Transferring money between bank accounts shouldn’t be a hassle, yet many find themselves puzzled by the process. If you’ve ever wondered how to seamlessly transfer funds from your BankMobile account to another bank, you’re in the right place.

Imagine the convenience of moving your money with just a few taps, knowing it’s safely on its way to where you need it most. Whether you’re paying a friend back, managing your savings, or just keeping your finances organized, understanding this process is key.

By the end of this guide, you’ll feel confident and in control, ready to handle your banking with ease. Ready to simplify your financial life? Let’s dive in.

Setting Up Your Account

Easily transfer money from your Bankmobile account to another bank. Log in, select ‘Transfer’, choose the recipient’s bank details, and confirm. Ensure both accounts are linked for smooth transactions.

Setting up your account is the first crucial step to transferring money from BankMobile to another bank account. It might seem like a daunting task at first, especially if you’re not familiar with online banking. However, with a few straightforward steps, you’ll be set up and ready to transfer funds smoothly and securely. You’ll feel a sense of accomplishment once it’s done, as you take control of your financial transactions with ease.

###

Creating An Online Profile

Creating an online profile is your starting point. Begin by visiting the BankMobile website or downloading their mobile app. You will find an option to create a new account or register.

Follow the prompts to input your personal information. This typically includes your name, email address, and phone number. Ensure that your email is one you check often, as it will be used for verification and communication.

Next, set up a strong password. A mix of letters, numbers, and symbols is recommended to keep your account safe. It’s vital to remember this password or store it securely.

Once your profile is created, you might feel a wave of relief knowing you’re a step closer to transferring money. Don’t underestimate the importance of this step; it’s the key to accessing a host of online banking features.

###

Linking Your Bank Account

Linking your bank account is where the magic begins. Log into your newly created BankMobile profile. Look for an option like ‘Link Account’ or ‘Add External Account’.

You’ll need your account number and routing number from the other bank. This information is usually found on a check or your bank statement. Input these details carefully to avoid errors.

BankMobile may ask you to verify your linked account. This often involves confirming small test deposits made to your account. It might take a day or two, but it’s a necessary security measure.

Once linked, you can start transferring money. Imagine the convenience of moving your funds with just a few clicks. It’s empowering to manage your finances so efficiently.

Are there any other steps you think could make the process even easier? Taking the time to set up your account correctly will save you hassle in the future.

Navigating The Bankmobile App

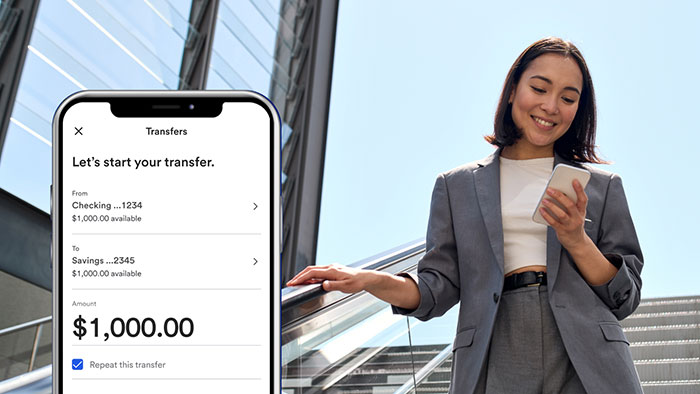

Transferring money using the Bankmobile app is straightforward. Access the transfer option, input the recipient’s bank details, and confirm the transaction. Ensure the information is accurate to avoid any delays or errors.

Navigating the Bankmobile App can feel like a breeze when you know where to start. Whether you’re new to digital banking or just looking to make a quick transfer, the app is designed to simplify your financial tasks. Ready to get started? Let’s dive into the essentials of using the Bankmobile app for transferring money to another bank account.

###

Downloading The App

To kick off your journey, the first step is downloading the Bankmobile app. You can find it on both the App Store for iOS devices and Google Play Store for Android. Once you’ve located the app, tap on the download button and watch as the app icon appears on your home screen.

