Are you considering transferring money from your Stash retirement account? Whether you’re planning for a big investment or simply need to access funds, understanding the transfer process can seem daunting.

But don’t worry—you’re not alone. Navigating financial decisions can be tricky, especially when it involves your hard-earned retirement savings. Imagine the peace of mind you’ll feel knowing exactly how to handle your funds effectively. In this guide, we’ll break down the steps you need to follow, making the process straightforward and stress-free.

By the end of this article, you’ll feel confident and informed, ready to manage your retirement account with ease. Dive in and discover how you can take control of your financial future today.

Understanding Stash Retirement Accounts

Understanding Stash Retirement Accounts can feel like decoding a mystery, especially if you’re new to managing your finances. Yet, grasping the basics is essential for transferring money from your Stash Retirement Account smoothly. You’ll find that once you understand the framework, managing your retirement funds becomes less daunting and more empowering.

What Is A Stash Retirement Account?

Stash Retirement Accounts are designed to help you save for your future. They offer tax advantages, which means more money for your retirement. You choose from options like Traditional IRA, Roth IRA, or SEP IRA, depending on your needs.

Each account type has unique benefits. A Roth IRA, for example, lets you withdraw tax-free in retirement. This could be a smart choice if you expect your tax rate to be higher in the future.

Why Choose Stash For Retirement Savings?

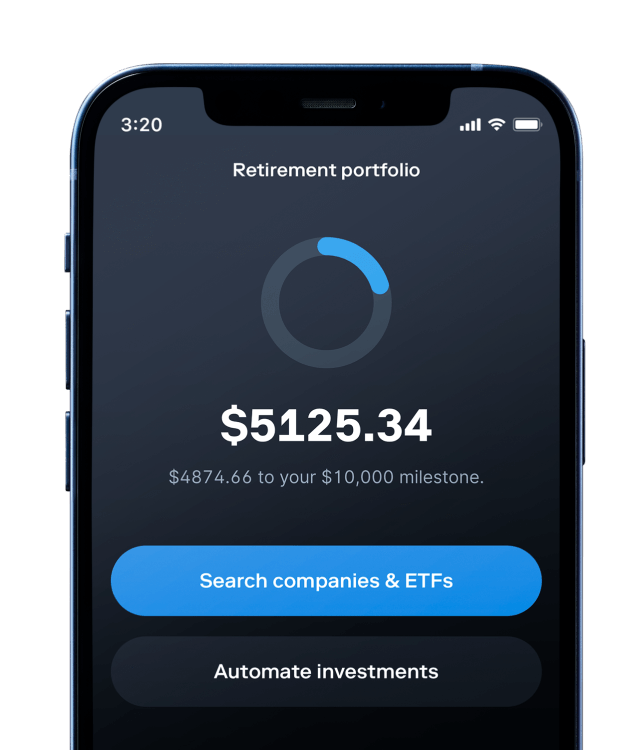

Stash simplifies investing, making it accessible to everyone. You don’t need to be a financial expert to start saving for retirement. They offer educational tools to help you make informed decisions.

Stash also allows you to start with small amounts. You don’t need a huge upfront investment, which is great if you’re just beginning to build your retirement savings.

Benefits Of Stash Retirement Accounts

Stash provides a user-friendly platform, ideal for beginners. The easy-to-use app lets you track your progress and adjust your investments as needed.

With automatic deposits, you can set it and forget it. Consistent contributions can grow your retirement fund over time without constant monitoring.

Things To Consider Before Transferring Money

Are you aware of the potential fees involved in transferring money from your retirement account? Understanding the costs can prevent unexpected surprises.

Think about your long-term financial goals. Will transferring money now benefit your future, or is it better to let your investments grow?

Reflect on your current financial situation. Is transferring money from your retirement account the best option for your needs right now?

Remember, your retirement account is a crucial part of your financial puzzle. Taking the time to understand it can lead to better decisions and a more secure future. What’s your plan to make the most of your Stash Retirement Account?

Eligibility For Money Transfer

Transferring funds from a Stash retirement account involves eligibility criteria. Confirm your account type and verify identity documents. Ensure all financial regulations are met to proceed smoothly.

