Are you tired of juggling between your Netspend card and your bank account? Transferring money from Netspend to your bank account might seem like a daunting task, but it doesn’t have to be.

Imagine having the freedom to seamlessly move your funds, knowing exactly where your money is and having it readily available when you need it. Sounds appealing, right? In this guide, you’ll discover the simple steps to make your money transfers effortless and stress-free.

With just a few clicks, you can take control of your finances and make sure your money is exactly where you want it. Dive in and find out how you can streamline your financial management today!

Understanding Netspend

Understanding Netspend can open a world of convenience for managing your finances. If you’re looking to streamline your transactions, transferring money from Netspend to your bank account is a straightforward process. Netspend is a prepaid debit card service that provides you with an easy way to access and manage your money. It’s particularly useful for individuals who might not have access to traditional banking systems or who prefer an alternative method for handling their finances.

What Is Netspend?

Netspend offers prepaid debit cards that act like regular debit cards. It allows you to load money onto the card and use it for purchases. You don’t need a credit check to get started, making it accessible for many people. It’s a tool designed to give you the freedom and security of managing your finances without the need for a bank account.

Benefits Of Using Netspend

Netspend cards come with benefits like direct deposit, which can save you trips to the bank. You can receive your paycheck or government benefits directly onto your card. This ensures your money is available right when you need it. Additionally, you can control your spending and avoid overdraft fees, as you can only spend what you load onto the card.

Common Uses For Netspend

Many use Netspend for budgeting or managing household expenses. It’s a helpful way to allocate funds specifically for groceries, bills, or entertainment. By using Netspend, you can easily track spending and stay on top of your budget. Consider how separating your finances might simplify your life.

Personal Experience With Netspend

Years ago, I was looking for a simple solution to manage my finances without the hassle of a traditional bank account. Netspend was the perfect fit. It helped me stay organized and focused on my financial goals. What about you? Have you ever thought of using a prepaid card to simplify your financial journey?

Why Transfer Money From Netspend To A Bank Account?

Transferring money from Netspend to a bank account can offer more flexibility. It allows you to pay bills or make large purchases that require a bank account. Plus, if you’re planning to save money, transferring funds to a savings account can be a practical step. Consider how this transfer might benefit your financial strategy.

If you’ve been thinking about integrating Netspend into your financial routine, understanding its uses and benefits can be a game-changer. Whether it’s for budgeting or managing daily expenses, knowing how Netspend works can help you make informed decisions about your money.

Reasons For Transferring To A Bank Account

Easily move funds from Netspend to a bank account for better access and management. Enjoy seamless transactions and secure your savings. This process enhances your financial flexibility and convenience, making money management more straightforward.

Transferring money from your Netspend account to a bank account can be a strategic financial move. Whether you’re looking to consolidate funds, manage expenses more efficiently, or just streamline your financial operations, there are several compelling reasons to make the switch. Understanding these reasons can help you make informed decisions about your personal finances and enhance your money management skills.

Convenience And Accessibility

Having your money in a bank account can significantly enhance your convenience. Unlike prepaid cards, bank accounts are widely accepted for various transactions, including online purchases and bill payments. Imagine trying to pay your rent online and finding out your prepaid card isn’t accepted. By transferring funds to your bank, you eliminate these hassles, making life a bit smoother.

Better Financial Management

Transferring money to a bank account can improve your financial management skills. Banks offer tools and services like budgeting apps and alerts for low balances. These tools provide insights into your spending habits and help you track expenses. This makes it easier to plan your budget and avoid unnecessary fees. Have you ever found yourself wondering where all your money went? With a bank account, you’ll have a clearer picture.

Security And Safety

Your money is safer in a bank account. Banks provide robust security measures to protect your funds, including insurance up to a certain limit. If your Netspend card is lost or stolen, your money could be at risk. In contrast, banks offer recovery options and fraud protection. Why take chances with your hard-earned money when banks provide peace of mind?