Installing the app is straightforward and won’t take long. Ensure your device has enough storage space to handle the app’s data. If you’ve ever downloaded an app before, you’re already halfway there!

###

Logging In Securely

Security is paramount, and logging in securely to your Bankmobile app is crucial. Use a strong, unique password that combines letters, numbers, and symbols. This step protects your financial information from unauthorized access.

You’ll also encounter options for additional security measures such as biometric login or two-factor authentication. Consider enabling these features for an extra layer of protection. Remember, your financial safety is in your hands.

Do you ever wonder how secure your banking habits are? Taking these small steps can make a big difference. After all, peace of mind in managing your finances is priceless.

Now, with your app downloaded and secure login details set, you’re well on your way to managing your money effortlessly. Ready for the next steps? Stay tuned as we continue to guide you through the process of transferring money using the Bankmobile app.

Initiating A Money Transfer

Transferring money from Bankmobile to another bank account is simple. Start by logging into your Bankmobile account. Select the ‘Transfer Funds’ option and input the recipient’s bank details. Confirm the transaction to complete the transfer securely.

Initiating a money transfer from Bankmobile to another bank account can seem daunting at first. But with a few simple steps, you can effortlessly move your funds. Whether you’re paying a friend back for dinner, sending money to family, or transferring to your savings, this guide will help you navigate the process smoothly.

###

Selecting Transfer Option

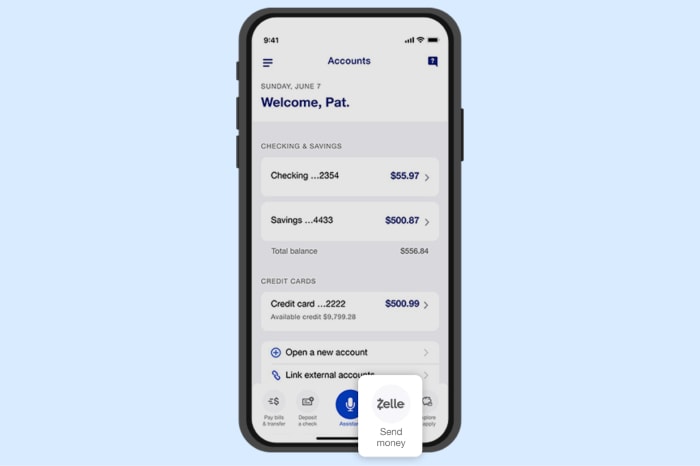

Begin by logging into your Bankmobile app or website. Once you’re in, look for the “Transfer” or “Send Money” option in the main menu. This is your gateway to moving money.

Most platforms will offer different transfer types, such as instant transfers or standard transfers. Choose the one that best suits your needs. If speed is your priority, an instant transfer may be worth the small fee.

###

Entering Recipient Details

Now that you’ve selected the transfer option, it’s time to enter the recipient’s details. Make sure you have the correct account number and bank routing number ready. Double-check these numbers to avoid any mishaps.

Consider how easy it is to mistype a number, especially when in a hurry. A simple mistake could send your money to the wrong person. Take a moment to verify everything before proceeding.

Have you ever accidentally sent money to the wrong person? If so, you know how stressful it can be. Taking extra care with these details can save you time and hassle later.

By following these steps, you can ensure that your money transfer from Bankmobile to another bank account is secure and efficient. What other tips or experiences do you have when transferring money? Share your thoughts and help others learn from your insights!

Choosing Transfer Methods

Choosing transfer methods is important when moving money from Bankmobile to another bank. Different methods offer various speeds and costs. It’s essential to understand each option to make the best choice for your needs.

Instant Transfer

Instant transfers process money quickly. This method is ideal for urgent transactions. It ensures funds reach the recipient in minutes. Instant transfers may incur higher fees. They offer convenience and speed. This is perfect for emergencies or immediate needs. Always check if your bank supports instant transfer options.