Transferring money from your Stash Retirement Account can seem like a maze. But understanding the eligibility for money transfer is your first step to navigating this process smoothly. Whether you’re planning a significant life change or simply reassessing your financial strategy, knowing the requirements is crucial.

Account Requirements

Before you can transfer funds, your account needs to be in good standing. This means no pending fees or unresolved issues.

You should have completed any mandatory waiting periods that Stash imposes. These can vary depending on the type of account and your specific circumstances.

Ensure your contact information is up-to-date. A simple oversight like an old email address can delay your transfer.

Withdrawal Restrictions

Not all funds in your account may be eligible for transfer at once. Stash usually has rules about transferring funds based on your account type and the investment maturity.

Some funds might have penalties for early withdrawal. For example, if your account has long-term investments, pulling out early could cost you.

Are you aware of any tax implications? It’s essential to consider how withdrawing money might affect your tax situation. Ignoring this could lead to unexpected financial surprises.

Thinking of transferring money soon? Make sure you meet all the eligibility requirements. This will help you avoid common pitfalls and ensure a smooth process.

Preparing For The Transfer

Begin by assessing your Stash retirement account balance and reviewing transfer options. Ensure all necessary details are correct to avoid delays. Contact your financial advisor for assistance if needed, ensuring a smooth process.

Preparing to transfer money from your Stash Retirement Account might seem daunting at first. However, with a little preparation and the right steps, you can ensure a smooth process. Let’s dive into the essential aspects you need to consider before initiating the transfer.

Gathering Necessary Documents

Start by collecting all relevant documents. You’ll need your Stash account details, such as the account number and any recent statements. Also, have identification ready, like your driver’s license or passport, to verify your identity.

Make sure you have information about the receiving account. This includes the account number and bank routing number if you’re transferring to a bank. Having these documents at your fingertips will speed up the process.

Keep copies of everything. This can be useful if any issues arise during the transfer. A little organization now can save a lot of time later.

Choosing The Right Transfer Method

Think about how you want to transfer the funds. Direct transfers between retirement accounts can be simple and cost-effective. If you’re moving to a new retirement account, a direct rollover might be the best choice.

Consider the timing and fees associated with each method. Some methods may take longer but cost less, while others are quicker but may have higher fees. Choose the one that aligns with your priorities.

Have you considered speaking to a financial advisor? They can offer insights tailored to your situation, ensuring you make the best choice. This step could save you money and stress in the long run.

Taking these steps not only prepares you for a successful transfer but also empowers you with the knowledge to handle your finances confidently. Are you ready to make your transfer smoothly and efficiently?

Initiating The Transfer Process

Transferring money from your Stash retirement account can seem complex. Yet, breaking it down into simple steps makes it manageable. The first step is initiating the transfer process, where you begin the journey to move funds. This involves accessing your account and navigating the transfer options.

Accessing Your Stash Account

Start by logging into your Stash account. Use your username and password. Ensure your details are correct to avoid login issues. Once inside, familiarize yourself with the dashboard. It holds the key to managing your funds.

Navigating To Transfer Options

On the dashboard, find the transfer section. This area handles all fund movements. Click on the transfer option to proceed. Follow the prompts to initiate your transaction. Each step guides you toward a successful transfer.

Selecting A Transfer Method

Choosing the best way to transfer money from a Stash Retirement Account involves considering convenience and security. Explore options like direct bank transfers or wire transfers to ensure a smooth transaction. Each method offers unique benefits, tailored for different needs.

Selecting the right method to transfer money from your Stash retirement account is crucial. The choice you make can impact the time it takes for the funds to become available, any potential fees, and the ease of the process itself. It’s worth taking a moment to understand your options and decide what works best for your financial goals and needs.

Direct Transfer To Bank

Opting for a direct transfer to your bank account is often the simplest route. This method usually involves fewer steps, making it appealing if you’re looking for quick access to your funds. To initiate this, log into your Stash account, navigate to the transfer section, and select your linked bank account as the destination.

Consider any fees that might be involved in this process. Some financial institutions may charge for direct transfers, although many offer this service for free. If speed is a priority for you, check how long the transfer will take—some banks provide same-day transfers, while others may take up to three business days.