Access To Additional Services

Banks offer a variety of services that prepaid cards do not. From loans to credit lines, having a bank account can open doors to additional financial services. If you’re considering buying a home or starting a business, having a banking relationship can be crucial. Can you imagine missing out on a great opportunity because your funds were locked in a prepaid account?

Transferring money from Netspend to a bank account isn’t just about moving funds; it’s about gaining control and access to a broader financial world. Think about your financial goals and how a bank account could help you achieve them.

Requirements For Transfer

Transferring money from Netspend to a bank account requires linking your bank account to your Netspend account. Ensure both accounts are verified and have accurate details. Initiate the transfer by logging into your Netspend account and selecting the transfer option.

Transferring money from your Netspend account to a bank account is a straightforward process, but there are certain requirements you need to meet. Knowing what you need ahead of time can save you a lot of hassle and make the transfer smooth and quick. Are you ready to get started? Let’s explore the essential requirements for a successful transfer.

###

Necessary Documents

Before initiating a transfer, ensure you have all the necessary documents at hand. You’ll typically need your Netspend account details, including your account number and routing number. Additionally, have your bank account information ready, such as your bank’s name, account number, and routing number.

Having these details organized can prevent delays. It’s like preparing for a trip—forgetting your passport can halt your journey. Similarly, missing details can stop your transfer in its tracks.

###

Account Compatibility

Not all bank accounts are compatible with Netspend transfers, so it’s crucial to check this first. Ensure that your bank accepts transfers from prepaid cards like Netspend. Banks usually list compatible services on their websites or customer service can provide this information.

Imagine you’re trying to fit a square peg in a round hole—frustrating and unproductive, right? The same goes for trying to transfer to an incompatible account. Always verify compatibility to avoid unnecessary complications.

In my experience, double-checking these details has saved me from numerous headaches. A quick call to your bank can clarify any doubts you might have. So, why not take a few minutes to verify and ensure everything is in place? Your peace of mind is worth it.

Setting Up Your Netspend Account

Transferring money from Netspend to a bank account is straightforward. Log into your account, navigate to the transfer section, and select your bank. Enter the amount and confirm the transfer to complete the process effortlessly.

Setting up your Netspend account is the first step in transferring money to your bank account. This process is straightforward and can be completed in a matter of minutes. Whether you’re a seasoned Netspend user or new to the platform, having your account set up correctly is crucial for smooth transactions.

Creating A Netspend Account

Creating a Netspend account is simple and user-friendly. Begin by visiting the Netspend website or downloading their app. You’ll need to provide your personal information, including your name, address, and social security number.

Once you submit your details, Netspend will guide you through the next steps. Expect to receive a confirmation email or message. Follow the prompts to verify your email address. This verification secures your account, allowing you to proceed with linking your bank account.

Linking Your Bank Account

Linking your bank account to your Netspend account is essential for transferring funds. Navigate to the account settings or transfer section on the Netspend platform. You’ll find an option to add a bank account.

Have your bank account number and routing number ready. Enter these details accurately. Netspend may require you to verify the bank account with a small deposit. Check your bank account for this deposit and confirm the amount on Netspend.

This step ensures a seamless connection between your Netspend account and your bank. Once linked, you can easily transfer money with a few clicks. Have you ever wondered how much easier life could be with streamlined financial transactions? Linking your accounts might just be the answer.

Transferring Money Step-by-step

Transferring money from your Netspend account to your bank is simple. You need a clear understanding of the process. This guide offers easy steps to ensure a smooth transfer. Follow each step to move your money without hassle.

Logging Into Your Netspend Account

Start by opening the Netspend website on your browser. Enter your username and password in the login fields. Click the “Log In” button to access your account. Make sure your login details are correct. This prevents any login issues.