Standard Transfer

Standard transfers are reliable for non-urgent money movements. They usually take a few business days. This method is often more cost-effective. It suits those who prioritize saving on fees over speed. Standard transfers are widely accepted by banks. They provide a secure way to transfer money. It’s essential to plan ahead with standard transfers.

Verifying Transfer Details

Transferring money from Bankmobile to another bank account involves verifying transfer details carefully. Ensure account numbers and amounts are accurate before proceeding. Double-checking this information helps prevent errors and delays in your transaction.

Transferring money between accounts can seem like a simple task, but ensuring the accuracy of each detail is crucial. One missed digit or typo could send your funds into a financial abyss. Verifying transfer details is an essential step you can’t afford to skip. Let’s dive into how you can make sure everything is spot-on before you hit send.

###

Reviewing Transaction Information

Before confirming the transfer, take a moment to carefully review all transaction information. This includes the recipient’s account number, the amount you wish to transfer, and any additional notes you might have added.

Have you double-checked the routing number? It’s easy to transpose numbers under pressure. You wouldn’t want your money ending up in the wrong account just because you were rushing.

###

Confirming The Transfer

Once you’ve reviewed the details, it’s time to confirm the transfer. Many banking apps offer a summary screen where you can see all the information you’ve entered.

Does everything look correct? If you’re unsure, don’t hesitate to hit the back button and check again. Double-checking now can save a lot of stress later.

When I transferred money to a friend’s account for the first time, I realized I had forgotten to update the recipient’s new bank details. Thankfully, reviewing the transaction information helped me catch the error before it was too late.

What about you? Have you ever caught a mistake just in time? Share your experiences in the comments below.

Taking a few extra minutes to verify your transfer details can be the difference between a seamless transaction and a financial headache.

Tracking Your Transfer

Transferring money is a straightforward task, yet tracking the transfer adds peace of mind. Knowing the status of your transaction ensures everything is running smoothly. Let’s delve into how you can keep tabs on your transfers with ease.

Checking Transfer Status

After initiating a transfer, checking its status is crucial. Log into your Bankmobile account. Navigate to the transaction history section. This area shows all your recent activities. Look for your transfer details. It will display if the transfer is pending or completed.

Sometimes, delays occur due to various reasons. Ensure you have entered all details correctly. Check if your internet connection is stable. If issues persist, contact customer support. They can provide updates and assist further.

Receiving Confirmation

Once the transfer is successful, you will receive a confirmation. This usually comes in the form of an email or SMS. The message will detail the amount sent and the recipient’s account. Keep this confirmation safe for future reference.

If you don’t receive a confirmation, double-check your email settings. Ensure notifications are enabled. Verify spam or junk folders as well. Missing confirmation may indicate a problem. Reach out to Bankmobile for assistance. They can verify if the transfer was completed successfully.

Managing Transfer Limits

Transferring money from Bankmobile to another bank account involves managing transfer limits effectively. Ensure your account has sufficient funds and check the daily transfer limit before initiating the transaction. This helps avoid delays and ensures a smooth transfer process.

Managing transfer limits can seem daunting, but it’s crucial for hassle-free transactions. When transferring money from BankMobile to another bank account, understanding and adjusting your daily limits play a key role. Think of it as setting boundaries that ensure smooth and secure transfers, without unexpected hiccups.

Understanding Daily Limits

Daily limits are like speed limits on a highway, ensuring safe and controlled transfers. Typically, these limits are set by the bank to protect your funds from unauthorized activities. It’s important to know your specific daily limit before initiating a transfer. You can easily find this information in your BankMobile app or by contacting customer support. Imagine planning a transfer for an urgent payment, only to realize your limit is lower than expected. This knowledge helps you plan your transactions effectively.

Adjusting Limits As Needed

Sometimes your financial needs require a bit more flexibility. If you need to send more money than your daily limit allows, consider adjusting your limits. BankMobile often allows you to request a temporary or permanent increase to accommodate larger transactions. Have you ever found yourself in a situation where you needed to make a large payment quickly? Adjusting your limit can prevent delays and ensure timely payments. Simply log into your account and follow the prompts to request an adjustment.

