Transferring money between ICICI Bank accounts is a task that many of us need to do regularly, whether it’s to pay a friend back, move funds to a savings account, or support family members. It should be a quick, hassle-free experience, yet many people find themselves lost in the process.

Are you tired of feeling overwhelmed by banking jargon and complex instructions? Don’t worry—you’re not alone. What if you could master this essential skill in just a few minutes? Imagine the peace of mind you’d have knowing you can seamlessly manage your finances anytime, anywhere.

In this guide, we’ll break down the process step-by-step, so you feel confident and in control. Get ready to simplify your financial life with ICICI Bank.

Account Setup

Setting up your ICICI account for smooth money transfers is crucial to enjoy hassle-free banking. Whether you are looking to transfer funds for the first time or seek efficient solutions for regular transactions, proper account setup is key. Let’s dive into the essentials you need to know.

Online Banking Registration

Online banking opens a gateway to manage your finances from anywhere. To register, visit the ICICI website and navigate to the online banking section. You will need your account details handy.

Once on the registration page, fill out the required fields like your account number and mobile number. After entering your details, you’ll receive an OTP (One-Time Password) on your registered mobile number.

Input the OTP and set a strong password for your account. Remember, your online banking credentials are sensitive—ensure your password is unique and complex.

Now, how often do you check your email? It’s advisable to use an email address you frequently monitor for any updates or alerts. This keeps you informed on account activities.

Mobile Banking App Installation

The ICICI mobile banking app is a powerful tool for managing your account on-the-go. Download the app from Google Play Store or Apple App Store. It’s free and takes just a few minutes.

Once installed, launch the app and select the option to register. Use the same credentials you set up for online banking. This ensures seamless integration across platforms.

Are you familiar with app permissions? The app will request access to certain phone features. Allow these permissions for optimal functionality, like easy OTP verification and quick access to your contacts for transferring money.

Why stick to traditional banking hours when you can manage everything from your phone? The mobile app offers 24/7 access to your account, making transfers as easy as a few taps.

Once your account setup is complete, transferring money between ICICI accounts is just a few clicks away. Ready to explore the convenience of digital banking?

Transfer Options

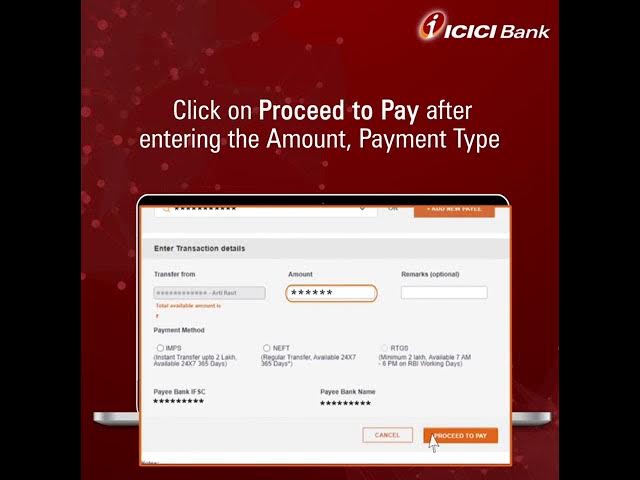

Transferring money between ICICI accounts is straightforward, yet choosing the right transfer option can make a difference in efficiency and cost. Your choice depends on factors such as the urgency of the transfer, the amount being transferred, and any associated fees. Let’s explore the available methods that you can consider for seamless transactions.

Neft Transfer

NEFT, or National Electronic Funds Transfer, is perfect for non-urgent transactions. It processes transfers in batches, meaning your money may not arrive instantly but will definitely get there on the same day. If you’re planning ahead, NEFT can be a reliable choice.

Imagine needing to pay your rent from your ICICI account. With NEFT, you can schedule the payment, ensuring it’s handled efficiently without stress. Plus, the fees are typically low, making it a cost-effective option.

Have you ever missed a payment because you forgot to send it on time? NEFT allows you to set up future transfers, so you never miss a deadline again. Why not give it a try next time you need to move funds?

Imps Transfer

IMPS, or Immediate Payment Service, is your go-to for instant transfers. It works 24/7, even on holidays, ensuring your money reaches its destination immediately. This option is ideal for urgent situations.

Picture yourself at a cafe, realizing you need to settle a dinner bill with a friend. IMPS allows you to transfer funds instantly without any wait time. It’s a lifesaver when time is of the essence.

Have you ever been in a situation where a quick transfer could save the day? IMPS ensures you’re never caught off guard. Next time you need to transfer funds urgently, consider IMPS for a hassle-free experience.