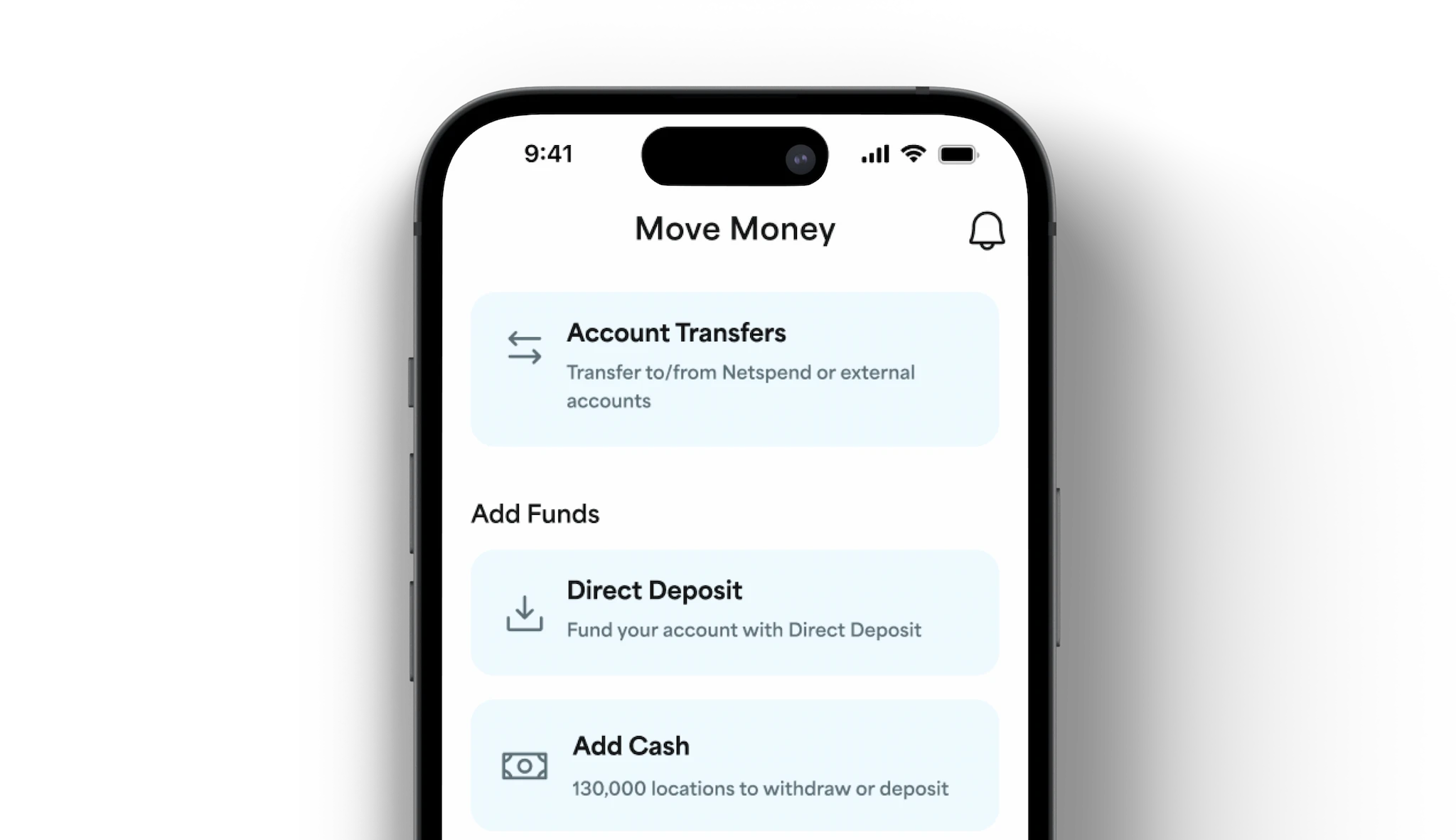

Navigating To Transfer Options

Once logged in, look at the top menu bar. Click on “Move Money” or similar option. This will lead you to the transfer section. Here, you find different money transfer options.

Initiating The Transfer

Click on “Transfer to Bank” or a similar option. Enter the bank account details where you want the funds. This includes the bank account number and routing number. Ensure all information is accurate.

