Are you dreaming of owning a condo but feeling unsure about the financial steps involved? The down payment is often the first hurdle, and understanding how much you need can make all the difference in your home-buying journey.

Whether you’re a first-time buyer or looking to invest in a property, knowing the right amount for a down payment can save you from unexpected surprises and stress. This article is designed to give you clear, straightforward insights into how much you might need to put down on a condo.

Stick with us, and you’ll discover tips and strategies that could help you save money and make a smarter investment. Ready to take the mystery out of down payments? Let’s dive into the details and empower you with knowledge that can turn your condo dreams into reality.

Down Payment Basics

A down payment is the money you pay first. It is a part of the full price. This payment shows your commitment to buying. It is important. Why? It helps you get a loan. It makes lenders trust you more. The bigger the down payment, the better. You pay less later.

A bigger down payment can lower monthly payments. It can reduce your loan amount. It can also lower interest rates. Less loan means less interest. You save money over time. A small down payment can mean higher monthly costs. Choose wisely. Think about your budget. Plan for future costs.

Factors Influencing Down Payments

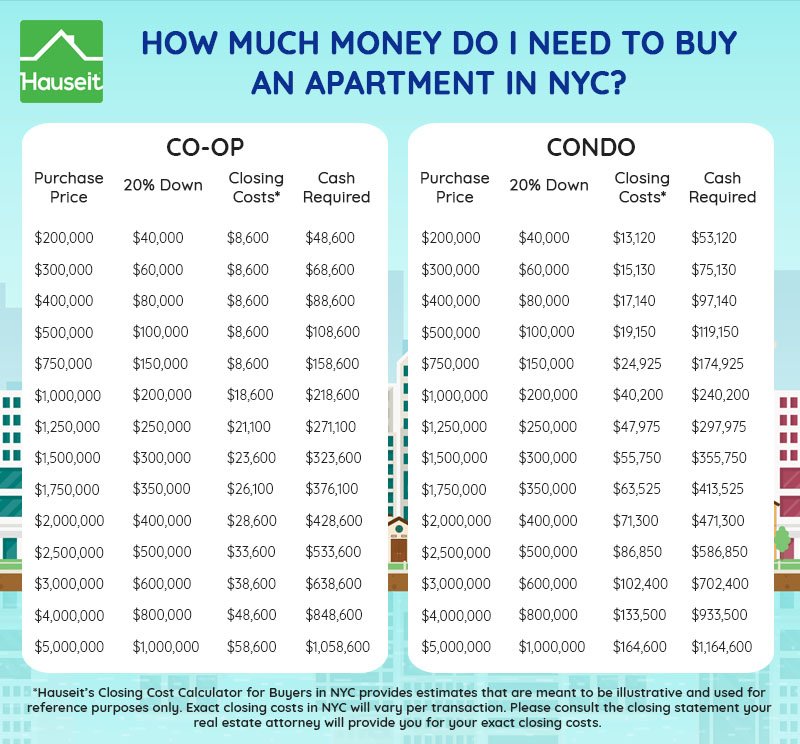

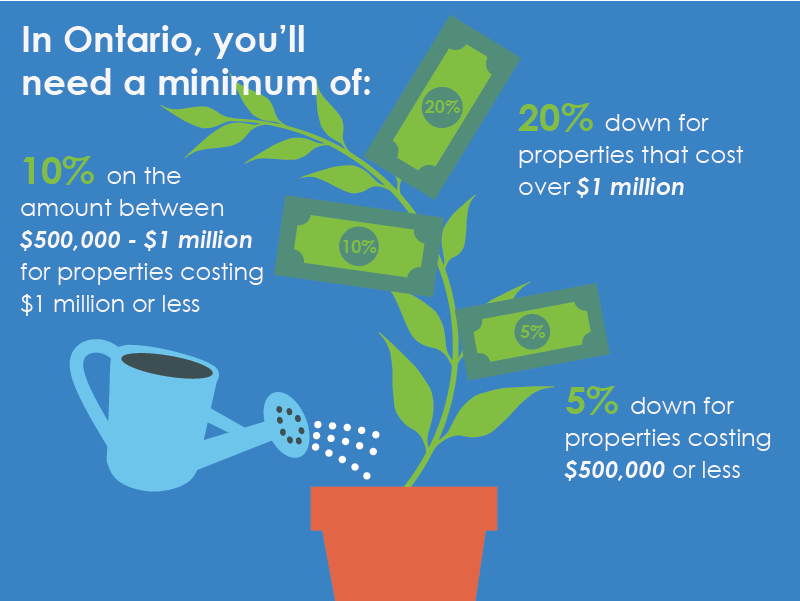

Location plays a big role in condo down payments. Popular areas cost more. This means you may need a bigger down payment. City centers often have higher prices than the suburbs. Even within a city, some neighborhoods are pricier. Always check prices in different areas before buying.

