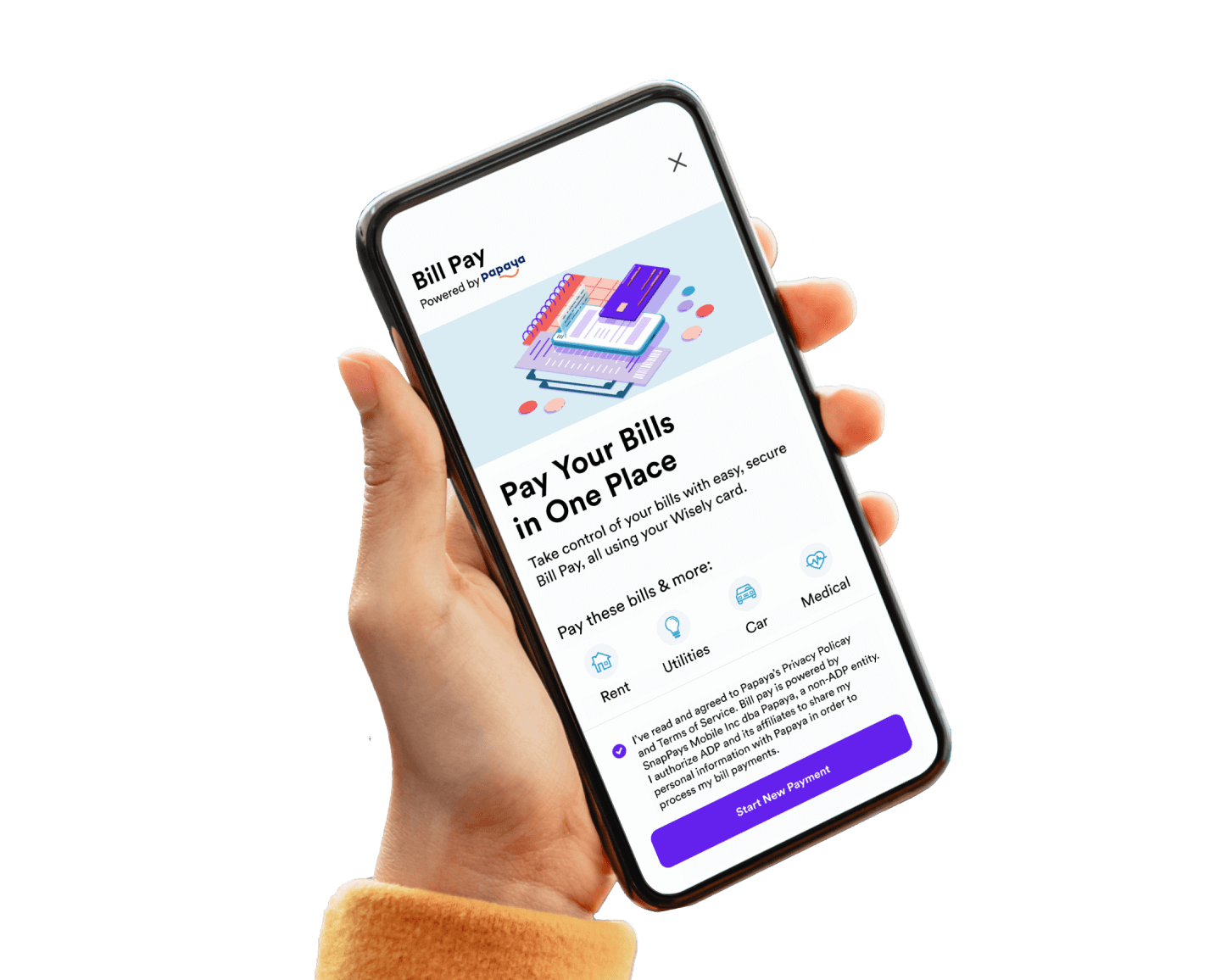

The card also supports online shopping and bill payments. You can use it wherever Visa or Mastercard is accepted, making it convenient for everyday use. Imagine not having to worry about carrying cash or writing checks.