Reviewing And Confirming Details

Double-check all the details entered. This step is crucial to avoid errors. Once confirmed, click the “Submit” or “Transfer” button. A confirmation message should appear. This confirms your transfer request is successful.

Fees And Limitations

Transferring money from Netspend to a bank account involves understanding fees and limitations. Netspend may charge a small transfer fee, and there could be limits on how much you can transfer at once. Always check these details to avoid unexpected charges.

Transferring money from your Netspend account to a bank account can be incredibly convenient, but it’s essential to understand the fees and limitations that come with it. Fees can vary depending on the method you choose, and there may be limits on how much you can transfer at once. By understanding these aspects, you can make smarter decisions and avoid unexpected costs.

Understanding Transfer Fees

When you transfer money from Netspend to a bank account, fees can sneak up on you. Netspend might charge a fee for each transfer, and this can add up quickly if you’re making multiple transfers.

Some users have found themselves surprised by the fees after regular transfers. Imagine transferring $100, only to find a $2 fee deducted from your account. That’s a small fee, but over time, it can feel like you’re losing money for nothing.

To keep more of your money, check the fee structure beforehand. This way, you won’t be blindsided by unexpected deductions.

Exploring Transfer Limits

Netspend imposes limits on how much you can transfer to your bank account. This can be frustrating if you need to move large sums quickly.

For example, you might want to transfer $1,000, but the daily limit is only $500. This means planning ahead is crucial, especially for significant expenses or investments.

Think about your needs and how often you plan to transfer money. Are the limits going to impact your financial plans? Understanding these limits can help you strategize and avoid unnecessary delays.

Consider how these fees and limits affect your financial goals. Have you ever been caught off guard by a fee or limit? Understanding these details can save you time and money in the long run.

Troubleshooting Common Issues

Transferring money from Netspend to your bank account should be simple. Yet, some users face issues that can delay or complicate the process. Understanding these common problems can help you troubleshoot efficiently.

Failed Transactions

Sometimes, transactions do not go through. This can happen due to incorrect bank details. Double-check your account number and routing number. Make sure they match your bank information exactly. Also, ensure your Netspend account has enough funds. Low balance often causes transaction failures. If the problem persists, contact Netspend customer service for assistance.

Delays In Transfer

Transfers can sometimes take longer than expected. Network issues or system maintenance can cause delays. Be patient and allow a few extra days for the transfer. Check your email for any notifications from Netspend about delays. Ensure your bank account is in good standing to avoid any processing issues. If delays continue, reach out to both Netspend and your bank for more information.

Security Considerations

Ensure your transactions are safe by using secure internet connections. Regularly update passwords to protect your accounts. Be cautious of sharing personal information online.

Transferring money from your Netspend account to a bank account can be a straightforward process. Yet, ensuring that your transactions are secure is paramount. As you navigate this financial task, it’s crucial to be aware of the various security considerations that can protect your funds and personal information. Let’s dive into some key areas you should focus on.

Protecting Your Information

Keeping your personal and financial information secure should be your top priority. Always use strong and unique passwords for your Netspend and bank accounts. A combination of uppercase, lowercase, numbers, and symbols makes a password harder to guess.

Consider enabling two-factor authentication, if available, to add an extra layer of security. This means you’ll have to verify your identity using a second method, like a text message, making unauthorized access much more difficult.

Be cautious about where you access your accounts. Avoid public Wi-Fi networks for financial transactions, as they can be less secure. If you must use them, consider a virtual private network (VPN) to encrypt your data. Have you ever wondered how much personal information you might be unknowingly sharing?

Recognizing Fraudulent Activities

Being able to spot fraudulent activities is a skill that can save you from potential financial loss. Always review your account statements regularly to catch any unauthorized transactions early. This proactive approach can help you address issues before they escalate.

Stay informed about common scams and phishing attempts. Fraudsters often impersonate financial institutions to steal your information. If you receive unexpected emails or messages asking for personal details, verify their authenticity directly with the company.

Remember, no legitimate company will ask for sensitive information like your password via email. Have you ever received a suspicious email that just didn’t feel right? Trust your instincts and double-check before taking any action.