Trends in the housing market affect down payments. In a hot market, prices rise quickly. This can lead to bigger down payments. During a market slowdown, prices might drop. This can mean smaller down payments. Always watch market reports before making a decision.

Your financial health matters. Credit scores can impact down payments. A high score might mean a lower payment. Income and debts are also important. Lenders check if you can handle payments. Having savings helps too. A strong financial profile can ease the process.

Typical Down Payment Percentages

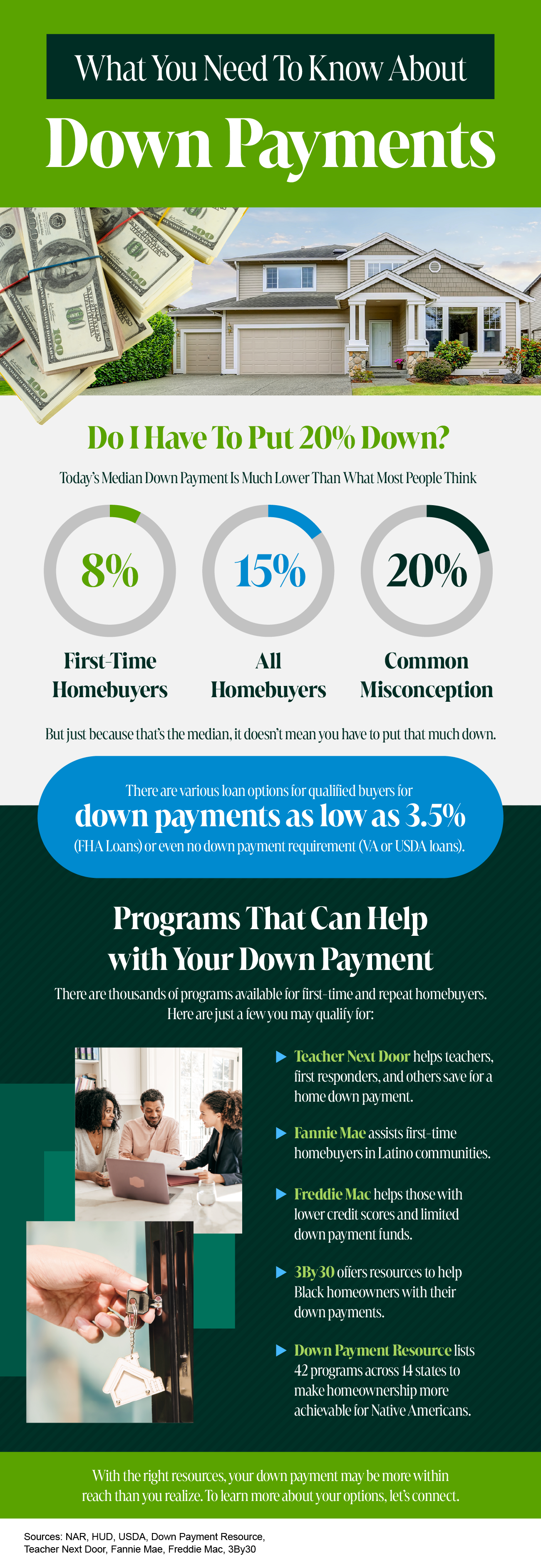

Conventional loans often need a down payment of 20%. This is a big amount for many people. A larger down payment can mean lower monthly payments. Some lenders offer loans with as little as 3% down. These options might have extra costs or rules. Saving more upfront can save money in the long run. It’s important to plan carefully.

FHA loans require a 3.5% down payment. This is lower than most conventional loans. These loans help first-time buyers. They have easier credit rules. FHA loans need mortgage insurance. This adds to the monthly cost. Consider this when planning your budget. They offer a path to owning a condo.