Rtgs Transfer

RTGS, or Real-Time Gross Settlement, is designed for high-value transfers. It processes transactions in real-time, making it ideal for transferring large sums of money quickly and securely.

If you’re planning a significant purchase or business transaction, RTGS ensures that the funds reach the recipient without delay. It’s the preferred choice for transactions over ₹2 lakh.

Have you ever worried about transferring large amounts safely? RTGS offers the peace of mind you need when dealing with substantial funds. It’s the choice for secure, high-value transactions.

Choosing the right transfer option is key to managing your finances effectively. Each method has its unique benefits, so consider what’s most important to you. Whether it’s speed, cost, or security, there’s a solution for every need. What’s your priority when transferring money?

Step-by-step Transfer Process

Transferring money between ICICI accounts is a straightforward process that can save you time and effort. Whether you’re helping a friend or moving funds for personal reasons, understanding the steps involved can make the transaction smooth. Let’s break down the process into easy-to-follow steps, ensuring you can manage transfers with confidence.

Logging Into Your Account

Start by accessing the ICICI Bank website or mobile app. Enter your user ID and password, making sure they are entered correctly to avoid any login issues. If you have trouble remembering them, you might want to use a password manager for ease. Once you’re logged in, navigate to the funds transfer section. Have you ever wondered how technology makes banking so convenient?

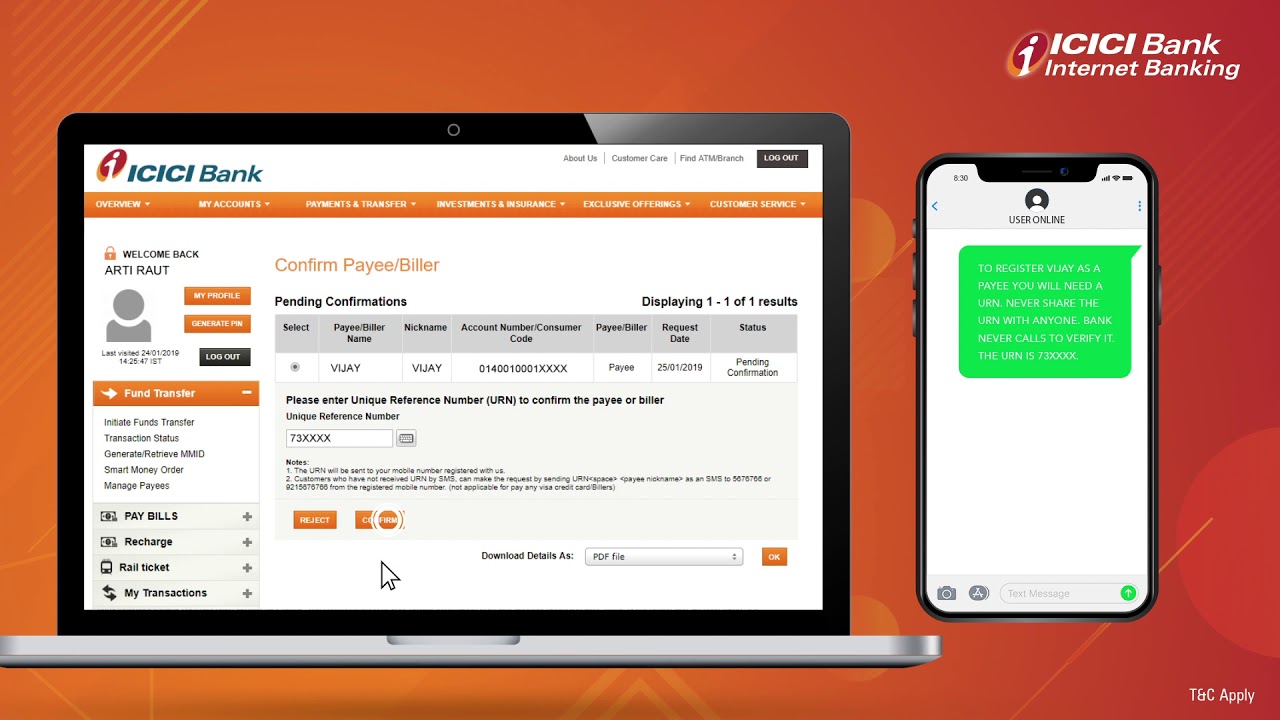

Adding Beneficiary Details

Before initiating any transfer, you need to add the recipient as a beneficiary. Click on ‘Add Beneficiary’ and fill in the necessary details such as account number and IFSC code. Double-check this information to avoid errors. This step is crucial, as it ensures your money reaches the right destination. Have you ever thought about how a simple mistake could lead to complications?