Remember, managing your transfer limits isn’t just about numbers; it’s about ensuring your financial activities align with your personal and business needs. Are you ready to take control of your transfers?

Troubleshooting Common Issues

Transferring money between banks can sometimes face hiccups. Understanding common issues helps in smooth transactions. This section addresses common problems during Bankmobile transfers. Learn how to resolve them effectively.

Resolving Failed Transfers

Failed transfers can be frustrating. Check your account balance first. Insufficient funds often cause issues. Confirm recipient details are correct. Mistakes in account numbers lead to failures. Network issues can also disrupt transfers. Ensure a stable internet connection.

If problems persist, consider resetting your password. Sometimes, security settings block transactions. Updating your app might help. New versions fix bugs and improve performance. Following these steps can resolve many transfer issues.

Contacting Customer Support

Still facing problems? Contact customer support. They offer solutions and guidance. Prepare your account details before calling. It speeds up the process. Use the Bankmobile app for quick help. The chat feature connects you instantly.

Check the FAQ section on the Bankmobile website. It addresses many common issues. If unresolved, escalate the issue. Request further assistance from a supervisor. Keep calm and patient during the process. Customer support is there to help you.

Ensuring Security

Transferring money from Bankmobile to another bank account involves several steps. Ensuring security during this process is crucial. You need to protect your financial information and recognize any suspicious activities. This keeps your money safe and ensures a smooth transfer.

Protecting Your Information

Your personal and financial information must remain secure. Use strong and unique passwords for your bank accounts. Avoid sharing your password with anyone. Regularly update your password to enhance security. Enable two-factor authentication for added protection. This extra step verifies your identity before accessing your account.

Always log out from your banking app after each session. Avoid using public Wi-Fi for bank transactions. Public networks are less secure and can expose your data. Monitor your account for any unusual activity. Report any suspicious transactions to your bank immediately.

Recognizing Fraudulent Activities

Be aware of common scams targeting bank users. Fraudsters often send fake emails or messages. They may ask for your account details or password. Never provide this information to unknown sources. Verify the authenticity of any communication from your bank.

Look for signs of phishing attempts. These include suspicious links or attachments. Be cautious of messages claiming urgent action needed. Banks rarely request sensitive information via email or text. If you suspect fraud, contact your bank directly. They can advise on the next steps to protect your account.

Frequently Asked Questions

How To Transfer Money From Bankmobile?

To transfer money from BankMobile, log into your account and navigate to the ‘Transfer Funds’ section. Enter the recipient’s bank details, specify the amount, and confirm the transaction. Ensure you double-check all details to avoid errors. Transfers typically process within a few business days.

Is Bankmobile Transfer Secure?

BankMobile utilizes advanced encryption technologies to ensure secure transactions. Always verify the recipient’s details before proceeding. Additionally, monitoring your account regularly can help detect any unauthorized activity. It’s advisable to use two-factor authentication for added security.

How Long Does Bankmobile Transfer Take?

BankMobile transfers usually take between 1 to 3 business days. The exact duration may vary depending on the recipient’s bank policies. Ensure all details are correct to avoid delays. For faster transactions, consider using instant transfer options if available.

Are There Fees For Transferring Money?

BankMobile may charge a small fee for transferring funds. Fees can vary based on the transfer amount and destination. Always check the fee structure before initiating a transfer. Some transfers may be free, especially between accounts within the same bank.

Conclusion

Transferring money from Bankmobile is simple and straightforward. Just follow the steps carefully. Ensure your details are correct. This avoids errors and delays. Keep your login information secure. Always prioritize safety while banking online. With regular practice, transfers become easier.

It’s all about being precise and cautious. Now, you’re equipped to manage your transactions. Remember, take your time. No rush needed. Enjoy the convenience of online banking!

References

- Mobile Banking Technology Options

- Money moves: following the money beyond the banking system

- Pros and cons of Mobile banking

- Simple mobile banking: learning from developing countries

- [B] The power of mobile banking: how to profit from the revolution in retail financial services