VA and USDA loans often need no down payment. This is great for those who qualify. VA loans are for veterans. USDA loans are for rural areas. Both have special rules. No down payment can help buyers get homes faster. They make home buying easier for many.

Saving Strategies For Down Payments

Make a clear budget plan. Write down all your monthly expenses. Identify areas where you spend too much. Cut down on those expenses. Save the extra money for your down payment. Track your spending every week. This helps to stick to your budget. Use simple apps to track your money.

Investing money can help grow your savings. Consider safe options like savings accounts. These accounts are easy to use. They offer some interest too. Avoid risky investments. They can make you lose money.

Some programs help people buy homes. They offer down payment assistance. Check if you qualify for these programs. Ask experts for advice. They help understand the process better. Visit local government websites. They have more information on these programs.

Expert Opinions

Real estate experts suggest saving at least 20% of the condo price. This amount is often needed to avoid extra costs. These costs include private mortgage insurance. But, some buyers might pay less. A smaller down payment is possible with special programs. Sometimes, only 5% is enough. It’s important to know what each lender offers.

Financial advisors also have advice. They say a bigger down payment is smart. It can save money in the long run. A bigger down payment means smaller monthly bills. You pay less interest. But, do not empty your savings. Keep enough for emergencies. Always plan for surprise costs. This keeps you safe and ready.

Common Mistakes To Avoid

Avoid overestimating savings when planning a condo down payment. Many believe 20% is necessary, but options vary. Research financing programs to find flexible solutions that fit your budget.

Underestimating Costs

Many people forget the real cost of buying a condo. They think only about the down payment. But, there are more costs. Closing costs can surprise you. These might include inspection fees, property taxes, and insurance. Make a list of all possible expenses. Keep extra money for unexpected costs. Plan wisely to avoid stress later.

Ignoring Hidden Fees

Hidden fees can catch you off guard. Condo association fees are common. These fees cover maintenance and shared facilities. Sometimes, there are special assessments. These are one-time payments for big repairs. Always ask about extra fees before buying. Read all agreements carefully. Knowing all fees helps in budgeting better.

Future Trends In Down Payments

Exploring future trends in condo down payments reveals a shift towards flexible options. Down payments often range from 5% to 20% of the condo price. Many buyers seek lower percentages to enter the market faster.

Impact Of Economic Changes

Economic shifts can change down payment rules. Prices of condos can rise or fall. This can affect how much you pay. Inflation can make condos cost more. Interest rates can change, too. Higher rates mean bigger payments. Jobs and income levels also play a part. If people earn more, they can pay more. If jobs are scarce, payments may be less.

Technological Advancements

Technology can simplify condo buying. Online tools help buyers find condo prices. Apps can calculate payments fast. Virtual tours show condos without visiting. This saves time. Blockchain can make payments safe. It helps avoid fraud. AI can suggest condos based on your budget. It makes searching easier. New tools can make payments smoother.

Frequently Asked Questions

What Is The Typical Down Payment For A Condo?

The typical down payment for a condo is usually 20% of the purchase price. However, some lenders might accept as low as 3% to 5% for qualified buyers. It’s important to check with your lender for specific requirements and options available to you.

Can You Buy A Condo With No Down Payment?

Buying a condo with no down payment is generally not possible. However, some programs, like VA or USDA loans, might offer zero-down options for eligible buyers. It’s crucial to explore these programs and consult with lenders to understand your eligibility and options.

How Does Condo Down Payment Affect Mortgage Rates?

A larger down payment often results in better mortgage rates. This is because lenders view larger down payments as less risky. A higher down payment can lead to lower interest rates, reducing your long-term mortgage costs. Consult with your lender to understand how your down payment impacts your rate.

Are There First-time Buyer Programs For Condos?

Yes, there are first-time buyer programs available for condos. Many government-backed programs, like FHA loans, offer lower down payment options. These programs can be beneficial for first-time buyers looking to enter the real estate market. It’s advisable to research and consult with lenders about your eligibility.

Conclusion

Determining the right down payment is crucial. It impacts your finances. A typical range is 3% to 20% of the condo’s price. Assess your budget carefully. Consider both short-term and long-term financial goals. A larger down payment may reduce monthly payments.

Research your options. Consult with a financial advisor if needed. Always factor in additional costs like closing fees. Staying informed helps make wise decisions. Owning a condo is a significant commitment. Plan wisely and ensure financial readiness. Enjoy the journey toward homeownership.