Security in financial transactions is not just about technology—it’s about being vigilant and informed. By taking these steps, you can confidently transfer money from your Netspend account to your bank, knowing your assets are protected.

Alternative Transfer Methods

Transferring money from Netspend to a bank account can be straightforward. Some prefer alternative methods for flexibility and convenience. These options can offer different benefits. Explore third-party services and other choices for seamless transfers.

Using Third-party Services

Third-party services provide an option for transferring funds. They often simplify the process. Services like PayPal can connect Netspend and bank accounts. Set up an account with these platforms. Link your Netspend card and bank account. Transfer funds between them easily.

These services offer user-friendly interfaces. They provide security features for peace of mind. Check their fees and limits. Ensure they meet your needs before choosing them.

Comparing Other Options

Other transfer methods exist beyond third-party services. Consider wire transfers or mobile banking apps. Some banks allow direct transfers from prepaid cards. Explore your bank’s capabilities.

Compare transaction speed and costs. Assess the convenience of each method. Choose an option that balances efficiency and affordability. Understanding these alternatives helps in making informed decisions.

Tips For A Smooth Transfer Experience

Transferring money from Netspend to a bank account can be simple. First, link your bank account to Netspend. Then, initiate the transfer and follow the prompts. Finally, confirm the transaction to complete the process smoothly.

Transferring money from your Netspend account to a bank account can feel like a daunting task. But with a few thoughtful strategies, you can ensure a seamless and hassle-free experience. Here are some key tips to help you navigate the process smoothly.

Planning Transfers

Proper planning can save you from unnecessary stress. Start by checking your Netspend balance to ensure you have enough funds for the transfer. It’s also wise to account for any potential fees that might be deducted during the transaction.

Consider the timing of your transfer. Transferring funds on a weekday might lead to faster processing compared to weekends or bank holidays. If you’re managing bills or other financial commitments, scheduling your transfers in advance can prevent any last-minute rush.

Monitoring Transactions

Keeping an eye on your transactions is crucial for financial security. After initiating a transfer, regularly check your bank account to confirm the funds have been deposited. This simple step can alert you to any discrepancies early on.

Set up notifications or alerts if your bank offers them. They can provide real-time updates on your account activity, offering peace of mind. If something seems off, don’t hesitate to contact customer support for assistance.

These simple yet effective tips can make a world of difference. Have you ever faced a hiccup during a transfer? How did you handle it?

Frequently Asked Questions

How Can I Transfer Money From Netspend To A Bank Account?

To transfer money, log into your Netspend account and select the ‘Transfer Money’ option. Enter your bank account details and the amount you wish to transfer. Follow the prompts to complete the transaction. Ensure your bank account is verified for a smooth transfer process.

Is There A Fee For Transferring Money From Netspend?

Netspend may charge a fee for transferring money to a bank account. The fee varies based on your account type and the amount. Check Netspend’s fee schedule for exact details. Always review the fee before confirming your transaction to avoid unexpected charges.

How Long Does A Netspend Transfer Take?

Transfers from Netspend typically take 1-3 business days to reflect in your bank account. The duration depends on banking processes and verification steps. Ensure your bank details are correct to avoid delays. For quicker transfers, consider options like instant transfer services if available.

Can I Transfer Money Using The Netspend App?

Yes, you can transfer money using the Netspend mobile app. Download the app, log in, and navigate to the transfer section. Enter the necessary details and follow the prompts. The app provides a convenient way to manage transfers on the go.

Conclusion

Transferring money from Netspend to your bank account is simple. Follow the steps outlined in this guide. Ensure your Netspend account is linked to your bank. Double-check your details before initiating the transfer. This prevents errors and delays. Keep track of your transactions.

It helps manage your finances better. The process is straightforward with practice. Soon, you’ll handle transfers with ease. Remember, always protect your account information. Stay informed and up-to-date with Netspend policies. This ensures smooth transactions every time. With these tips, you can confidently transfer your money.