###

Security And Control

Security is a major concern for anyone handling money. The Wisely Card offers protection against unauthorized transactions, giving you peace of mind. It’s like having a digital watchdog that alerts you to any suspicious activity.

Moreover, you can track your spending through a mobile app. This feature helps you stay on top of your finances, ensuring you don’t spend more than you have. It’s like having a financial advisor in your pocket.

###

How To Get A Wisely Card

Getting a Wisely Card is simple. You can apply through your employer if they offer it as a payment option. Alternatively, you can sign up online, providing some basic information.

Once you receive your card, you’ll need to activate it and set up a PIN. This step ensures that only you can access your funds. Does the idea of managing your finances with ease sound appealing?

###

Is The Wisely Card Right For You?

Consider your spending habits and financial goals. If you prefer a card that offers flexibility, security, and ease of use, the Wisely Card might be a great fit. It’s designed for those who want a modern approach to managing their money.

The Wisely Card is more than just a tool—it’s a solution tailored to fit the fast-paced, digital world we live in. Could this be the financial tool you’ve been searching for?

Benefits Of Transferring To A Bank Account

Transferring money from a Wisely card to a bank account offers convenience and security. It simplifies access to funds for everyday needs. This process ensures a stable financial management experience, supporting budgeting and tracking expenses efficiently.

Transferring money from your Wisely Card to a bank account offers numerous advantages that can simplify your financial life. If you’ve ever found yourself juggling multiple payment methods or struggling to keep track of your expenses, transferring funds to a bank account might just be the solution you’ve been searching for. In this section, we’ll explore the benefits of this transfer and how it can provide greater control and flexibility over your finances.

Convenience And Accessibility

Having funds in your bank account means you can access them easily through online banking, ATMs, and physical bank branches.

Imagine a scenario where you need to pay for an emergency expense. With your bank account, you can quickly transfer money or make a payment without any hassle.

This accessibility can save you time and stress during those unexpected moments when you need money urgently.

Enhanced Financial Management

Transferring money to a bank account allows you to better manage your finances by consolidating your funds in one place.

You can track your spending, set budgets, and monitor your transactions more effectively using banking apps and statements.

Having a clear overview of your financial situation can help you make informed decisions and avoid unnecessary fees or charges.

Security And Protection

Bank accounts often come with additional security measures, such as fraud alerts and insurance for your deposits.

Knowing your money is safeguarded by these protections can give you peace of mind, especially when you consider the risks associated with carrying large amounts of cash or relying solely on a prepaid card.

Have you ever worried about losing your card or falling victim to fraud? Transferring your money to a bank account can minimize these concerns.

Access To Additional Services

With a bank account, you can take advantage of various financial services, such as loans, credit lines, and investment opportunities.

These services can be pivotal in achieving your long-term financial goals, whether it’s buying a home, starting a business, or planning for retirement.

By transferring your money to a bank account, you’re not just storing it—you’re opening doors to new possibilities.

Building Your Financial Profile

Keeping your money in a bank account helps you build a financial profile, which can be beneficial when applying for credit or loans.

Banks often look at your account history to evaluate your financial responsibility.

Wouldn’t it be great to strengthen your financial reputation and increase your chances of securing better rates and offers in the future?

Checking Transfer Eligibility

Ensure your Wisely Card supports bank transfers to move money easily. Check transfer eligibility through the app or website. Enjoy smooth transactions by confirming details before proceeding.

Checking transfer eligibility is crucial when moving funds from a Wisely Card to a bank account. This process ensures that your transfer goes smoothly. Knowing the requirements helps avoid delays. Let’s dive into what you need to check.