Think about what you plan to do with the funds once they reach your bank. If you’re using them for immediate expenses, this method makes sense. However, if you’re thinking of reinvesting, there might be a better option.

Transfer To Another Retirement Account

Transferring funds to another retirement account can be a smart move for those looking to maintain tax advantages. This method allows you to continue growing your retirement savings without incurring withdrawal penalties.

Start by determining which type of retirement account you want to transfer your funds to—options could include an IRA or another 401(k) plan. Each account type has its own benefits and restrictions, so align your choice with your retirement strategy.

Initiating a transfer to another retirement account usually requires a bit more paperwork. You’ll need to provide details about the receiving account, which may include account numbers and the financial institution’s information. Consider reaching out to a financial advisor if you’re unsure which type of account best suits your future plans.

Have you considered the potential benefits of consolidating your retirement funds into one account? It can simplify management and potentially reduce fees. Whatever you choose, make sure it supports your long-term financial objectives.

By understanding these methods, you can make informed decisions about transferring money from your Stash retirement account. Which method aligns with your current needs and future goals?

Completing The Transfer

Transferring money from a Stash Retirement Account involves several steps. Completing the transfer is crucial. This ensures your funds move safely and efficiently. Follow these guidelines to avoid any issues and ensure a smooth process.

Reviewing Transfer Details

Begin by checking the transfer details. Ensure all information is accurate. Verify the amount you wish to transfer. Double-check the account numbers involved. Any error can delay the transfer process. Confirm the recipient’s account information is correct. This guarantees your money reaches the right destination.

Confirming The Transaction

After reviewing, proceed to confirm the transaction. This step finalizes the transfer. Look for a confirmation button or link. Click to initiate the transfer. You may receive a confirmation message. This message often includes transaction details. Save this confirmation for your records. It can be useful if any issues arise.

Ensure you understand the terms and fees associated. Some transfers may involve charges. Knowing these ahead can prevent surprises. Completing the transfer with attention to detail ensures a successful transaction.

Monitoring The Transfer Status

Transferring money from a Stash retirement account requires close monitoring. Keeping track ensures everything is on track and avoids unnecessary stress. Monitoring the transfer status helps you stay informed about your funds.

Expected Timeframes

Understanding the expected timeframes is crucial. Transfers from a Stash retirement account usually take 5 to 7 business days. This period includes processing and final approval. Sometimes, it might take longer due to holidays or bank delays. Knowing this timeframe helps manage your expectations. Waiting can be stressful, but knowing the timeline helps.

Tracking The Transfer

Tracking your transfer is simple with Stash. Log into your Stash account to check the status. The dashboard shows updates and progress. Look for notifications or emails from Stash. They provide important updates about your transfer. If you see any delays, contact Stash support promptly. They assist in resolving issues and provide clarity. Tracking ensures your money reaches its destination safely.

Handling Transfer Issues

Transferring money from a Stash retirement account involves a few simple steps. Log in to your account, select the transfer option, and follow the prompts. Ensure all details are correct to avoid delays.

Handling transfer issues from your Stash retirement account can be a bit tricky, but it’s manageable with the right guidance. Whether you’re moving funds to another retirement account or withdrawing for personal use, you might encounter some bumps along the way. Understanding common problems and knowing where to find help can make the process smoother and less stressful.

###

Common Problems

When transferring money from your Stash retirement account, you might face a few hurdles. One frequent issue is incorrect account information, which can delay or halt the transfer. Double-check your details before initiating a transfer to avoid this hassle.

Another issue is unexpected fees. Some users find themselves surprised by transaction or processing fees. It’s crucial to review Stash’s fee policy or consult their resources to understand any potential charges.

Processing time can also be a concern. Transfers might take longer than expected, particularly during peak times. Planning ahead and initiating transfers well before any deadlines can help you avoid unnecessary stress.

###

Customer Support Assistance

Stash offers multiple avenues for assistance if you encounter transfer issues. Their customer support team is ready to help resolve your problems. You can reach them via phone, email, or through their in-app chat feature.

Before contacting support, gather all relevant information about your account and the transfer issue. This preparation will help the support team address your problem more efficiently.