Initiating The Transfer

With the beneficiary added, you can proceed to transfer funds. Choose the ‘Transfer Funds’ option and select the beneficiary from your list. Enter the amount you wish to transfer and confirm the transaction details. Consider setting a reminder for regular transfers, as this can help you manage your finances efficiently. Do you keep track of your transactions regularly?

Each step in the process is designed to be user-friendly, making banking accessible to everyone. By following these steps, you can ensure your money transfers are secure and timely, giving you peace of mind.

Security Measures

Ensuring security while transferring money between ICICI accounts is crucial. The bank offers various security measures to protect your transactions. These measures help prevent unauthorized access and ensure peace of mind.

Two-factor Authentication

Two-factor authentication adds an extra layer of security to your transactions. After entering your password, you will receive a one-time code. This code is sent to your registered mobile number or email. You must enter this code to complete the transaction. This step ensures only you can access your account.

Recognizing Phishing Attempts

Phishing attempts can trick you into revealing personal information. Be cautious of emails or messages asking for passwords or bank details. ICICI Bank will never ask for such information via email or SMS. Always check the sender’s email address and look for spelling errors. If something seems off, contact ICICI customer support immediately.

Troubleshooting Common Issues

Transferring money between ICICI accounts is usually smooth. But sometimes, issues arise. Understanding common problems helps you troubleshoot effectively. This guide covers typical issues and fixes. Let’s dive into the details.

Failed Transactions

Sometimes, transactions fail unexpectedly. This might cause frustration. Reasons for failure include insufficient funds or incorrect details. Always check your account balance first. Confirm the recipient’s details are correct. An outdated app version might also be the culprit. Ensure your banking app is up-to-date.

Network issues can disrupt transactions too. Try completing the transfer during off-peak hours. If problems persist, contact ICICI customer support. They provide immediate assistance and solutions.

Beneficiary Not Added

Adding a beneficiary is essential for transfers. Sometimes, the beneficiary fails to appear. This can occur if you skip a step in the process. Ensure you follow the entire procedure correctly. Double-check all entered details.

Bank processing times also affect beneficiary addition. ICICI may take a few hours to verify and approve. If the beneficiary still isn’t visible, contact support. They can verify the status and help resolve the issue.

Customer Support

Transferring money between ICICI accounts can seem challenging. But, having reliable customer support makes the process easier. ICICI Bank offers various support channels. These are designed to assist you efficiently. Whether you prefer speaking to someone or using online resources, ICICI has you covered.

Contacting Icici Bank

If you need direct assistance, contacting ICICI Bank is simple. You can call their customer service team for help. They provide a toll-free number for your convenience. The staff is trained to answer all your queries. They guide you through the transfer process step-by-step. This ensures a smooth transaction every time.

Online Support Resources

ICICI Bank also provides extensive online support resources. Their website contains a detailed FAQ section. This section answers common questions about money transfers. You can find step-by-step guides and video tutorials. These resources help clarify any doubts you may have. If you prefer self-service, this is an excellent option.

For more personalized help, use the live chat feature. It connects you with a customer support representative. They provide real-time assistance for any issues. This feature is available on both the website and the mobile app. It makes getting help easier and faster.

Frequently Asked Questions

How To Transfer Money Using Icici Mobile App?

To transfer money using ICICI’s mobile app, log in and select the ‘Transfer Money’ option. Enter recipient details and amount, then follow prompts to complete the transaction. Ensure your mobile number is linked to your account for seamless processing.

Can I Transfer Funds Via Icici Net Banking?

Yes, ICICI net banking allows easy fund transfers. Log in to your account, go to ‘Fund Transfer’ and choose the transfer method. Enter recipient details and verify the transaction using OTP. Ensure your account is active for efficient transfers.

What Are Icici Transfer Charges?

ICICI charges vary based on transfer type and amount. Most intra-bank transfers are free, but NEFT and RTGS may incur nominal fees. Always check the latest fee schedule on ICICI’s official website for accurate information.

How Long Does An Icici Transfer Take?

ICICI transfers typically occur instantly for intra-bank transactions. NEFT may take a few hours, while RTGS is immediate during banking hours. Ensure all details are correct for timely processing.

Conclusion

Transferring money between ICICI accounts is simple and convenient. Follow the steps mentioned above. You can transfer funds quickly. Ensure correct account details before confirming. Use online banking for fast transactions. Mobile apps also offer easy transfer options. Keep your banking credentials secure.

Avoid sharing them with others. Secure transactions protect your funds. Need assistance? ICICI Bank provides customer support. Contact them for help anytime. Regularly check your account for updates. Stay informed about new features or services. Happy banking with ICICI!