Understanding Wisely Card Transfer Basics

Start by understanding your Wisely Card’s transfer capabilities. Some cards may have restrictions. Check the terms and conditions. This will help you know if transfers to a bank account are allowed.

Reviewing Account Balance And Limits

Ensure your Wisely Card has enough balance. Check if it meets the minimum transfer amount. Some cards have daily or monthly limits. Be aware of these to plan your transfer.

Verifying Bank Account Details

Double-check your bank account details. Incorrect details can cause transfer failures. Make sure your bank supports incoming transfers from your Wisely Card.

Checking For Transaction Fees

Some transfers may include fees. Review any charges before proceeding. This prevents unexpected deductions from your balance.

Confirming Personal Information

Ensure your personal information is up-to-date. This includes your name and contact details. Correct details ensure a smooth transfer process.

Contacting Customer Support

Still unsure about eligibility? Contact Wisely’s customer support. They can provide accurate information. This helps clarify any doubts about your transfer eligibility.

Preparing For The Transfer

Transferring money from your Wisely card to your bank account can be a straightforward process if you prepare correctly. Understanding the steps and gathering the necessary information will ensure a smooth transaction. It’s crucial to verify your bank account details before initiating the transfer to avoid any errors that could delay the process. Let’s dive into the specifics to make sure you’re fully prepared.

Gather Necessary Information

Before you start the transfer, make sure you have all the essential information at hand. This includes your Wisely card details and your bank account number. You’ll need to know the routing number too, which identifies your bank. Double-check these numbers to ensure accuracy.

Consider writing them down or storing them safely on your phone. It’s easier to access them when everything is organized. Have you ever scrambled to find a crucial piece of information just as you were about to hit send? Avoid that stress by preparing ahead.

Verify Your Bank Account

Once you have your information gathered, the next step is verifying your bank account. Log into your online banking portal to ensure your account is active and ready to receive funds. Check for any pending issues that might affect the transfer.

It’s also wise to confirm your bank account details with a quick call to your bank. Mistakes can happen, and a small error in your account number can lead to a delay. Wouldn’t it be frustrating if your money was stuck somewhere in the ether because of a tiny mistake?

Think about the last time you transferred funds. Did you encounter any hiccups? By verifying your bank details, you mitigate the risk of repeating past mistakes.

Being prepared is half the battle won. It’s like packing your bags before a trip; the journey is smoother when you know you haven’t left anything behind. So gather your information and verify your account to ensure your transfer goes off without a hitch.

Step-by-step Transfer Process

Transferring money from your Wisely card to a bank account is simple. This guide will walk you through the steps. Follow each step to ensure a smooth transfer process.

Logging Into Your Wisely Account

First, access the Wisely website. Use your credentials to log in securely. Ensure your internet connection is stable. This helps prevent disruptions during the process.

Navigating To Transfer Options

Once logged in, locate the transfer options. These are often under the “Transfer Money” section. Click on it to proceed. This step is crucial for setting up your transfer.

Entering Bank Account Details

Next, input your bank account details. Ensure the information is accurate. Double-check account numbers and routing details. Mistakes here can delay the transfer.

Confirming The Transfer

Finally, review all details carefully. Confirm the transfer to finalize it. Make sure all information is correct. Once confirmed, the transfer will process. Check your bank account for the deposit.

Understanding Transfer Fees

Transferring money from a Wisely Card to a bank account involves understanding the transfer fees. These fees can vary depending on the bank and the transfer method. Always check for potential costs to ensure a smooth transaction.

Understanding how fees work when transferring money from your Wisely Card to a bank account can save you money and stress. Nobody wants unexpected costs. Knowing the fees beforehand helps you make informed decisions about your finances.

###

What Are Transfer Fees?

Transfer fees are charges that apply when you move money from your Wisely Card to your bank account. These fees can vary based on the amount of money you’re transferring, the bank involved, and other factors. It’s crucial to check these details before initiating a transfer.