Moreover, Stash’s online help center offers a wealth of information. You can find articles and FAQs addressing common transfer issues. This resource might save you time and provide quick solutions to your problems.

Have you ever experienced a transfer issue that seemed insurmountable? By leveraging these resources, you can tackle it head-on and ensure your funds move smoothly.

Tax Implications Of Transfers

Transferring money from a Stash Retirement Account involves tax considerations. Understanding these implications can save you from unexpected costs. It’s crucial to know how transfers affect your taxable income and potential penalties. Planning ahead ensures you comply with tax regulations.

Tax Penalties

Early withdrawals from retirement accounts may incur penalties. The IRS imposes a 10% penalty for withdrawals before age 59½. This penalty is separate from regular income taxes. Consider this before transferring funds. Avoiding penalties requires strategic planning and timing.

Documentation For Tax Purposes

Proper documentation is vital during transfers. Keep records of all transactions. This includes transfer amounts and dates. These records help during tax filing. They prove compliance with tax rules. Accurate documentation prevents errors and ensures transparency.

Ensuring Future Financial Planning

Discover simple steps to transfer money from your Stash Retirement Account. Secure your financial future easily. Navigate the process with confidence and ensure your savings are well-managed.

Ensuring your future financial planning is crucial when you decide to transfer money from your Stash retirement account. This decision isn’t just about shifting funds; it’s about securing your financial future and making thoughtful choices to maximize your returns. Many individuals often overlook the importance of careful planning, leading to missed opportunities and suboptimal growth in their retirement savings.

###

Reinvesting Transferred Funds

Once you’ve transferred your funds, the next step is reinvestment. This can be a daunting process, but it’s an opportunity to align your investments with your financial goals. Consider diversifying your portfolio to spread risk and potentially increase returns.

Think about what sectors or industries you believe will grow in the future. For instance, renewable energy or technology might be areas worth exploring. The key is to be strategic and informed, rather than making hasty decisions.

###

Consulting Financial Advisors

Transferring money from a retirement account can have significant implications. It’s wise to consult a financial advisor who can provide tailored advice based on your unique situation. They can help you understand the tax implications and suggest strategies to minimize any adverse effects.

You may wonder if you truly need a financial advisor. Consider this: having an expert guide can prevent costly mistakes and enhance your investment strategy. They can also help you stay focused on your long-term goals, rather than getting distracted by short-term market fluctuations.

Your financial future depends on the actions you take today. With careful planning and expert guidance, you can make informed decisions that will benefit you in the years to come. What steps will you take to ensure your financial security?

Frequently Asked Questions

How Do I Start Transferring Money From Stash?

To transfer money from your Stash Retirement Account, log in to your Stash account. Navigate to the transfer section. Follow the prompts to initiate the transfer. Ensure you have the necessary bank details ready. Confirm the transaction details before submitting to avoid errors.

Are There Any Fees For Transferring From Stash?

Transferring money from a Stash Retirement Account may incur fees. Fees can vary based on the type of transfer. It is essential to check Stash’s fee structure before proceeding. Contact Stash support for detailed information. Understanding fees can help manage costs effectively.

How Long Does A Transfer From Stash Take?

Transfers from Stash Retirement Accounts typically take 3 to 5 business days. The duration may vary based on the receiving bank. Ensure all details are correct to avoid delays. Contact Stash support if the transfer takes longer than expected. Patience is key during the process.

Can I Transfer Money To Any Bank Account?

Yes, you can transfer money from Stash to most bank accounts. Ensure the receiving account accepts electronic transfers. Verify account details before initiating the transfer. Contact your bank if you face any issues. Always double-check information to ensure a smooth transaction.

Conclusion

Transferring money from a Stash Retirement Account is simple. Follow the steps carefully. Ensure your details are correct. Double-check your account information. Mistakes can delay transfers. Take your time. Plan ahead to avoid stress. Consult support if needed. Secure your financial future today.

Keep track of your transactions. Stay informed about your retirement funds. Managing your money well is crucial. A little effort now makes a big difference later. Prioritize your financial goals. Make informed decisions for peace of mind. Your retirement journey is important.

Stay proactive and confident in your choices.