###

Factors Influencing Fees

Several factors can influence the transfer fees. The amount you’re transferring can be a major factor; higher amounts might incur higher fees. The bank you’re transferring to can also affect the fee structure, as some banks may have partnerships or special rates with Wisely.

###

Typical Fee Structures

Most transfer services have a percentage-based fee or a flat fee. For instance, you might pay 1% of the transfer amount or a flat fee of $5. Always read the terms carefully to understand which structure applies to your transaction.

###

Are There Ways To Avoid Fees?

Sometimes you can avoid fees by meeting certain conditions. Some cards offer fee waivers if you maintain a minimum balance or use direct deposit. Look into these options to see if you qualify.

###

Why Understanding Fees Matters

Understanding transfer fees can help you budget more effectively. If you know the cost of moving your money, you can plan for it and avoid surprises. This knowledge empowers you to make smarter financial choices, ultimately saving you money.

###

Your Personal Experience

Have you ever been surprised by a transfer fee? Share your experiences in the comments. Your story might help someone else avoid an unexpected charge.

By knowing the ins and outs of transfer fees, you can confidently manage your finances. Stay informed and keep more money in your pocket.

Troubleshooting Common Issues

Transferring money from a Wisely card to a bank account is convenient. But sometimes users face issues during the process. Understanding these problems can help in solving them quickly. Below are some common issues and tips to troubleshoot them effectively.

Failed Transfers

Failed transfers can be frustrating. Ensure your bank details are correct. Double-check the account number and routing number. Incorrect details can lead to transaction failures. Also, confirm that your Wisely card has enough balance. Insufficient funds can block the transfer. If the problem persists, contact Wisely’s customer support for help.

Delayed Transactions

Delayed transactions might occur due to various reasons. Bank processing times vary. Some transactions may take longer than others. Check your bank’s processing times to understand possible delays. Network issues can also cause delays. Ensure a stable internet connection during the transaction. If delays continue, reach out to your bank for assistance.

Security Tips For Safe Transfers

Ensure secure transfers from your Wisely card to a bank account by verifying transaction details. Use strong passwords and enable two-factor authentication for added security. Regularly monitor your account for any unauthorized activities.

Transferring money from your Wisely card to a bank account can be a straightforward process. However, ensuring that these transactions are safe and secure is crucial. With cyber threats on the rise, being vigilant about your financial activities online is more important than ever. Here are some essential security tips to help you protect your money during transfers.

Use Strong Passwords And Pins

Using a strong password or PIN is your first line of defense against unauthorized access. Make sure your password is a mix of letters, numbers, and symbols.

Avoid using easily guessed information like birthdays. Change your passwords regularly to maintain security.

Enable Two-factor Authentication

Two-factor authentication (2FA) adds an extra layer of security. It requires you to verify your identity with something you know (like a password) and something you have (like a phone).

Check if your bank offers 2FA and enable it for your account. It might feel like an extra step, but it significantly reduces the risk of unauthorized access.

Monitor Your Account Regularly

Regularly checking your account statements can alert you to any suspicious activity. Make it a habit to review your transactions frequently.

If you notice anything unusual, contact your bank immediately. Being proactive can prevent potential fraud.

Beware Of Phishing Scams

Phishing scams are designed to trick you into giving away personal information. Be wary of emails or messages asking for your account details.

Always verify the source before clicking on links or downloading attachments. When in doubt, contact the company directly to confirm legitimacy.

Use Secure Networks

Avoid using public Wi-Fi networks for financial transactions. These networks are often less secure and can be a hotspot for hackers.

Use a secure network or a Virtual Private Network (VPN) for added protection. Your financial information is too valuable to risk on an unsecured connection.

Keep Your Devices Updated

Ensure that your smartphone and computer are running the latest software updates. Updates often include security patches that protect against vulnerabilities.

Regularly check for updates and install them promptly. A secure device is less likely to be compromised.

Following these tips can help safeguard your money transfers. Remember, security is not just a one-time setup; it’s an ongoing process. How do you stay vigilant in protecting your financial transactions? Share your thoughts in the comments below!

Alternative Money Transfer Methods

Transferring money from a Wisely Card to a bank account is a straightforward process. This method offers a convenient way to manage finances by moving funds electronically. Simplify your transactions while ensuring security and ease of use.

Transferring money from your Wisely card to a bank account is quite convenient, but did you know there are alternative methods to move your money around? Exploring these options can be beneficial, especially when you’re in a pinch or looking for more efficient ways to manage your finances. Whether you’re tech-savvy or prefer traditional methods, there’s something for everyone. Let’s dive into these alternatives to broaden your financial horizons.

###

Digital Wallets And Apps

Digital wallets are a handy solution. With apps like PayPal, Venmo, or Cash App, you can transfer money to your bank account seamlessly. These platforms are user-friendly and often require just a few taps on your smartphone.

Imagine needing to send money quickly to a friend or family member. A digital wallet can make this process swift and stress-free. Have you tried using these apps for fast transfers?

###

Direct Bank Transfers

Direct bank transfers offer a straightforward method for moving money. Most banks provide online banking services that let you transfer funds directly from your Wisely card to your bank account.

Simply log in to your bank’s website or app, navigate to the transfer section, and follow the prompts. It’s as easy as sending a text message. Have you checked if your bank offers this service?

###

Wire Transfers

Wire transfers might seem old-fashioned, but they are reliable and secure. They are particularly useful for large sums. While they usually come with fees, the peace of mind they offer can be worth it.

If you’ve ever needed to transfer a significant amount urgently, wire transfers provide that extra layer of assurance. Is security a priority for you when transferring large amounts?

###

Mobile Banking

Many banks now offer mobile banking apps that allow you to manage all your financial needs from your phone. You can transfer money, pay bills, and even check your balance at any time.

These apps are perfect for people who are constantly on the go. Do you prefer handling your finances with a mobile app?

###

Peer-to-peer Lending Platforms

Peer-to-peer lending platforms can be an unconventional yet interesting way to transfer money. They connect borrowers directly with lenders, often offering more favorable terms than traditional banks.

If you’ve ever thought about lending or borrowing money outside the traditional banking system, these platforms might intrigue you. Would you consider using peer-to-peer lending for your financial needs?

Exploring these alternative money transfer methods can open up new possibilities for managing your funds. Which method resonates most with your lifestyle and financial goals?

Frequently Asked Questions

How Can I Transfer Money From My Wisely Card?

To transfer money from your Wisely Card to a bank account, log into your Wisely account online. Select the transfer option and enter your bank details. Follow the prompts to complete the transaction. Ensure your card and account are linked for a seamless transfer.

Are There Fees For Transferring Money?

Wisely Card transfers to a bank account are usually free. However, some banks may charge a fee for incoming transfers. Always check with your bank for potential charges. Wisely’s website provides detailed information about any fees that may apply.

How Long Does A Transfer Take?

Transfers from a Wisely Card to a bank account typically take one to three business days. Processing times may vary based on your bank’s policies. Ensure all entered details are correct to avoid delays. Check your Wisely account for updates on the transfer status.

Can I Transfer Money Internationally?

Wisely Cards primarily support domestic transfers. International transfers may not be available or could incur additional fees. Contact Wisely customer support for specific information about international transfer options. They can provide guidance based on your location and needs.

Conclusion

Transferring money from your Wisely Card to a bank account is simple. Follow the steps provided to ensure a smooth transaction. Always check your bank details before confirming the transfer. This helps avoid any errors. Keep track of your transaction status for peace of mind.

By managing your funds effectively, you save time and effort. Remember, the process is designed for user convenience. If you face issues, seek help from customer support. They are ready to assist with any concerns. Stay informed and make the most of your financial tools.